Indian Fish Market Size, Share, Trends and Forecast by Fish Type, Product Type, Distribution Channel, Sector, and State, 2026-2034

Indian Fish Market Summary:

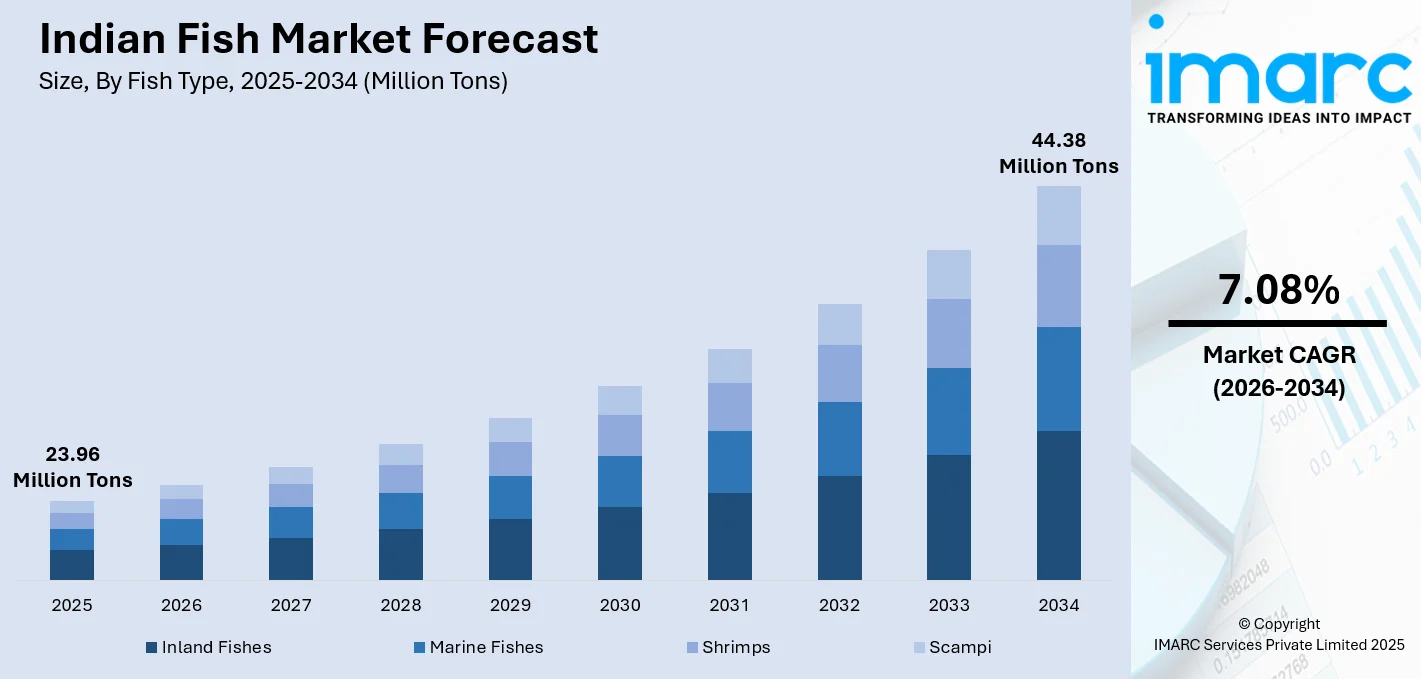

The Indian fish market size reached 23.96 Million Tons in 2025 and is projected to reach 44.38 Million Tons by 2034, growing at a compound annual growth rate of 7.08% from 2026-2034.

The market is driven by rising health consciousness and shifting dietary preferences toward protein-rich food alternatives. Growing urbanization and increasing disposable incomes facilitate greater accessibility to diverse aquatic products through expanding retail networks. Government initiatives promoting aquaculture development and infrastructure modernization strengthen production capabilities across freshwater and marine ecosystems. Enhanced cold chain logistics and digital traceability systems improve product quality throughout the supply chain. Export competitiveness and bilateral trade agreements expand market reach to international destinations, reinforcing India's position within the Indian fish market share.

Key Takeaways and Insights:

- By Fish Type: Inland fishes dominate the market with a share of 70.3% in 2025, driven by freshwater aquaculture, rich rivers, government modernization, cost-effective production, and strong carp consumption traditions.

- By Product Type: Fresh leads the market with a share of 60.4% in 2025, owing to quality preference, short supply chains, wet markets, cultural habits, and growing cold storage.

