Indian Mobile Components Manufacturing and Assembly Market Size, Share, Trends and Forecast by Mobile Type, Mobile Components, Assembly and Domestic Manufacturing, and Region, 2025-2033

Indian Mobile Components Manufacturing and Assembly Market Size and Share:

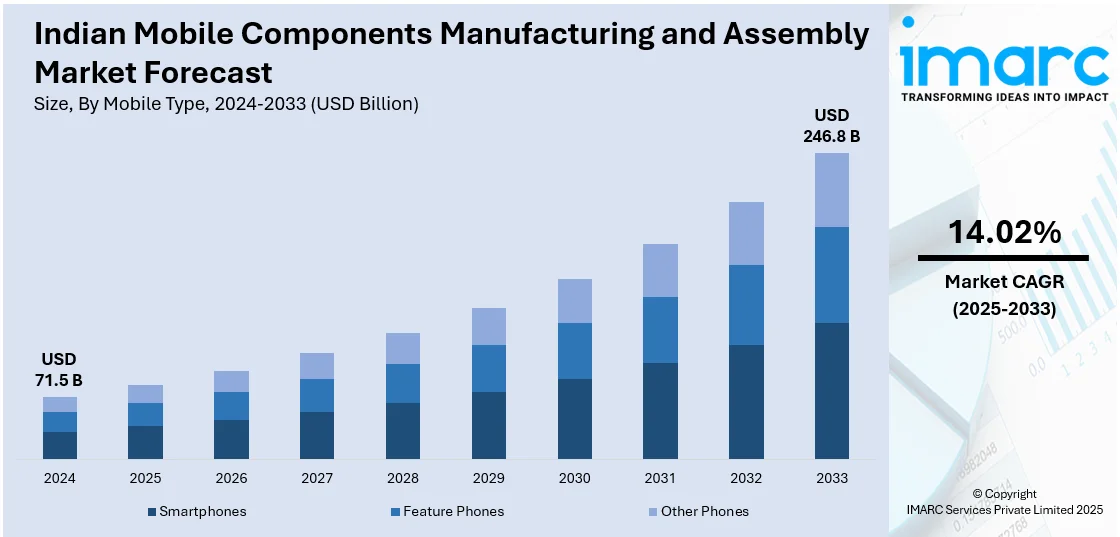

The Indian mobile components manufacturing and assembly market size was valued at USD 71.5 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 246.8 Billion by 2033, exhibiting a CAGR of 14.02% from 2025-2033. The market is driven by increasing smartphone usage, pro-government policies, and advancing digital infrastructure. Higher localization initiatives and a strong domestic talent pool are supporting production capacity. With increasing assembly facilities and the growth of indigenous component production, India is emerging as a strategic hub for worldwide mobile production. All these developments together indicate the growing importance and competitive advantage of the Indian mobile components manufacturing and assembly market share in the global arena.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 71.5 Billion |

|

Market Forecast in 2033

|

USD 246.8 Billion |

| Market Growth Rate 2025-2033 | 14.02% |

India's mobile component manufacturing and assembly industry has made significant traction with continued support from government policy and focused incentive schemes. Initiatives focused on boosting domestic production capacity have promoted a favorable investment environment and have invited large-scale participation throughout the electronics manufacturing value chain. According to the reports, in April 2025, Hosur's new factory of Tata Electronics started manufacturing older iPhone models, and Foxconn's \\$2.6 billion plant at Bengaluru is ready to go into production, making iPhone 16. Moreover, by providing output-based financial incentives based on local value addition, output, and export performance, such programs have spurred new as well as existing participants to scale up operations. Moreover, the emergence of specialized electronic manufacturing clusters, the enhancement of infrastructure, and the simplification of regulations have largely lowered barriers to entry. Government-sponsored initiatives aimed at boosting skill development and technical training have further enhanced the ability of the sector to serve industry needs. With these initiatives ongoing in keeping with national priorities for electronics self-reliance, they are promoting a culture favorable to technological growth and further localization. These initiatives combined go towards making India a globally competitive destination for the manufacture of mobile components and high-volume assembly processes.

To get more information on this market, Request Sample

The quick growth of India's digital economy, coupled with a huge and growing population increasingly connected to the internet, is a key driving force behind demand for mobile components and assembly processes. As per the sources, in December 2024, India's mobile production grew from 26% domestic production in 2014 to 99.2% with exports growing from ₹1,566 crore in FY 2014-15 to ₹1.2 lakh crore in 2023-24. Furthermore, with smartphone penetration increasing steadily, driven by low-cost access to data and devices, the demand for high-performance and diverse mobile components amplifies in proportion. Consumers are looking for devices with increased functionality, such as improved cameras, higher-speed processors, and better power efficiency, and manufacturers are responding by upgrading components and innovating product design constantly. This phenomenon, combined with the spread of digital services, online learning, mobile banking, and digital entertainment platforms, is speeding up device replacement cycles. In addition, evolution in technologies like 5G, artificial intelligence (AI), and Internet of Things (IoT) is accelerating mobile device performance standards, with more advanced components required. The resulting market dynamics are forcing producers to implement flexible, high-capacity production facilities to keep pace with changing consumer demands, and thus solidify India's status as a strategic hub for the manufacturing and development of mobile technology.

