Indian PCB (Printed Circuit Board) Market Size, Share, Trends and Forecast by Manufacturing Type, Application, Product Type, Layer, Segment, Laminate Type, and Region, 2026-2034

Indian PCB (Printed Circuit Board) Market Summary:

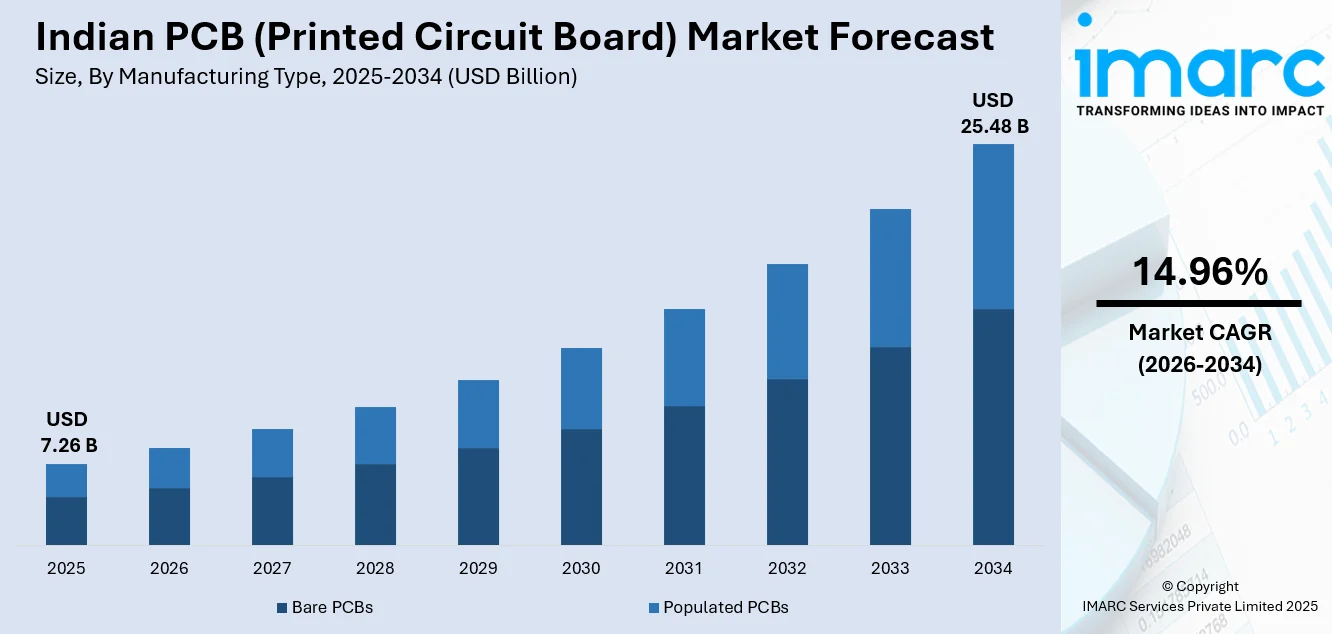

The Indian PCB (printed circuit board) market size was valued at USD 7.26 Billion in 2025 and is projected to reach USD 25.48 Billion by 2034, growing at a compound annual growth rate of 14.96% from 2026-2034.

The market growth is propelled by accelerating electric vehicle (EV) adoption requiring sophisticated battery management systems and implementation of government incentives under Production-Linked Incentive schemes encouraging domestic manufacturing. Apart from this, the booming smartphone production positioning India as the world's second-largest mobile phone manufacturer and rapid 5G infrastructure deployment is creating demand for high-frequency boards, collectively expanding the India PCB (printed circuit board) market share.

Key Takeaways and Insights:

- By Manufacturing Type: Bare PCBs dominates the market with a share of 74% in 2025, driven by government PLI schemes channeling investments into component manufacturing for air conditioners and LED production.