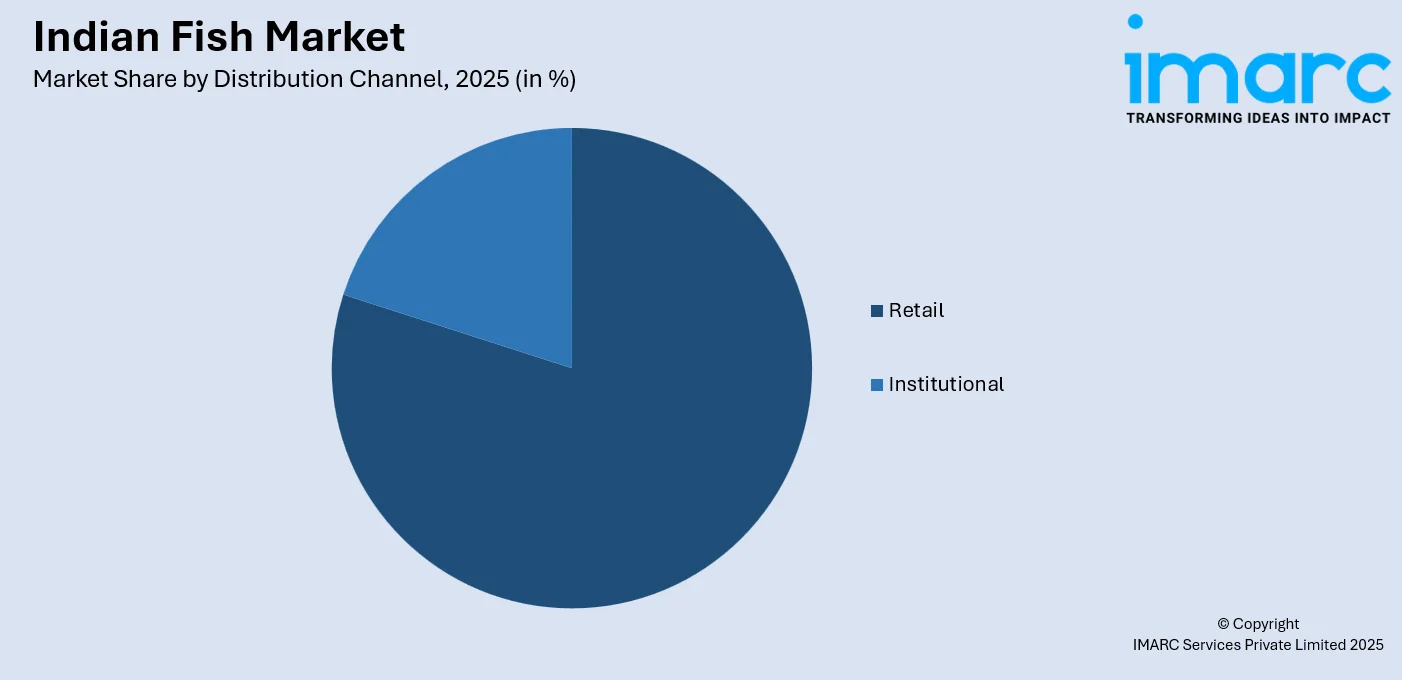

- By Distribution Channel: Retail represents the largest segment with a market share of 79.8% in 2025, driven by wet markets, supermarkets, e-commerce, convenient purchases, competitive pricing, and strong brand engagement with consumers.

- By State: West Bengal leads the market with a share of 19.7% in 2025, driven by abundant rivers, favorable climate, infrastructure, skilled labor, high consumption, and culturally integrated fish cuisine.

- Key Players: The market exhibits significant diversity, with local fishermen utilizing proximity to water resources, large-scale aquaculture farms ensuring stable production, innovative sustainable practices being adopted, and export-oriented processors obtaining international certifications to enhance global competitiveness. Some of the key players operating in the market include Abad Fisheries Private Limited, Golden Prize India, Kirti Foods, Munnujii Foods International Pvt. Ltd, Oceans Secret, Seasaga Group, and Silver Sea Food.

