Indian Animal Feed Market Size, Share, Trends and Forecast by Product Type and Region, 2026-2034

Indian Animal Feed Market Summary:

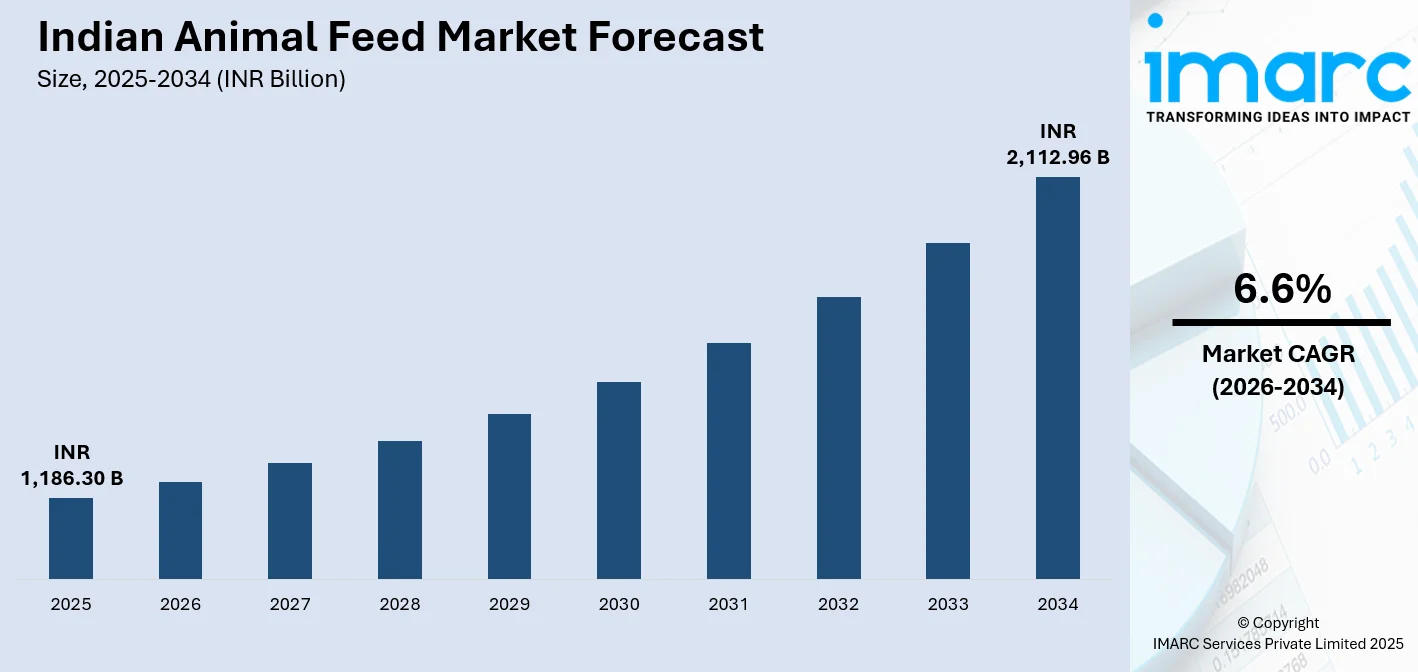

The Indian animal feed market size was valued at INR 1,186.30 Billion in 2025 and is projected to reach INR 2,112.96 Billion by 2034, growing at a compound annual growth rate of 6.6% from 2026-2034.

The market is primarily driven by escalating demand for animal-based protein products as dietary patterns shift toward meat, eggs, and dairy consumption. Rising livestock populations, favorable government schemes supporting feed manufacturing infrastructure, and increasing farmer awareness about scientifically formulated nutrition solutions are propelling commercial feed adoption across India's diverse agricultural landscape. Moreover, the growing cold chain facilities and enhanced distribution networks are facilitating market penetration beyond traditional agricultural regions, thereby expanding the Indian animal feed market share.