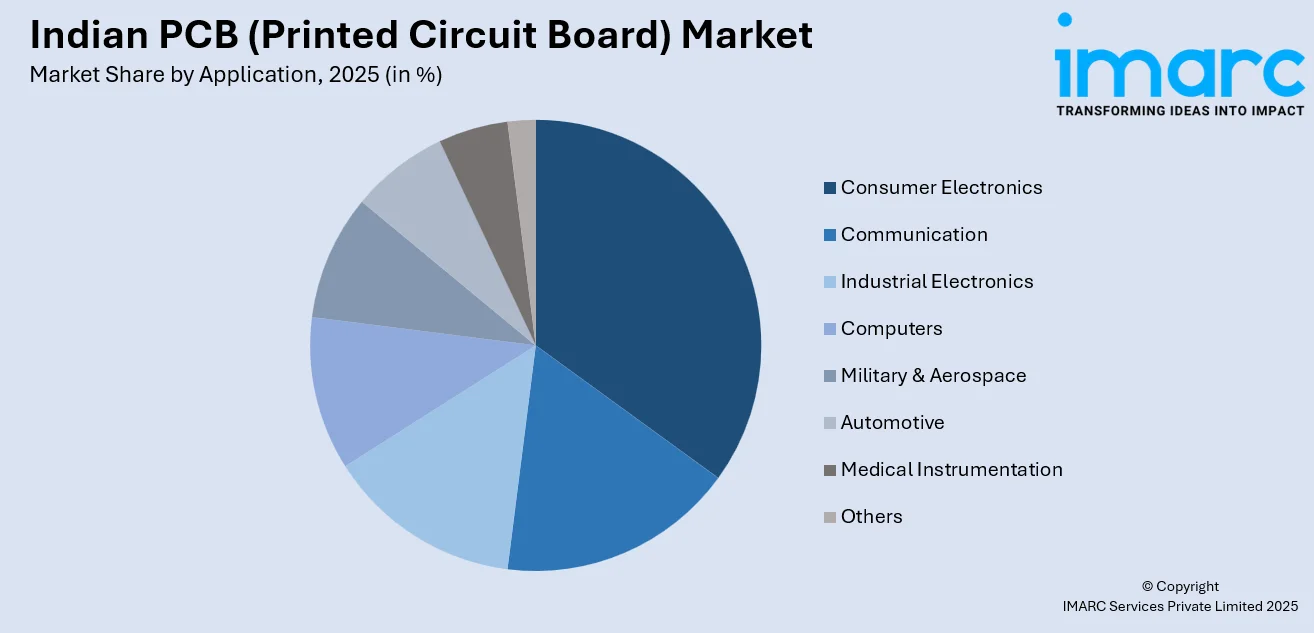

- By Application: Consumer electronics leads the market with a share of 35% in 2025, propelled by India's electronics manufacturing value surging sixfold over the past decade to reach INR 11.3 lakh crore.

- By Product Type: Rigid 1-2 sided represents the largest segment with a market share of 50% in 2025, favored for its cost-effectiveness delivering 40-50% lower per-unit costs compared to multilayer alternatives.

- By Layer: Single-sided holds a market share of 53% in 2025, dominating basic electronics and lighting applications through simplicity and affordability advantages.

- By Segment: Rigid PCBs lead the market with a share of 82% in 2025, essential for automotive engine control systems and consumer electronics motherboards across vehicle and device categories.

- By Laminate Type: FR-4 represents the largest segment with a market share of 61% in 2025, serving as the industry-standard material balancing performance and cost-effectiveness for mainstream electronics.

- By State: Maharashtra dominates with a market share of 29% in 2025, benefiting from manufacturing concentration in Pune, Mumbai, and Nashik industrial clusters.

- Key Players: The India PCB market exhibits moderate to high competitive intensity, with domestic manufacturers competing alongside international players leveraging government incentives and expanding production capacities through joint ventures and strategic partnerships across price and technology segments. Key market players include AT&S, Epitome Components Ltd., Shogini Technoarts, Cipsa Tec India Pvt Ltd, Sulakshana Circuits Ltd, PCB Power Limited, Hi-Q Electronics Pvt Ltd, Vintek Circuit India Pvt Ltd, India Circuit Ltd (Garg Electronics), Nano Electrotech Pvt Ltd and Meena Circuit Pvt Ltd.