To get more information on this market Request Sample

The Indian fish market reflects a dynamic blend of traditional practices and modern aquaculture innovations, driven by shifts in consumer dietary preferences and agricultural modernization. Increasing awareness of fish as a high-quality protein source, rich in omega-three fatty acids, is driving growing domestic consumption across urban and rural populations. Government investments in infrastructure enhance cold storage networks, processing facilities, and export capabilities, while technological advancements in breeding, feeding systems, and water quality management improve productivity. According to sources, in December 2025, the Government reported PMMSY-driven post-harvest losses reduced to 9.16% in FY 2023–24, supported by expanded cold storage, ice plants, digital fisheries data, and climate-resilient coastal village initiatives. Moreover, abundant natural resources, including extensive coastlines, river networks, and freshwater bodies, provide optimal conditions for diverse fish farming practices. Cultural dietary traditions, coupled with rising health consciousness and disposable incomes, position fish as an accessible, affordable alternative to terrestrial proteins. These factors collectively support sustained market growth across inland aquaculture and marine fisheries throughout India.

Indian Fish Market Trends:

Integration of Advanced Aquaculture Technologies

The Indian fish farming sector is experiencing transformative technological integration, revolutionizing production efficiency and sustainability standards. Automated feeding systems equipped with sensors adjust feed distribution based on real-time fish behaviour, minimizing waste and optimizing nutrient absorption. Internet-of-Things enabled monitoring solutions track critical water quality parameters including dissolved oxygen and temperature, providing farmers actionable insights through mobile applications. Recirculating aquaculture systems enable high-density farming in limited spaces while reducing water consumption through advanced filtration mechanisms. As per sources, in July 2024, the Department of Fisheries approved 11,995 RAS units worth ₹887.85 Crore under PMMSY across 31 States, promoting water-efficient, biosecure aquaculture with targeted financial assistance. Moreover, genetic selection programs develop disease-resistant and fast-growing fish strains, enhancing yield predictability.

Emergence of Organized Retail and E-Commerce Channels

Traditional fish distribution models are undergoing significant transformation as organized retail formats and digital platforms reshape consumer access to seafood products. Modern supermarkets are establishing dedicated seafood sections with improved hygiene standards, temperature-controlled displays, and diverse product offerings including value-added and ready-to-cook options. E-commerce platforms specializing in fresh produce are disrupting conventional supply chains by connecting fishermen directly with urban consumers, ensuring traceability and freshness through sophisticated cold chain logistics. As per sources, in 2025, BigBasket announced a nationwide 10-minute delivery rollout, expanding quick-commerce via dark stores, micro-fulfillment centers, and tech-driven logistics to accelerate fresh food access across India. These platforms leverage technology for inventory management and quality assurance, reducing intermediary margins and improving farmer incomes.

Focus on Sustainable and Organic Aquaculture Practices

Environmental consciousness and consumer demand for responsibly sourced seafood are driving adoption of sustainable aquaculture practices across Indian fish farms. Farmers are implementing integrated fish farming systems that harmoniously combine aquaculture with agriculture, creating symbiotic relationships that minimize waste and optimize resource utilization. Organic fish farming initiatives are eliminating chemical fertilizers, antibiotics, and synthetic additives, appealing to health-conscious domestic consumers and meeting stringent international market requirements. According to reports, in November 2025, India marked World Fisheries Day, highlighting sustainable aquaculture, GST cuts on fish products, PMMSY-led infrastructure expansion, and marine export growth, reinforcing responsible seafood production and blue economy development. Furthermore, water management innovations including pond aeration systems and natural filtration methods reduce environmental impact while maintaining optimal production conditions.

Market Outlook 2026-2034:

The Indian fish market is poised for robust expansion, with revenue growth driven by sustained domestic consumption increases, export market diversification, and infrastructure modernization. Technological adoption in aquaculture operations will enhance productivity and sustainability, while government policy support through financial incentives accelerates sector transformation. Growing middle-class population with rising disposable incomes will fuel demand for premium and value-added fish products, supported by expanding organized retail networks and e-commerce penetration. Export opportunities in European, Japanese, and Southeast Asian markets will strengthen India's global competitiveness. The market size was estimated at 23.96 Million Tons in 2025 and is expected to reach 44.38 Million Tons by 2034, reflecting a compound annual growth rate of 7.08% over the forecast period 2026-2034.

Indian Fish Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Fish Type |

Inland Fishes |

70.3% |

|

Product Type |

Fresh |

60.4% |

|

Distribution Channel |

Retail |

79.8% |

|

State |

West Bengal |

19.7% |

Fish Type Insights:

- Inland Fishes

- Indian Major Carps

- Pangasius

- Exotic Carps

- Clarias

- Anabas

- Rupchanda

- Tilapia

- Seabass

- Others

- Marine Fishes

- Shrimps

- Scampi

Inland fishes dominate with a market share of 70.3% of the total Indian fish market in 2025.

