Indian Feed Additives Market Size, Share, Trends and Forecast by Source, Product Type, Livestock, Form, and Region, 2025-2033

Market Overview:

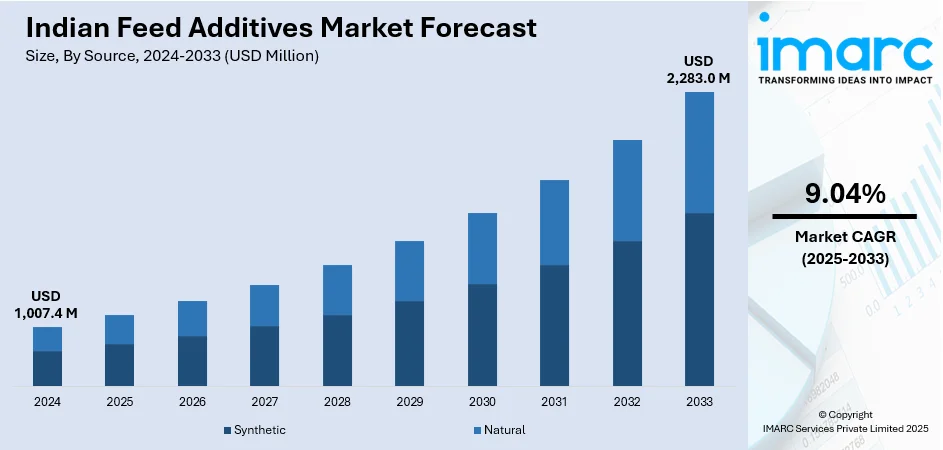

The Indian feed additives market size reached USD 1,007.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,283.0 Million by 2033, exhibiting a growth rate (CAGR) of 9.04% during 2025-2033. The growing awareness about animal nutrition, the emerging technological advancement in feed additive formulations, the rising adoption of modern animal husbandry practices, and the implementation of favorable government initiatives to support livestock development represent key factors propelling the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1,007.4 Million |

|

Market Forecast in 2033

|

USD 2,283.0 Million |

| Market Growth Rate (2025-2033) | 9.04% |

Feed additives are substances incorporated into animal diets to improve their health, growth, and performance. These additives can be of various types, such as vitamins, minerals, amino acids, probiotics, prebiotics, enzymes, and growth promoters. They are intended to complement the nutritional content of animal feed and address specific deficiencies or enhance physiological functions. It is essential in modern animal husbandry practices to promote better digestion, immune function, and nutrient absorption. It also helps reduce the risk of diseases, optimize feed utilization, and increase the efficiency of meat, milk, or egg production. Additionally, some additives aid in combating environmental stressors and improving animal welfare.

To get more information on this market, Request Sample

The market is primarily driven by the increasing consumption of animal-based products in India, including meat, milk, and eggs. In addition, the rising population and a growing middle class with increasing disposable incomes are influencing the market growth. As a result, there is a greater emphasis on enhancing the productivity and quality of livestock leading to increased use of feed additives to improve animal health and performance. Moreover, the growing awareness among Indian farmers and livestock producers about the importance of animal nutrition and its impact on productivity represents another major growth-inducing factor. They are increasingly adopting modern animal husbandry practices and looking for ways to optimize feed efficiency and address nutrient deficiencies. Besides this, the government of India’s (GOI) initiatives to promote the use of feed additives and improve animal health through various schemes and subsidies are contributing to market growth.

Indian Feed Additives Market Trends/Drivers:

The emerging technological advancement

The market is transforming the way feed supplements are produced and utilized in the livestock industry. These innovations have been instrumental in improving animal nutrition, health, and performance. In addition, several advancements in probiotics and prebiotics led to the development of feed additives that support the gut health of animals thus influencing the market growth. Probiotics are beneficial microorganisms that aid in digestion and nutrient absorption, while prebiotics promotes the growth of these beneficial microbes. The use of these additives helps improve the gut microbiota, leading to enhanced immune function and performance in livestock. Moreover, the integration of the microencapsulation technique employed to protect sensitive feed additives from degradation during feed processing and storage represents another major growth-inducing factor. Along with this, it encapsulates additives in a protective coating, and their stability and bioavailability are improved, ensuring better nutrient delivery to the animal's digestive system which enhances the effectiveness of feed additives and reduces wastage, leading to more efficient feed utilization, thus propelling the market growth.

