Indian Bio Agriculture Market Size, Share, Trends and Forecast by Segment and Region, 2025-2033

Indian Bio Agriculture Market Size and Share:

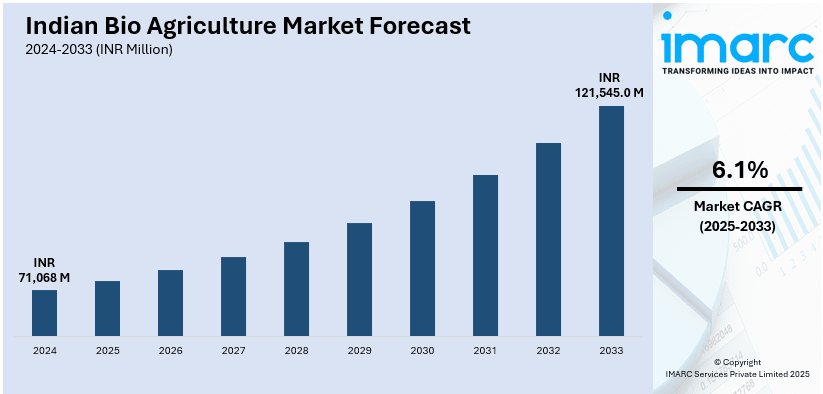

The Indian bio agriculture market size was valued at INR 71,068 Million in 2024. Looking forward, IMARC Group estimates the market to reach INR 1,21,545.0 Million by 2033, exhibiting a CAGR of 6.1% from 2025-2033. Growing demand for organic food, increasing government support through subsidies and policy incentives, rising awareness of soil health and sustainability, advancements in biofertilizer and biopesticide technologies, expanding adoption of precision farming, and the need for eco-friendly agricultural inputs are some of the major factors positively impacting the Indian bio agriculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

INR 71,068 Million |

|

Market Forecast in 2033

|

INR 1,21,545.0 Million |

| Market Growth Rate (2025-2033) | 6.1% |

The growth of the market in India is driven primarily by increasing consumer demands for organic and chemical-free food products as more people are health-conscious. The implementation of government schemes that encourage sustainable practices and encourage farmers through subsidies and funds facilitates market expansion. The Press Information Bureau, India, said that INR 122528.77 crore has been allocated for initiatives meant for farmers' welfare programs for the financial year 2024-2025 by the Ministry of Agriculture and Farmer Welfare. Apart from that, the depletion of soil fertility due to the over-application of chemicals is causing farmers to go for bio-based agricultural inputs. Also, organic farming driven by certification programs and high prices for organic produce and is also driving Indian bio agriculture market growth.

To get more information on this market, Request Sample

Additionally, continuous advancement gained in microbial research and biotechnology makes biofertilizers and biopesticides more efficient and increasingly applicable to large-scale farming. Pest resistance and soil degradation due to climatic changes increase the need for sustainable solution initiation and consequently adopt bio-based inputs. In addition, rigorous regulations and farmer education, along with the uptake of biological inputs, further strengthen Indian bio agriculture market demand. According to a report published on November 16, 2024, the Indian government aims at training one crore farmers under the natural agricultural techniques program by 2024-2025. This program seeks to teach farmers scientifically proven methods for natural farming. Besides, increased investments by agrochemical companies in biological solutions and investments for research provides a boost to market development.

Indian Bio Agriculture Market Trends:

Growth in Biofertilizers and Biopesticides

Biofertilizers and biopesticides experience a high degree of development and acceptance, which is a significant Indian bioagriculture market trend. Other advances in microbial science allow for the separation of very efficient strains from microorganisms, which promote nutrient uptake and protect crops against pathogens. The drive to change toward this new technology has been throttled by an increasing need to reduce dependency on synthetic agrochemicals due to regulatory restrictions and soil health concerns. Strategic partnerships between biotechnology institutions and companies specializing in biofertilizers, biopesticides, and biostimulants lead to increased scale production and improved distribution networks. For instance, on October 1, 2024, the National Botanical Research Institute (NBRI) collaborated with entrepreneur Krishna Nayak in Nabarangpur, Odisha, to establish a biofertilizer production unit with an annual capacity of 1,400 Tonnes. This initiative has benefitted over 25,000 farmers across various districts in Odisha, as well as regions in Chhattisgarh and Andhra Pradesh.