Inland fishes maintain commanding market dominance attributed to India's extensive freshwater resources including rivers, lakes, reservoirs, and purpose-built aquaculture facilities spread across the subcontinent. The ganges-brahmaputra river system, peninsular river networks, and numerous water bodies provide natural habitats supporting diverse species cultivation. Major carps including rohu, catla, and mrigal constitute primary production volumes aligned with traditional consumption preferences prevalent across non-coastal regions. Government schemes promoting inland aquaculture through financial subsidies, technical training programs, and infrastructure development accelerate productivity enhancements. As of 2025, over 26 lakh stakeholders, including fishers, micro-enterprises, and Fish Farmer Producer Organisations, have registered on the National Fisheries Digital Platform (NFDP), strengthening inland aquaculture productivity and market linkages

Inland fishes varieties are gaining popularity, offering alternative protein sources complementing traditional carp consumption patterns. Brackish water aquaculture in coastal backwaters expands production capacities beyond purely freshwater environments. Integrated farming approaches combining fish cultivation with rice paddies or vegetable farming optimize resource utilization while providing supplementary income streams for rural communities. State-level initiatives in West Bengal, Andhra Pradesh, Odisha, and Bihar strengthen regional production ecosystems through targeted interventions addressing local constraints. Enhanced market linkages connecting producers with urban consumption centers improve price realization while reducing intermediary margins.

Product Type Insights:

- Fresh

- Frozen

- Canned

- Others

Fresh leads with a share of 60.4% of the total Indian fish market in 2025.

The fresh dominants market position driven by deep-rooted cultural preferences valuing recently harvested fish perceived as superior in taste, texture, and nutritional content compared to processed alternatives. Traditional culinary practices across Indian cuisines emphasize fresh ingredient utilization in preparations ranging from simple curries to elaborate festive dishes. Community fish markets operating daily throughout urban and rural localities facilitate direct producer-consumer connections minimizing supply chain delays. In August 2025, the Department of Fisheries, Government of India, approved fisheries development projects worth ₹1347.55 Crore in Kerala under PMMSY, covering ponds, vessels, RAS units, and livelihood support. Moreover, morning catch availability in local markets aligns with consumer shopping patterns prioritizing same-day purchase for immediate consumption.

Seasonal species availability creates temporal variety in market offerings aligning with natural breeding cycles and harvest seasons. Short shelf-life characteristics necessitate rapid turnover motivating frequent purchasing behaviour sustaining continuous market activity. Limited processing requirements reduce cost structures enabling affordable pricing accessible to economically diverse consumer segments. Growing health consciousness reinforces fresh fish consumption as wholesome protein sources free from preservatives or artificial additives. Regional festivals and religious observances incorporating fish in traditional meals create periodic demand spikes requiring robust supply chain responsiveness.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Institutional

Retail exhibits a clear dominance with a 79.8% share of the total Indian fish market in 2025.

The retail commands overwhelming market dominance owing to extensive geographical penetration through diverse format variations serving localized consumer requirements. Traditional wet markets operating in dedicated municipal spaces or designated street sections maintain cultural significance offering live fish selection, customized cutting services, and bargaining interactions valued by conventional shoppers. Specialized fishmongers establish neighbourhood presence building loyal customer bases through consistent quality, trusted relationships, and credit facilities supporting regular patronage. Modern retail formats including supermarkets and hypermarkets dedicate refrigerated sections to seafood departments providing organized displays, hygiene standards, and convenient shopping experiences attractive to affluent urban consumers.

E-commerce platforms specializing in fresh produce revolutionize accessibility particularly among younger, digitally savvy consumers valuing doorstep delivery convenience. Mobile applications enable product browsing, price comparisons, and scheduled deliveries aligned with personal timing preferences. Cold chain integration throughout last-mile logistics maintains product freshness eliminating traditional concerns regarding temperature abuse during transportation. As per sources, in December 2025, under PMMSY, 734 cold storages and ice plants, 6410 fish kiosks, and 21 wholesale fish markets have been approved nationwide to enhance post-harvest fisheries infrastructure. Furthermore, subscription models offering regular delivery frequencies appeal to consistent consumers simplifying repeat purchase decisions while ensuring continuous supply. Community buying groups leveraging collective bargaining power negotiate favorable pricing from wholesalers distributing bulk purchases among member households.

