India Wound Dressing Market Size, Share, Trends and Forecast by Type, Wound Type, End User, and Region, 2025-2033

India Wound Dressing Market Overview:

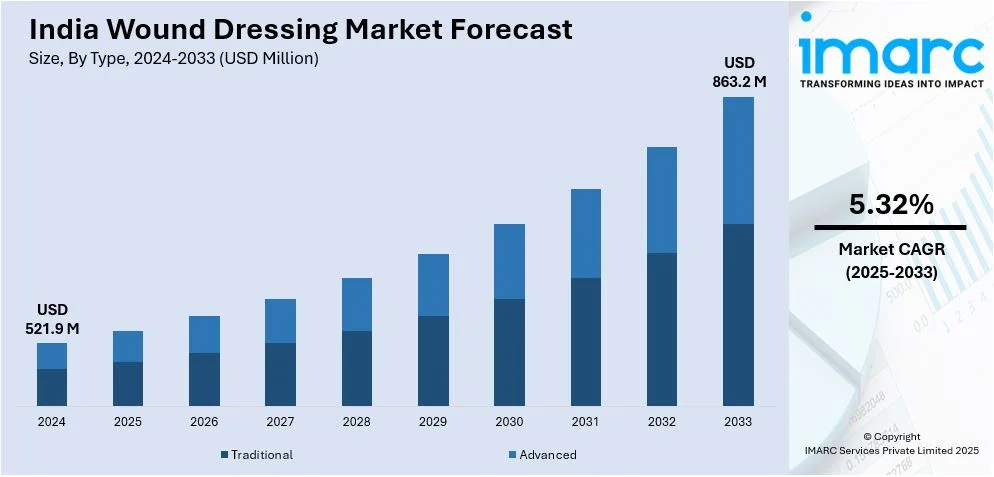

The India wound dressing market size reached USD 521.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 863.2 Million by 2033, exhibiting a growth rate (CAGR) of 5.32% during 2025-2033. The rising incidences of chronic wounds, diabetic ulcers, and surgical procedures, advancements in wound care technologies, and improved healthcare infrastructure are contributing to the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 521.9 Million |

| Market Forecast in 2033 | USD 863.2 Million |

| Market Growth Rate (2025-2033) | 5.32% |

India Wound Dressing Market Trends:

Rising Adoption of Advanced Wound Care Products

The growing preference for improved wound care solutions is propelling growth in the India wound dressing market. Advanced wound dressings, such as hydrocolloid, foam, alginate, and hydrogel dressings, are gaining popularity due to their improved healing properties and capacity to treat chronic wounds, such as pressure/diabetic ulcers and surgical wounds. India has seen a sharp rise in the number of diabetic patients, which has led to a major increase in chronic wounds. According to the International Diabetes Federation (IDF), India is expected to have around 92.9 million diabetic patients by 2025, driving up demand for appropriate wound care treatments. Advanced dressings that promote moisture balance, prevent infections, and enhance tissue regeneration are increasingly preferred in such cases. Furthermore, with an increase in the number of operations being carried out in India, the requirement for post-surgery wound treatment rises. The Indian healthcare sector is witnessing strong growth, with private equity and venture capital flows reaching USD 1 Billion during the first five months of 2024, 220% more than last year. This expansion allows greater access to modern wound care products, indicating a healthy market outlook.

To get more information of this market, Request Sample

Increasing Use of Antimicrobial and Bioactive Dressings

The rising need for antimicrobial and bioactive dressings is influencing India's wound dressing market. These new dressings are intended to lower infection risk, particularly in patients with chronic wounds, burns, or surgical incisions. Antimicrobial dressings, which contain silver, iodine, or honey, give better bacteria protection while also promoting speedier healing. Rising concerns about hospital-acquired infections (HAIs) are fueling demand for such remedies. Based on a report by the National Centre for Biotechnology Information (NCBI), HAIs impact 7-10% of hospitalized patients in India, necessitating the use of infection-prevention wound care treatments. Antimicrobial dressings are an excellent approach for minimizing bacterial colonization, particularly in high-risk environments. In addition, bioactive dressings with growth factors, collagen, or skin substitutes are becoming increasingly popular because of their healing properties. These dressings stimulate cellular growth, tissue repair, and angiogenesis, which are especially useful for diabetic ulcers, pressure sores, and surgical wounds.

