India Xylene Market Size, Share, Trends and Forecast by Type, Application, End-User Industry, and Region, 2025-2033

India Xylene Market Overview:

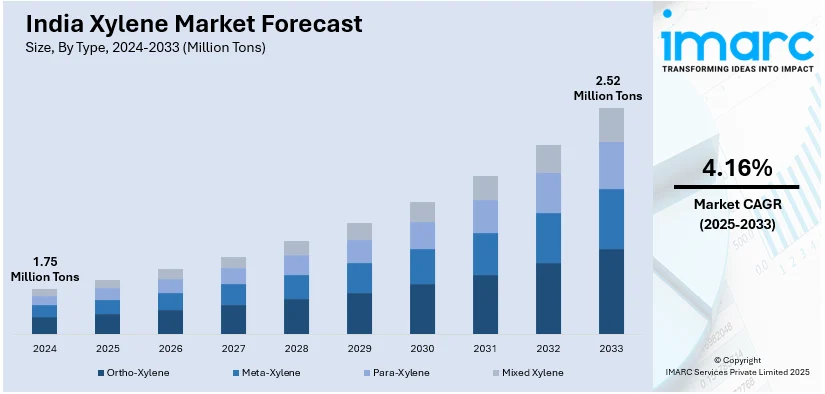

The India xylene market size reached 1.75 Million Tons in 2024. Looking forward, IMARC Group expects the market to reach 2.52 Million Tons by 2033, exhibiting a growth rate (CAGR) of 4.16% during 2025-2033. The market is driven by rising demand for paints and coatings, fueled by infrastructure growth and urbanization. Additionally, the petrochemical sector’s need for xylene in PTA production used in polyester and plastics expands the India xylene market share. The implementation of government initiatives, expanding packaging industries, and increasing disposable incomes further propel market growth, encouraging capacity expansions and technological advancements.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 1.75 Million Tons |

| Market Forecast in 2033 | 2.52 Million Tons |

| Market Growth Rate 2025-2033 | 4.16% |

India Xylene Market Trends:

Rising Demand from the Paints and Coatings Industry

The increasing demand from the paints and coatings sector is significantly supporting the India xylene market growth. A research report from the IMARC Group indicates that the market for paints and coatings in India was valued at USD 8.8 Billion in 2024. It is projected to grow to USD 17.4 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.35% from 2025 to 2033. With rapid urbanization, infrastructure development, and a booming real estate industry, the need for high-performance paints and coatings are on the rise. Xylene, a key solvent in paint formulations, enhances durability, drying speed, and gloss retention, making it indispensable for manufacturers. Additionally, government initiatives including "Housing for All" and smart city projects are further propelling demand. The shift toward water-based and eco-friendly paints leads to innovations in xylene-based products to meet environmental regulations. As disposable incomes rise and consumer preference for premium paints grows, the xylene market is expected to expand steadily. Companies are investing in production capacity to cater to this rising demand, ensuring a robust supply chain to support the industry's growth in the coming years.

To get more information on this market, Request Sample

Increasing Use in the Petrochemical and Plastics Sector

Another major trend in the India xylene market is its growing application in the petrochemical and plastics industries. With a refining representation of approximately 256.816 MMTPA among 23 refineries and a solid petrochemical landscape, India ranks 4th globally (after the USA, China, and Japan) in refining capacity. India's initiative, which includes the Oilfields Amendment Bill 2024 and the Hydrocarbon Exploration and Licensing Policy (HELP), aims to increase the exploration area to 1 million square kilometers by 2030 in order to expand its reserves to 651.8 Million Metric Tons (MMT) of crude oil and 1,138.6 Billion Cubic Meters (BCM) of natural gas. With a 2022–2023 GVA of Rs. 2.12 Lakh Crore (about USD 25,542 Million) and substantial investments in bio-refineries, xylene, and green fuels, India's petrochemical industry is well-positioned for rapid expansion and increased global competitiveness. Xylene is a crucial feedstock for producing purified terephthalic acid (PTA), a primary raw material for polyester and PET bottle manufacturing. With India's packaging industry expanding due to e-commerce growth and rising consumption of bottled beverages, PTA demand has accelerated, directly improving xylene consumption. Additionally, the textile industry's reliance on polyester fibers is further creating a positive India xylene market outlook. Government policies promoting domestic manufacturing, such as the Production Linked Incentive (PLI) scheme, are encouraging investments in petrochemical plants, enhancing xylene production capabilities. As India focuses on reducing plastic waste and adopting recycled PET, the demand for high-quality xylene-derived PTA is expected to rise, positioning the market for sustained growth in the near future.

India Xylene Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, application, and end-user industry.

Type Insights:

- Ortho-Xylene

- Meta-Xylene

- Para-Xylene

- Mixed Xylene

The report has provided a detailed breakup and analysis of the market based on the type. This includes ortho-xylene, meta-xylene, para-xylene, and mixed xylene.

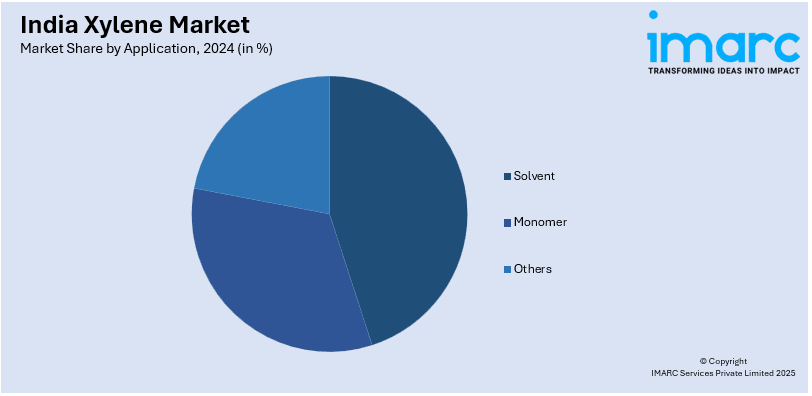

Application Insights:

- Solvent

- Monomer

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes solvent, monomer, and others.

End-User Industry Insights:

- Plastics and Polymers

- Paints and Coatings

- Adhesives

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user industry. This includes plastics and polymers, paints and coatings, adhesives, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Xylene Market News:

- December 25, 2024, Indian Oil Corporation (IOCL) announced an investment of INR 61,000 Crore (approximately USD 7,320 Million) in a naphtha cracker project in Paradip, Odisha, to transform the place into a major petrochemical hub. The initiative will improve India's production of xylene and para-xylene, which will, in turn, support the growth of India's petrochemical industry.

India Xylene Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ortho-Xylene, Meta-Xylene, Para-Xylene, Mixed Xylene |

| Applications Covered | Solvent, Monomer, Others |

| End-User Industries Covered | Plastics, Polymers, Paints, Coatings, Adhesives, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India xylene market performed so far and how will it perform in the coming years?

- What is the breakup of the India xylene market on the basis of type?

- What is the breakup of the India xylene market on the basis of application?

- What is the breakup of the India xylene market on the basis of end-user industry?

- What is the breakup of the India xylene market on the basis of region?

- What are the various stages in the value chain of the India xylene market?

- What are the key driving factors and challenges in the India xylene market?

- What is the structure of the India xylene market and who are the key players?

- What is the degree of competition in the India xylene market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India xylene market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India xylene market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India xylene industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)