Sector Insights:

- Organised

- Unorganised

Organised includes commercial aquaculture farms, processing units, and export-focused enterprises using modern infrastructure, certifications, and technology-led operations. These players adopt automated feeding, biosecurity controls, and integrated cold chains to maintain quality and global compliance. Tie-ups with organised retail and e-commerce ensure market reach, while value-added, frozen, and ready-to-cook products support margins.

Unorganised consists of traditional fishermen, small fish farmers, and wet market vendors operating with limited infrastructure and regulatory oversight. These participants depend on inherited skills, community ties, and customer familiarity. Cash transactions, flexible pricing, and geographic proximity strengthen local competitiveness. However, credit access, technology gaps, and inadequate cold storage limit scalability.

State Insights:

- West Bengal

- Andhra Pradesh

- Karnataka

- Kerala

- Gujarat

- Tamil Nadu

- Maharashtra

- Others

West Bengal dominates with a market share of 19.7% of the total Indian fish market in 2025.

West Bengal maintains market leadership position leveraging favorable geographical endowments including the ganges-brahmaputra delta system, numerous rivers, wetlands, and extensive aquaculture infrastructure supporting robust production volumes. The state's rich freshwater resources facilitate diverse species cultivation including major carps, catfish, and other varieties aligned with regional consumption preferences. Cultural significance of fish in Bengali cuisine drives exceptionally high per capita consumption rates surpassing national averages substantially. Traditional preparation methods ranging from simple mustard-based curries to elaborate festival dishes sustain year-round demand irrespective of seasonal variations.

West Bengal wholesale fish markets constitute critical distribution hubs channelling products to retail networks across eastern India and neighbouring states. Established supply chains connecting rural production centers with urban consumption markets ensure efficient product flow minimizing delays and quality deterioration. Skilled labor availability across hatchery operations, fish farming, processing, and trading activities supports comprehensive value chain functionality. Export-oriented shrimp farming along coastal districts generates foreign exchange while providing employment opportunities. Climate conditions characterized by adequate rainfall, moderate temperatures, and suitable water quality parameters favor aquatic species thriving supporting sustained productivity levels.

Market Dynamics:

Growth Drivers:

Why is the Indian Fish Market Growing?

Rising Health Consciousness and Dietary Diversification

Consumer awareness regarding nutritional benefits of fish consumption is fundamentally reshaping dietary patterns across urban and rural India, driven by understanding of fish as an exceptional protein source rich in essential omega-three fatty acids, vitamins, and minerals beneficial for cardiovascular health, brain development, and overall wellness. In May 2024, ICMR released revised Dietary Guidelines emphasizing fish and nutrient-rich foods to reduce non-communicable diseases, addressing India’s 56.4% diet-related disease burden. Medical recommendations increasingly advocate fish as a healthy alternative to red meat, particularly for individuals managing cholesterol levels or seeking weight management solutions. Urban professionals and younger generations demonstrate greater willingness to experiment with diverse fish species beyond traditional varieties, influenced by exposure to global cuisines and lifestyle trends emphasizing balanced nutrition.

Government Policy Support and Infrastructure Development

Comprehensive government initiatives through flagship schemes provide targeted financial assistance, technical support, and infrastructure investments that directly address critical gaps across the fisheries value chain, catalyzing sector modernization and expansion. In December 2025, under PMMSY, the Government approved development of 95 coastal villages as Climate Resilient Coastal Fishermen Villages, with central funding of ₹47.50 Crore supporting alternative livelihoods and infrastructure. Furthermore, substantial budgetary allocations support construction of cold storage facilities, ice plants, and processing units that reduce post-harvest losses and extend product shelf life, improving market efficiency. Subsidies for pond construction, hatchery establishment, and aquaculture equipment reduce entry barriers for new farmers while enabling existing operators to scale operations and adopt advanced technologies. Training programs and capacity building initiatives disseminate scientific farming practices, disease management protocols, and quality control standards.

Expanding Export Opportunities and Global Market Access

International demand for Indian seafood products continues strengthening, driven by India's reputation for high-quality aquaculture produce, competitive pricing, and improving compliance with stringent global food safety standards, creating lucrative export opportunities. Bilateral trade agreements with major importing nations reduce tariff barriers and simplify export procedures, facilitating market entry and expansion. Growing global consumer preference for sustainably sourced, traceable seafood aligns with India's adoption of international certification standards, enhancing product acceptance in premium market segments. As per sources, in July 2025, India–UK CETA was signed, granting 100% duty-free access for key seafood products, expected to boost Indian marine exports, including shrimp, frozen fish, and value-added seafood. Moreover, diversification beyond traditional shrimp exports into value-added products including frozen fish fillets and ready-to-cook packs captures higher margins and reduces dependence on commodity pricing fluctuations.