Key Takeaways and Insights:

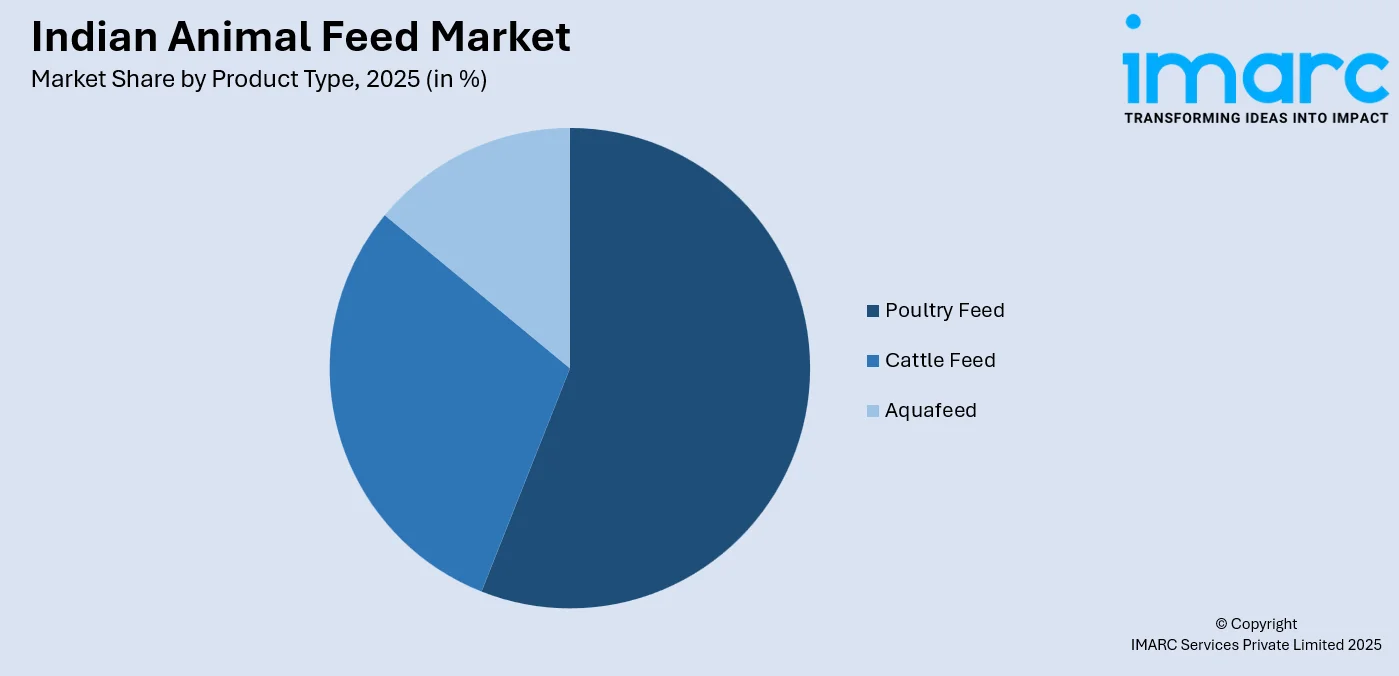

- By Product Type: Poultry feed dominates the market with a share of 56% in 2025, owing to the extensive consumption of chicken and eggs, along with the rapid expansion of organized poultry farming businesses that require scientifically formulated nutritional products.

- By Region: North India leads the market with a share of 31% in 2025, benefiting from extensive dairy farming activities in Punjab, Haryana, and Uttar Pradesh, robust agricultural infrastructure, and proximity to major grain-producing belts that facilitate cost-effective raw material procurement.

- Key Players: The Indian animal feed market features a competitive landscape comprising established multinational corporations, diversified agribusiness conglomerates, and specialized regional manufacturers. Key players include Anmol Feed, Avanti Feeds Limited, Charoen Pokphand Foods PCL, Godrej Agrovet Limited, Grobest Feeds Corporation India Pvt Limited, Growel Feeds Private Limited, JAPFA India, Kapila Group, KSE Limited, SKM Animal Feeds & Foods (India) Private Limited, Suguna Foods Private Limited, The Waterbase Limited, and Uno Feeds.