Expansion of Organic Farming and Certification Programs

The growth of organic farming is enhancing the Indian bio agriculture market outlook, which is driven by increasing health consciousness and environmental concerns. India is undergoing considerable expansion in organic farming, propelled by the demand of consumers for pesticide-free foods and the support of the government through schemes According to industry reports, in India, there are 1764677.15 hectares of land used for organic farming. In addition to organic farming, the growing number of organic certification programs also supports the market expansion. Some of the certification programs are the national program for organic production (NPOP) and the participatory guarantee system (PGS-India). These programs increase farmer participation and encourage organic production. Export prospects are also on the rise, as international markets are favoring certified organic produce. Industries are committing to standalone organic input portfolio development, which is compatible with certification requirements. This development is paving a structured market for biofertilizers, biostimulants, and natural pest management services specific to certified organic farming.

Rising Adoption of Biostimulants for Stress Resistance and Yield Enhancement

The growth of biostimulants in the market is due to the increasing quest for solutions to enhance crop resilience against abiotic stress factors like extreme drought, salinity, and temperature shifts. Products such as seaweed extracts, protein hydrolysates, fulvic and humic acids, and microbial-derived compounds are widely used in agriculture practices. Favorable government policies toward sustainable agriculture and the awareness among farmers regarding biostimulants further fuel the demand for biostimulants. Companies are investing in advanced formulations and conducting field trials to demonstrate efficacy, which results in wider adoption among commercial and smallholder farmers. For instance, on March 26, 2024, in order to support sustainable agriculture, UPM Biochemicals launched plant-based stimulants known as UPM Solar oTM. By strengthening the soil microbiome and boosting water retention, these biostimulants promote plant growth by improving nutrient absorption and stress tolerance. Long-term studies indicate that UPM SolargoTM supports enhanced quality and yield of crops and could lower the dependency on conventional fertilizers that include potassium, phosphate, and nitrogen, which can contribute up to 80% of CO₂ emissions at crop production.

Indian Bio Agriculture Industry Segmentation:

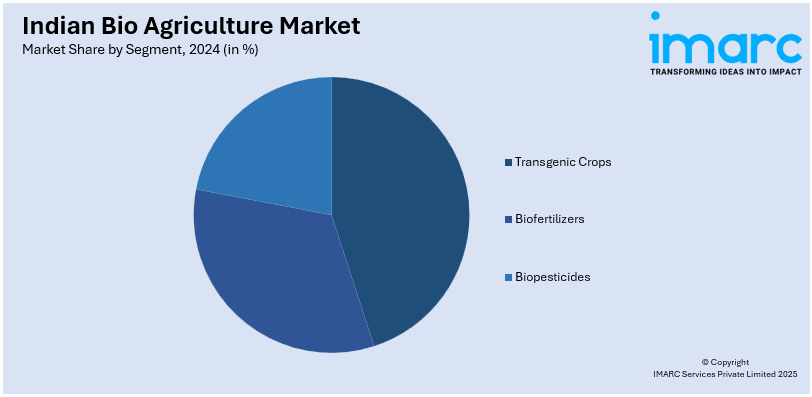

IMARC Group provides an analysis of the key trends in each segment of the Indian bio agriculture market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on segment.

Analysis by Segment:

- Transgenic Crops

- Biofertilizers

- Biopesticides

Transgenic crops lead the Indian bio-agriculture market due to their greater yield potential, pest resistance, and improved weather stress adaptability. Genetically modified (GM) crops like Bt cotton have been the most commodity field, minimizing chemical pesticide usage and improving productivity. Growing concern about herbicide tolerance and drought tolerance in maize and soybean crops is increasing to address climate uncertainty and soil degradation. Regulatory developments, such as the approval of field trials of GM mustard, show that transgenic technology is under expansion. Biosafety, farmer acceptability, and seed prices are some of the concerns which shape market dynamics. Recent developments in gene editing technologies like CRISPR are creating specific trait improvements in crops. As a part of India's bio-agriculture industry, transgenic crops are getting more focus on food security and green agriculture. Therefore, greater productivity, environmental sustainability, and economic viability will be accorded to transgenic crops.

