India Wind Turbine Components Market Size, Share, Trends and Forecast by Component, Wind Turbine Type, Wind Farm Type, and Region, 2025-2033

India Wind Turbine Components Market Overview:

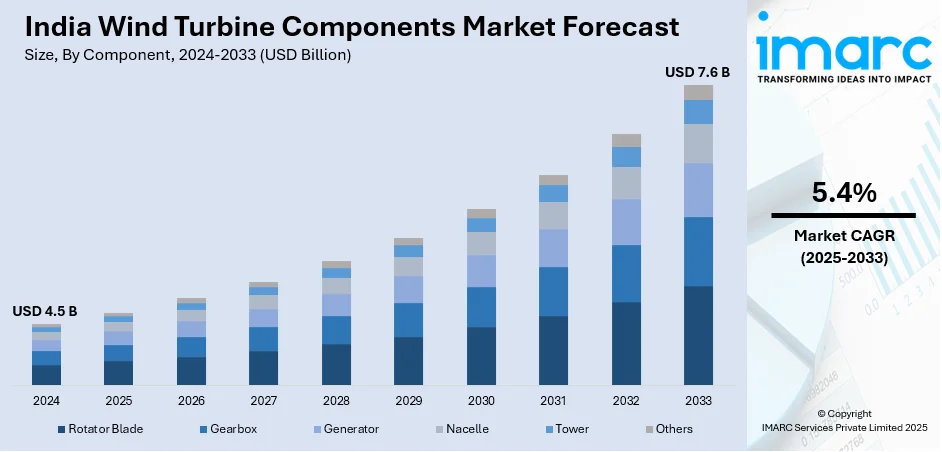

The India Wind Turbine Components Market size reached USD 4.5 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.6 Billion by 2033, exhibiting a growth rate (CAGR) of 5.4% during 2025-2033. The market is propelled by amplifying demand for clean and sustainable power, supported by supportive government policies and strategic investment in renewable infrastructure. The trend towards domestic manufacturing, along with technological advancements in turbines and efficiency, is fueling market growth. Economically viable solutions, access to a skilled labor pool, and good wind conditions in many regions add to the appeal of the market. These combined elements are consistently adding to the growth of the India wind turbine components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.6 Billion |

| Market Growth Rate 2025-2033 | 5.4% |

India Wind Turbine Components Market Trends:

Shift Toward Larger and More Efficient Turbines

India's wind sector is changing in the direction of bigger and more sophisticated turbines that deliver higher energy output. They come equipped with longer blades and better aerodynamics to enable them to perform well even in low-wind areas. The shift towards higher-capacity turbines also decreases the number of installations needed, which results in lower maintenance and infrastructure costs. It favors improved land use and reduces project development complexities. Advanced digital monitoring systems are being incorporated to provide the best performance and rapid problem-solving. These systems employ real-time analytics of data, fault detection through artificial intelligence (AI), and predictive maintenance to improve turbine life and optimize energy production. With developers looking for long-term profitability, the use of these bigger, smarter turbines is becoming a primary strategy in India wind turbine components market growth.

To get more information on this market, Request Sample

Growing Localization and Domestic Manufacturing

India is increasingly concentrating on local manufacturing of wind turbine parts to lower dependence on imports and make its renewable energy supply chain more robust. With 80% localization as the goal, the government is pushing the manufacturing of crucial parts like gearboxes, generators, blades, hubs, and nacelles under the "Make in India" program. This drive not only seeks to facilitate job creation and skill formation but also enables quicker delivery, improved cost management, and a more robust supply chain. Production is being expanded and product quality enhanced by manufacturers to cater to domestic as well as international demand. Partnerships with foreign technology companies are increasing the competitiveness of local suppliers. This localization push is one which supports India's overall initiatives at industrial growth and sustainability and keeps the country competitively aligned on the international level in wind power.