To get more information on this market Request Sample

India's PCB industry is undergoing transformative growth as the nation transitions from heavy import dependence to becoming a manufacturing powerhouse in electronics. Government initiatives including the Production-Linked Incentive schemes and Make in India campaign are catalyzing unprecedented investments in domestic manufacturing infrastructure. The convergence of electric vehicle adoption, 5G telecommunications rollout, and consumer electronics manufacturing boom is creating robust demand across rigid, flexible, and high-density interconnect board categories. In January 2025, the Ministry of Commerce and Industry announced the third round of the PLI Scheme for White Goods, with 24 companies committing INR 3,516 crore to boost PCB component production for air conditioners and LED lights. Simultaneously, strategic partnerships are enhancing India's technological capabilities, with Amber Enterprises forming a joint venture with Korea Circuit in October 2024 to establish advanced manufacturing facilities.

Indian PCB (Printed Circuit Board) Market Trends:

Rapid Localization and Domestic Manufacturing Scale-Up

India is witnessing unprecedented growth in domestic PCB manufacturing as the government pushes for electronics self-reliance through strategic policy interventions. The establishment of dedicated electronics manufacturing clusters and specialized PCB production zones is attracting both domestic and international investments. Companies are setting up state-of-the-art facilities equipped with advanced automation and surface mount technology capabilities to meet growing domestic demand. In September 2024, Karnataka's Minister for Electronics and Information Technology announced the establishment of India's first PCB and Supply Chain Cluster in Mysuru, aimed at enhancing local production capabilities and strengthening the country's electronics manufacturing ecosystem. This initiative supports India's broader goal of advancing its electronics manufacturing sector and fostering self-reliance in key technology components, reducing the current import dependency.

Technology Migration Toward Advanced PCB Solutions

The Indian market is experiencing a significant shift from basic single and double-layer boards toward sophisticated multilayer, high-density interconnect, and rigid-flex PCBs driven by demanding applications in automotive electronics, telecommunications infrastructure, and premium consumer devices. Manufacturers are investing heavily in cutting-edge fabrication technologies including laser drilling, microvia processing, and advanced surface finishing techniques to meet international quality standards. The transition is supported by government incentive schemes encouraging high-value production capabilities. In January 2025, the Ministry of Commerce and Industry announced the third round of the Production-Linked Incentive Scheme for White Goods, with 24 companies committing INR 3,516 crore to boost the production of PCB components for air conditioners and LED lights across India, demonstrating substantial confidence in India's technological advancement and manufacturing potential.

5G Infrastructure Rollout Accelerating PCB Demand

India's aggressive 5G network deployment is generating substantial opportunities for PCB manufacturers specializing in high-frequency and high-speed boards required for telecommunications equipment. The rapid expansion of base stations, network equipment, and 5G-enabled consumer devices is driving demand for PCBs with superior signal integrity and electromagnetic interference shielding capabilities. Manufacturers are developing specialized boards capable of handling advanced signal processing and millimeter-wave frequencies essential for next-generation connectivity. India deployed 5G services across 779 districts as of December 2024, representing one of the fastest 5G rollouts globally and creating unprecedented demand for multilayer and HDI boards in network equipment, telecommunications infrastructure, and 5G-capable smartphones. This telecommunications infrastructure expansion is positioning India as a critical manufacturing hub for advanced PCB technologies.

Market Outlook 2026-2034:

India's PCB market is poised for robust expansion as the electronics manufacturing ecosystem matures with enhanced domestic capabilities, advanced technology adoption, and supply chain localization. The convergence of electric vehicle proliferation, consumer electronics growth, and industrial automation is creating diversified demand across application segments. The market generated a revenue of USD 7.26 Billion in 2025 and is projected to reach a revenue of USD 25.48 Billion by 2034, growing at a compound annual growth rate of 14.96% from 2026-2034. Apart from this, strategic investments by domestic players and international partnerships are strengthening manufacturing infrastructure while government schemes continue to provide fiscal incentives and policy support.

