India Zirconium Market Size, Share, Trends and Forecast by Occurrence Type, Form, End Use, and Region, 2025-2033

India Zirconium Market Overview:

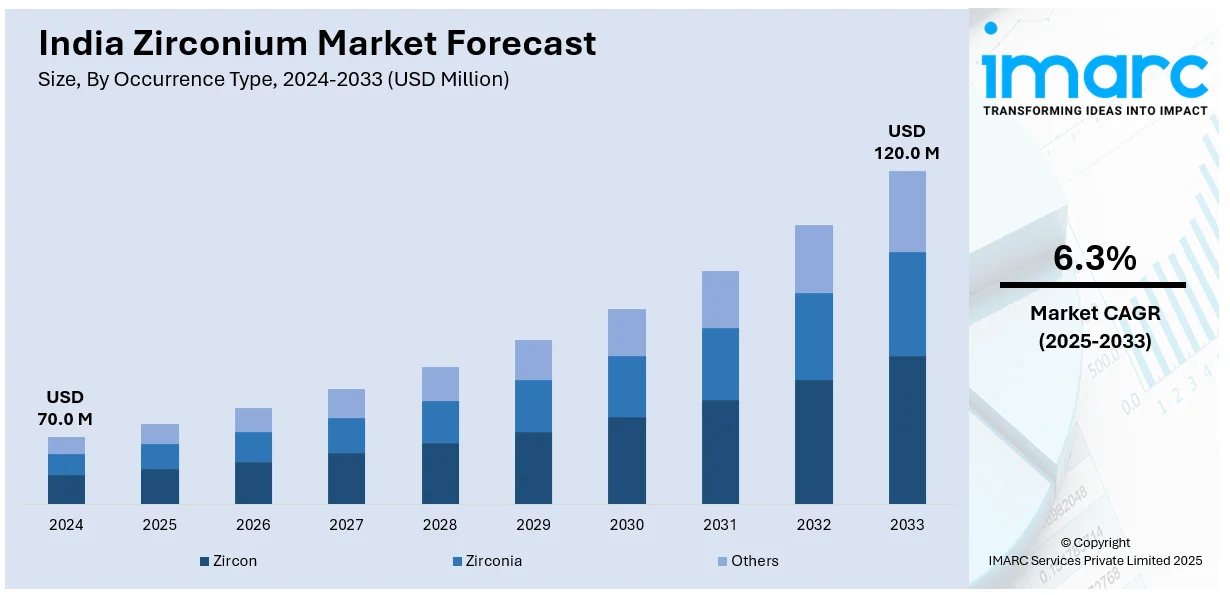

The India zirconium market size reached USD 70.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 120.0 Million by 2033, exhibiting a growth rate (CAGR) of 6.3% during 2025-2033. The market is driven by the expanding ceramics and chemical industries, propelling demand in the healthcare and defense sectors, significant applications in nuclear energy, advancements in metal-organic frameworks for catalysis, and government initiatives promoting domestic manufacturing, technological innovation, and strategic investments in high-performance zirconium-based materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 70.0 Million |

| Market Forecast in 2033 | USD 120.0 Million |

| Market Growth Rate (2025-2033) | 6.3% |

India Zirconium Market Trends:

Expansion of the Ceramics Industry

Zirconium is an important ingredient in the ceramics sector, especially in the manufacture of tiles, sanitary ware, and tableware. Its characteristics improve the strength, whiteness, and beauty of ceramic products. The ceramics industry in India has been enhancing steadily, and this has led to the propelling demand for zirconium. Based on statistics from the India Brand Equity Foundation (IBEF), the ceramics and glassware industry recorded an upsurge of 20.32% in May 2021 over May 2019. This trend indicates the strong development of the ceramics sector in the nation. With the development of the industry, the demand for zirconium, which is needed to manufacture high-quality ceramic products, blossoms accordingly. The "Make in India" program has further strengthened the ceramics industry by promoting local manufacturing and investment. The policy push has resulted in new manufacturing facilities being set up and existing ones being upgraded, thus enhancing the capacity for the production of ceramic items. As a result, demand for zirconium has risen to cater to the raw material needs of these rising operations. Further, rapid urbanization and expansion in the real estate market have contributed to the augmentation of demand for sanitary ware and ceramic tiles. As more commercial and residential developments take place, the demand for zirconium-enriched ceramics rises, also propelling the Indian zirconium market further.

To get more information on this market, Request Sample

Growth of the Chemical Industry

Zirconium compounds find wide applications in the chemical industry as catalysts, pigments, and refractory materials. The expansion of India's chemical industry has largely contributed to the flourishing demand for zirconium. The small and medium enterprises (SMEs) of the domestic chemical industry are expected to reflect a revenue increment of 20-24% in the FY 2023. This whopping progress reflects an upbeat chemical market, which correspondingly fuels the consumption of zirconium-based substances utilized in myriad chemical processes as well as goods. Also, the Indian overall chemical industry itself is expected to be valued at USD 304 Billion in 2025, expanding with a compound annual growth rate (CAGR) of 9.3%. This strong development path reflects the growing size of chemical production and the resultant boost in demand for zirconium compounds used as inputs in production processes. Government policies, like the "Make in India" campaign, have been instrumental in encouraging the development of the chemical industry. With a focus on local manufacturing and de-linking from imports, these policies have helped to bring about a supportive environment for the expansion of the chemical industry. Consequently, the demand for zirconium, used in many applications in the chemicals industry, has seen a significant elevation.