Implementation of favorable government initiatives

The government of India has taken several initiatives to enhance animal nutrition, health, and welfare while ensuring food safety and environmental sustainability. In addition, the introduction of several livestock development programs, offering financial incentives, subsidies, and technical assistance to farmers and livestock producers are influencing the market growth. These programs encourage the adoption of modern animal husbandry practices, including the use of quality feed additives, to improve animal productivity. Moreover, the government provides funding and support for research and development (R&D) in animal nutrition and feed technology for the development of innovative feed additives that address specific nutritional requirements and contribute to improved animal health and performance representing another major growth-inducing factor. Besides this, the government is promoting sustainable farming practices, including the adoption of eco-friendly feed additives that reduce environmental impacts and improve feed efficiency while reducing greenhouse gas (GHG) emissions thus accelerating the market growth.

Indian Feed Additives Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian feed additives market report, along with forecasts at the country and regional levels from 2025-2033. Our report has categorized the market based on source, product type, livestock and form.

Breakup by Source:

- Synthetic

- Natural

Synthetic represents the leading source

The report has provided a detailed breakup and analysis of the market based on the source. This includes synthetic and natural. According to the report, synthetic accounted for the largest market share.

Synthetic feed additives are manufactured through chemical processes, ensuring consistent quality and standardized compositions. They offer a wide range of nutritional components, such as vitamins, amino acids, and minerals, essential for improving animal health and productivity. In addition, synthetic sources provide a cost-effective and reliable solution for meeting the nutritional requirements of livestock and offer precise dosages and formulations, ensuring accurate nutrient delivery to animals, thus influencing market growth.

Moreover, synthetic additives can be customized to address specific deficiencies and nutritional imbalances in animal diets which allows for customized feed formulations, optimizing animal performance and supporting herd health representing another major growth-inducing factor. Besides this, they undergo rigorous quality control measures and comply with regulatory standards, assuring their safety and efficacy thus driving their widespread adoption across the market.

Breakup by Product Type:

- Amino Acids

- Lysine

- Methionine

- Threonine

- Tryptophan

- Phosphates

- Monocalcium Phosphate

- Dicalcium Phosphate

- Mono-Dicalcium Phosphate

- Defluorinated Phosphate

- Tricalcium Phosphate

- Others

- Vitamins

- Fat-Soluble

- Water-Soluble

- Acidifiers

- Propionic Acid

- Formic Acid

- Citric Acid

- Lactic Acid

- Sorbic Acid

- Malic Acid

- Acetic Acid

- Others

- Carotenoids

- Astaxanthin

- Canthaxanthin

- Lutein

- Beta-Carotene

- Enzymes

- Phytase

- Protease

- Others

- Mycotoxin Detoxifiers

- Binders

- Modifiers

- Flavors and Sweeteners

- Flavors

- Sweeteners

- Antibiotics

- Tetracycline

- Penicillin

- Others

- Minerals

- Potassium

- Calcium

- Phosphorus

- Magnesium

- Sodium

- Iron

- Zinc

- Copper

- Manganese

- Others

- Antioxidants

- Bha

- Bht

- Ethoxyquin

- Others

- Non-Protein Nitrogen

- Urea

- Ammonia

- Others

- Preservatives

- Mold Inhibitors

- Anticaking Agents

- Phytogenics

- Essential Oils

- Herbs and Spices

- Oleoresin

- Others

- Probiotics

- Lactobacilli

- Stretococcus Thermophilus

- Bifidobacteria

- Yeast

Amino acids represent the most popular product type

The report has provided a detailed breakup and analysis of the market based on the product type. This includes amino acids (lysine, methionine, threonine, and tryptophan), phosphates (monocalcium phosphate, dicalcium phosphate, mono-dicalcium phosphate, defluorinated phosphate, tricalcium phosphate, and others), vitamins (fat-soluble, and water-soluble), acidifiers (propionic acid, formic acid, citric acid, lactic acid, sorbic acid, malic acid, acetic acid, and others), carotenoids (astaxanthin, canthaxanthin, lutein, beta-carotene), enzymes (phytase, protease, and others), mycotoxin detoxifiers (binders and modifiers), flavors and sweeteners (flavors and sweeteners), antibiotics (tetracycline, penicillin, and others), minerals (potassium, calcium, phosphorus, magnesium, sodium, iron, zinc, copper, manganese, and others), antioxidants (bha, bht, ethoxyquin, and others), non-protein nitrogen (urea, ammonia, and others), preservatives (mold inhibitors and anticaking agents), phytogenics (essential oils, herbs and spices, oleoresin, and others), and probiotics (lactobacilli, stretococcus thermophilus, bifidobacterial, and yeast). According to the report, amino acids accounted for the largest market share.

Amino acids are essential components of animal diets essential in protein synthesis, growth, and animal health. As the building blocks of proteins, amino acids are vital for optimizing the performance and productivity of livestock. In addition, the rising demand for amino acids as feed additives due to their ability to address specific nutritional deficiencies in animal diets is influencing market growth.

Moreover, the widespread adoption of amino acids helps improve the quality of feed formulations and enhance nutrient utilization, resulting in better feed conversion rates and growth in livestock. Additionally, amino acids are known to support immune function, reproduction, and stress tolerance in animals, thus accelerating market growth. Livestock producers and feed manufacturers recognize the importance of amino acids in achieving optimal animal health and meeting the growing demand for high-quality animal protein.

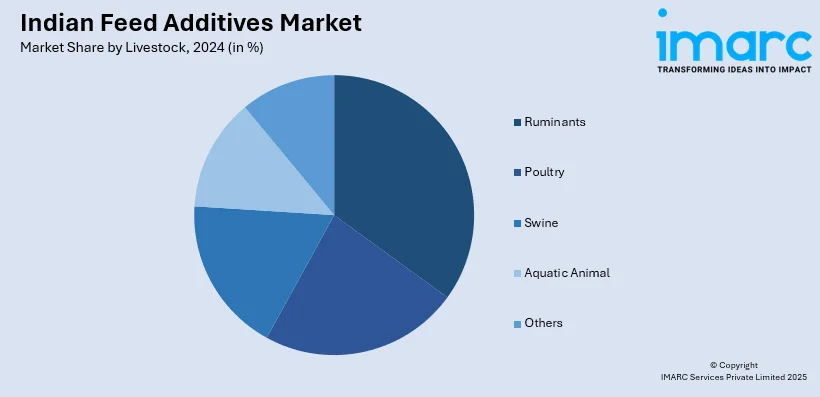

Breakup by Livestock:

- Ruminants

- Calves

- Dairy Cattle

- Beef Cattle

- Others

- Poultry

- Broilers

- Layers

- Breeders

- Swine

- Starters

- Growers

- Sows

- Aquatic Animal

- Others

Poultry holds the largest share of the market

A detailed breakup and analysis of the market based on the livestock has also been provided in the report. This includes ruminants (calves, dairy cattle, beef cattle, and others), poultry (broilers, layers, and breeders), swine (starters, growers, and sows), aquatic animals, and others. According to the report, poultry accounted for the largest market share.

Poultry farming has experienced substantial growth due to rising consumer demand for poultry products, such as chicken and eggs, coupled with increasing investments in the poultry industry. In addition, poultry feed additives are essential in enhancing the growth, health, and performance of birds, contributing to improved feed conversion rates and overall profitability for poultry farmers, thus influencing the market growth. These additives address the specific nutritional requirements of poultry, ensuring optimal growth and disease prevention.

Moreover, the poultry sector's ability to efficiently convert feed into high-quality protein makes it an attractive option for livestock producers. The demand for poultry feed additives is further driven by the widespread adoption of modern poultry management practices, including the use of specialized feed formulations customized to the nutritional needs of different poultry species and production stages represents another major growth-induing factor.

Breakup by Form:

- Dry

- Liquid

Dry additives presently account for the largest market share

A detailed breakup and analysis of the market based on the form has also been provided in the report. This includes dry and liquid. According to the report, dry additives accounted for the largest market share.