To get more information on this market Request Sample

As traditional subsistence farming gives way to commercial production models that need for standardized feed solutions, the Indian cattle industry is undergoing a fundamental upheaval. The consumption of animal protein products is increasing due to rising disposable incomes, which immediately increases the need for premium feed formulations. Commercial producers are becoming more aware of the direct relationship between balanced nutrition and productivity measures such as growth rates, feed conversion ratios, and reproductive efficiency. Grain surpluses, oilseed processing wastes, and agricultural byproducts provide the sector with significant raw material availability. By creating species-specific formulations suited to various livestock stages and adding useful additives like probiotics, enzymes, and immune boosters, feed makers are adapting to changing market demands. Technological integration spanning automated mixing systems, precision feeding platforms, and digital supply chain management is enhancing operational efficiency and quality consistency across manufacturing facilities. In 2025, De Heus India, a division of De Heus Animal Nutrition, inaugurated a new feed manufacturing plant in Rajpura, Punjab. The factory, established with an investment of nearly 17 million USD, ranks among the largest and most sophisticated in India, featuring an installed capacity of 180 kMT and the ability to increase to 240 kMT. The factory features distinct production lines for cattle, buffalo, poultry, and pig feed. It employs cutting-edge European technology and automation to create premium animal feeds.

Indian Animal Feed Market Trends:

Precision Feeding Technologies and Digital Integration

Automation and digital technology are being quickly adopted by feed makers to improve nutritional delivery, decrease waste, and improve production uniformity. Superior quality control is made possible while reducing human error in formulation processes via real-time batching systems, ingredient tracking platforms, and automated mixing technologies. Farmers in rural and semi-urban areas who have historically had access to advanced supply chain tools would especially benefit from the growing popularity of mobile applications and digital platforms for inventory management, distribution tracking, and customer engagement. Farmers can monitor animal health indices, feed intake patterns, and performance measures more precisely with the aid of data-driven decision-making systems. This allows for prompt interventions and better livestock productivity results. In 2025, Elmentoz Research Pvt. Ltd., a deep-tech biotech firm leading in precision animal health nutrition and intelligent feed solutions for poultry, aquaculture, and pet food, declared the completion of its initial seed funding round from angel investors in India and Norway. Through this investment, Elmentoz is creating the largest BSF-oriented smart protein facility in India, which can process 2,000 MT of industrial byproducts monthly using its proprietary advanced automation technologies.

Sustainability and Alternative Protein Development

Environmental considerations are fundamentally reshaping ingredient sourcing strategies and manufacturing processes across the feed industry. Manufacturers are incorporating agro-industrial by-products and alternative protein sources to reduce dependence on conventional grains while lowering production costs and environmental footprints. In 2024, Indian agritech startup Loopworm introduced sustainable animal feed protein derived from silkworms, offering an eco-friendly alternative to traditional protein sources that addresses both sustainability concerns and resource efficiency. Government guidelines on emission reduction and waste management are accelerating innovation in feed formulations, encouraging research into novel ingredients including insect meals, algae-based proteins, and fermented agricultural residues that offer comparable nutritional profiles with reduced ecological impact.

Premium Feed Formulations and Quality Enhancement

Consumer awareness about food safety and nutritional quality is driving demand for premium feed products enriched with specialized additives and micronutrients. Livestock producers are increasingly adopting fortified feed formulations containing vitamins, minerals, amino acids, and probiotics to improve animal health, reproductive efficiency, and end-product quality. Species-specific feeds tailored to different growth stages are becoming standard practice, particularly in commercial poultry and dairy operations where productivity directly correlates with feed quality. This quality-focused shift is particularly pronounced in organized farming segments where producers serve urban markets demanding traceable, safe animal products, compelling feed manufacturers to invest in research and development for nutrition-optimized formulations. In 2025, dsm-firmenich Animal Nutrition & Health (ANH) officially opened a new feed additive facility in Jadcherla, Hyderabad, India. The updated facility includes a production line for the top global solutions in Mycotoxin Risk Management and a new storage space, spanning 11,200 square meters. The cutting-edge feed additive facility features innovative Bühler technology and complies with the top global standards for quality, safety, and environmental protection.

