India Wood Pulp Market Size, Share, Trends and Forecast by Type, Grade, End Use Industry, and Region, 2026-2034

India Wood Pulp Market Overview:

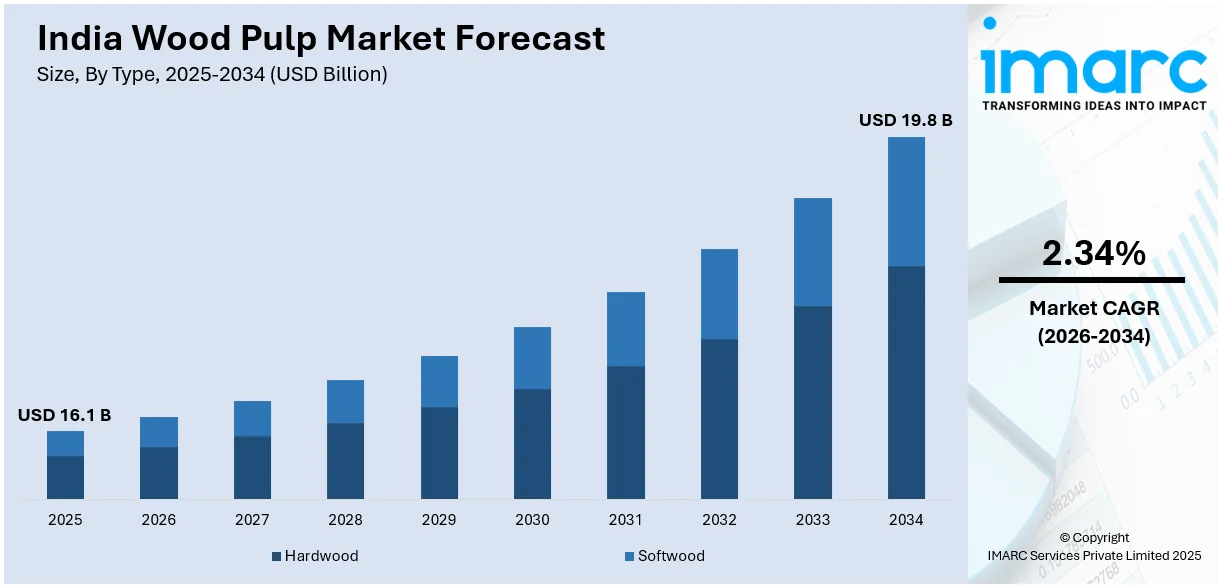

The India wood pulp market size reached USD 16.1 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 19.8 Billion by 2034, exhibiting a growth rate (CAGR) of 2.34% during 2026-2034. The rising demand for sustainable packaging, increasing adoption in the textile sector for viscose fiber production, government initiatives promoting domestic pulp manufacturing, and growing environmental concerns boosting recycled pulp usage are supporting the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 16.1 Billion |

| Market Forecast in 2034 | USD 19.8 Billion |

| Market Growth Rate 2026-2034 | 2.34% |

India Wood Pulp Market Trends:

Escalating Demand for Sustainable Packaging Solutions

The growing emphasis on environmental sustainability has fueled demand for eco-friendly packaging materials in India, particularly wood pulp-based packaging, which is biodegradable and recyclable. The pulp & paper market in India is projected to reach $5.8 billion by 2025, with a CAGR of 3.45% from 2025 to 2029, highlighting the increasing reliance on wood pulp for packaging applications. Packaging paper, a key segment within this industry, holds over 35% of the market share and is widely used in consumer goods, pharmaceuticals, food and beverages, and e-commerce. The rise of organized retail and online shopping has further driven demand, reinforcing the critical role of wood pulp-based packaging. Additionally, global market factors are influencing the Indian business. Prices in the worldwide pulp market fell sharply in 2023, with hardwood pulp down 32% and softwood pulp down 24% due to excess and insufficient demand. This price drop has made wood pulp more affordable for Indian businesses, boosting its use in environmentally friendly packaging solutions. The convergence of these variables establishes wood pulp-based packaging as a significant driver of India's transition to sustainable and environmentally friendly materials.

To get more information on this market Request Sample

Expansion of the E-Commerce Sector

India’s booming e-commerce sector is driving significant demand for wood pulp-based packaging materials. The country’s e-commerce market is expected to reach US$ 325 billion by 2030, supported by around 500 million shoppers and increasing internet penetration, especially in rural areas. As online retail expands, the need for sustainable and reliable packaging solutions has intensified. Wood pulp-based packaging plays a crucial role in supporting e-commerce logistics due to its versatility and eco-friendliness, aligning with companies' efforts to reduce their environmental impact. Additionally, India's tissue paper market is projected to grow at an annual rate of 13%, surpassing both global and Asian averages. This growth is driven by government initiatives such as the Swachh Bharat Abhiyan, which promotes hygiene and improved sanitation practices. Economic factors, including a rising affluent population, are also fueling demand across various sectors like leisure, hospitality, recreation, food, durables, retail, and medical services. With these strong growth trends, the wood pulp market in India is poised for significant expansion, reflecting broader economic and consumer behavior shifts.

