Indian Shrimp Feed Market Size, Share, Trends and Forecast by Type, Ingredient, Additives, and Region, 2025-2033

Market Overview:

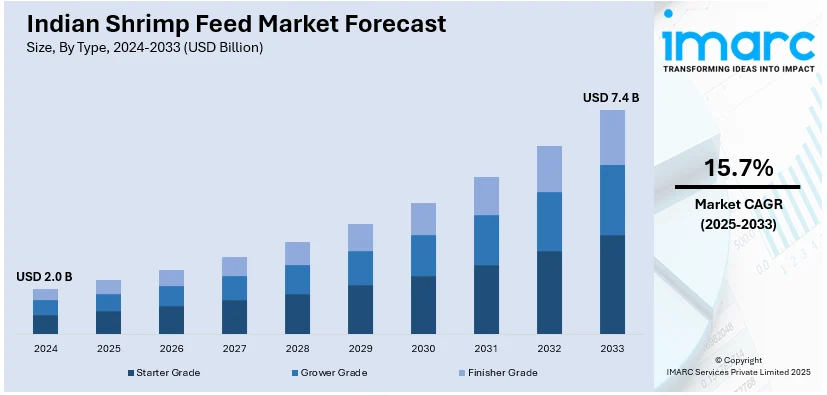

The Indian shrimp feed market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.7% during 2025-2033. The rising preference for shrimp among consumers, the growing shift towards sustainable shrimp farming practices to increase yield while reducing environmental impacts, and the widespread adoption of advanced technologies are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033 |

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.0 Billion |

|

Market Forecast in 2033

|

USD 7.4 Billion |

|

Market Growth Rate 2025-2033

|

15.7% |

Shrimp feed is a specially formulated food product designed to meet the dietary needs of farmed shrimp. It is a vital part of aquaculture, ensuring the health and growth of the shrimp population. The feed primarily comprises proteins, carbohydrates, vitamins, and minerals that together form a balanced diet for the shrimp. Protein, usually derived from fish meal, soy, or other plant sources, is essential for growth and development. Carbohydrates provide energy, while vitamins and minerals are crucial for metabolic processes and disease resistance. The feed can also contain certain additives to improve its nutritional value or make it more appealing to the shrimp. Importantly, the formulation of shrimp feed must be carefully managed to ensure it is environmentally sustainable and does not contribute to water pollution. This, in turn, safeguards the overall health of the aquaculture system and ultimately contributes to a more sustainable and productive shrimp farming industry.

To get more information on this market, Request Sample

Changing dietary patterns in India and a rising preference for seafood, particularly shrimp, among consumers are stimulating the shrimp farming industry and, consequently, the shrimp feed industry. As India becomes more health-conscious, the high protein content and low fat in shrimps make them an attractive choice for many. This shift in consumption patterns is encouraging aquaculture farmers to increase their production to meet this demand, hence boosting the demand for shrimp feed. Along with this, the escalating shift towards sustainable and intensive shrimp farming practices to increase yield while reducing environmental impacts is positively influencing the market. Therefore, the growing need for quality feed that can promote growth and disease resistance is leading to improved feed conversion rates. This trend is driving the growth of specialized shrimp feed producers who can meet these specific requirements. Apart from this, the rising investment in the aquaculture sector by private entities and multinational companies, driven by the promising prospects of the sector, is positively affecting the industry. Moreover, the widespread adoption of technologies, such as precision feeding and developing feeds with probiotics and functional ingredients is creating a positive market outlook.

Indian Shrimp Feed Market Trends/Drivers:

Increase in Aquaculture Practices

The most substantial driver for the shrimp feed industry in India is the proliferation of aquaculture practices. India holds one of the leading positions globally in aquaculture production, indicating a promising potential for shrimp feed manufacturers. Aquaculture has been thriving due to a combination of favorable factors, such as the country's vast coastal and inland water resources, diverse species availability, conducive climatic conditions, and robust demand for seafood. This growth in the industry is directly proportional to the rise in demand for shrimp feed as it is a critical input for shrimp farming. Farmers are increasingly recognizing the importance of quality feed in enhancing shrimp growth rates, health, and overall yield. Thus, the rise in aquaculture practices acts as a powerful driver for the shrimp feed industry in India.

Government Initiatives and Policies

Another significant factor propelling the shrimp feed industry is the proactive support from the Indian government. Along with this, the government, under its numerous initiatives, has been encouraging aquaculture through various subsidy schemes and providing training to farmers. In addition, it is particularly focusing on promoting brackish water shrimp farming, which is a boon for the shrimp feed industry. Moreover, the government's initiative to relax import norms for key ingredients used in shrimp feed, such as fishmeal and soybean meal, is fueling the industry's growth. Hence, the government's initiatives and policies are shaping a conducive environment for the shrimp feed industry's advancement.

