India Zinc Oxide Market Size, Share, Trends and Forecast by Process, Application, and Region, 2025-2033

India zinc oxide Market Overview:

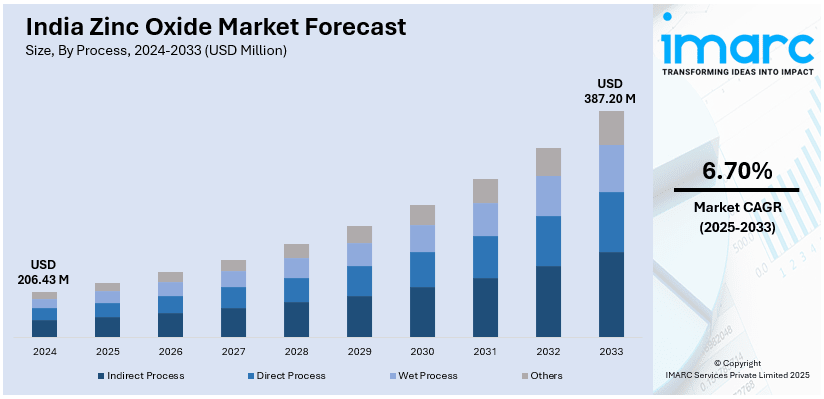

The India zinc oxide market size reached USD 206.43 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 387.20 Million by 2033, exhibiting a growth rate (CAGR) of 6.70% during 2025-2033. The market is expanding due to the rising demand in rubber, ceramics, pharmaceuticals, and cosmetics. Growth is driven by tire manufacturing, government initiatives in industrial expansion, and increasing applications in personal care and healthcare products. Environmental regulations influence production processes, which, in turn, is also contributing to the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 206.43 Million |

| Market Forecast in 2033 | USD 387.20 Million |

| Market Growth Rate 2025-2033 | 6.70% |

India Zinc Oxide Market Trends:

Rising Demand from the Rubber and Tire Industry

The India zinc oxide market is witnessing significant demand growth from the rubber and tire industry, which remains its largest end-use sector. Zinc oxide is a key ingredient in rubber vulcanization, enhancing durability, heat resistance, and elasticity. With the rapid expansion of India’s automotive segment, mainly propelled by escalating vehicle manufacturing and fueling user requirement for two-wheelers and four-wheelers, tire manufacturing is experiencing sustained growth. For instance, as per industry reports, in September 2024, the total manufacturing of quadricycles, passenger vehicles, and two- and three-wheelers stood at 27,73,039 units. Additionally, government initiatives promoting electric mobility, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, are further accelerating tire production. This surge is increasing the need for high-quality zinc oxide to meet performance and safety standards. Domestic manufacturers are also investing in capacity expansion and technological upgrades to cater to the growing demand. Furthermore, fluctuations in zinc prices and supply chain constraints may impact production costs, prompting companies to explore cost-effective production methods and alternative sources of raw materials.

To get more information on this market, Request Sample

Expanding Applications in the Pharmaceutical and Cosmetics Industry

Zinc oxide is gaining traction in India’s pharmaceutical and cosmetics sectors due to its antibacterial, UV-protective, and skin-soothing properties. In pharmaceuticals, it is widely used in ointments, creams, and medicated powders for treating skin conditions such as rashes, sunburn, and acne. The increasing prevalence of dermatological issues, along with heightened consumer awareness of skincare, is driving demand for zinc oxide-based formulations. For instance, as per industry reports, approximately 1 in 2 customers across India are suffering with dry skin in 2024, with 82% respondents revealing experience anxiety when attending public places due to skin conditions. In the cosmetics industry, its role as a key ingredient in sunscreens, lotions, and personal care products is expanding, supported by growing consumer preference for mineral-based, chemical-free skincare solutions. The Indian government’s focus on promoting domestic pharmaceutical production under the Production Linked Incentive (PLI) scheme is encouraging local zinc oxide manufacturers to enhance quality standards and expand supply chains. Moreover, stringent regulations on product safety and efficacy are prompting companies to invest in high-purity grades of zinc oxide, ensuring compliance with international standards for pharmaceutical and cosmetic applications.

India Zinc Oxide Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on process and application.

Process Insights:

- Indirect Process

- Direct Process

- Wet Process

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes indirect process, direct process, wet process, and others.

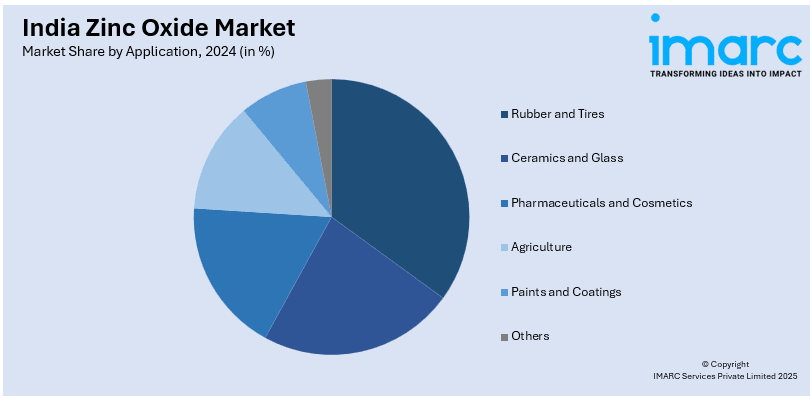

Application Insights:

- Rubber and Tires

- Ceramics and Glass

- Pharmaceuticals and Cosmetics

- Agriculture

- Paints and Coatings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes rubber and tires, ceramics and glass, pharmaceuticals and cosmetics, agriculture, paints and coatings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Zinc Oxide Market News:

- In April 2024, CodeSkin, a new India-based skincare company announced its entry in the market by launching its portfolio for pioneering sunscreens, including Ultra Mineral Glo SPF 40+, UltraSensitive Mineral SPF 50+, UltraMatte Oil-free Fluid SPF 50+, UltraLite Fluid SPF 50+, etc. The mineral range of sunscreens are integrated only with zinc oxide.

- In March 2024, a major zinc oxide provider for pharmaceutical, tire, and ceramic sectors, announced plans to attain USD 28.7 Million through an IPO, with around USD 18.9 Million of this investment to be leveraged for the development of a research and development facility in Andhra Pradesh.

India Zinc Oxide Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Indirect Process, Direct Process, Wet Process, Others |

| Applications Covered | Rubber and Tires, Ceramics and Glass, Pharmaceuticals and Cosmetics, Agriculture, Paints and Coatings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India zinc oxide market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India zinc oxide market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India zinc oxide industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The zinc oxide market in India was valued at USD 206.43 Million in 2024.

The India zinc oxide market is projected to exhibit a CAGR of 6.70% during 2025-2033, reaching a value of USD 387.20 Million by 2033.

The India zinc oxide market is driven by rapid automotive-rubber growth (especially tires), expanding pharmaceutical and skincare uses, rising demand in ceramics, coatings and construction, supportive government initiatives (PLI, RKVY), and a shift toward eco-friendly nano/Zn-based solutions, all despite raw-material price volatility.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)