Market Restraints:

What Challenges the Indian Fish Market is Facing?

Post-Harvest Losses and Cold Chain Infrastructure Deficiencies

Inadequate cold storage facilities across production regions result in significant post-harvest losses, compromising product quality and reducing farmer incomes despite adequate production volumes. Temperature control failures during transportation accelerate spoilage, particularly affecting small-scale fishermen lacking access to refrigerated vehicles. Limited penetration of organized cold chain networks in rural areas forces producers to rely on traditional preservation methods or accept distress sales at reduced prices.

Water Pollution and Environmental Degradation

Deteriorating water quality in rivers, lakes, and coastal areas threatens sustainable fish production, as industrial effluents, agricultural runoff, and untreated sewage contaminate aquatic ecosystems critical for wild fish populations and aquaculture operations. Eutrophication caused by excessive nutrient loading reduces dissolved oxygen levels, creating zones where fish cannot survive and limiting productive water area.

Disease Outbreaks and Biosecurity Challenges

Infectious diseases affecting cultured fish populations can rapidly spread through aquaculture operations, causing massive mortality events that devastate farmer incomes and disrupt local supply chains. Limited availability of qualified veterinary services and diagnostic facilities delays disease identification and treatment, allowing infections to intensify. Inadequate biosecurity practices including improper pond preparation and insufficient quarantine protocols facilitate pathogen transmission between farms.

Competitive Landscape:

The Indian fish market exhibits a multifaceted competitive structure characterized by coexistence of traditional small-scale fishermen, medium-sized aquaculture enterprises, and emerging technology-driven commercial operations spanning production, processing, and distribution segments. Traditional fishing communities leverage generational expertise and locational advantages near water bodies, maintaining strong positions in fresh fish supply chains through established relationships with local wet markets and retail vendors. Large-scale aquaculture farms demonstrate competitive strength through economies of scale, scientific farming practices, and consistent production volumes that support contractual arrangements with organized retail chains. Processing companies focusing on value-added products differentiate through quality certifications, modern facilities meeting international hygiene standards, and brand development targeting urban consumers.

Some of the key players include:

- Abad Fisheries Private Limited

- Golden Prize India

- Kirti Foods

- Munnujii Foods International Pvt. Ltd.

- Oceans Secret

- Seasaga Group

- Silver Sea Food

Recent Developments:

- In August 2025, Essex Marine Limited, a Kolkata-based seafood processing and exporting company, opened its SME public issue on BSE to raise Rs. 23.01 Crore. The IPO, offering 42.62 Lakh shares at Rs. 54 each, will fund expansion, working capital, loan repayment, and general corporate purposes, strengthening operations and export capacity.

Indian Fish Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered |

|

| Product Types Covered | Fresh, Frozen, Canned, Others |

| Distribution Channels Covered | Retail, Institutional |

| Sectors Covered | Organised, Unorganised |

| States Covered | West Bengal, Andhra Pradesh, Karnataka, Kerala, Gujarat, Tamil Nadu, Maharashtra, Others |

| Companies Covered | Abad Fisheries Private Limited, Golden Prize India, Kirti Foods, Munnujii Foods International Pvt. Ltd, Oceans Secret, Seasaga Group, Silver Sea Food, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian fish market reached a volume of 23.96 Million Tons in 2025.

The Indian fish market is expected to grow at a compound annual growth rate of 7.08% from 2026-2034 to reach 44.38 Million Tons by 2034.

Inland fishes held the largest market share, driven by abundant freshwater resources, government-backed aquaculture modernization, strong cultural preference for carp, lower farming costs, widespread farmer participation, and reliable seed supply from established hatcheries.

Key factors driving the Indian fish market include growing health awareness, supportive government policies, infrastructure investment, expanding export demand, and technological advancements improving aquaculture productivity, efficiency, quality control, and sustainable practices across the fisheries value chain.

Major challenges include inadequate cold chain infrastructure causing post-harvest losses, water pollution threatening production, disease outbreaks impacting operations, limited veterinary services, climate change disrupting breeding cycles, and fragmented supply chains reducing efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)