Indian Saccharin Market Size, Share, Trends and Forecast by Product Type, Application, 2025-2033

Market Overview:

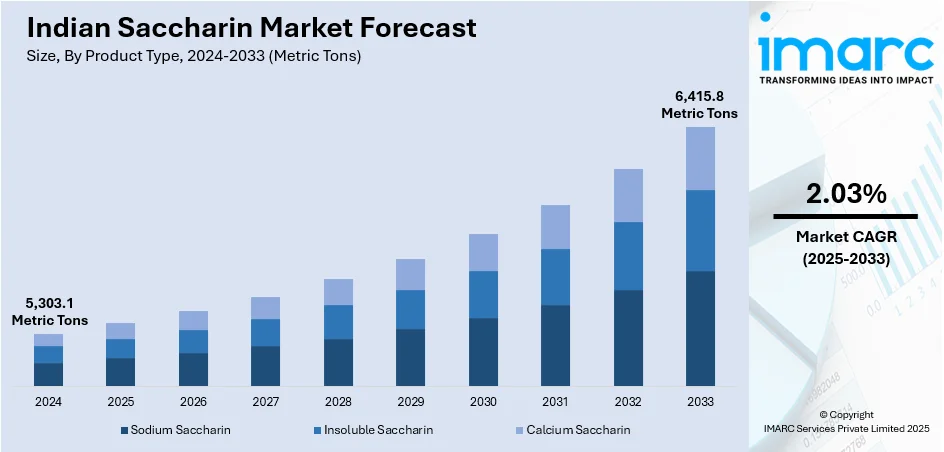

The Indian saccharin market size reached 5,303.1 Metric Tons in 2024. Looking forward, IMARC Group expects the market to reach 6,415.8 Metric Tons by 2033, exhibiting a growth rate (CAGR) of 2.03% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

5,303.1 Metric Tons |

|

Market Forecast in 2033

|

6,415.8 Metric Tons |

| Market Growth Rate (2025-2033) | 2.03% |

Saccharin is an artificial sweetener that is chemically synthesized from O-toluene sulfonamide or Phthalic anhydride. It can be 300 times sweeter than table sugar (sucrose) and does not affect the blood sugar levels or cause tooth decay as it has no calories like other non-nutritive sweeteners. It becomes unstable when heated but does not react chemically with other food ingredients, which makes it suitable for storage. On account of its favorable properties, saccharin is mostly consumed by diabetics and individuals on a sugar-free diet. It is also extensively employed in the manufacturing of diet soft drinks and other low-calorie foods and is useful in foods and pharmaceuticals in which the presence of sugar might lead to spoilage. As a result of this, saccharin is extensively used in various sugar-free products, such as baked goods, jams, chewing gums, tinned fruits, and toothpaste.

To get more information on this market, Request Sample

With around 72 million people suffering from diabetes, India currently has the second largest population of diabetic patients in the world. The increasing incidences of such health issues have made Indian consumers more conscious of their health and wellbeing. Owing to this, people have started shifting toward low-calorie diets and avoid consuming excess amounts of sugar. Saccharin, being a zero-calorie sweetener, is also used by consumers to manage their weight. Moreover, the leading market players in India are improving and upgrading the production technologies, as well as introducing value-added products, to sustain the intense competition in the market. These technological advancements have helped in minimizing the adverse effects of saccharin on both human health and the environment. Apart from this, various organizations are taking initiatives to promote the usage of saccharin as an artificial sweetener, which in turn is bolstering the growth of the market in India.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indian saccharin market report, along with forecasts for the period 2025-2033. Our report has categrized the market based on product type and application.

Breakup by Product Type:

- Sodium Saccharin

- Insoluble Saccharin

- Calcium Saccharin

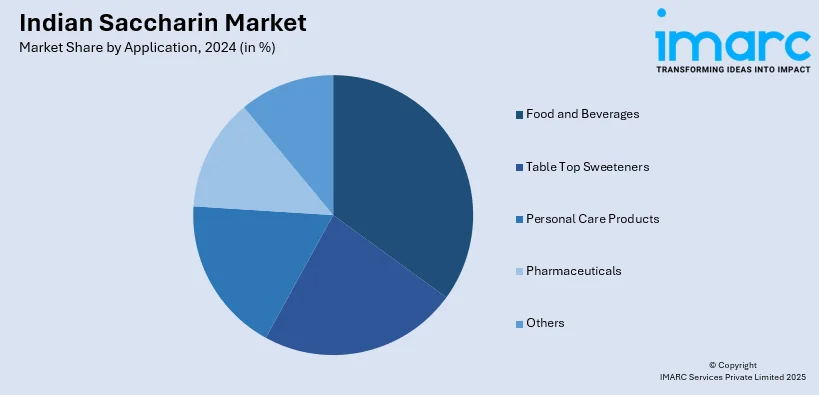

Breakup by Application:

- Food and Beverages

- Table Top Sweeteners

- Personal Care Products

- Pharmaceuticals

- Others

Amongst these, the food and beverages sector dominated the market, accounting for the majority of the overall market share.

Competitive Landscape:

The competitive landscape of the market is characterized by the presence of numerous small and large manufacturers operating in the market. Some of these players include:

- Anmol Chemicals Private Limited

- Blue Jet Healthcare Ltd

- CDH - Central Drug House (P) Ltd.

- Chemcopia Ingredients Pvt Ltd

- DK Pharmachem

- Salvi Chemical Industries Ltd.

- Shree Vardayini Chemical Industries Pvt. Ltd.

- Silverline Chemicals

- Swati Petro Products Pvt. Ltd.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Metric Tons, Million USD |

| Segment Coverage | Product Type, Application |

| Companies Covered | Anmol Chemicals Private Limited, Blue Jet Healthcare Ltd, CDH - Central Drug House (P) Ltd., Chemcopia Ingredients Pvt Ltd, DK Pharmachem, Salvi Chemical Industries Ltd., Shree Vardayini Chemical Industries Pvt. Ltd., Silverline Chemicals, Swati Petro Products Pvt. Ltd., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The saccharin market in India reached 5,303.1 Metric Tons in 2024.

The India saccharin market is projected to exhibit a (CAGR) of 2.03% during 2025-2033, reaching 6,415.8 Metric Tons by 2033.

The market is fuelled by heightening health awareness, growing food and beverage (F&B) demand for low-calorie sweeteners, and broadening use in foods, drinks, and pharmaceuticals. Rising incidence of diabetes and obesity is driving consumers towards sugar substitutes. Additionally, cost savings, easy access, and industry demand from oral care and confectionery industries drive long-term market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)