India Wood Plastic Composites Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Wood Plastic Composites Market Summary:

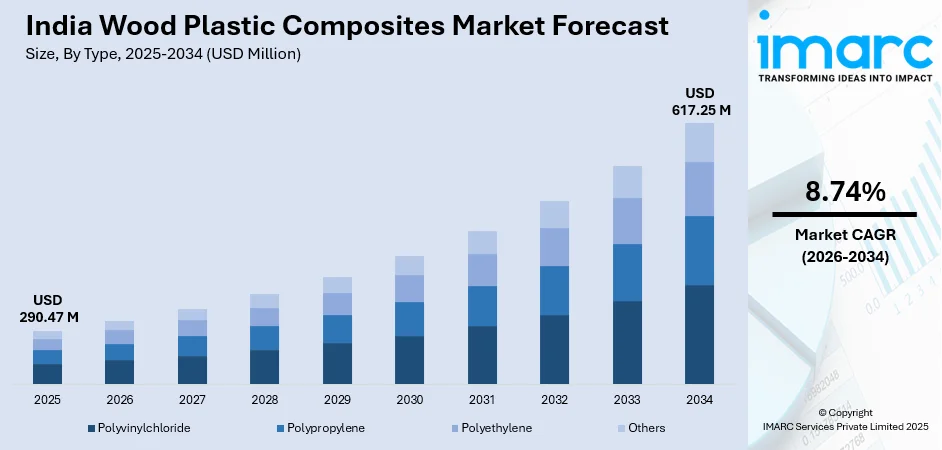

The India wood plastic composites market size was valued at USD 290.47 Million in 2025 and is projected to reach USD 617.25 Million by 2034, growing at a compound annual growth rate of 8.74% from 2026-2034.

In India, the market is witnessing robust expansion, driven by increasing adoption of sustainable construction materials and growing environmental consciousness among consumers and industries. Rising urbanization, broadening infrastructure development under government initiatives, and the shift towards eco-friendly building solutions are accelerating demand across residential and commercial segments. The market benefits from superior properties of wood plastic composites (WPCs), including moisture resistance, durability, and low maintenance requirements.

Key Takeaways and Insights:

- By Type: Polyvinylchloride dominates the market with a share of 43% in 2025, owing to its exceptional thermal stability, moisture resistance, and versatility in both interior and exterior applications. The material's cost-effectiveness and superior durability are fueling market expansion.

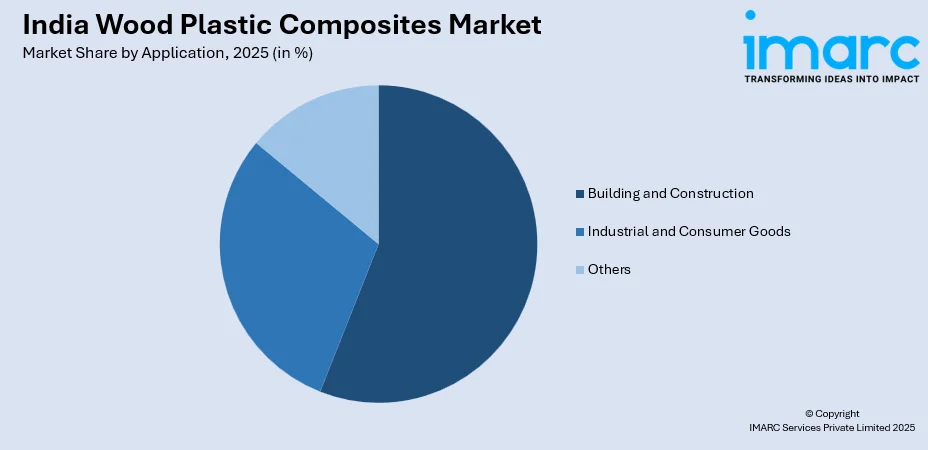

- By Application: Building and construction lead the market with a share of 56% in 2025. This dominance is driven by increasing green building certifications, infrastructure development projects, and growing preferences for sustainable construction materials across residential and commercial sectors.

- By Region: North India represents the largest region with 30% share in 2025, driven by extensive infrastructure development in Delhi-NCR, rapid urbanization, rising real estate investments, and strong presence of construction companies adopting sustainable building materials.