India Wood Pulp Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type, grade, and end use industry.

Type Insights:

- Hardwood

- Softwood

The report has provided a detailed breakup and analysis of the market based on the type. This includes hardwood and softwood.

Grade Insights:

- Mechanical

- Chemical

- Semi-Chemical

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes mechanical, chemical, semi-chemical, and others.

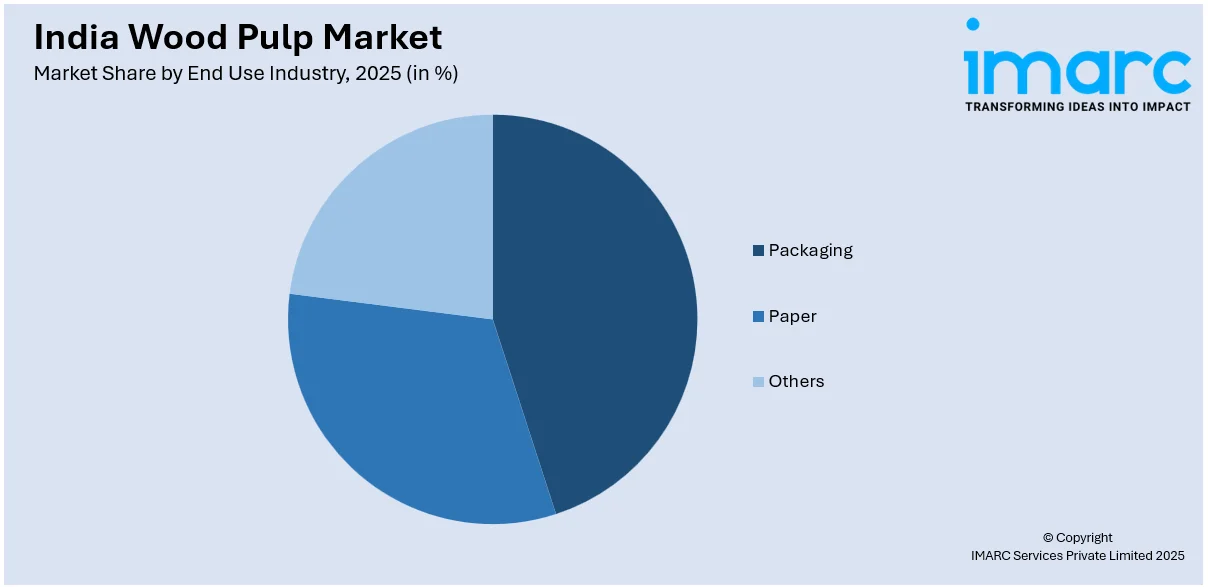

End Use Industry Insights:

Access the Comprehensive Market Breakdown Request Sample

- Packaging

- Food and Beverages

- Pharmaceutical

- Personal Care and Cosmetics

- Automotive

- Others

- Paper

- Newspaper

- Books and Magazines

- Tissues

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes packaging (food and beverages, pharmaceutical, personal care and cosmetics, automotive, and others), paper (newspaper, books and magazines, tissues, and others), and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wood Pulp Market News:

- January 2025: Jani Sales, a global paper products selling organization, established a 60 TPD tissue paper factory in Gujarat, India. The firm, which trades over 3.5 lakh metric tons of waste paper each year, runs one of India's largest MG machines, with a capacity of 100 MT/day. The firm intends to extend its market presence in India, Southeast Asia, and Africa, with plans to add new manufacturing lines dependent on market needs.

- January 2025: Silverton Pulp and Paper, in collaboration with Worthwell Papers, introduced White Kraft Liner (WKL) for premium packaging solutions in India. The new containerboard solution aims to lessen dependency on imports while allowing the Indian packaging sector to migrate to more inventive and premium packaging options. The 28-30BF WKL features high brightness and a smooth surface for outstanding printability, meeting market demands.

- September 2024: JK Paper Limited expanded production capacity at its Fort Songadh mill in Gujarat, India, by adding a new bleached chemi-thermomechanical pulp (BCTMP) line. The new line will expand the company's capacity to produce lightweight coated boards and high-quality pulp. The start-up is expected in late 2025, expanding the mill's production capacity to meet rising market demand.

India Wood Pulp Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hardwood, Softwood |

| Grades Covered | Mechanical, Chemical, Semi-Chemical, Others |

| End Use Industries Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India wood pulp market performed so far and how will it perform in the coming years?

- What is the breakup of the India wood pulp market on the basis of type?

- What is the breakup of the India wood pulp market on the basis of grade?

- What is the breakup of the India wood pulp market on the basis of end use industry?

- What are the various stages in the value chain of the India wood pulp market?

- What are the key driving factors and challenges in the India wood pulp market?

- What is the structure of the India wood pulp market and who are the key players?

- What is the degree of competition in the India wood pulp market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wood pulp market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wood pulp market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wood pulp industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)