Indian PCB (Printed Circuit Board) Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Manufacturing Type |

Bare PCBs |

74% |

|

Application |

Consumer Electronics |

35% |

|

Product Type |

Rigid 1-2 Sided |

50% |

|

Layer |

Single-Sided |

53% |

|

Segment |

Rigid PCBs |

82% |

|

Laminate Type |

FR-4 |

61% |

|

State |

Maharashtra |

29% |

Manufacturing Type Insights:

- Bare PCBs

- Populated PCBs

Bare PCBs dominate with a market share of 74% of the total Indian PCB (printed circuit board) market in 2025.

Bare PCBs represent the foundational segment of India's PCB industry, serving as essential components that require subsequent assembly processes before becoming functional electronic modules. The dominance of this segment reflects India's position in the global electronics supply chain where domestic manufacturers increasingly focus on producing high-quality bare boards for both local consumption and export markets. Government support through the Production-Linked Incentive schemes has catalyzed significant investments in bare PCB manufacturing infrastructure across India.

The bare PCB segment benefits from lower capital intensity compared to assembly operations while offering attractive margins as domestic manufacturers adopt advanced fabrication technologies. Companies are establishing integrated facilities capable of producing multilayer and HDI bare boards to reduce import dependence, which currently accounts for a major percentage of India's total PCB requirements. The establishment of India's first PCB and Supply Chain Cluster in Mysuru announced in September 2024 specifically aims to enhance local bare PCB production capabilities, creating an ecosystem that supports startups and research institutions while fostering technological innovation and quality improvements in domestic bare board manufacturing.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Consumer Electronics

- Communication

- Industrial Electronics

- Computers

- Military & Aerospace

- Automotive

- Medical Instrumentation

- Others

Consumer electronics lead with a share of 35% of the total Indian PCB (printed circuit board) market in 2025.

Consumer electronics applications drive India's PCB market growth as the country emerges as a global manufacturing hub for smartphones, tablets, laptops, televisions, and smart home devices. India's transformation into the world's second-largest mobile phone manufacturer has created unprecedented demand for PCBs across various consumer device categories. The electronics production value in India witnessed remarkable growth, driven by strategic policy interventions including Make in India and Production-Linked Incentive schemes that have attracted major global electronics brands to establish manufacturing operations.

The consumer electronics segment encompasses diverse PCB requirements ranging from simple single-layer boards for basic appliances to sophisticated multilayer HDI boards for premium smartphones and advanced computing devices. Mobile devices dominate the PCB demand within consumer electronics, accounting for a major percentage of total market value while representing only a limited percentage of production volume, indicating demand for premium, high-value PCBs in this segment. The rapid adoption of smart home electronics, IoT-enabled appliances, and connected devices is further expanding PCB consumption across consumer categories, with manufacturers investing in advanced board designs featuring enhanced connectivity capabilities and miniaturized form factors to support next-generation consumer electronics.

Product Type Insights:

- Rigid 1-2 Sided

- Standard Multilayer

- Flexible Circuits

- HDI/Microvia/Build-Up

- Rigid Flex

- Others

Rigid 1-2 sided exhibits a clear dominance with a 50% share of the total Indian PCB (printed circuit board) market in 2025.

Rigid 1-2 sided PCBs constitute the largest product category in India's market, serving fundamental electronics applications across consumer devices, industrial equipment, automotive systems, and lighting solutions. These boards offer optimal balance between functionality and cost-effectiveness, providing 40-50% lower per-unit costs compared to multilayer alternatives while meeting performance requirements for numerous mainstream electronics applications. The simplicity of manufacturing processes for rigid 1-2 sided boards enables domestic producers to achieve competitive pricing and rapid production cycles, making them attractive for high-volume consumer electronics manufacturing that drives India's electronics production growth.