Market Outlook 2026-2034:

The Indian animal feed market is positioned for sustained expansion driven by structural shifts in agricultural practices and consumption patterns. Government infrastructure investments, demonstrate policy commitment toward modernizing livestock nutrition infrastructure. Export-oriented aquaculture sectors and branded poultry products are creating demand for specialized high-value feed formulations meeting international quality standards. The market generated a revenue of INR 1,186.30 Billion in 2025 and is projected to reach a revenue of INR 2,112.96 Billion by 2034, growing at a compound annual growth rate of 6.6% from 2026-2034. Market consolidation through strategic acquisitions and capacity expansions indicates industry maturation as established players leverage economies of scale and integrated supply chains.

Indian Animal Feed Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Poultry Feed | 56% |

| Region | North India | 31% |

Product Type Insights:

Access the comprehensive market breakdown Request Sample

- Poultry Feed

- Cattle Feed

- Aquafeed

Poultry feed dominates with a market share of 56% of the total Indian animal feed market in 2025.

India's poultry sector represents the fastest-growing segment of animal agriculture, with broiler and layer operations increasingly concentrated in integrated production systems that demand specialized nutritional solutions. Poultry feed formulations incorporate precise ratios of energy sources, protein concentrates, vitamins, and minerals tailored to different production stages from starter to finisher phases. The prevalence of organized contract farming arrangements, particularly in Andhra Pradesh and Telangana, has standardized feed specifications and quality parameters, ensuring consistent flock performance and disease resistance.

The segment benefits from established supply chain networks that efficiently distribute feed from manufacturing hubs to thousands of poultry farms across diverse geographic regions. Feed companies invest substantially in research initiatives focused on optimizing amino acid profiles, incorporating gut health promoters, and reducing antibiotic dependency through natural growth enhancers. Karnataka's poultry clusters demonstrate how locally produced maize and soybean meal availability directly impacts feed pricing competitiveness, while proximity to consumption centers in metropolitan areas ensures rapid inventory turnover and freshness maintenance.

Regional Insights:

- North India

- South India

- East India

- West India

North India leads with a share of 31% of the total Indian animal feed market in 2025.

North India's dominance stems from its substantial dairy farming infrastructure, particularly in Haryana, Punjab, and Uttar Pradesh, which collectively house extensive buffalo and cattle populations supporting India's position as the world's largest milk producer. The region benefits from abundant wheat bran, rice bran, and oilseed meal availability generated by Punjab's agricultural activities, providing cost-effective raw materials for cattle feed manufacturing. Cooperative dairy networks such as those operating across Uttar Pradesh procure millions of liters daily, creating consistent demand for nutritionally balanced cattle feed that enhances milk production efficiency.

The concentration of feed manufacturing plants in proximity to grain mandis and processing facilities enables logistical efficiencies and reduces transportation costs, strengthening competitive positioning. North India's established distribution networks reach remote villages through dealer and retailer channels, supported by agricultural extension services that promote scientific feeding practices. Haryana's progressive farmers increasingly adopt total mixed ration systems and silage-based feeding regimens, driving demand for specialized cattle feed products that complement roughage components and optimize rumen fermentation for maximum milk fat and protein yields.

Market Dynamics:

Growth Drivers:

Why is the Indian Animal Feed Market Growing?