Dry feed additives are preferred over other forms due to their ease of handling, storage, and transportation. In addition, the rising demand for dry forms including powdered, granulated, or pelletized additives that can be easily mixed into the animal feed is influencing the market growth. Along with this, it offers several advantages, including better stability and longer shelf life, as they are less susceptible to degradation and moisture absorption which ensures the additives retain their efficacy until they are consumed by the animals, thus propelling the market growth.

Additionally, the dry form allows for precise and accurate dosing, ensuring that the right amount of additive is delivered to each animal, optimizing feed efficiency and cost-effectiveness, thus accelerating market growth. Moreover, dry feed additives can be uniformly distributed throughout the feed, providing consistent nutrient delivery to all animals in the herd or flock resulting in improved animal nutrition, health, and performance which represents another major growth-inducing factor. Furthermore, the convenience of using dry feed additives led to widespread adoption among farmers, feed manufacturers, and the livestock industry, establishing dry form as the leading choice in the market, thus augmenting the market growth.

Breakup by Region:

- North India

- East India

- West and Central India

- South India

South India exhibits a clear dominance in the market

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, East India, West and Central India, and South India. According to the report, South India accounted for the largest market share.

South India is driven by the increasing demand for eggs, milk, and meat. In addition, the growing population of livestock, including cattle, poultry, and aquaculture, creates a robust demand for feed additives to support their nutrition and health. Moreover, the expanding poultry and aquaculture industry due to the escalating demand for poultry meat and seafood led to the widespread adoption of feed additives to enhance the productivity and quality of these animals represents another major growth-inducing factor.

Besides this, the widespread adoption of progressive farming practices and modern animal husbandry techniques including the use of advanced feed additives to optimize feed efficiency and improve animal performance are accelerating the market growth. Along with this, the state government initiatives to support the livestock industry, including financial incentives and subsidies that encourage the adoption of feed additives are propelling the market growth.

Competitive Landscape:

Nowadays, key players in the market are employing various strategies to strengthen their positions and maintain their competitive edge in the industry. They are investing heavily in research and development (R&D) to develop innovative and effective feed additives focusing on understanding animal nutrition and health requirements to create products that cater to specific livestock needs. Moreover, companies are investing in brand-building and marketing efforts to help key players establish themselves as trusted and reliable suppliers in the market. They engage in advertising campaigns, digital marketing, and participation in industry events to promote their products and strengthen their market position. Besides this, they are continuously expanding their product portfolios to offer a diverse range of feed additives by introducing new formulations, blends, and specialized additives that address different stages of animal growth and production.

The report has provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided.

Indian Feed Additives Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Sources Covered | Synthetic, Natural |

| Product Types Covered |

|

| Livestocks Covered |

|

| Forms Covered | Dry, Liquid |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian feed additives market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian feed additives market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian feed additives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

We expect the Indian feed additives market to exhibit a CAGR of 9.04% during 2025-2033.

The increasing concerns towards the quality of livestock products, coupled with the growing consumption of dairy and poultry products, are primarily driving the Indian feed additives market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the restriction on numerous trade activities and limited raw material supply for feed additives.

Based on the source, the Indian feed additives market has been divided into synthetic and natural, where synthetic source currently exhibits a clear dominance in the market.

Based on the product type, the Indian feed additives market can be categorized into amino acids, phosphates, vitamins, acidifiers, carotenoids, enzymes, mycotoxin detoxifiers, flavors and sweeteners, antibiotics, minerals, antioxidants, non-protein nitrogen, preservatives, phytogenics, and probiotics. Currently, amino acids hold the majority of the total market share.

Based on the livestock, the Indian feed additives market has been segmented into ruminants, poultry, swine, aquatic animal, and others. Among these, poultry currently accounts for the largest market share.

Based on the form, the Indian feed additives market can be bifurcated into dry and liquid. Currently, dry form exhibits a clear dominance in the market.

On a regional level, the market has been classified into North India, East India, West and Central India, and South India, where South India currently dominates the Indian feed additives market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)