India Wine Market Size, Share, Trends and Forecast by Product type, Color, Distribution Channel, and Region, 2026-2034

India Wine Market Summary:

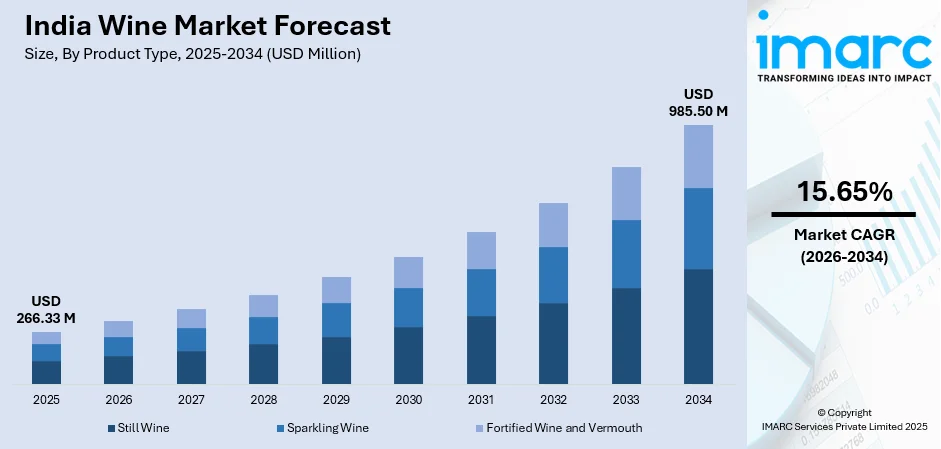

The India wine market size was valued at USD 266.33 Million in 2025 and is projected to reach USD 985.50 Million by 2034, growing at a compound annual growth rate of 15.65% from 2026-2034.

The India wine market is experiencing robust growth driven by rising disposable incomes among urban consumers and evolving lifestyle preferences favoring premium alcoholic beverages. The expanding hospitality sector, growing wine tourism in key production regions, and increasing acceptance of wine as a sophisticated beverage choice are accelerating market expansion. Enhanced e-commerce accessibility, supportive government policies, and rising awareness about perceived health benefits of moderate wine consumption are further strengthening the India wine market share.

Key Takeaways and Insights:

- By Product Type: Still wine dominates the market with a share of 69% in 2025, driven by its affordability, versatility with Indian cuisines, and widespread availability across retail channels.

- By Color: Red wine leads the market with a share of 49% in 2025, attributed to perceived health benefits, compatibility with spiced Indian dishes, and growing consumer preference for robust flavors.

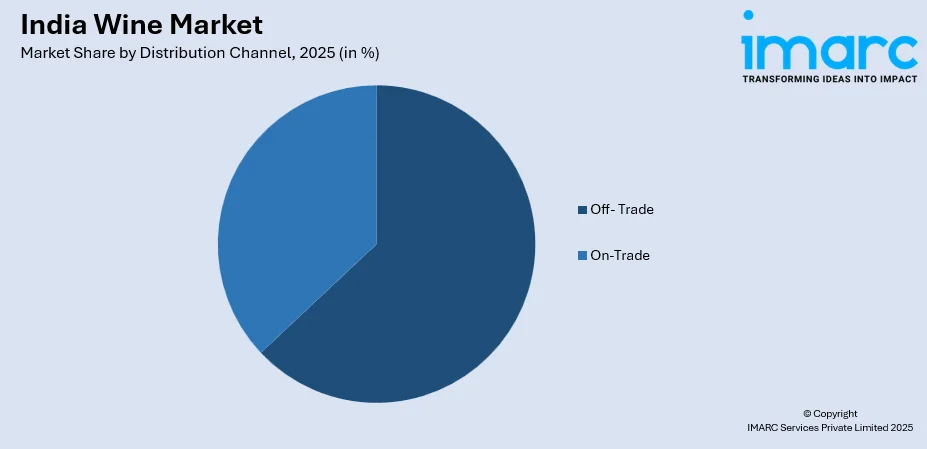

- By Distribution Channel: Off-Trade represents the largest segment with a market share of 63% in 2025, fueled by expanding supermarket networks, e-commerce growth, and increasing home consumption preferences.

