India Wool Market Size, Share, Trends and Forecast by Wool Type, Form, End User and Region, 2025-2033

India Wool Market Size and Share:

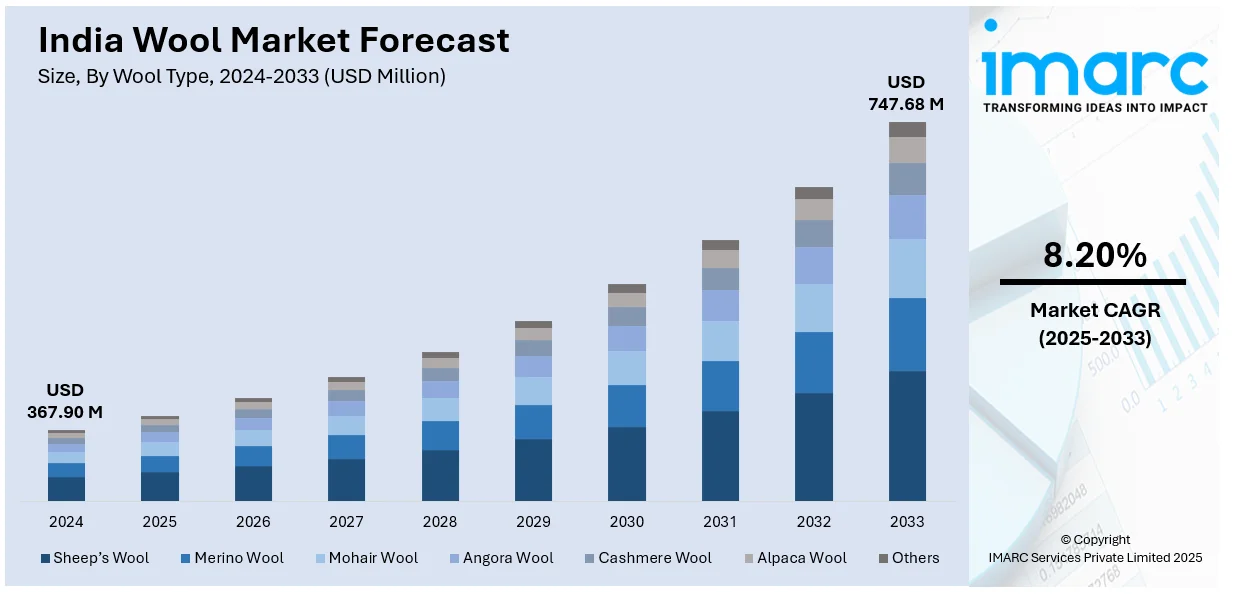

The India wool market size reached USD 367.90 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 747.68 Million by 2033, exhibiting a growth rate (CAGR) of 8.20% during 2025-2033. The India wool market share is propelled by increasing demand for woolen garments as a result of colder winters in northern states, increased fashion trends, and rising disposable incomes. The shift toward sustainable and eco-friendly products and the increase in popularity of wool for insulation and durability purposes also drive the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 367.90 Million |

| Market Forecast in 2033 | USD 747.68 Million |

| Market Growth Rate (2025-2033) | 8.20% |

India Wool Market Trends:

Increasing Demand for Sustainable and Eco-Friendly Wool Products

The India wool market outlook is witnessing an increasing trend toward eco-friendly and sustainable wool products due to growing environmental awareness. There is an increased awareness among consumers regarding the consequences of fast fashion and the need to support sustainable processes in the production of textiles. Wool as a natural product is increasingly popular as a biodegradable and renewable resource, particularly for clothing, carpets, and blankets. The move toward sustainability can be seen in the increasing popularity of organic wool, which does not contain chemicals and dyes. Moreover, companies are emphasizing minimizing their carbon footprint by using energy-efficient operations and sustainable production methods for wool. Recently, In January 2025, PurFi Global, an established innovator in textile rejuvenation technology, along with its joint venture partner, Arvind Limited, a worldwide leader in textile production, revealed intentions for a substantial increase in manufacturing capacity to back the sustainability objectives of top global fashion and design firms. Numerous brands and retailers have shown leadership in promoting a circular economy, promising to utilize 100% recycled or sustainably sourced materials by 2030. This trend is part of the world's shift toward environmentally friendly products, and with consumers increasingly placing importance on sustainability, the Indian wool market will continue to grow, with greater demand for sustainably sourced and environmentally friendly wool products.

