India Wind Power Market Size, Share, Trends and Forecast by Location, and Region, 2025-2033

Market Overview:

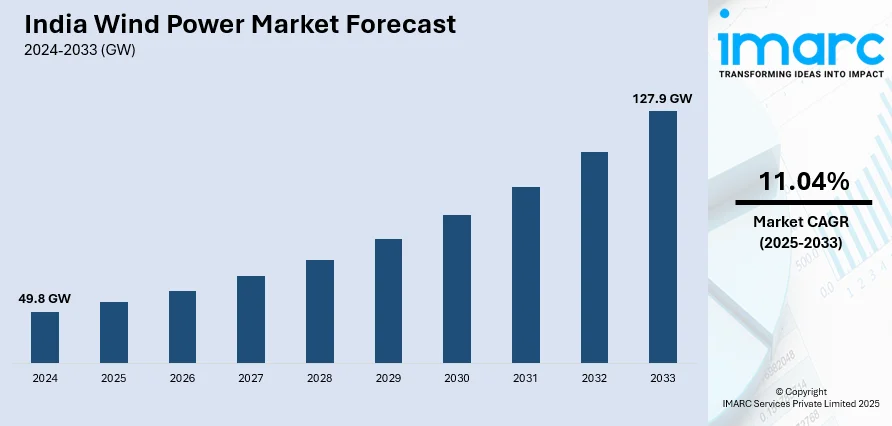

The India wind power market size reached 49.8 GW in 2024. The market is projected to reach 127.9 GW by 2033, exhibiting a growth rate (CAGR) of 11.04% during 2025-2033. The market growth is attributed to the escalating demand for renewable energy, favorable government policies, and technological advancements in the wind power sector.

Market Insights:

- The market is segmented regionally into North India, West and Central India, South India, and East and Northeast India.

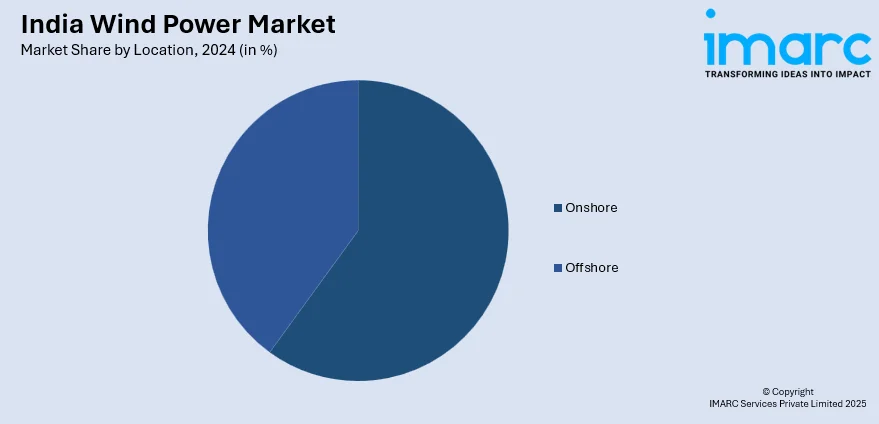

- The market is segmented by location into onshore and offshore wind power.

Market Size and Forecast:

- 2024 Market Size: 49.8 GW

- 2033 Projected Market Size: 127.9 GW

- CAGR (2025-2033): 11.04%

Wind power is a renewable energy source harnessed from the kinetic energy of the wind to generate electricity. This process involves the use of wind turbines, which consist of large blades connected to a rotor. As the wind blows, it causes the blades to rotate, converting the kinetic energy into mechanical energy. The mechanical energy is then transformed into electricity through a generator housed within the turbine. Wind power is considered an environmentally friendly and sustainable alternative to traditional fossil fuels, as it produces no greenhouse gas emissions during electricity generation. It has gained global prominence for its ability to harness a natural and abundant resource, contributing to the diversification of energy sources and the reduction of reliance on non-renewable energy. Wind power projects can range from small-scale installations to large wind farms, playing a crucial role in the transition towards cleaner and more sustainable energy systems.

To get more information of this market, Request Sample

The wind power industry in India is undergoing significant shifts driven by key drivers and emerging trends that underscore the nation's commitment to sustainable energy. A primary driver is numerous initiatives by government bodies, such as the National Wind-Solar Hybrid Policy and the Wind Auction Scheme, that aim to boost investments and streamline project development. Moreover, technological advancements play a pivotal role, with a notable trend towards larger and more efficient wind turbines. Apart from this, the rising integration of smart technologies, data analytics, and advanced materials enhances the performance and reliability of wind power installations, making them more competitive. Furthermore, government incentives and financial support further stimulate the India wind power market growth, encouraging both domestic and international investments. Besides this, competitive bidding processes and feed-in tariffs contribute to the overall growth of the wind power sector across the country. Moreover, there is a growing emphasis on hybrid energy solutions, combining wind power with solar and energy storage technologies to ensure a consistent and reliable power supply. This, in turn, will continue to catalyze the India wind power market over the forecasted period.