Indian Shrimp Feed Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indian shrimp feed market report, along with forecasts at the country and state levels from 2025-2033. Our report has categorized the market based on type, ingredient and additives.

Breakup by Type:

- Starter Grade

- Grower Grade

- Finisher Grade

Grower grade represents the most widely used type

The report has provided a detailed breakup and analysis of the market based on the type. This includes starter grade, grower grade, and finisher grade. According to the report, grower grade represented the largest segment.

The market for grower grade shrimp feed in India is experiencing significant growth, driven by the increasing intensification of shrimp farming operations. As farmers aim to maximize yield and profitability, they are moving from traditional to more intensive farming systems, which necessitates the use of grower feed. Grower feed, rich in proteins and essential nutrients, supports the rapid and healthy growth of juvenile shrimps to marketable sizes. Another important driver is the expansion of the aquaculture sector, fuelled by supportive government policies and growing private investment. In addition, the rise in shrimp export demand is another influential factor. To meet international quality standards and ensure the shrimps' wellbeing, farmers are increasingly recognizing the importance of using grower feeds. Moreover, the shift towards sustainable aquaculture practices and increased awareness about the impact of feed on shrimp health and productivity is encouraging the use of high-quality grower grade shrimp feed.

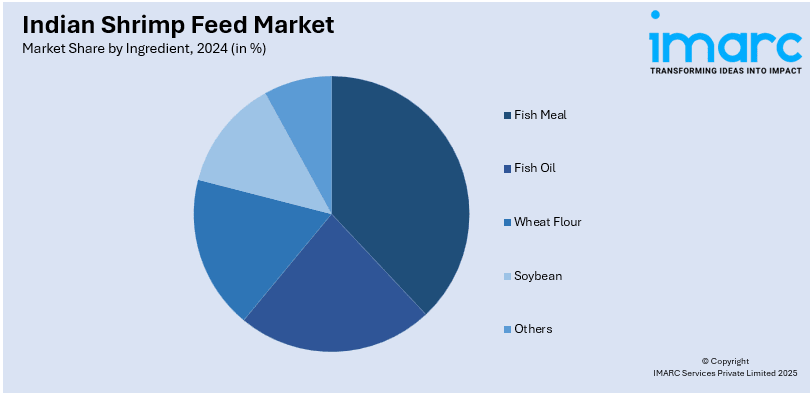

Breakup by Ingredient:

- Fish Meal

- Fish Oil

- Wheat Flour

- Soybean

- Others

Wheat flour account for the majority of the market share

A detailed breakup and analysis of the market based on the ingredient has also been provided in the report. This includes fish meal, fish oil, wheat flour, soybean, and others. According to the report, wheat flour accounted for the largest market share.

The use of wheat flour as an ingredient in the Indian shrimp feed industry is experiencing significant growth due to several factors. Wheat flour is an excellent binder in shrimp feed, ensuring the stability of feed in water and allowing the shrimp to feed for a longer period. This increases feed efficiency and contributes to the health and growth of shrimps, making it a popular choice among shrimp farmers. Additionally, wheat flour is comparatively inexpensive and readily available in the Indian market, making it a cost-effective option for feed manufacturers. Increasing prices and fluctuating availability of traditional protein sources, such as fishmeal and soybean meal are also leading feed manufacturers to explore alternative ingredients, thereby driving the demand for wheat flour. The Indian government's policies encouraging the use of locally available and cost-effective ingredients in aqua feed further promote the use of wheat flour. Lastly, advances in feed formulation technologies have enabled the development of well-balanced and nutritious feeds using wheat flour, enhancing its attractiveness in the shrimp feed industry. These factors are collectively driving the growth of the wheat flour ingredient in the Indian shrimp feed market.

Breakup by Additives:

- Vitamin and Protein

- Fatty Acid

- Antibiotics

- Antioxidant

- Feed Enzyme and Others

Vitamin and protein represents the most widely used type

The report has provided a detailed breakup and analysis of the market based on the additives. This includes vitamin and protein, fatty acid, antibiotics, antioxidant, and feed enzyme and others. According to the report, vitamin and protein represented the largest segment.