The dominance of rigid 1-2 sided boards reflects India's current position in the electronics value chain where basic to intermediate complexity devices account for substantial production volumes. These boards find extensive applications in power supplies, LED drivers, basic control systems, and entry-level consumer electronics where sophisticated multilayer construction is unnecessary. However, the segment is gradually evolving as manufacturers upgrade capabilities to produce more complex rigid boards with improved copper thickness, better surface finishes, and tighter tolerances to meet quality requirements of premium devices, supported by government initiatives encouraging technology advancement and equipment modernization across India's PCB manufacturing infrastructure.

Layer Insights:

- Single-Sided

- Double-Sided

- Multi-Layer

Single-sided leads with a share of 53% of the total Indian PCB (printed circuit board) market in 2025.

Single-sided PCBs represent the largest layer category in India's market, serving as the workhorse for basic electronics applications where simplicity, cost-effectiveness, and ease of manufacturing are paramount considerations. These boards feature copper circuitry on one side of the substrate with components mounted on the same or opposite side, making them ideal for high-volume, price-sensitive applications including LED lighting, basic consumer appliances, power supplies, and simple control circuits that constitute significant portions of India's electronics manufacturing output.

The prominence of single-sided boards reflects strong demand from the lighting industry, consumer appliances sector, and entry-level electronics manufacturing where cost optimization is critical for market competitiveness. The LED lighting segment, which received substantial support through the PLI Scheme for White Goods with 9 companies investing INR 256 crore announced in January 2025, extensively utilizes single-sided PCBs for driver circuits and control modules. Additionally, the growing solar energy sector employs single-sided boards in inverters, charge controllers, and basic monitoring systems, contributing to sustained demand despite the gradual industry migration toward more complex multilayer configurations for advanced electronics applications.

Segment Insights:

- Rigid PCBs

- Flexible PCBs

Rigid PCBs exhibit a clear dominance with an 82% share of the total Indian PCB (printed circuit board) market in 2025.

Rigid PCBs overwhelmingly dominate India's PCB market, serving as the backbone for numerous electronics applications across automotive systems, consumer devices, industrial equipment, and telecommunications infrastructure. The inherent mechanical strength, dimensional stability, and cost advantages of rigid boards make them the preferred choice for the majority of electronics applications where flexing or bending is not required. Rigid PCBs are essential components in automotive engine control units, consumer electronics motherboards, industrial automation controllers, and telecommunications equipment that collectively drive India's electronics manufacturing growth.

The automotive sector particularly relies on rigid PCBs for critical systems including engine management, power distribution, safety electronics, and infotainment modules, with India's automotive PCB market growing rapidly due to electric vehicle adoption and advanced driver-assistance systems proliferation. Rigid boards excel in automotive environments requiring resistance to vibrations, thermal stress, and harsh operating conditions while maintaining long-term reliability. The consumer electronics segment similarly depends on rigid PCBs for smartphones, laptops, televisions, and appliances, with companies creating jobs to serve growing rigid board demand across industrial and consumer electronics applications.

Laminate Type Insights:

- FR-4

- Polyamide

- CEM-1

- Paper

- Others

FR-4 leads with a share of 61% of the total Indian PCB (printed circuit board) market in 2025.

FR-4 laminates constitute the dominant material category in India's PCB market, serving as the industry-standard substrate offering optimal balance between electrical performance, mechanical properties, thermal stability, and cost-effectiveness for mainstream electronics applications. This glass-reinforced epoxy laminate provides excellent insulation properties, dimensional stability, and ease of processing, making it the preferred choice for the vast majority of consumer electronics, industrial equipment, automotive systems, and telecommunications devices manufactured in India. The widespread adoption of FR-4 reflects its proven reliability and versatility across diverse operating conditions.