India Wind Power Market Trends:

Regional Concentration of Wind Power Capacity Additions

As per the India wind power market research report, there has been a significant focus of capacity additions in southern states like Gujarat, Tamil Nadu, and Karnataka, recently and these states are leading the way. Rajasthan has become the fastest-growing state, following positive policies, high land availability, and suitable wind conditions. All these are well in line with the government's effort towards regional growth and development, as reported by the India wind power market forecast. Offshore wind energy is also picking up, with Gujarat and Tamil Nadu being the most favored states for offshore installation because of the high wind potential in these places. Technological innovations in turbine technology, such as floating turbines, are enhancing the viability of offshore wind farms. Further, the government's recent waiver of ISTS fees on wind projects sanctioned by June 2025 is likely to speed up onshore and offshore wind capacity growth, facilitating India's ambitious target of achieving 140 GW of wind energy capacity by 2030, which in turn is making a favorable India wind power market outlook. The growing need for renewable energy, coupled with economic incentives, has drawn both local and foreign investment to India's wind energy industry. With the cost of wind power production further falling, wind energy is becoming increasingly competitive with traditional energy sources. Increased emphasis on sustainability and the growth in grid infrastructure to handle renewable energy further improve the potential of the sector. With consistent policy support and advancements in technology, India's wind power sector is likely to be among the drivers of the growth of the wind power industry size in India.

Grid Integration, Technological Trends, and Government Support

Despite the impressive growth in capacity, grid integration remains a major challenge due to the limitations of the current transmission infrastructure, which struggles to accommodate the intermittency of wind energy generation. The Green Energy Corridor initiative is a key solution to this issue, aimed at improving grid connectivity and facilitating the transmission of renewable energy from regions with high wind potential to demand centers across the country. Technological innovations are also helping to drive the sector forward, with a rising focus on wind-solar hybrid systems, thereby augmenting the India wind power market share. These systems combine wind power with solar energy and energy storage technologies, ensuring a more stable and reliable energy supply. The ongoing development of larger, more efficient turbines is another important trend, improving the overall output and cost-effectiveness of wind projects. Furthermore, government policies continue to encourage growth, such as the competitive bidding process for wind projects and the provision of financial support and incentives. The recent policy changes serve to create a more attractive investment environment, accelerating both domestic and international participation in the sector, as per the India wind power market analysis. As the demand for renewable energy rises, these innovations and supportive policies are expected to play a crucial role in driving progress. With advancements in turbine efficiency, energy storage solutions, and the integration of wind and solar systems, India’s renewable energy infrastructure will become more robust. These factors will enhance the sector's competitiveness, creating new opportunities for investors. This positions India’s wind power market for continued expansion, in line with the nation's ambitious targets. The dynamic developments in technology, policy, and infrastructure will significantly contribute to the wind power industry growth in India.

India Wind Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on location.

Location Insights:

- Onshore

- Offshore

The report has provided a detailed breakup and analysis of the market based on the location. This includes onshore and offshore.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East and Northeast India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In May 2025, Senvion secured its first order for the 3.1M130 wind turbine from Powerica Limited for a 52.7 MW wind power project in Gujarat. The order includes supply, erection, commissioning, as well as long-term operations and maintenance, with deliveries scheduled to begin in Q3 of FY25–26. The 3.1M130 turbine, optimized for land-constrained zones, features over 80% locally manufactured components, supporting India’s growing wind energy sector and the Make in India initiative.

- In April 2025, Suzlon Energy secured a 100.8 MW wind power order from Sunsure Energy for its inaugural wind project in the Jath region of Maharashtra. Suzlon will supply 48 S120 wind turbine generators (WTGs) with a 2.1 MW capacity each, and handle the project's execution, including installation and operations. This partnership strengthens Suzlon's role in advancing India's renewable energy transition and supports Sunsure Energy's goal of achieving 10 GW of capacity by 2030.

- In March 2025, Siemens Gamesa announced the divestiture of a 90% stake in its Indian wind business to a group of investors led by TPG, retaining a 10% share. The deal, which includes two manufacturing plants and approximately 1,000 employees in India, aims to create a new company focused on the Indian onshore wind market, a sector expected to see significant growth with 57 GW capacity anticipated by 2032. Siemens Gamesa will continue supporting the venture through a long-term technology licensing agreement.

- In January 2025, Senvion India secured a 121.5 MW wind power order from Continuum Green Energy, comprising 45 units of the 2.7M130 wind turbine generators. The project includes supply, erection, and commissioning of the turbines and Unit Sub-Station (USS), with deliveries starting in 2025. This deal highlights Senvion's commitment to innovation, sustainability, and delivering tailored solutions to meet the diverse wind conditions in India.

India Wind Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | GW |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Locations Covered | Onshore, Offshore |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wind power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wind power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wind power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India wind power market reached a volume of 49.8 GW in 2024.

The India wind power market is projected to exhibit a CAGR of 11.04% during 2025-2033, reaching a volume of 127.9 GW by 2033.

The market for wind power in India is fueled by aggressive goals for renewable energy as well as advantageous government initiatives like tax breaks and auctions. Robust investment in grid infrastructure and wind-rich zones enhances capacity expansion. Technological improvements in turbine efficiency and hybrid systems and strong domestic manufacturing and global partnerships further reinforce sector growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)