To get more information of this market, Request Sample

Rise in Woolen Apparel Demand for Winter and Fashion Markets

Indian demand for woolen clothing is on the increase, especially in winters and in the fashion segment. Wool has inherent insulating value, and as India's north is witnessing steadily colder winters, the demand for woolen wear is on the rise. Apart from this, urbanization and rising disposable income are fueling demand for good-quality, fashion-conscious woolen clothing. According to the Edelweiss Mutual Fund report, since 2015, India's per capita income has expanded at a compound annual growth rate of 8.7%, which has led to a rise in discretionary spending. With a move toward organized retail and branded goods, India's consumer industry is experiencing unprecedented growth. Woolen garments, including coats, sweaters, and shawls, are becoming increasingly popular in urban cities, particularly among young businesspeople and style-conscious consumers. Global fashion patterns are also being adopted locally, with wool finding application in diverse designs and fashions. The increasing use of woolen accessories, like scarves, hats, and socks, further contributes to the growth of the market. As the winter clothing market grows and consumer preferences change, the India wool market growth is consistent in both fashion-oriented and conventional woolen goods.

India Wool Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on wool type, form, and end user.

Wool Type Insights:

- Sheep’s Wool

- Merino Wool

- Mohair Wool

- Angora Wool

- Cashmere Wool

- Alpaca Wool

- Others

The report has provided a detailed breakup and analysis of the market based on the wool type. This includes sheep’s wool, merino wool, mohair wool, angora wool, cashmere wool, alpaca wool, and others.

Form Insights:

- Woven

- Non- Woven

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes woven, non-woven, and others.

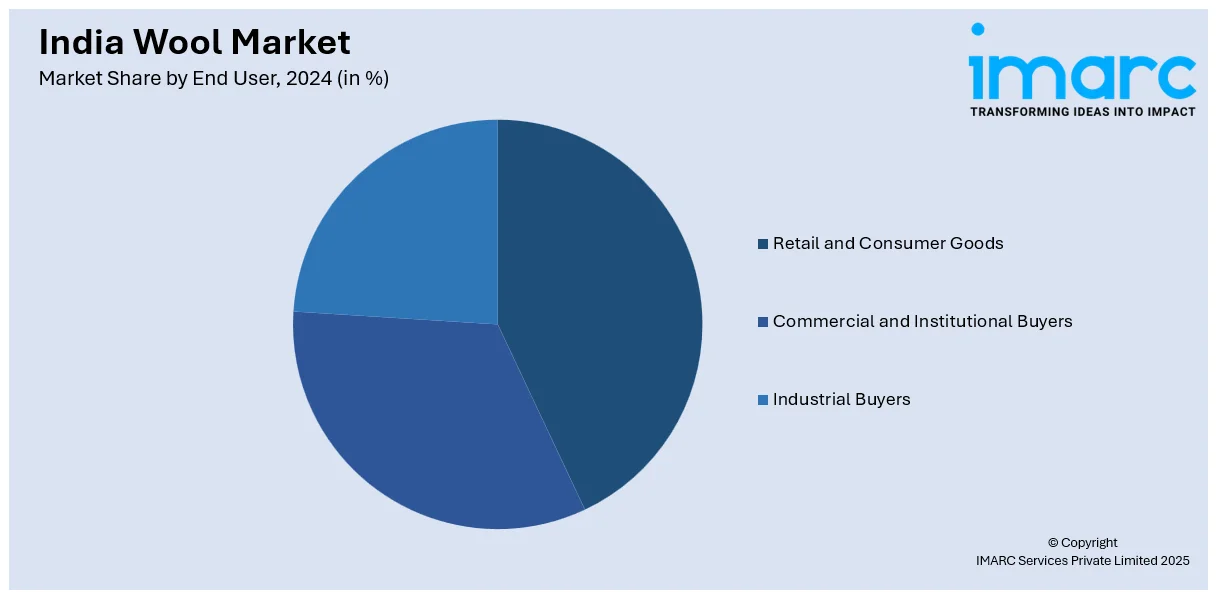

End User Insights:

- Retail and Consumer Goods

- Commercial and Institutional Buyers

- Industrial Buyers

The report has provided a detailed breakup and analysis of the market based on the end user. This includes retail and consumer goods, commercial and institutional buyers, and industrial buyers.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wool Market News:

- In February 2025, Leading wool producers have joined forces to form New Zealand Wool, which wants to increase its market share in India. It has engaged with different partners throughout the whole value chain by taking part in Bharat Tex 2025. The consortium said that its showcase's high-quality and sustainable wool products have captivated visitors at Bharat Tex 2025.

India Wool Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Wool Type Covered | Sheep’s Wool, Merino Wool, Mohair Wool, Angora Wool, Cashmere Wool, Alpaca Wool, Others |

| Form Covered | Woven, Non-Woven, Others |

| End User Covered | Retail and Consumer Goods, Commercial and Institutional Buyers, Industrial Buyers |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wool market from 2019-2033

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wool market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wool industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wool market in India was valued at USD 367.90 Million in 2024.

The India wool market is projected to exhibit a CAGR of 8.20% during 2025-2033, reaching a value of USD 747.68 Million by 2033.

Key factors driving the India wool market include increasing demand for premium and sustainable textiles, growing fashion consciousness, and rising domestic production of high-quality fine wool. Additionally, expanding exports to international apparel markets and evolving manufacturing capabilities for blends and value-added products support market growth across segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)