India Paper Shredder Market Size, Share, Trends and Forecast by Type, Bin Capacity, Distribution Channel, End-User, and Region, 2025-2033

Market Overview:

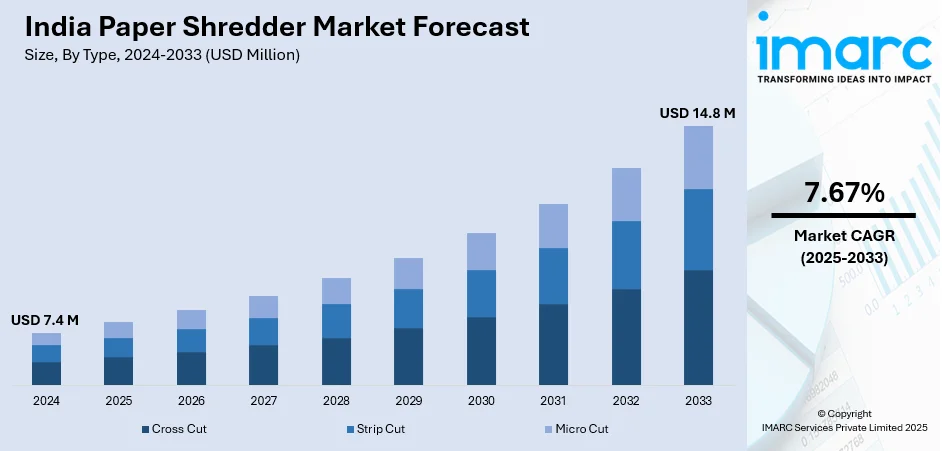

The India paper shredder market size reached USD 7.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 14.8 Million by 2033, exhibiting a growth rate (CAGR) of 7.67% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.4 Million |

|

Market Forecast in 2033

|

USD 14.8 Million |

| Market Growth Rate 2025-2033 | 7.67% |

A paper shredder is a mechanical device used to cut paper into pieces, stripes or fine particles as per the customer’s requirement. Paper shredders play a significant role in organizations in order to process waste papers and secure confidential and sensitive pieces of information from getting into the hands of unauthorized personnel. Shredders are available in a variety of shapes and sizes depending upon their utility, such as strip cut shredders with a single blade to cut paper into thin strips, industrial paper shredders used for bulk shredding and crosscut shredders to cut paper into minuscule pieces. Shredding paper is an effective method to manage large paper waste as it leaves a limited amount of residue in the environment.

To get more information on this market, Request Sample

The growth of the Indian paper shredder market is primarily driven by industrialization in the country. With numerous Indian and foreign businesses and organizations starting their operations in India, the utilization of paper and paper products has increased significantly. In order to match the quantity of waste papers generated, the demand of paper shredders is also experiencing a healthy growth. Moreover, paper shredders are being adopted in the Indian commercial sector as it provides security of data by safeguarding confidential information from privacy invasion. Additionally, paper shredders help in reducing operational costs of an organization since third-party shredding is an expensive alternative.

This report provides a deep insight into the Indian paper shredder market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for paper shredder manufacturers, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the India paper shredder market in any manner.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the India paper shredder market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on type, bin capacity, distribution channel and end-user.

Breakup by Type:

- Cross Cut

- Strip Cut

- Micro Cut

Breakup by Bin Capacity:

- Up to 20 Liter

- 21-70 Liter

- 71-135 Liter

- Above 135 Liter

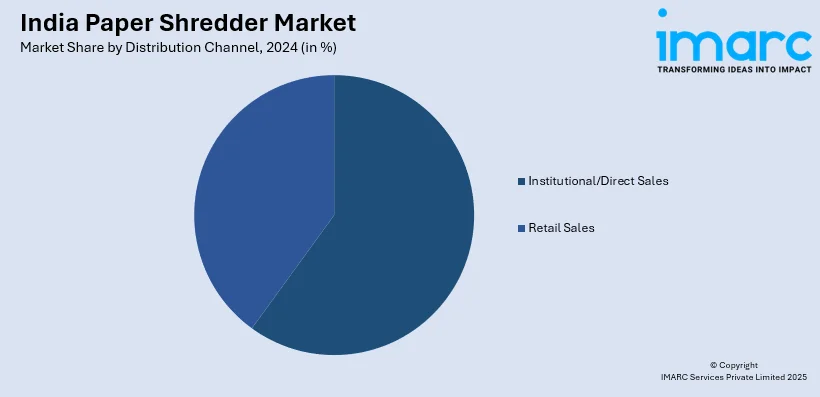

Breakup by Distribution Channel:

- Institutional/Direct Sales

- Retail Sales

Breakup by End-User:

- Commercial Paper Shredder

- Office/Residential Paper Shredder

Breakup by Region:

- North India

- East India

- West and Central India

- South India

Value Chain Analysis

Key Drivers and Challenges

Porters Five Forces Analysis

PESTEL Analysis

Government Regulations

Competitive Landscape:

The report has also analysed the competitive landscape of the market with some of the key players being AVANTI Business Machines Limited, INFRES Methodex Pvt. Ltd., Kobra India Security Systems Pvt. Ltd., Pitney Bowes India Pvt. Ltd., TRENDZ PAPER AND STATIONERS (INDIA) PVT. LTD., Concept Business Products, Pilot India Group, HSM GmbH + Co. KG, Aditya Technologies Pvt. Ltd., Kores (India) Limited, etc.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Type, Bin Capacity, Distribution Channel, End-User, Region |

| Region Covered | North India, West and Central India, South India, East India |

| Companies Covered | AVANTI Business Machines Limited, INFRES Methodex Pvt. Ltd., Kobra India Security Systems Pvt. Ltd., Pitney Bowes India Pvt. Ltd., TRENDZ PAPER AND STATIONERS (INDIA) PVT. LTD., Concept Business Products, Pilot India Group, HSM GmbH + Co. KG, Aditya Technologies Pvt. Ltd. and Kores (India) Limited |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indian paper shredder market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Indian paper shredder market?

- What are the key regional markets in the Indian paper shredder industry?

- What is the breakup of the Indian paper shredder market on the basis of type?

- What is the breakup of the Indian paper shredder market on the basis of bin capacity?

- What is the breakup of the Indian paper shredder market on the basis of distribution channel?

- What is the breakup of the Indian paper shredder market on the basis of end-user?

- What are the various stages in the value chain of the Indian paper shredder industry?

- What are the key driving factors and challenges in the Indian paper shredder industry?

- What is the structure of the Indian paper shredder industry and who are the key players?

- What is the degree of competition in the Indian paper shredder industry?

- What are the profit margins in the Indian paper shredder industry?

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)