FR-4's market dominance is reinforced by well-established supply chains, mature manufacturing processes, and comprehensive qualification by electronics manufacturers worldwide, reducing technical risks for Indian PCB producers serving global markets. The material's compatibility with standard manufacturing equipment and processes enables domestic manufacturers to achieve competitive production costs while meeting international quality standards. As India scales up PCB manufacturing under government initiatives, FR-4 laminates benefit from increasing domestic availability of copper-clad laminates and supporting materials, though the industry still relies significantly on imports for high-grade FR-4 materials, with manufacturers working toward establishing local copper-clad laminate production facilities to reduce dependence on Chinese and Taiwanese suppliers.

State Insights:

- Maharashtra

- Tamil Nadu

- Karnataka

- Gujarat

- Other States

Maharashtra exhibits a clear dominance with a 29% share of the total Indian PCB (printed circuit board) market in 2025.

Maharashtra leads India's PCB market driven by its position as a major industrial hub with extensive electronics manufacturing infrastructure concentrated in Pune, Mumbai, and Nashik metropolitan regions. The state benefits from well-established automotive, consumer electronics, and industrial equipment manufacturing clusters that create consistent demand for PCBs across multiple application segments. The presence of numerous original equipment manufacturers, contract manufacturers, and electronics assembly operations provides a robust customer base for PCB producers, while superior logistics infrastructure including major ports and transportation networks facilitates raw material imports and finished product distribution.

The state's leadership is further reinforced by favorable government policies, availability of skilled technical workforce, and proximity to major consumer markets and export channels. Maharashtra hosts several major PCB manufacturing facilities operated by domestic players and international companies establishing Indian operations. The competitive advantages of established supply chains, supporting industries for raw materials and equipment, and access to research and development capabilities position Maharashtra to maintain market leadership despite growing competition from Karnataka, Tamil Nadu, and Gujarat which are expanding their electronics manufacturing capacities through government-backed initiatives and infrastructure development programs.

Market Dynamics:

Growth Drivers:

Why is the Indian PCB (Printed Circuit Board) Market Growing?

Electric Vehicle (EV) Adoption Driving Advanced PCB Requirements

India's aggressive push toward electric mobility is fundamentally transforming the automotive PCB market as electric vehicles require substantially more sophisticated and numerous PCBs compared to conventional internal combustion engine vehicles. Battery electric vehicles utilize advanced high-density interconnect PCBs for critical systems including battery management modules that monitor cell voltages and temperatures, power electronics controlling energy flow between batteries and motors, charging infrastructure managing power conversion and distribution, and drivetrain control systems coordinating vehicle performance. In 2025, India's electric vehicle (EV) market achieved a significant milestone, with total EV sales hitting 2.3 million units, representing 8 percent of all newly registered vehicles, as stated in the Annual Report: India EV Market 2025 compiled by the India Energy Storage Alliance (IESA) utilizing Vahan Portal data. Electric vehicle PCBs must meet stringent automotive qualification standards for reliability, temperature cycling, vibration resistance, and long operational lifespans, pushing Indian manufacturers to invest in advanced materials, precise fabrication processes, and comprehensive testing capabilities to serve this rapidly expanding segment.

Government Production-Linked Incentive Schemes Catalyzing Investment

Government policy interventions through Production-Linked Incentive schemes are fundamentally reshaping India's PCB manufacturing landscape by providing substantial financial incentives for domestic production and technology upgradation. These schemes offer significant benefits for companies investing in PCB manufacturing infrastructure, encouraging both capacity expansion by existing players and entry of new manufacturers into the market. In March 2025, the Union Cabinet approved the Electronics Component Manufacturing Scheme with funding of INR 22,919 crore specifically designed to make India self-reliant in the electronics supply chain, with dedicated provisions for PCB manufacturing support. The PLI framework incentivizes production of high-value multilayer and HDI boards rather than basic single-layer boards, driving technological sophistication across India's PCB industry. Additionally, fiscal measures including customs duty rationalization, anti-dumping duties on low-cost imports, and tax benefits for electronics manufacturing zones create favorable conditions for domestic PCB producers to compete effectively against established international suppliers. The government's broader Make in India initiative attracts global electronics brands to establish local manufacturing operations, automatically generating substantial captive demand for domestically produced PCBs while reducing India's traditional import dependency which currently accounts for approximately 88% of total requirements.