Rising Demand for Animal Protein Products

Fundamental shifts in dietary preferences driven by urban modifications, income growth, and lifestyle changes are accelerating consumption of meat, eggs, dairy products, and seafood across India's demographic spectrum. Urban populations increasingly incorporate animal protein into daily diets, recognizing nutritional benefits including muscle development, bone strength, and immune system support that complement traditional plant-based nutrition patterns. This consumption transition creates direct demand for commercial livestock production systems requiring standardized feed formulations to achieve productivity benchmarks and quality consistency. The livestock sector responds by adopting scientifically balanced feeds that optimize feed conversion ratios, reduce grow-out periods, and enhance reproductive efficiency, directly translating consumption patterns into feed market growth. Quick-service restaurant expansion and processed food sectors amplify demand for consistent-quality animal products, compelling producers to implement controlled nutrition programs ensuring standardized output characteristics. IMARC Group predicts that the India quick service restaurants market is projected to attain USD 16.3 Billion by 2033.

Expanding Livestock Population and Commercial Farming

India's livestock population continues growing substantially, creating foundational demand for feed products as traditional grazing and crop residue feeding cannot sustain commercial productivity requirements. States including Uttar Pradesh, Rajasthan, and Madhya Pradesh account for substantial shares of cattle and poultry populations, with farmers increasingly transitioning from subsistence models toward commercial operations requiring scientifically formulated feed solutions. Organized farming systems encompassing integrated poultry operations, commercial dairy units, and intensive aquaculture facilities depend entirely on manufactured feed products to achieve target productivity metrics and economic viability. Preliminary figures from the Ministry of Statistics and Programme Implementation (MoSPI) published on 31st May 2024 indicated that the Gross Value Added (GVA) from the livestock sector amounted to roughly ₹13,55,460 crores at current prices during the 2022-23 financial year, accounting for around 30.23% of the GVA for the Agricultural and Allied Sectors. Commercial livestock operations benefit from economies of scale in feed procurement, creating stable demand channels that encourage feed manufacturer investments in production capacity and distribution infrastructure.

Government Support and Policy Initiatives

Government infrastructure development through schemes including the National Livestock Mission and Rashtriya Gokul Mission provides direct support for feed manufacturing facilities and distribution systems serving rural agricultural communities. In 2024, Union Home Minister Amit Shah inaugurated a state-of-the-art animal feed plant at Sabarkantha Dairy in Gujarat with production capacity of 800 metric tons, representing INR 210 Crore (USD 25.2 million) investment that demonstrates public sector commitment to modernizing livestock nutrition infrastructure. Policy initiatives encompassing subsidized feed ingredients, technical training programs, and livestock insurance schemes reduce risk for farmers adopting commercial production systems, indirectly amplifying feed demand through enhanced farming viability. Regulatory frameworks establishing feed quality standards and safety certifications professionalize the industry while protecting farmers from adulterated or substandard products, building confidence in commercial feed adoption. Government procurement programs for milk, eggs, and meat create reliable market outlets for livestock producers, encouraging investments in productivity-enhancing inputs including balanced feed formulations that deliver consistent production outcomes aligned with quality specifications.

Market Restraints:

What Challenges the Indian Animal Feed Market is Facing?

Volatility in Raw Material Prices and Import Dependency

Feed manufacturing economics remain vulnerable to price fluctuations affecting key ingredients including maize, soybean meal, and fishmeal, with India importing substantial quantities of oilseeds and pulses to bridge domestic production gaps. International commodity market dynamics, currency exchange rate variations, and trade policy changes create input cost uncertainties that compress profit margins for feed manufacturers while potentially affecting affordability for farmers. Seasonal agricultural production cycles further introduce supply variability that complicates inventory planning and price stabilization efforts across the value chain.

Fragmented Farmer Base and Limited Awareness

India's livestock sector remains dominated by smallholder farmers operating with limited resources, traditional management practices, and inadequate access to technical information regarding scientific feeding regimens and modern nutrition management. This fragmentation constrains market penetration for manufactured feed products, as many farmers continue relying on home-mixed formulations or agricultural by-products despite suboptimal nutritional outcomes. Extension service gaps, language barriers in communicating technical concepts, and conservative farming mindsets resistant to adopting new practices pose substantial challenges for market expansion efforts targeting the vast base of rural livestock keepers.