India Wound Dressing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, wound type, and end user.

Type Insights:

- Traditional

- Advanced

The report has provided a detailed breakup and analysis of the market based on the type. This includes traditional and advanced.

Wound Type Insights:

- Traumatic

- Surgical

- Diabetic Foot

- Venous Leg Ulcer and Burns

A detailed breakup and analysis of the market based on the wound type have also been provided in the report. This includes traumatic, surgical, diabetic foot, and venous leg ulcer and burns.

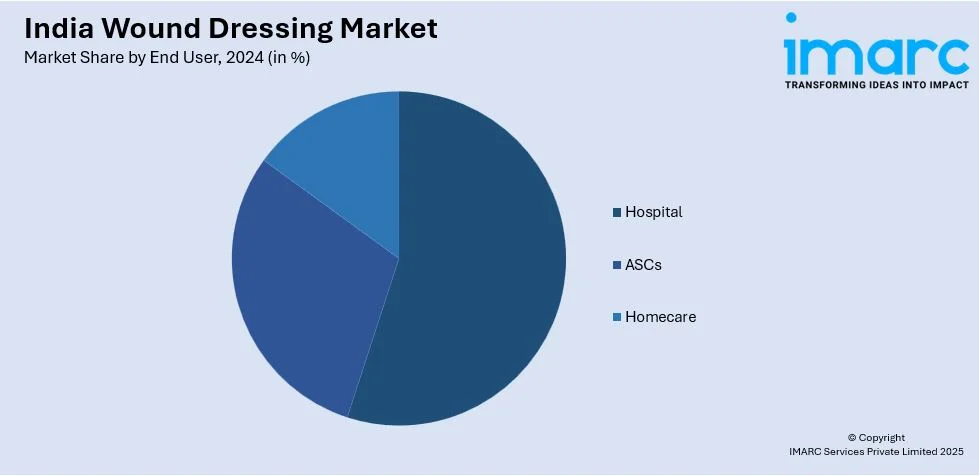

End User Insights:

- Hospital

- ASCs

- Homecare

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospital, ASCs, and homecare.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Wound Dressing Market News:

- January 2025: Researchers from NITK Surathkal created a pH-sensitive hydrogel using poly-aspartic acid, polyvinyl alcohol, and sole fish collagen. It showed outstanding swelling qualities in rabbits, guaranteeing optimum hydration, infection management, and encouraging quicker, scarless wound healing.

- October 2024: Kerala University received a patent for a biocompatible hydrogel film used to treat diabetic wounds. The study, titled "Synthesis of Ferulic Acid Incorporated Alginate Dialdehyde Gelatin Hydrogel Film," is a big step forward in regenerative medicine.

- February 2024: Indian scientists, led by Prof. Devasish Chowdhury and Prof. Rajlakshmi Devi, created an eco-friendly wound dressing using banana fibers combined with biopolymers such as chitosan and guar gum. This novel patch provides both mechanical assistance and antioxidant properties.

India Wound Dressing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Traditional, Advanced |

| Wound Types Covered | Traumatic, Surgical, Diabetic Foot, Venous Leg Ulcer and Burns |

| End Users Covered | Hospital, ASCs, Homecare |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India wound dressing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India wound dressing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India wound dressing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The wound dressing market in India was valued at USD 521.9 Million in 2024.

The India wound dressing market is projected to exhibit a CAGR of 5.32% during 2025-2033, reaching a value of USD 863.2 Million by 2033.

India wound dressing market is growing due to increasing cases of chronic wounds like diabetic foot ulcers and pressure sores. An aging population, more surgeries, and better healthcare access also contribute. There's a shift toward advanced dressings, hydrogels, alginates, and antimicrobial types, which offer improved healing. Government health programs and rising awareness further support this trend.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)