Indian Mobile Components Manufacturing and Assembly Market Trends:

Increase in Domestic Production and Smartphone Penetration

India has become the world's second-largest mobile phone manufacturer with its growing internet base, rising disposable incomes, and huge, technology-embracing population. According to estimates, India will soon cross 900 million internet users, of which 886 million were in 2024 alone, an 8% year-on-year increase. The growth in internet penetration has boosted the need for smartphones, driving local manufacturing and assembly facilities. The arrival of smartphones subsequently fueled this demand, particularly with urban and internet-savvy consumers. Today, India boasts around 650 million smartphone users, representing 46% smartphone penetration. This expansion has resulted in a large demand for components like printed circuit boards (PCBs), connectors, and acoustic components, facilitating the growth of the mobile device supply chain. With an expanding domestic consumer market and government support for local production, India's mobile manufacturing industry is transforming into a globally competitive, high-output sector.

Demographic Advantage and Cost-Efficient Labor

India's positive demographic landscape offers a sound basis for expansion in mobile phone adoption and manufacturing. India has a large and youthful population, an emerging middle class, and an amplifying number of working women and men. These socio-economic forces have shifted consumption patterns and widened demand for digital connectivity. As the youth population becomes increasingly connected digitally, mobile phones become tools for communication, learning, and employment. Further, India has a large source of unskilled, semi-skilled, and skilled labor concentrated in big manufacturing states. The presence of cheap labor has been a significant factor in positioning India as an attractive location for electronics manufacturing. This competitive labor advantage lowers manufacturing costs and attracts both local and global companies to set up or increase business in the nation. The convergence of demographic power and affordability of labor makes India able to ramp up its mobile manufacturing ecosystem without losing its attractiveness for investments to come.

Technological Evolution and Policy-Driven Growth

Continuous technological evolution is revolutionizing Indian mobile components manufacturing and assembly market growth. As consumer demands evolve and product lifecycles shorten, manufacturers are under pressure to innovate repeatedly and introduce new models as frequently as possible. Such a trend kindles the demand for mobile parts such as plastics, metals, connectors, and PCBs. In addition, the Indian government has launched friendly policies and programs such as "Make in India," which have greatly enhanced the business environment for mobile phone producers. Foreign direct investment (FDI) inflows are growing, and projects like Samsung's Noida mega-factory highlight India's manufacturing potential. Other international brands, especially Chinese producers, are also expanding their local production base. Although numerous companies continue to remain assembly-centric, a trend toward in-house value addition and R&D is taking root, encouraged by government schemes. These advancements are progressively transforming India into a complete mobile manufacturing center, ranging from design and component production to end assembly and innovation.

Indian Mobile Components Manufacturing and Assembly Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian mobile components manufacturing and assembly market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on mobile type, mobile components, and assembly and domestic manufacturing.

Analysis by Mobile Type:

- Smartphones

- Feature Phones

- Other Phones

With a commanding 88.9% share in 2024, smartphones dominated India mobile components manufacturing and assembly market forecast. This overwhelming dominance is a testament to the growing dependence of Indian consumers on sophisticated digital connectivity, high-speed internet, and feature-rich mobile devices. The spread of smartphones is due to increased affordability, expanding rural and urban smartphone penetration, and consumer pressure for newer features. Smartphone-driven demand has pushed component vendors to emphasize advancements in battery life, processing capabilities, and camera units. Concurrently, indigenous assembly units have prioritized the switch from feature phone-compatible components to smartphone-compatible components, impacting procurement trends and production quantities. With smartphones as the sole device for communication, payments, media consumption, and productivity, the mobile part supply chain also continues to orient itself towards smartphone-specific needs. This focus on smartphones further reinforces the vertical integration of local production and is likely to maintain high levels of output and investment appeal in the mobile environment.