Quality Control and Regulatory Compliance Challenges

The animal feed industry contends with quality assurance complexities spanning raw material authentication, contamination prevention, accurate nutrient composition verification, and regulatory compliance with evolving food safety standards. Incidents involving adulteration, presence of antibiotic residues, or aflatoxin contamination can severely damage brand reputations and erode farmer confidence in commercial feed products. Smaller manufacturers operating with limited quality testing infrastructure may struggle to consistently meet specifications, while regulatory enforcement mechanisms remain unevenly applied across states, creating uneven competitive conditions and consumer protection gaps.

Competitive Landscape:

The Indian animal feed market exhibits a consolidated-yet-competitive structure where multinational corporations leverage technological capabilities, extensive distribution networks, and integrated value chain operations alongside diversified domestic conglomerates possessing strong agricultural sector presence and regional specialized manufacturers serving niche segments. Competition centers on product innovation incorporating functional additives, cost optimization through backward integration into ingredient sourcing, and market penetration strategies targeting different farmer segments with tailored product portfolios and service offerings. Strategic collaborations between feed companies and livestock producers, investments in research and development facilities, and capacity expansion initiatives in high-growth regions characterize the competitive dynamics shaping market evolution. Some of the ley players include:

- Anmol Feed

- Avanti Feeds Limited

- Charoen Pokphand Foods PCL

- Godrej Agrovet Limited

- Grobest Feeds Corporation India Pvt Limited

- Growel Feeds Private Limited

- JAPFA India

- Kapila Group

- KSE Limited

- SKM Animal Feeds & Foods (India) Private Limited

- Suguna Foods Private Limited

- The Waterbase Limited

- Uno Feeds

Recent Developments:

- In December 2025, The Karnataka government allowed poultry feed producers to buy maize directly from farmers at Minimum Support Price (MSP) rates for the 2025-26 kharif season, ensuring improved price realization and less reliance on middlemen.

- In November 2025, The virtual laying of the foundation stone for a 250 metric tonnes per day (MTPD) cattle feed plant of NDDB Dairy Services, a fully owned subsidiary of the National Dairy Development Board (NDDB), took place at the Agrovision event in Nagpur. The event saw the presence of Union Minister for Road Transport and Highways along with Union Minister of Agriculture and Farmers’ Welfare, the Chairman of NDDB, along with officials from NDDB Dairy Services, were in attendance as well.

Indian Animal Feed Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Poultry Feed, Cattle Feed, Aquafeed |

| Regions Covered | North India, South India, East India, West India |

| Companies Covered | Anmol Feed, Avanti Feeds Limited, Charoen Pokphand Foods PCL, Godrej Agrovet Limited, Grobest Feeds Corporation India Pvt Limited, Growel Feeds Private Limited, JAPFA India, Kapila Group, KSE Limited, SKM Animal Feeds & Foods (India) Private Limited, Suguna Foods Private Limited, The Waterbase Limited, Uno Feeds, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian animal feed market size was valued at INR 1,186.30 Billion in 2025.

The Indian animal feed market is expected to grow at a compound annual growth rate of 6.6% from 2026-2034 to reach INR 2,112.96 Billion by 2034.

Poultry feed dominated the Indian animal feed market with a 56% share in 2025, driven by the widespread adoption of organized poultry farming practices, increasing chicken and egg consumption across demographic segments, and the sector's rapid commercialization supported by integrated production systems and contract farming arrangements.

Key factors driving the India animal feed market include rising demand for animal protein products, expanding livestock populations, favorable government policy initiatives supporting feed manufacturing infrastructure, growing farmer awareness about balanced nutrition benefits, and increasing commercial livestock production systems requiring standardized feed formulations.

Major challenges include volatile raw material prices particularly for maize and soybean meal, lack of standardization and quality control across manufacturing sectors, feed ingredient adulteration issues, limited rural infrastructure for storage and distribution, periodic disease outbreaks affecting livestock populations, and technical knowledge gaps among smallholder farmers regarding optimal feeding practices.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)