Smartphone and Consumer Electronics Manufacturing Boom

India's emergence as a global smartphone manufacturing powerhouse is generating unprecedented demand for PCBs as the country transitions from primarily assembly operations to comprehensive manufacturing including component production. India has become the world's second-largest mobile phone manufacturer, driven by strategic policy interventions attracting major global brands to establish extensive manufacturing footprints. Smartphones utilize multiple sophisticated PCBs for main logic boards, display driver circuits, camera modules, battery management, wireless connectivity, and sensors, with premium devices employing advanced HDI and rigid-flex technologies requiring precise multilayer construction. Beyond smartphones, the consumer electronics boom encompasses tablets, laptops, smart televisions, wearables, audio devices, and smart home appliances, each driving specific PCB requirements across different complexity levels and production volumes. The expansion creates opportunities for Indian PCB manufacturers to serve domestic demand while building export capabilities as global electronics brands increasingly source components from their Indian manufacturing bases. The consumer electronics growth particularly benefits domestic PCB producers developing capabilities in smartphone-grade boards requiring advanced materials, fine-line processing, and stringent quality standards.

Market Restraints:

What Challenges the Indian PCB (Printed Circuit Board) Market is Facing?

Heavy Import Dependence for Critical Raw Materials

India's PCB industry faces significant constraints from persistent dependence on imported raw materials, particularly copper-clad laminates and specialty chemicals that constitute essential inputs for board manufacturing. Domestic producers must source approximately 88% of critical materials including high-grade copper foils, photoresists for imaging processes, and advanced laminates from international suppliers primarily located in China, Taiwan, South Korea, and Japan. This import reliance exposes manufacturers to supply chain vulnerabilities including logistics disruptions, extended lead times, currency fluctuations affecting material costs, and potential geopolitical tensions impacting availability. The absence of domestic copper-clad laminate production facilities forces Indian PCB manufacturers to maintain higher raw material inventories than would otherwise be necessary, tying up working capital and reducing operational flexibility while vulnerability to international price fluctuations limits their ability to compete effectively on cost against integrated manufacturers in China and Southeast Asia.

High Capital Investment Requirements for Advanced Technology

Establishing modern PCB manufacturing facilities demands substantial capital investments that create significant barriers to entry and expansion, particularly for advanced technology segments including HDI, rigid-flex, and high-layer-count multilayer boards. These capital requirements encompass specialized equipment for drilling, imaging, plating, etching, lamination, and testing, along with cleanroom infrastructure, wastewater treatment systems, and quality control laboratories. Small and medium-sized manufacturers struggle to secure financing for technology upgradation while established players face decisions regarding allocation of limited capital between capacity expansion and technology improvement, creating consolidation pressures as only well-capitalized companies can effectively compete in advanced segments.

Intense Competition from Established Low-Cost Asian Manufacturers

Indian PCB manufacturers face formidable competition from well-established producers in China, Taiwan, South Korea, and Southeast Asian nations that benefit from decades of industry development, mature supply chains, economies of scale, and government support. Chinese manufacturers particularly offer aggressive pricing enabled by vertical integration, automated high-volume production, and comprehensive domestic supply chains for materials and equipment. This competitive pressure constrains margins for Indian producers while customers accustomed to international quality standards and delivery performance create high expectations that domestic manufacturers must meet while building capabilities. The competition intensifies in advanced technology segments where established Asian suppliers have substantial lead times in process development and equipment optimization.