- Key players: Key players drive the India wood plastic composites market by expanding product portfolios, improving material technologies, and strengthening distribution networks. Their investments in research and development (R&D), strategic partnerships, and focus on sustainability are enhancing product quality and accelerating market penetration across diverse application segments. Some of the key players operating in the market include Ado Woods, Alstone Industries Private Limited, Ecoste, JKD Plastics, Kumar Arch Tech Private Limited (ECHON), Meghmani Group, SCHALEWOOD, Shubh Wood, TVL Engineers Pvt. Ltd (Floresta), and WoodAlt.

To get more information on this market Request Sample

The India wood plastic composites market is advancing, as the construction sector embraces sustainable and durable building solutions that combine the aesthetic appeal of wood with enhanced performance characteristics of polymers. The growing emphasis on green building certifications is significantly boosting demand, with India certifying 370 projects covering 8.5 Million gross square meters to LEED specifications in 2024, reflecting the country's commitment to sustainable construction practices. The material's resistance to moisture, termites, and weather conditions makes it particularly suitable for India's diverse climatic zones, from humid coastal regions to arid northern areas. Rising consumer awareness about environmental conservation and deforestation concerns is shifting preferences towards wood alternatives that utilize recycled materials and wood waste. Furthermore, the expanding modular construction segment and increasing adoption in automotive interior applications are creating additional growth avenues. As manufacturers continue to invest in advanced extrusion technologies and product innovations, the market is well-positioned for sustained expansion.

India Wood Plastic Composites Market Trends:

Rising Adoption of Sustainable Construction Materials

In India, the market growth is being propelled by increasing preferences for eco-friendly building materials that align with green construction practices. Environmental consciousness among builders, architects, and consumers is driving the transition from conventional wood to sustainable alternatives. The emergence of stringent building codes and energy efficiency standards is accelerating this shift. Additionally, rising concerns over deforestation and long-term material durability are encouraging the adoption of WPCs in construction applications.

Expanding Modular Construction and Prefabricated Housing Segment

The growing popularity of modular construction and prefabricated housing is significantly boosting WPC adoption across India. As per IMARC Group, the India modular construction market size reached USD 3.0 Billion in 2024. WPCs perfectly align with the requirements for lightweight, durable, and easy-to-install materials essential for prefab construction. The modular kitchen segment is witnessing particularly strong demand as WPC offers customizable solutions with enhanced performance in high-temperature and humid conditions. India's booming construction sector presents substantial opportunities for modular WPC applications in kitchens, bathrooms, and interior fittings.

Growing Automotive Sector Applications

The automotive industry's focus on lightweight materials for improved fuel efficiency is creating new opportunities for WPCs in vehicle interior applications. WPC is increasingly being adopted for dashboards, door panels, headliners, and trunk liners due to its durability, aesthetic appeal, and weight advantages over conventional materials. Automotive manufacturers are integrating sustainable materials to meet environmental regulations and consumer preferences. Furthermore, the ease of molding and design flexibility of WPCs support customization and cost-effective mass production in automotive components.

Market Outlook 2026-2034:

The India wood plastic composites market outlook remains highly positive, as the country accelerates infrastructure development and sustainable construction initiatives. The market generated a revenue of USD 290.47 Million in 2025 and is projected to reach a revenue of USD 617.25 Million by 2034, growing at a compound annual growth rate of 8.74% from 2026-2034. Government initiatives are expected to substantially boost demand for sustainable building materials. The expanding real estate sector, coupled with rising consumer preference for low-maintenance and weather-resistant products, positions WPC as a preferred material choice. Ongoing technological advancements in extrusion processes, development of new polymer blends, and growing manufacturer investments in production capacity expansion are strengthening market fundamentals.

India Wood Plastic Composites Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Polyvinylchloride |

43% |

|

Application |

Building and Construction |

56% |

|

Region |

North India |

30% |

Type Insights:

- Polyvinylchloride

- Polypropylene

- Polyethylene

- Others

Polyvinylchloride dominates with a market share of 43% of the total India wood plastic composites market in 2025.

The polyvinylchloride segment maintains its leadership position owing to superior thermal stability, excellent moisture resistance, and exceptional durability that make it ideal for both interior and exterior applications. Polyvinylchloride-based WPCs offer enhanced stiffness and strength compared to other polymer types, making them particularly suitable for structural applications, including doors, door frames, and window profiles. The material's ability to withstand India's diverse climatic conditions, from extreme heat to high humidity, has driven widespread adoption.