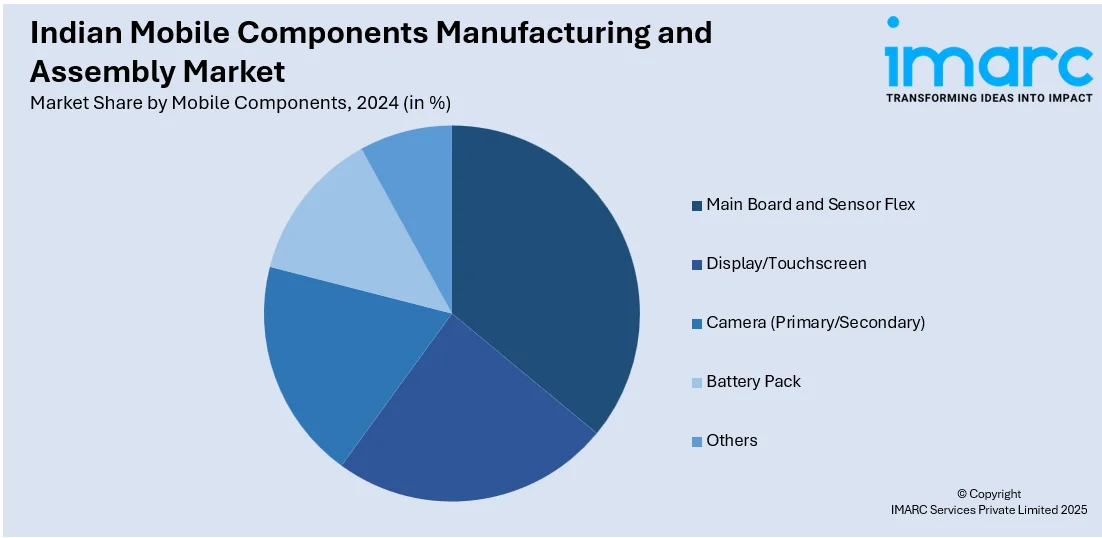

Analysis by Mobile Components:

- Main Board and Sensor Flex

- Display/Touchscreen

- Camera (Primary/Secondary)

- Battery Pack

- Others

Main boards and sensor flex cables are key subcategories in India's mobile components manufacturing industry. They are central to the function of devices since main boards carry core circuitry, processors, and memory, while sensor flex cables enable touch sensitivity, biometric identification, and motion sensing. Increased integration of sophisticated functionality in contemporary smartphones like face recognition, fingerprint sensing, and AI-aided cameras has further raised the value of high-precision component manufacture. Whereas local manufacturing has traditionally focused on assembly, need is stimulating being directed towards localization of complex components such as main boards. The shift is underpinned by investment in printed circuit board (PCB) production, surface-mount technology (SMT) lines, and labor skill building. Sensor flex manufacturing is also becoming increasingly relevant with the desire by smartphone vendors for slim design and flexible electronics. The rising technological needs and complexity of these components make them strategic focus areas for capability building and long-term value addition within India's electronic manufacturing setup.

Analysis by Assembly and Domestic Manufacturing:

- Assembly

- Domestic Manufacturing

Holding a share of 70.6% in 2024, assembly continues to dominate the Indian mobile manufacturing landscape. While end-to-end manufacturing remains limited, the extensive presence of large-scale assembly lines enables India to meet high domestic demand and support global supply chains. Assembly activities involve the integration of pre-manufactured components into finished devices, a process that has expanded rapidly due to favorable cost structures, labor availability, and streamlined government regulations. Despite limited indigenous sourcing of high-end components, the emphasis on final-stage device assembly has significantly boosted local employment and export volumes. The large share of assembly is also linked to India’s attractiveness as a low-cost destination for global OEMs looking to diversify production beyond traditional hubs. While the share of value-added manufacturing is expected to rise, assembly remains a vital contributor to India’s mobile ecosystem, serving as a gateway for future transitions toward deeper component-level production and research and development (R&D) localization.

Regional Analysis:

- Uttar Pradesh

- Andhra Pradesh

- Telangana

- Others

Uttar Pradesh has become a hub in India's mobile assembly and manufacturing industry based on strategic government initiatives, favorable infrastructure, and availability of labor. The state's capital area, specifically Noida and Greater Noida, has seen considerable investment in mobile manufacturing units and is one of the most industrialized centers for electronics in the nation. Dedicated electronics manufacturing zones, key policy incentives, and ease of doing business have made Uttar Pradesh a destination of choice for domestic as well as foreign companies. Its attractiveness is further driven by the availability of logistics networks, power infrastructure, and skill development centers. Strong backward linkages in the labor and training ecosystems and forward linkages in the supply chains have made the state the largest contributor to the country's national mobile output. Its increasing prominence adds to the trend of regional specialization in India's manufacturing base, where key states such as Uttar Pradesh are pillars in increasing national capabilities for high-volume mobile assembly and components.