Integration of Smart Technologies and Digital Tools

Smart technologies are increasingly contributing to the wind turbine components market in India. Advanced sensors, data analysis, and artificial intelligence (AI)-powered monitoring systems are being added to turbines to improve performance and minimize downtime. These digital instruments assist in monitoring real-time wind pattern, vibration, and wear data, supporting predictive maintenance and optimal energy generation. Remote monitoring also enables effective asset management and rapid response to possible failures. As wind farms grow increasingly complex and spread over difficult landscapes, intelligent technology provides a dependable means of maximizing operations. This shift towards digital is changing the management and maintenance of wind energy assets around India. In addition, the incorporation of machine learning (ML) algorithms provides for ongoing optimization, enhancing operational efficiency and longevity of turbine parts, as well as lowering total maintenance expenses. With these developments, India's wind energy industry will become more robust and able to meet future energy needs.

India Wind Turbine Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, wind turbine type, and wind farm type.

Component Insights:

- Rotator Blade

- Gearbox

- Generator

- Nacelle

- Tower

- Others

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes rotator blade, gearbox, generator, nacelle, tower, and others.

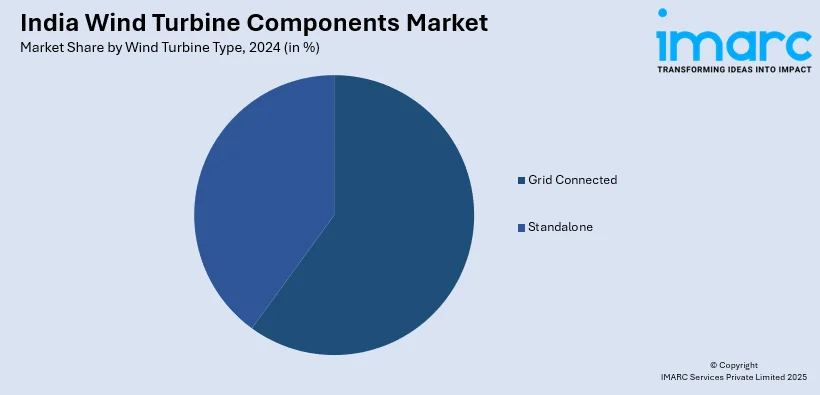

Wind Turbine Type Insights:

- Grid Connected

- Standalone

The report has provided a detailed breakup and analysis of the market based on the wind turbine type. This includes grid connected and standalone.

Wind Farm Type Insights:

- Onshore

- Offshore

A detailed breakup and analysis of the market based on the wind farm type have also been provided in the report. This includes onshore and offshore.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wind Turbine Components Market News:

- In April 2025, Senvion India launched its 3.1M130 wind turbine, now listed in MNRE’s RLMM as of April 2025. Built on the proven 2XM platform with a 130-meter rotor, it's designed for pad-constrained sites and over 80% locally manufactured. Fully tested and certified in India, the turbine meets high performance standards. Senvion reaffirms its commitment to innovation and domestic manufacturing in India's growing wind energy sector.

- In April 2025, ZF Wind Power launched a 30 MW test rig at its Test and Prototype Center in Belgium to simulate real-world conditions for validating wind turbine powertrains and components. This advanced facility enhances testing of gearboxes, generators, and bearings, boosting efficiency and durability. By integrating testing and assembly in one location, ZF accelerates product development, shortens validation cycles, and strengthens its role in advancing next-generation wind energy technologies.

India Wind Turbine Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Rotator Blade, Gearbox, Generator, Nacelle, Tower, Others |

| Wind Turbine Types Covered | Grid Connected, Standalone |

| Wind Farm Types Covered | Onshore, Offshore |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India wind turbine components market performed so far and how will it perform in the coming years?

- What is the breakup of the India wind turbine components market on the basis of component?

- What is the breakup of the India wind turbine components market on the basis of wind turbine type?

- What is the breakup of the India wind turbine components market on the basis of wind farm type?

- What is the breakup of the India wind turbine components market on the basis of region?

- What are the various stages in the value chain of the India wind turbine components market?

- What are the key driving factors and challenges in the India wind turbine components market?

- What is the structure of the India wind turbine components market and who are the key players?

- What is the degree of competition in the India wind turbine components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wind turbine components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wind turbine components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wind turbine components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)