Competitive Landscape:

The India PCB market exhibits dynamic competitive intensity characterized by a mix of domestic manufacturers, international players establishing local operations, and emerging startups leveraging government incentives to build modern production capabilities. Established domestic leaders command significant market share through comprehensive manufacturing capabilities, established customer relationships, and quality certifications serving automotive, consumer electronics, and industrial segments. International players are increasingly entering through joint ventures and wholly-owned subsidiaries. The competitive landscape is evolving as manufacturers invest in technology upgradation moving from basic single and double-layer boards toward multilayer, HDI, and rigid-flex capabilities to capture higher value segments and reduce import dependency. Competition centers on quality consistency, delivery reliability, price competitiveness, and technical support capabilities, with larger players differentiating through comprehensive service offerings including design assistance, prototype development, and supply chain integration. Some of the companies covered in the report include:

- AT&S

- Epitome Components Ltd.

- Shogini Technoarts

- Cipsa Tec India Pvt Ltd

- Sulakshana Circuits Ltd

- PCB Power Limited

- Hi-Q Electronics Pvt Ltd

- Vintek Circuit India Pvt Ltd

- India Circuit Ltd (Garg Electronics)

- Nano Electrotech Pvt Ltd

- Meena Circuit Pvt Ltd

Recent Developments:

- In September 2025, The government of Andhra Pradesh has sanctioned an Rs 856 crore incentive package for the largest printed circuit board facility in India, which is being established by electronics manufacturing firm Syrma SGS. Officials reported that the state cabinet, led by Chief Minister approved the package.

Indian PCB (Printed Circuit Board) Market Report Coverage:

|

Report Features |

Details |

|

Base Year of the Analysis |

2025 |

|

Historical Period |

2020-2025 |

|

Forecast Period |

2026-2034 |

|

Units |

Billion USD |

|

Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

|

Manufacturing Types Covered |

Bare PCBs, Populated PCBs |

|

Applications Covered |

Consumer Electronics, Communication, Industrial Electronics, Computers, Military & Aerospace, Automotive, Medical Instrumentation, Others |

|

Product Types Covered |

Rigid 1-2 Sided, Standard Multilayer, Flexible Circuits, HDI/Microvia/Build-Up, Rigid Flex, Others |

|

Layers Covered |

Single-Sided, Double-Sided, Multi-Layer |

|

Segments Covered |

Rigid PCBs, Flexible PCB |

|

Laminate Types Covered |

FR-4, Polyamide, CEM-1, Paper, Others |

|

States Covered |

Maharashtra, Tamil Nadu, Karnataka, Gujarat, Other States |

|

Companies Covered |

AT&S, Epitome Components Ltd., Shogini Technoarts, Cipsa Tec India Pvt Ltd, Sulakshana Circuits Ltd, PCB Power Limited, Hi-Q Electronics Pvt Ltd, Vintek Circuit India Pvt Ltd, India Circuit Ltd (Garg Electronics), Nano Electrotech Pvt Ltd and Meena Circuit Pvt Ltd |

|

Customization Scope |

10% Free Customization |

|

Post-Sale Analyst Support |

10-12 Weeks |

|

Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian PCB (printed circuit board) market size was valued at USD 7.26 Billion in 2025.

The Indian PCB (printed circuit board) market is expected to grow at a compound annual growth rate of 14.96% from 2026-2034 to reach USD 25.48 Billion by 2034.

Bare PCBs dominated the market with 74% share in 2025, driven by the presence of bare PCBs as the foundational segment of India's PCB industry, serving as essential components that require subsequent assembly processes before becoming functional electronic modules.

Key factors driving the Indian PCB (printed circuit board) market include accelerating electric vehicle adoption with retail EV sales growing, requiring advanced battery management PCBs, government Production-Linked Incentive schemes through the Electronics Component Manufacturing Scheme, and booming consumer electronics manufacturing with India emerging as the world's second-largest mobile phone manufacturer as electronics production value surged.

Major challenges include heavy dependence on imported raw materials with approximately 88% of copper-clad laminates and specialty chemicals sourced from China, Taiwan, and South Korea exposing manufacturers to supply chain vulnerabilities and cost fluctuations, high capital investment requirements for establishing modern PCB manufacturing facilities creating barriers to entry and expansion, and intense competition from established low-cost Asian manufacturers particularly from China which continues to dominate India's PCB imports despite anti-dumping duties imposed in 2024.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)