India Yacht Market Size, Share, Trends and Forecast by Type, Length, Propulsion, and Region, 2025-2033

India Yacht Market Overview:

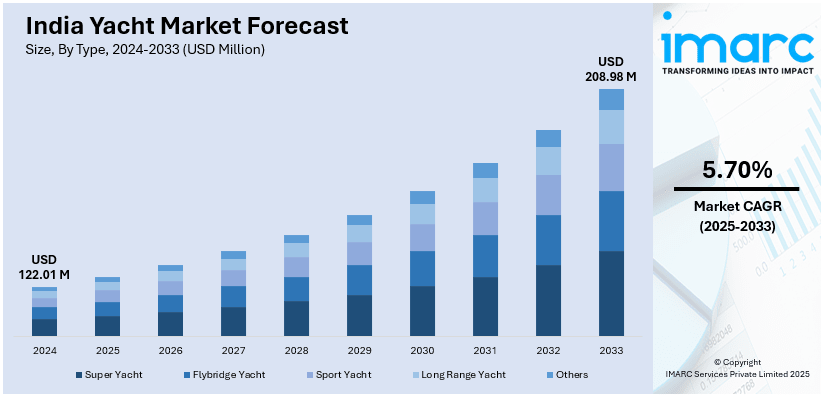

The India yacht market size reached USD 122.01 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 208.98 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. The increased interest in luxury and recreational marine tourism, the growing culture of leisure boating among affluent individuals, and government initiatives to develop coastal infrastructures and promote marine tourism, especially in states like Goa, Kerala, and Maharashtra, are among the key factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 122.01 Million |

| Market Forecast in 2033 | USD 208.98 Million |

| Market Growth Rate 2025-2033 | 5.70% |

India Yacht Market Trends:

Surge in Marine Tourism and Charter Yacht Services

India’s yacht market is experiencing robust growth, fueled by a surge in marine tourism and demand for luxury coastal experiences. Coastal states such as Goa, Kerala, Maharashtra, and the Andaman and Nicobar Islands are emerging as key destinations for charter yacht services, catering to the evolving preferences of affluent travelers. The appeal of bespoke vacationing, through leisure cruises, private celebrations, and corporate events, has significantly boosted interest in yacht charters. Companies are responding by offering premium, all-inclusive packages featuring water sports, gourmet dining, and overnight stays, tailored to high-net-worth individuals (HNWIs) and international tourists seeking exclusivity. The number of registered charter yachts in India has been steadily rising, with the majority concentrated in hubs like Goa and Mumbai. Furthermore, the luxury yacht charter market is projected to expand rapidly, reflecting a broader trend toward experiential and upscale tourism. This growth not only enhances yacht ownership but also drives expansion in ancillary sectors such as yacht rentals, crew training, and integrated luxury hospitality.

To get more information on this market, Request Sample

Coastal Infrastructure Development and Government Support

India’s yacht industry is gaining momentum, propelled by increased investments in coastal and marina infrastructure and the support of favorable government policies. Initiatives such as the Sagarmala Program and various state-led projects are transforming India’s coastline by enhancing port facilities, streamlining yacht registration, and promoting ease of navigation. The Indian government has committed nearly NR 6 lakh crore under Sagarmala, with a portion allocated to developing marinas and boosting maritime tourism. Goa is at the forefront, having witnessed a 40% rise in cruise passenger arrivals in the 2023-24 financial year, driven by new marinas in Chapora and Panaji. Meanwhile, Mumbai is enhancing its yachting appeal through upgraded jetties designed to accommodate private yachts and charter operators. Additionally, the private sector is stepping in, with over INR 500 crore proposed for marina development in states like Kerala and Maharashtra. These combined efforts are enabling India to host international sailing events, attract global yacht brands, and create a robust ecosystem for yacht ownership and luxury marine travel, positioning the country as a rising contender in global yacht tourism.

India Yacht Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, length, and propulsion.

Type Insights:

- Super Yacht

- Flybridge Yacht

- Sport Yacht

- Long Range Yacht

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes super yacht, flybridge yacht, sport yacht, long range yacht, and others.

Length Insights:

- Up to 20 M

- 20 to 50 M

- Above 50 M

A detailed breakup and analysis of the market based on the length have also been provided in the report. This includes up to 20 M, 20 to 50 M, and above 50 M.

Propulsion Insights:

- Motor Yacht

- Sailing Yacht

The report has provided a detailed breakup and analysis of the market based on the propulsion. This includes motor yacht and sailing yacht.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Yacht Market News:

- March 2025: The Delhi government revealed its plan to introduce a river cruise service between Sonia Vihar and Jagatpur. The proposal is for improving a six-kilometer section of the Yamuna from the Wazirabad barrage to Jagatpur (Shani shrine). The project will be carried out by IWAI and DDA in conjunction with the Delhi Jal Board.

- November 2024: Goa launched its first super yacht 'RA11' at the Captain of Ports jetty. The luxury boat, built by Vijay Marine Engineering, has enormous lounges, dining spaces, and a large outside deck, making it ideal for weddings, private events, or leisurely activities.

India Yacht Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Super Yacht, Flybridge Yacht, Sport Yacht, Long Range Yacht, Others |

| Lengths Covered | Up to 20 M, 20 to 50 M, Above 50 M |

| Propulsions Covered | Motor Yacht, Sailing Yacht |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India yacht market performed so far and how will it perform in the coming years?

- What is the breakup of the India yacht market on the basis of type?

- What is the breakup of the India yacht market on the basis of length?

- What is the breakup of the India yacht market on the basis of propulsion?

- What are the various stages in the value chain of the India yacht market?

- What are the key driving factors and challenges in the India yacht?

- What is the structure of the India yacht market and who are the key players?

- What is the degree of competition in the India yacht market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India yacht market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India yacht market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India yacht industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)