Competitive Landscape:

India mobile components manufacturing and assembly market outlook is becoming more competitive, driven by robust policy support, rising domestic demand, and technology integration. The segment is witnessing heightened participation from both incumbents and new entrants, all looking to ride the burgeoning smartphone market and supportive production-linked incentive schemes. The most significant manufacturing bases are found in states such as Uttar Pradesh, Tamil Nadu, and Andhra Pradesh, wherein infrastructure and accessibility of labor suit scalability. Backward integration of the value chain is increasing by producing critical parts like PCBs, batteries, displays, connectors, and plastics to minimize dependency on imports. Firms also diversify the offerings by undertaking automation and precision engineering to boost quality and the efficiency of production. This dynamic environment represents a shift from core assembly towards an integrated manufacturing practice, consistent with national aspirations towards technological independence and increased local content in the electronic industry.

The report provides a comprehensive analysis of the competitive landscape in the Indian mobile components manufacturing and assembly market with detailed profiles of all major companies, including:

- Samsung Electronics Co. Ltd.

- Xiaomi Corporation

- Lenovo Group Ltd.

- Micromax Informatics Limited

- Oppo Guangdong Mobile Communications Co. Ltd.

- Vivo Mobile Communications Co. Ltd.

- Lava International Limited

- Karbonn Mobiles

- Intex Technologies

Latest News and Developments:

- April 2025: Dixon Technologies announced its strategic expansion into electronics component manufacturing, focusing on mobile device components. Initially targeting in-house production, Dixon plans to manufacture display modules, camera modules, mechanical enclosures, and lithium-ion batteries.

- April 2025: Samsung India announced an INR 1,000 crore investment to expand its Sriperumbudur facility in Tamil Nadu. This expansion aims to enhance manufacturing capabilities and create 100 new jobs.

- April 2025: Samsung requested a one-year extension for the Production-Linked Incentive (PLI) scheme for smartphones, after missing targets in its second year. The company aims to secure incentives for a full five years, with expectations of receiving USD 384 million. Samsung is also reportedly considering shifting some of its production from Vietnam to India due to US-led tariff disputes.

- March 2025: The Union Cabinet approved a USD 2.75 Billion Electronics Component Manufacturing Scheme for a six-year period. The scheme aims to boost component manufacturing, building on earlier initiatives focused on semiconductors, IT hardware, and mobile phones. Unlike previous efforts, incentives under this scheme are based on turnover and employment generation rather than incremental production.

- January 2025: Dixon Technologies and Vivo India announced a joint venture to set up an OEM facility dedicated to smartphone and electronics manufacturing. The new facility aims to serve not only Vivo but also potential clients such as Samsung, Xiaomi, Motorola, Oppo, Transsion, Google, and Nothing.

Indian Mobile Components Manufacturing and Assembly Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Million Units |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Mobile Types Covered | Smartphones, Feature Phones, Other Phones |

| Mobile Components Covered | Main Board and Sensor Flex, Display/Touchscreen, Camera (Primary/Secondary), Battery Pack, and Others |

| Assembly and Domestic Manufacturing Covered | Assembly, Domestic Manufacturing |

| Regions Covered | Uttar Pradesh, Andhra Pradesh, Telangana, Others |

| Companies Covered | Samsung Electronics Co. Ltd., Xiaomi Corporation, Lenovo Group Ltd., Micromax Informatics Limited, Oppo Guangdong Mobile Communications Co. Ltd., Vivo Mobile Communications Co. Ltd., Lava International Limited, Karbonn Mobiles and Intex Technologies |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian mobile components manufacturing and assembly market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian mobile components manufacturing and assembly market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India mobile components manufacturing and assembly industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The mobile components manufacturing and assembly market in India was valued at USD 71.5 Billion in 2024.

The Indian mobile components manufacturing and assembly market is projected to exhibit a CAGR of 14.02% during 2025-2033, reaching a value of USD 246.8 Billion by 2033.

Key drivers of the Indian mobile components production and assembly industry are the smartphone adoption at high rates, the growing disposable incomes, and growing internet penetration. Government policies and initiatives like "Make in India" encourage indigenous production, mitigating import dependency. The expanded demand for both feature and smartphones also boost the market. Further, India's availability of skilled labor and the low cost of labor make the country more desirable as a hub for mobile component manufacturing.

The smartphone segment leads the Indian market for mobile components manufacturing and assembly, with a projected share of 88.9% in 2024. Growing smartphone penetration, triggered by increasing disposable incomes, tech-savvy consumers, and growing internet accessibility, has propelled demand for mobile components like PCBs, connectors, and sensors. This surge supports the market-leading position of the smartphone segment.

Some of the major players in the Indian mobile components manufacturing and assembly market include Samsung Electronics Co. Ltd., Xiaomi Corporation, Lenovo Group Ltd., Micromax Informatics Limited, Oppo Guangdong Mobile Communications Co. Ltd., Vivo Mobile Communications Co. Ltd., Lava International Limited, Karbonn Mobiles and Intex Technologies, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)