- By Region: North India holds the largest share at 31% in 2025, supported by high urbanization rates in Delhi NCR, strong hospitality presence, and affluent consumer demographics.

- Key Players: The India wine market exhibits a moderately consolidated competitive landscape with domestic producers holding significant market presence. Leading wineries are investing in premium product portfolios, sustainable practices, and wine tourism infrastructure to strengthen brand positioning and expand consumer reach across metropolitan and tier-two cities.

To get more information on this market Request Sample

The India wine market is undergoing significant transformation as urbanization, western lifestyle adoption, and premiumization trends reshape consumer preferences. Young professionals and women are increasingly embracing wine as a sophisticated alternative to traditional spirits, driving demand for diverse product offerings. The domestic wine industry, centered in Maharashtra's Nashik region and Karnataka, has witnessed substantial quality improvements through advanced viticulture practices and innovative winemaking techniques. Leading wineries are expanding their portfolios with premium varietals while investing in sustainable production methods. The hospitality sector, encompassing luxury hotels and fine-dining establishments, continues to play a pivotal role in shaping consumption patterns and elevating wine culture awareness across urban centers. Wine tourism has emerged as a powerful catalyst for consumer engagement, with vineyard experiences attracting growing numbers of domestic and international visitors seeking immersive tastings and culinary pairings.

India Wine Market Trends:

Premiumization and Quality Enhancement

The India wine market is witnessing a pronounced shift toward premium and boutique wine varieties as affluent consumers seek sophisticated drinking experiences. Domestic wineries are investing in advanced winemaking techniques, oak barrel aging, and premium grape varietals to compete with international brands. In January 2025, Grover Zampa Vineyards launched its limited-edition Grover Essence De Cabernet Sauvignon, aged in oak barrels for over 36 months, exemplifying the industry's commitment to quality enhancement and India wine market growth.

Expansion of Wine Tourism Infrastructure

Wine tourism is emerging as a significant driver of consumer engagement and brand awareness across India's wine-producing regions. Vineyard experiences, including tastings, culinary pairings, and resort stays, are attracting domestic and international visitors seeking immersive encounters with local wine culture. Maharashtra's Nashik region, often called India's wine capital, recorded over 340,000 winery visitors in 2023. Leading producers are expanding tourism infrastructure with vineyard resorts and experiential facilities to capitalize on this growing trend.

Sustainability and Eco-Conscious Practices

Environmental sustainability is gaining prominence among Indian wineries as consumer preferences shift toward eco-friendly products. Producers are adopting solar energy solutions, recyclable packaging materials, and reforestation initiatives to align with global sustainability standards. Wineries are implementing water conservation techniques, organic viticulture practices, and carbon footprint reduction strategies across their operations. This commitment to environmental stewardship is enhancing brand appeal among environmentally aware consumers while positioning Indian wines competitively in international markets that increasingly prioritize sustainable production credentials.

Market Outlook 2026-2034:

The India wine market is poised for sustained expansion as evolving consumer preferences, increasing urbanization, and growing acceptance of wine culture accelerate demand across metropolitan and emerging cities. Rising disposable incomes among young professionals and changing lifestyle aspirations are creating favorable conditions for market growth. Expanding e-commerce platforms, wine tourism development, and premiumization trends will further strengthen market prospects. Additionally, supportive government policies, improved distribution networks, and growing hospitality sector investments are expected to enhance accessibility and drive consumption across diverse consumer segments nationwide. The market generated a revenue of USD 266.33 Million in 2025 and is projected to reach a revenue of USD 985.50 Million by 2034, growing at a compound annual growth rate of 15.65% from 2026-2034.

India Wine Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Still Wine | 69% |

| Color | Red Wine | 49% |

| Distribution Channel | Off-Trade | 63% |

| Region | North India | 31% |

Product Type Insights:

- Still Wine

- Sparkling Wine

- Fortified Wine and Vermouth

The still wine dominates with a market share of 69% of the total India wine market in 2025.

