India White Putty Market Size, Share, Trends and Forecast by Application, Purity, Pack Size, Type, End Use, and Region, 2025-2033

India White Putty Market Overview:

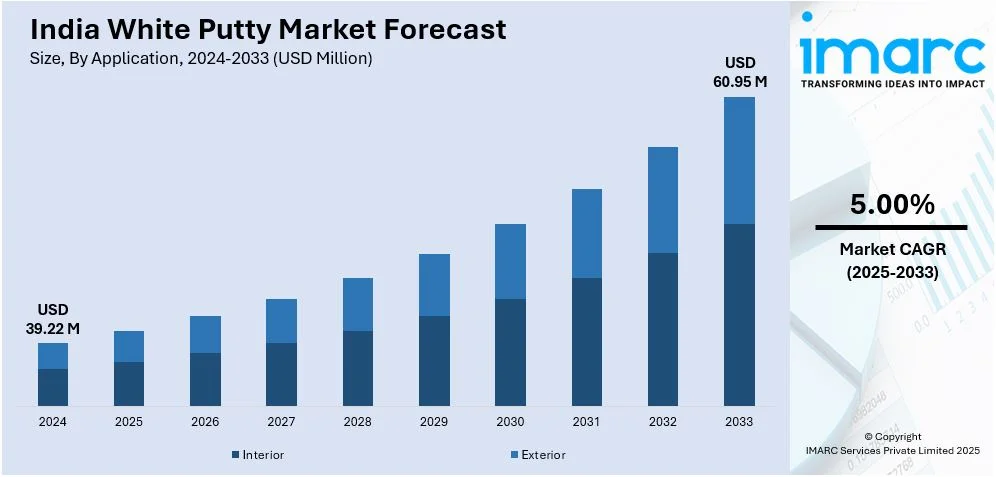

The India white putty market size reached USD 39.22 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 60.95 Million by 2033, exhibiting a growth rate (CAGR) of 5.00% during 2025-2033. The market is driven by growing construction activities, rising urbanization, and increasing demand for smooth, durable wall finishes. Additionally, expanding infrastructure projects, a surge in residential real estate, and the preference for premium interior aesthetics boost market growth, while technological advancements in putty formulations enhance product performance and consumer adoption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 39.22 Million |

| Market Forecast in 2033 | USD 60.95 Million |

| Market Growth Rate 2025-2033 | 5.00% |

India White Putty Market Trends:

Rising Demand from the Real Estate and Construction Sectors

The expansion of India's real estate sector, driven by urbanization and infrastructure development, is fueling the rising demand for white putty. The immense boom in building projects for residence and commerce accelerated the demand for white putty to provide sustainable and smooth walls, which supported higher consumption rates of white putty. Some of the measures adopted by the government, such as Smart Cities Mission and Pradhan Mantri Awas Yojana (PMAY), are again accelerating market demand. Moreover, as customers demand good-quality interior and exterior finishes, contractors and builders opt for white putty due to its excellent adhesion, water resistance, and durability. The increasing trend towards visually attractive and low-maintenance walls is further supporting the demand, making white putty an essential product in India's construction industry.

To get more information of this market, Request Sample

Shift Towards Premium and Eco-Friendly Products

The market in India is witnessing a shift toward premium and eco-friendly white putty formulations, driven by consumer demand for durability, smoothness, and crack resistance. Rising awareness of sustainable construction has led manufacturers to develop low-VOC variants. Regulatory standards promoting green building materials are further influencing innovations. Similarly, the National Efficient Cooking Programme (NECP) by EESL aims to deploy 2 million induction-based cookstoves, offering a 25-30% cost advantage over traditional methods. These initiatives reflect a broader trend of energy-efficient and eco-conscious product development. Leading brands are investing in R&D to enhance product performance, ensuring better adhesion, water resistance, and environmental compliance. This growing preference for sustainable solutions is reshaping India's construction and home appliance markets.

Growth in Organized Retail and Online Sales Channels

The growth of organized retail and e-commerce websites is revolutionizing the flow of white putty in India. Conventional hardware shops are being increasingly supplemented by new-age retail formats, providing consumers with more access to branded as well as high-quality putty products. E-commerce websites are also becoming important drivers of market penetration, allowing buyers to compare products, read reviews, and make a well-informed choice. Top players are using digital channels to access larger consumer bases backed by focused promotion and marketing measures and promotional prices. This emphasis on organized retail and online markets is increasing visibility and accessibility for products, contributing to the accelerating growth of India white putty market.