The growing demand for polyvinylchloride WPCs is further supported by their cost-effectiveness and ease of processing through extrusion manufacturing techniques. These composites can be fabricated into complex shapes and profiles while maintaining consistent quality and dimensional accuracy. The segment benefits from increasing applications in wall cladding, ceiling panels, and decorative elements where the combination of aesthetic appeal and functional performance is essential. Additionally, polyvinylchloride-based WPCs offer superior resistance to moisture, termites, and chemical exposure, enhancing durability in both interior and exterior applications.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Building and Construction

- Windows and Doors

- Decking and Flooring

- Sliding and Fencing

- Others

- Industrial and Consumer Goods

- Others

Building and construction leads with a share of 56% of the total India wood plastic composites market in 2025.

Building and construction command the largest market share, driven by increasing adoption of sustainable building materials and growing green building certifications across India. WPCs are extensively utilized in decking, fencing, wall cladding, windows, and door applications where durability and weather resistance are paramount. In 2025, the Indian Green Building Council (IGBC) documented registrations for 142 new green initiatives covering more than 875 Million square feet across 14 sectors, including residential, commercial, institutional, and industrial areas, creating substantial demand for eco-friendly construction materials. The segment benefits from WPC's ability to resist moisture, termites, and ultraviolet (UV) degradation while requiring minimal maintenance.

The construction industry's shift towards sustainable practices is accelerating WPC adoption in both residential and commercial projects. Modern infrastructure developments, including smart cities, affordable housing schemes, and commercial complexes, are increasingly specifying WPC products for exterior cladding, balcony flooring, and outdoor furniture applications. The Energy Conservation Building Code requirements and emphasis on sustainable material sourcing are reinforcing demand patterns. The India building and construction market is expected to witness continued growth, supported by government housing initiatives under Pradhan Mantri Awas Yojana, further strengthening prospects for WPC applications in this segment.

Regional Insights:

- South India

- North India

- West and Central India

- East India

North India exhibits a clear dominance with a 30% share of the total India wood plastic composites market in 2025.

North India maintains regional leadership, driven by extensive infrastructure development activities concentrated in Delhi-NCR and surrounding states. The region benefits from rapid urbanization, significant real estate investments, and presence of major construction companies adopting sustainable building materials. Property prices along key infrastructure corridors like Dwarka Expressway have appreciated by 58% year-on-year in the fourth quarter of 2024, reflecting strong construction activities and demand for premium building materials, including WPC products.

The regional market growth is further supported by major infrastructure projects, including metro expansions, airport renovations, expressway developments, and smart city initiatives, across northern states. North India's industrial manufacturing base, particularly in Uttar Pradesh and Haryana, provides strong supply chain advantages for WPC production and distribution. The region's diverse climatic conditions, ranging from extreme summers to cold winters, make WPC's weather-resistant properties particularly valuable for construction applications.

Market Dynamics:

Growth Drivers:

Why is the India Wood Plastic Composites Market Growing?

Rapid Urbanization and Infrastructure Development

India's accelerating urbanization and massive infrastructure development programs are creating substantial demand for durable and sustainable construction materials. In January 2025, the government sanctioned 56 Watershed Development Projects across 10 high-achieving states with a budget of INR 700 Crores (USD 80.9 Million). The government's ambitious initiatives, including Smart Cities Mission and affordable housing programs, are generating extensive opportunities for WPC applications in residential and commercial construction. Major infrastructure projects, spanning highways, airports, metro networks, and industrial corridors, require weather-resistant and low-maintenance materials that WPC effectively provides. WPCs also offer long service life and reduced lifecycle costs, making them suitable for large-scale public infrastructure. Their versatility supports applications, ranging from decking and facades to street furniture and utility structures.

Rising Environmental Concerns and Deforestation Awareness

Increasing environmental concerns and deforestation awareness are reshaping material preferences within India’s building and manufacturing sectors. Consumers and industries increasingly favor alternatives that reduce pressure on natural forests while maintaining visual appeal and performance. WPCs address these concerns by utilizing recycled plastics and reclaimed wood fibers, supporting responsible resource utilization. Their production helps divert waste from landfills and promotes circular economy practices. Compared to traditional wood, WPCs offer superior resistance to moisture, insects, and decay, extending product lifespan. Manufacturers are aligning product development with sustainability narratives to meet evolving buyer expectations. As environmental responsibility becomes a key purchasing criterion, WPCs gain acceptance across construction, landscaping, and interior applications nationwide. This shift also supports regulatory compliance, brand differentiation, and long term cost savings for projects while encouraging sustainable consumption patterns among businesses and households across urban and semiurban regions nationwide.