Regional Analysis:

- North India

- South India

- East India

- West India

West India is a dominant region in the Indian bio-agriculture market due to its diverse agro-climatic zone, mass production of cash crops, and strong agribusiness infrastructure. Maharashtra and Gujarat are significant states and have high consumption of bio-based products such as bio-fertilizers, bio-pesticides, and organic farming. Maharashtra, being a leading producer of sugarcane and Bt cotton, creates demand for precision agriculture and genetically modified technology. The dynamic agro-industrial economy in Gujarat propels innovations in bio-seeds, sustainable agriculture, and controlled ecosystem agriculture. Rajasthan's semi-arid conditions focus on drought-tolerant bio-crops and soil improvement microbial technologies. Organic certification incentives, efficient irrigation, and precision biotech drive the sector's strength at the regional level. Increasing recognition of climate-resilient agriculture and investment in agri-biotech companies enhance market development. West India continues to be an essential center for bio-agriculture innovation, keeping commercial cultivation in check with eco-friendly and sustainable methods.

Competitive Landscape:

The India bio-agriculture industry is fast evolving, driven by increasing demand for sustainable agriculture solutions. The competitive landscape is influenced by intense competition among existing players, startups, and research players. Government initiatives, increasing farmer consciousness, and environmental concerns are propelling market growth. Competition is based on creating bio-fertilizers, bio-pesticides, and genetically enhanced crops. Also, price, distribution, and regulatory approvals are crucial factors in the market. Continuous diversification of products, strategic alliances, and researcha and developmetn (R&D) investments arecommon strategics in the market. On October 25, 2024, Biorizon Biotech, a Spanish biotechnology firm specializing in natural-origin biostimulants and biopesticides, announced a strategic partnership with AgroStar, India's leading agri-tech platform. This collaboration aims to introduce Biorizon's advanced biostimulation and biocontrol products into the Indian market, thereby improving crop health and encouraging sustainable agricultural practices. Regulatory issues and differential adoption levels across geographies also influence competition, with innovation and flexibility being the major drivers.

The report provides a comprehensive analysis of the competitive landscape in the Indian bio agriculture market with detailed profiles of all major companies.

Latest News and Developments:

- January 10, 2025: The 8th edition of the National Programme for Organic Production (NPOP) was launched in New Delhi, emphasizing India's potential in organic farming. The Union Minister of Commerce & Industry announced that organic farming exports could reach ₹20,000 crore in the next three years. New programs and technology developments that aim to increase organic farming, simplify operations, and improve India's standing in the global organic market were showcased during the event.

- December 24, 2024: Insecticides (India) Limited (IIL) entered into a memorandum of understanding with BioPrime Agro Solutions Pvt. Limited to launch 'Relieve,' a biological product, in the Indian market. 'Relieve' is a patented formulation derived from seaweed and botanical extracts, developed to enhance crop health and yield while mitigating abiotic stresses such as drought, heat, and salinity. This collaboration underscores IIL's commitment to providing sustainable and eco-friendly farming solutions to Indian farmers.

Indian Bio Agriculture Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million INR, Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Segments Covered | Transgenic Crops, Biofertilizers, Biopesticides |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian bio agriculture market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian bio agriculture market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian bio agriculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bio agriculture market in India was valued at INR 71,068 Million in 2024.

The key factors driving the market are rising consumer awareness of organic products, government support through subsidies and incentives, increasing demand for sustainable farming, and the adoption of eco-friendly agricultural practices. Additionally, growing health consciousness and environmental concerns fuel the transition towards bio-based agriculture.

The bio agriculture market in India is projected to exhibit a CAGR of 6.1% during 2025-2033, reaching a value of INR 1,21,545.0 Million by 2033.

Transgenic crops dominate the market due to their enhanced resistance to pests and diseases, improved yield potential, and ability to thrive in adverse environmental conditions. These traits significantly increase crop productivity, making them highly attractive to farmers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)