India White Putty Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application, purity, pack size, type and end use.

Application Insights:

- Interior

- Exterior

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes interior, and exterior.

Purity Insights:

- 99%

- >99%

The report has provided a detailed breakup and analysis of the market based on the purity. This includes 99%, and >99%.

Pack Size Insights:

- Up to 5 Kg

- 20Kg

- 30Kg

- 40Kg and Above

A detailed breakup and analysis of the market based on the pack size have also been provided in the report. This includes up to 5 kg, 20kg, 30kg, and 40kg and above.

Type Insights:

- Cement Based

- Acrylic Based

The report has provided a detailed breakup and analysis of the market based on the type. This includes cement based, and acrylic based.

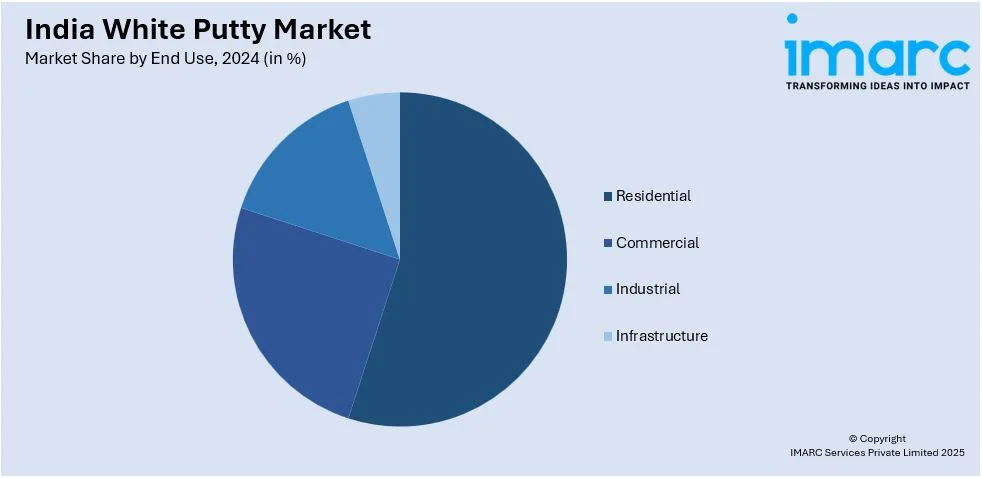

End Use Insights:

- Residential

- Commercial

- Industrial

- Infrastructure

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential, commercial, industrial, and infrastructure.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India White Putty Market News:

- In April 2024, Walplast Products Pvt. Ltd., India's third-largest Wall Putty manufacturer, expanded its capacity with two new plants in Chennai and Perundurai, Tamil Nadu, producing 150,000 and 180,000 metric tonnes annually. The company plans two more plants in 2024-25, including a Madhya Pradesh unit with a 216,000-tonne capacity and advanced technology. A Maharashtra plant will also open, adding Grey Products to Walplast’s portfolio with a 100,000-tonne capacity.

- In January 2024, Birla White is revolutionizing wall care with its white cement-based wall putty, ensuring superior adhesion, smooth finish, and moisture resistance. The brand introduced India’s first scented putty, WallCare Rose, infused with fragrances like rose, lemon, and sandalwood to enhance work efficiency. With innovations like Bio-Shield, Excel, and WallSeal Waterproof putty, Birla White continues to set industry benchmarks, transforming homes with quality and elegance.

India White Putty Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Interior, Exterior |

| Purity’s Covered | 99%, >99% |

| Pack Sizes Covered | Up to 5 Kg, 20Kg, 30Kg, 40Kg and Above |

| Types Covered | Cement Based, Acrylic Based |

| End Uses Covered | Residential, Commercial, Industrial, Infrastructure |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India white putty market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India white putty market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India white putty industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The white putty market in India was valued at USD 39.22 Million in 2024.

The India white putty market is projected to exhibit a CAGR of 5.00% during 2025-2033, reaching a value of USD 60.95 Million by 2033.

Growth is driven by rising construction activities, increased demand for smooth and durable wall finishes, and expansion in real estate. Improved awareness of surface preparation, along with a growing preference for aesthetic interiors, also supports the market’s steady expansion in urban and semi-urban regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)