Still wine maintains its leadership position due to its affordability, widespread availability, and seamless compatibility with diverse Indian cuisines. Unlike sparkling or fortified varieties, still wines offer versatility for both casual dining and fine-dining occasions, enabling broader consumer accessibility. The segment benefits from established distribution networks across supermarkets, specialty stores, and online platforms, making it the preferred choice for home consumption and social gatherings among price-conscious consumers.

Domestic wineries have concentrated production efforts on still wine varieties, further strengthening market availability and price competitiveness. In October 2024, Sula Vineyards expanded its still wine portfolio with the launch of a new Merlot variant, commemorating its 25th anniversary. Growing consumer awareness about red and white wine varieties and their perceived health benefits continues to fuel demand, positioning still wine as the foundational segment driving India's wine market expansion.

Color Insights:

- Red Wine

- Rose Wine

- White Wine

Red wine leads the market with a share of 49% of the total India wine market in 2025.

Red wine's dominant market position stems from its perceived health benefits, particularly antioxidant properties associated with moderate consumption. The robust flavor profiles of red wines complement the spiced nature of Indian cuisine, making them increasingly popular across fine-dining establishments and home consumption occasions. Consumer preference for full-bodied wines has driven domestic producers to invest significantly in premium red wine varietals.

The segment continues to benefit from increasing global exposure and premiumization trends among urban consumers. In May 2024, Sula Vineyards' cabernet sauvignon received the gold medal at the Global Wine Masters competition, representing the highest honor achieved by an Indian wine at this prestigious international event. Such recognition has enhanced consumer confidence in domestically produced red wines, accelerating adoption and strengthening the segment's market leadership.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Off-Trade

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

- On-Trade

The off-trade represents the largest market with a 63% share of the total India wine market in 2025.

Off-trade channels dominate due to growing home consumption preferences, affordability advantages, and expanding retail accessibility. Supermarkets, hypermarkets, and specialized wine stores offer consumers diverse domestic and imported wine selections at competitive prices compared to on-trade venues. The convenience of purchasing wine for personal consumption, social gatherings, and festive occasions has significantly contributed to off-trade channel growth. Additionally, improved product visibility, promotional offers, and knowledgeable staff assistance in modern retail environments are enhancing consumer purchasing experiences.

E-commerce platforms have emerged as transformative distribution channels, particularly following regulatory relaxations permitting online alcohol sales in select states. Modern retail formats featuring dedicated tasting areas and promotional activities are enhancing consumer engagement and brand awareness. Online wine retailers are experiencing substantial growth by offering curated selections, doorstep delivery convenience, and detailed product information. These digital platforms are expanding market reach beyond traditional retail channels, particularly benefiting urban consumers seeking premium and imported wine varieties.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India holds the largest share of 31% of the total India wine market in 2025.

North India leads the market driven by high urbanization rates and affluent consumer demographics concentrated in Delhi NCR and surrounding major metropolitan areas. The region significantly benefits from a strong hospitality presence, with luxury hotels, fine-dining restaurants, and upscale wine bars catering to sophisticated urban consumers. Substantial tourism and business travel further support robust on-trade consumption patterns, establishing northern India as a prominent consumption hub for premium wine varieties nationwide.

Premium retail establishments across northern urban centers provide consumers with diverse selections of domestic and imported wine varieties at competitive prices. Expanding e-commerce accessibility has revolutionized wine distribution, enabling convenient doorstep delivery and broader product choices for discerning consumers. Modern retail formats featuring dedicated wine sections and promotional activities enhance consumer engagement and brand awareness significantly. These distribution advancements continue strengthening market penetration across Delhi NCR and adjacent metropolitan regions.

Market Dynamics:

Growth Drivers:

Why is the India Wine Market Growing?

Rising Disposable Incomes and Changing Consumer Preferences

India's expanding middle class and increasing affluence are transforming beverage consumption patterns, with wine emerging as an aspirational lifestyle choice among urban consumers. Young working professionals in metropolitan cities are embracing wine as a sophisticated alternative to traditional spirits, driven by exposure to global dining cultures and premiumization trends. The perception of wine as a healthier alcoholic option has particularly resonated with health-conscious consumers. Industry data indicates that Indian middle-class population is expected to reach 61% by 2047, creating substantial long-term demand for premium beverages including wine.