The market for vitamin and protein additives in the Indian shrimp feed industry is witnessing significant growth, driven by the intensification of shrimp farming practices. It necessitates high-quality feed additives to ensure the shrimps' health and optimal growth, underpinning the demand for vitamin and protein additives. These additives help enhance the feed conversion ratio, bolster the immune system, and increase the disease resistance of shrimps, critical for profitable shrimp farming. Additionally, the increasing awareness among farmers about the benefits of nutrient-rich feed in improving the yield and quality of shrimp is fueling the demand for vitamin and protein additives. Moreover, as India's shrimp export market continues to expand, the need to meet the stringent quality standards of international markets is driving the use of these additives to produce healthier and larger shrimps. The Indian government's favorable policies and initiatives to promote the use of nutrient-rich feed additives in aquaculture further contribute to the market growth.

Breakup by Region:

- Andhra Pradesh

- West Bengal

- Tamil Nadu and Pondicherry

- Gujarat

- Odisha

- Maharashtra

- Others

Andhra Pradesh exhibits a clear dominance, accounting for the largest Indian shrimp feed market share

The report has also provided a comprehensive analysis of all the major regional markets, which includes Andhra Pradesh, West Bengal, Tamil Nadu and Pondicherry, Gujarat, Odisha, Maharashtra, and Others. According to the report, Andhra Pradesh accounted for the largest market share.

The Indian shrimp industry in Andhra Pradesh, the leading state in shrimp production, is witnessing significant growth, driven by the state's extensive coastline and favorable climatic conditions. It provides an ideal environment for shrimp farming, propelling industry growth. Government initiatives and state-led programs have supported infrastructure development, provided training to farmers, and offered financial incentives, further stimulating the industry. The state government's proactive measures to relax norms for importing key shrimp feed ingredients have also aided the industry's expansion.

Andhra Pradesh's strategic geographical location with proximity to key ports facilitates efficient export of shrimps, making it an attractive hub for shrimp farming. This has resulted in increased investment from both domestic and multinational companies in the sector. Increasing awareness among farmers about the benefits of using high-quality feed to improve shrimp yield and health is also driving the growth of the shrimp industry.

Competitive Landscape:

The key players in the market are investing in research and development to improve shrimp feed formulation and ensure it meets the nutritional requirements of shrimps, leading to better health, faster growth, and improved disease resistance. These investments are also focusing on developing eco-friendly and sustainable feeds. Along with this, several manufacturers are setting up new processing units and feed mills and upgrading existing facilities with advanced technologies for increased efficiency and output. Therefore, it is significantly supporting the market. In addition, companies are forming strategic partnerships and collaborations with research institutes, technology providers, and even with international firms to leverage their expertise in the field. These collaborations often aim to enhance product portfolios, improve feed quality, or expand market reach. Moreover, the widespread adoption of sustainable ingredients in feed, reducing waste from production processes, and supporting sustainable farming practices among their client farmers, contribute to the market.

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Indian Shrimp Feed Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD, Tons |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Starter Grade, Grower Grade, Finisher Grade |

| Ingredients Covered | Fish Meal, Fish Oil, Wheat Flour, Soybean, Others |

| Additives Covered | Vitamin and Protein, Fatty Acid, Antibiotics, Antioxidant, Feed Enzyme and Others |

| States Covered | Andhra Pradesh, West Bengal, Tamil Nadu and Pondicherry, Gujarat, Odisha, Maharashtra, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indian shrimp feed market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Indian shrimp feed market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indian shrimp feed industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Indian shrimp feed market was valued at USD 2.0 Billion in 2024.

We expect the Indian shrimp feed market to exhibit a CAGR of 15.7% during 2025-2033.

The introduction of high-quality shrimp feed with improved water stability, nutrition density, hygienic raw materials, palatability, etc., is primarily driving the Indian shrimp feed market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary halt in numerous aquaculture practices, thereby negatively impacting the Indian market for shrimp feed.

Based on the type, the Indian shrimp feed market can be categorized starter grade, grower grade, and finisher grade. Currently, grower grade accounts for the majority of the total market share.

Based on the ingredient, the Indian shrimp feed market has been segregated into fish meal, fish oil, wheat flour, soybean, and others. Among these, wheat flour currently exhibits a clear dominance in the market.

Based on the additives, the Indian shrimp feed market can be bifurcated into vitamin and protein, fatty acid, antibiotics, antioxidant, and feed enzyme and others. Currently, vitamin and protein hold the largest market share.

On a regional level, the market has been classified into Andhra Pradesh, West Bengal, Tamil Nadu and Pondicherry, Gujarat, Odisha, Maharashtra, and others, where Andhra Pradesh currently dominates the Indian shrimp feed market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)