India Women’s Health Devices Market Size, Share, Trends and Forecast by Application, Distribution Channel, and Region, 2025-2033

India Women’s Health Devices Market Overview:

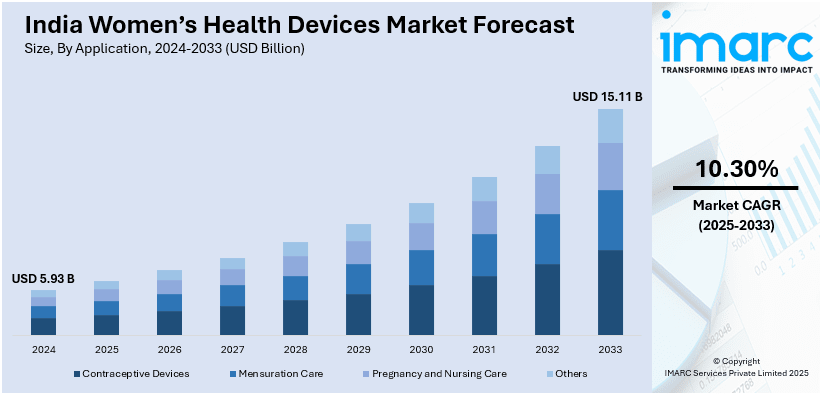

The India women’s health devices market size reached USD 5.93 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 15.11 Billion by 2033, exhibiting a growth rate (CAGR) of 10.30% during 2025-2033. The market is being driven by rising awareness about reproductive health, increasing prevalence of gynecological conditions, government initiatives promoting preventive care, growing access to telemedicine, and rapid advancements in wearable and AI-based diagnostic technologies that enable personalized, accessible, and affordable solutions for women across diverse socio-economic and geographic segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.93 Billion |

| Market Forecast in 2033 | USD 15.11 Billion |

| Market Growth Rate 2025-2033 | 10.30% |

India Women’s Health Devices Market Trends:

Increasing Awareness and Health Education Among Women

One of the major drivers in the women's health devices industry in India has been the rise in women's awareness and health education. More women are becoming informed about their reproductive health, menstrual hygiene, care requirements during pregnancy, and chronic ailments like osteoporosis and breast cancer. This is due to both government initiatives and the activities of private healthcare organizations that carry out community outreach programs, awareness campaigns, and online education drives in urban and rural regions. The ease of accessing information on the internet and the development of mobile health (mHealth) platforms have enabled women to approach solutions proactively. Women are extensively participating in routine health checkups, employing diagnostic equipment in the home, and purchasing wearable health devices specific to female health indicators. Menstrual health consciousness, most notably, has promoted the need for intelligent period trackers, disposable menstrual cups, and sophisticated sanitary products. In addition, taboo suppression of gynecological topics has promoted what is acceptable to say in terms of female-specific medical devices.

To get more information of this market, Request Sample

Technological Advancements and Innovation in Medical Devices

Continuous technological advancements and the advent of device miniaturization are also bolstering the market growth. In line with this, rising investments in R&D, the expanding med-tech startup market, and international collaborations involving Indian and medical device manufacturers abroad are further bolstering the India women’s health devices market. Contemporary diagnostic systems and wearables are now emerging with improved accuracy, connectivity, and simplicity. Among recent innovations are small breast imaging systems, AI-based ovulation and fertility monitors, and Bluetooth-connected pelvic floor trainers. Startups and large firms are creating solutions that are personalized, portable, and smartphone-compatible. This allows women from diverse socio-economic strata to track conditions such as PCOS, endometriosis, and menopause-associated hormonal fluctuations in the comfort of their homes. Furthermore, telehealth-compatible devices and remote monitoring solutions enable gynecologists and endocrinologists to deliver more responsive, data-based care. With these technologies now so intuitive and cost-effective, they are demolishing barriers to women's access to good quality care—particularly in tier 2 and tier 3 cities where specialist facilities are often unavailable. Miniaturization of devices is especially helpful. Portable ultrasound devices, palm-sized ECG monitors, and home-based cervical screening packs are some ways that innovative front-edge tech is revolutionizing diagnostics.

India Women’s Health Devices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on application and distribution channel.

Application Insights:

- Contraceptive Devices

- Mensuration Care

- Pregnancy and Nursing Care

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes contraceptive devices, mensuration care, pregnancy and nursing care, and others.

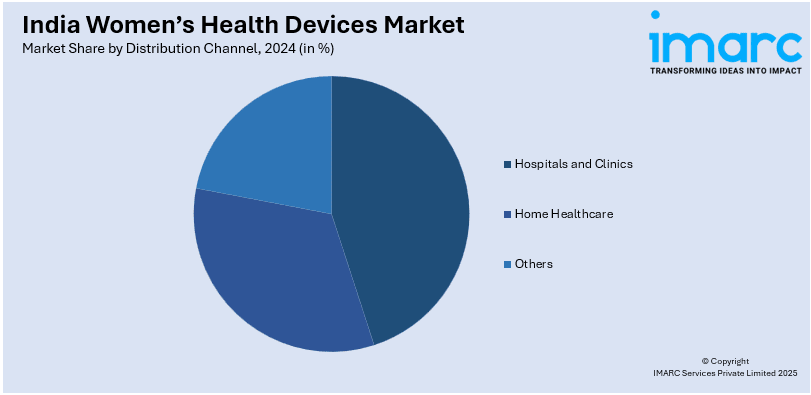

Distribution Channel Insights:

- Hospitals and Clinics

- Home Healthcare

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hospitals and clinics, home healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Women’s Health Devices Market News:

- January 2025: Pune-based MedTech firm Periwinkle Technologies launched Smart Scope® CX, an AI-driven device enabling rapid, single-visit cervical cancer screening with results in 30 seconds. This innovation reduced reliance on multi-visit diagnostics and improved access in low-resource settings.

- October 2024: Mankind Pharma completed the acquisition of Bharat Serums and Vaccines (BSV) for INR 13,768 crore, aiming to strengthen its position in women's health and fertility treatments.

- January 2024: Organon announced plans to launch the JADA System, a breakthrough device for controlling postpartum hemorrhage (PPH), in India in the near-term. The system uses vacuum-induced technology to manage abnormal postpartum bleeding efficiently.

India Women’s Health Devices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Contraceptive Devices, Mensuration Care, Pregnancy and Nursing Care, Others |

| Distribution Channels Covered | Hospitals and Clinics, Home Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India women’s health devices market performed so far and how will it perform in the coming years?

- What is the breakup of the India women’s health devices market on the basis of application?

- What is the breakup of the India women’s health devices market on the basis of distribution channel?

- What are the various stages in the value chain of the India women’s health devices market?

- What are the key driving factors and challenges in the India women’s health devices?

- What is the structure of the India women’s health devices market and who are the key players?

- What is the degree of competition in the India women’s health devices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India women’s health devices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India women’s health devices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India women’s health devices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)