Expansion of Wine Tourism and Experiential Marketing

Wine tourism has emerged as a powerful driver of consumer engagement, brand awareness, and direct sales for Indian wineries. Vineyard experiences, including tastings, culinary events, and resort accommodations, are attracting growing numbers of domestic and international visitors seeking immersive encounters with local wine culture. Maharashtra and Karnataka state governments have implemented supportive agro-tourism policies, providing incentives for wine tourism infrastructure development. Leading producers are expanding hospitality offerings with vineyard stays and food pairing experiences.

Growing E-Commerce Accessibility and Digital Distribution

The legalization of online alcohol sales in select Indian states has revolutionized wine distribution, enabling consumers to conveniently access diverse product selections from home. E-commerce platforms have significantly expanded market reach beyond traditional retail channels, particularly benefiting urban consumers seeking premium and imported wine varieties. Technology-enabled distribution networks are improving supply chain efficiency and cold chain logistics, essential for maintaining wine quality. The digital transformation has created new consumer touchpoints, with online wine retailers experiencing substantial growth since regulatory relaxations began in 2020, fundamentally reshaping how Indian consumers discover and purchase wine.

Market Restraints:

What Challenges the India Wine Market is Facing?

Complex Regulatory Environment and High Taxation

India's fragmented regulatory landscape, with varying state-level excise policies and licensing requirements, creates significant operational challenges for wine producers and distributors. High import duties on foreign wines limit consumer access to international varieties, while inconsistent interstate taxation complicates distribution networks, increases operational costs, and hinders seamless market expansion across state boundaries.

Limited Consumer Awareness and Wine Education

Despite growing interest, overall wine literacy remains low among Indian consumers, with many unable to differentiate between wine varieties or understand food pairing principles. This knowledge gap limits market penetration beyond metropolitan areas and restricts development of sophisticated wine appreciation culture across broader consumer segments in tier II and III cities.

Infrastructure and Supply Chain Constraints

Inadequate cold chain infrastructure and fragmented distribution networks pose challenges for maintaining wine quality during transportation and storage. Rural and semi-urban areas lack sufficient retail accessibility, while supply chain disruptions also affect timely product availability, limiting market expansion beyond established urban centers and restricting reach to emerging consumer markets nationwide.

Competitive Landscape:

The competitive environment of the Indian wine market is rather concentrated, with local producers controlling a sizable portion of the market. Leading wineries are focusing on product portfolio diversification, quality enhancement through advanced viticulture practices, and brand differentiation strategies to capture evolving consumer preferences. Competition is intensifying as players invest in wine tourism infrastructure, sustainable production methods, and premium product development. Strategic partnerships, acquisitions, and collaborations with international winemakers are enabling domestic producers to access advanced techniques and expand market reach. Companies are leveraging digital marketing, experiential retail concepts, and hospitality partnerships to strengthen brand positioning across metropolitan and emerging tier-two city markets.

India Wine Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still Wine, Sparkling Wine, Fortified Wine and Vermouth |

| Colors Covered | Red Wine, Rose Wine, White Wine |

| Distribution Channels Covered |

|

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India wine market size was valued at USD 266.33 Million in 2025.

The India wine market is expected to grow at a compound annual growth rate of 15.65% from 2026-2034 to reach USD 985.50 Million by 2034.

Still wine holds the largest share of 69%, dominating due to its affordability, versatility with Indian cuisines, widespread retail availability, and established distribution networks across supermarkets, specialty stores, and e-commerce platforms.

Key factors driving the India wine market include rising disposable incomes, evolving consumer preferences toward premium beverages, expanding wine tourism infrastructure, growing e-commerce accessibility, supportive government policies, and increasing adoption among young urban professionals.

Major challenges include complex state-level regulatory requirements, high import duties on foreign wines, limited consumer wine education, inadequate cold chain infrastructure in semi-urban areas, fragmented distribution networks, and social stigma around alcohol consumption in certain regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)