Technological Advancements and Expanding Manufacturing Capacity

Advancements in extrusion technology and material formulation are enhancing the quality, consistency, and application range of WPC products in India. Improved manufacturing processes allow producers to achieve better surface finishes, higher strength, and precise dimensional control. These developments expand WPC usage into new applications, such as structural profiles, modular components, and customized architectural elements. At the same time, increasing domestic manufacturing capacity is improving product availability and reducing dependence on imports. Local production enables competitive pricing, faster delivery, and better customization for regional market needs. Manufacturers are also investing in product innovation to cater to diverse climatic conditions and design preferences. As technology continues to improve and economies of scale strengthen, WPC becomes more accessible to a wider customer base, reinforcing its role as a mainstream material in India’s construction and design ecosystem.

Market Restraints:

What Challenges the India Wood Plastic Composites Market is Facing?

Higher Initial Investment Costs

The upfront cost of WPC products remains significantly higher compared to conventional wood and other traditional building materials, creating adoption barriers particularly among price-sensitive consumers and budget-constrained construction projects. While WPC offers superior long-term value through reduced maintenance requirements and extended lifespan, the initial price premium can deter buyers who prioritize immediate cost savings over lifecycle benefits. This cost differential is particularly pronounced in price-competitive segments of the market in India, where affordability remains a primary purchasing consideration.

Limited Consumer Awareness and Market Education

Despite growing adoption in commercial applications, awareness about WPCs and their benefits remains limited among residential consumers, small contractors, and traditional building professionals. Many potential users lack understanding of WPC's performance advantages, installation requirements, and long-term cost benefits compared to conventional materials. This knowledge gap restricts market penetration particularly in tier-two and tier-three cities where traditional wood products continue to dominate construction practices. Insufficient market education and demonstration of product benefits present ongoing challenges for broader consumer adoption.

Competition from Established Traditional Materials

WPCs face intense competition from well-established traditional materials, including natural wood, plywood, medium-density fiberboard, and other conventional building products that benefit from entrenched supply chains, familiar handling practices, and lower initial costs. The deeply rooted preference for natural wood aesthetics and the established carpentry ecosystem in India create inertia against transitioning to composite alternatives. Additionally, improving technologies in traditional wood treatment and preservation are extending the competitive viability of conventional products in certain applications.

Competitive Landscape:

The India wood plastic composites market exhibits a moderately fragmented competitive structure with presence of both established domestic manufacturers and emerging regional players. Companies are focusing on product innovations, capacity expansion, and distribution network strengthening to capture growing market opportunities. Competition is driven by investments in advanced extrusion technologies, development of application-specific product variants, and enhancement of material performance characteristics. Strategic initiatives, including vertical integration, sustainable manufacturing practices, and expansion into new geographic territories, are defining competitive positioning. Market participants are increasingly emphasizing quality certifications, customer service excellence, and technical support capabilities to differentiate their offerings and build lasting relationships with construction industry stakeholders.

Some of the key players include:

- Ado Woods

- Alstone Industries Private Limited

- Ecoste

- JKD Plastics

- Kumar Arch Tech Private Limited (ECHON)

- Meghmani Group

- SCHALEWOOD

- Shubh Wood

- TVL Engineers Pvt. Ltd (Floresta)

- WoodAlt

India Wood Plastic Composites Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

Polyvinylchloride, Polypropylene, Polyethylene, Others |

| Applications Covered |

|

| Region Covered | South India, North India, West and Central India, East India |

| Companies Covered | Ado Woods, Alstone Industries Private Limited, Ecoste, JKD Plastics, Kumar Arch Tech Private Limited (ECHON), Meghmani Group, SCHALEWOOD, Shubh Wood, TVL Engineers Pvt. Ltd (Floresta), WoodAlt. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India wood plastic composites market size was valued at USD 290.47 Million in 2025.

The India wood plastic composites market is expected to grow at a compound annual growth rate of 8.74% from 2026-2034 to reach USD 617.25 Million by 2034.

Polyvinylchloride dominated the market with a share of 43%, owing to its superior thermal stability, moisture resistance, durability, and versatility in both interior and exterior construction applications.

Key factors driving the India wood plastic composites market include expanding green building construction, rapid urbanization and infrastructure development, rising environmental awareness, growing preference for sustainable materials, and increasing applications in modular construction and automotive sectors.

Major challenges include higher initial investment costs compared to conventional materials, limited consumer awareness about WPC benefits, competition from established traditional wood products, and the need for market education among small contractors and residential consumers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)