India Zirconium Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on occurrence type, form, and end use.

Occurrence Type Insights:

- Zircon

- Zirconia

- Others

The report has provided a detailed breakup and analysis of the market based on the occurrence type. This includes zircon, zirconia, and others.

Form Insights:

- Crystal

- Powder

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes crystal and powder.

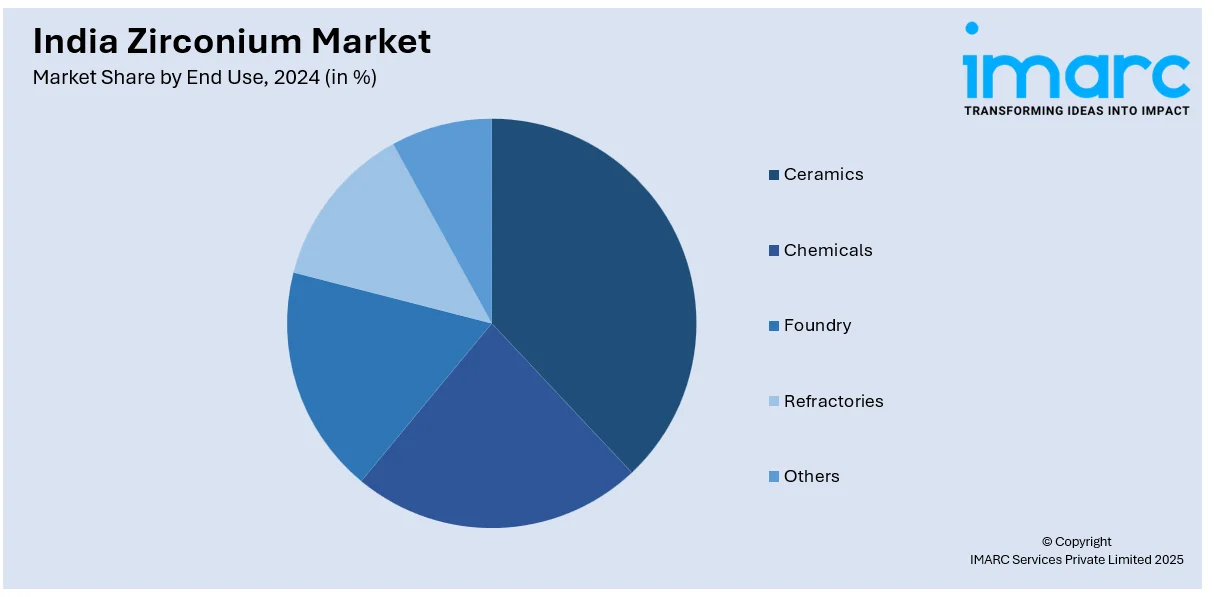

End Use Insights:

- Ceramics

- Chemicals

- Foundry

- Refractories

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes ceramics, chemicals, foundry, refractories, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Zirconium Market News:

- March 2025: The Central Drugs Standard Control Organization (CDSCO) approved AstraZeneca to import sodium zirconium cyclosilicate for the treatment of hyperkalemia in adult patients in India. This approval has broadened the application of zirconium-based compounds in the pharmaceutical industry, boosting demand for high-purity zirconium. Increased usage of zirconium in medical applications has made India's zirconium market stronger by inducing investment and manufacturing.

- November 2024: India created a 1500km-range missile with sophisticated capabilities, strengthening its strategic defense capability. Applications of zirconium-based alloys in missile coatings and propulsion systems created additional demand for high-performance zirconium materials. Expansion in the defense industry stimulated India's zirconium market by encouraging investments in cutting-edge materials and technology.

India Zirconium Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Occurrence Types Covered | Zircon, Zirconia, Others |

| Forms Covered | Crystal, Powder |

| End Uses Covered | Ceramics, Chemicals, Foundry, Refractories, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India zirconium market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India zirconium market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India zirconium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The zirconium market in India was valued at USD 70.0 Million in 2024.

The India zirconium market is projected to exhibit a CAGR of 6.3% during 2025-2033, reaching a value of USD 120.0 Million by 2033.

Rapid urbanization and infrastructure development are catalyzing the demand for zirconium, especially in tiles and sanitaryware manufacturing. Additionally, the increasing use of zirconium in the nuclear energy sector is supporting the market growth, as zirconium alloys are vital for nuclear fuel cladding due to their low neutron absorption. The rising focus on defense and aerospace is positively influencing the market, with zirconium being employed in specialty alloys and coatings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)