Indian Textile and Apparel Market Size, Share, Trends and Forecast by Raw Material, Application, Product Type, and State, 2026-2034

Indian Textile and Apparel Market Summary:

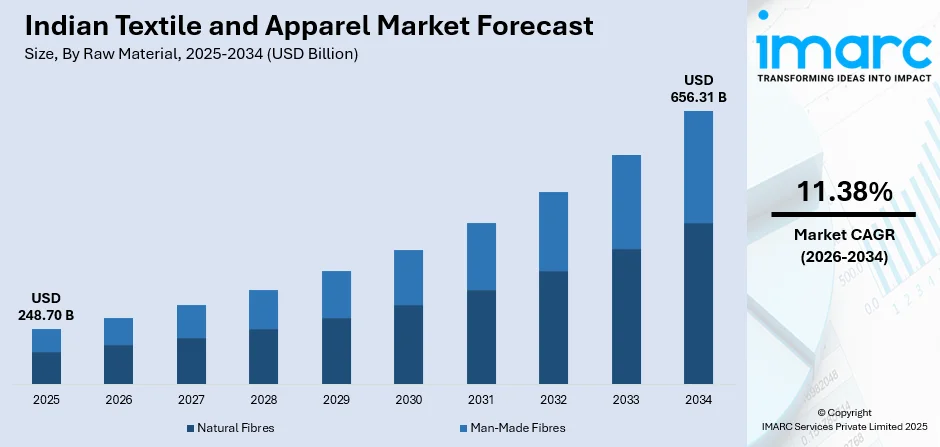

The Indian textile and apparel market size was valued at USD 248.70 Billion in 2025 and is projected to reach USD 656.31 Billion by 2034, growing at a compound annual growth rate of 11.38% from 2026-2034.

India's textile and apparel sector represents a cornerstone of economic development, weaving together traditional craftsmanship with modern manufacturing capabilities while serving domestic consumption needs and international export demands across diverse product categories and regional manufacturing hubs. The market's significance extends beyond economic metrics, encompassing social dimensions through rural employment generation, women's workforce participation in garment manufacturing, and preservation of regional textile traditions that contribute to India's cultural identity while meeting evolving preferences, thereby expanding the Indian textile and apparel market share.

Key Takeaways and Insights:

- By Raw Material: Natural fibres dominate the market with a share of 56% in 2025, leveraging India's historical cotton cultivation heritage, abundant agricultural resources, and established processing infrastructure that supports both traditional handloom operations and mechanized textile production facilities.

- By Application: Clothing textiles lead the market with a share of 40% in 2025, driven by India's massive population base, rising disposable incomes fueling apparel consumption, growing fashion consciousness among urban consumers, and expanding organized retail presence.

- By Product Type: Fabric represents the largest segment with a market share of 38% in 2025, reflecting the intermediate manufacturing stage where weaving mills transform yarn into finished textile materials for downstream garment manufacturers and home furnishing producers.

- By State: Maharashtra leads the market with a share of 20% in 2025, benefiting from concentrated industrial clusters around Mumbai and Pune, established textile mills infrastructure, strategic port access facilitating raw material imports and finished goods exports.

- Key Players: The competitive landscape features established textile conglomerates alongside specialized regional manufacturers, creating a diverse ecosystem where large-scale integrated mills compete with smaller specialized weavers. Major participants include Alok Industries Limited, Arvind Limited, Bombay Dyeing, Garden Silk Mills Private Limited (GSMPL), Grasim Industries Limited (Aditya Birla Group), Raymond Limited, Trident Limited India, Vardhman Textiles Limited, and Welspun Living Limited.

To get more information on this market Request Sample

India's textile and apparel industry functions as a vital economic engine, employing millions across the value chain from cotton farmers to garment workers while generating substantial foreign exchange through exports to global markets. The sector uniquely balances traditional handloom heritage with modern manufacturing technologies, serving diverse market segments from basic commodity fabrics to premium fashion textiles. Regional manufacturing clusters have developed specialized expertise, with Maharashtra focusing on integrated mill production, Gujarat excelling in synthetic textiles, Tamil Nadu dominating cotton spinning, and Uttar Pradesh maintaining strong handloom traditions that preserve cultural textile arts while meeting contemporary market demands. The industry's remarkable diversity manifests in specialized regional ecosystems where centuries-old craftsmanship coexists with cutting-edge automation, exemplified by Varanasi's handloom weavers producing intricate Banarasi silk saris using traditional pit looms alongside modern power loom facilities in Surat manufacturing synthetic fabrics at industrial scale for fast-fashion retailers. This dual character enables Indian textiles to simultaneously serve heritage luxury markets valuing artisanal authenticity and mass-market segments demanding cost-effective standardized products, creating unique competitive positioning that few other manufacturing nations can replicate through their industrial capabilities alone. In 2025, up to 30 textile and apparel units established through the Production Linked Incentive (PLI) scheme have started production. As per the Union Ministry of Textiles, out of the 74 applications chosen for the scheme announced on September 24, 2021, 40 have begun investing, 22 have met the required threshold level, and 30 units have commenced production.

Indian Textile and Apparel Market Trends:

Integration of Digital Manufacturing Technologies Across Production Processes

Advanced automation systems and digital workflow management platforms are transforming traditional textile manufacturing operations, enabling mills to achieve higher precision in pattern replication, reduce material wastage through optimized cutting algorithms, and accelerate production cycles. Computer-aided design systems allow designers to create intricate patterns and simulate fabric behaviors before physical production, while automated looms incorporate sensors that detect defects in real-time and adjust operations accordingly, improving overall quality standards across the manufacturing chain. In 2025, Embee Group, a highly regarded name in India’s textile printing machinery, has made a significant move into the future by introducing its inaugural range of digital textile printers. Embee unveiled two direct-to-fabric digital printers at the exhibition: Sapphire (an entry-level scanning printer intended for mills starting their digital journey) and Emerald (a higher-capacity model targeted at customers needing increased productivity and flexibility).

Sustainability Consciousness Reshaping Raw Material Sourcing and Processing Methods

Environmental awareness among consumers and regulatory pressures are driving textile manufacturers toward sustainable practices, including adoption of organic cotton cultivation methods that eliminate synthetic pesticides, implementation of closed-loop water recycling systems in dyeing facilities, and exploration of alternative natural fibers such as bamboo and hemp. Brands are increasingly communicating their sustainability credentials through transparent supply chain documentation, while innovative startups are developing biodegradable synthetic alternatives and natural dye formulations that reduce chemical discharge into water bodies. In 2025, Arvind Limited, a prominent textile-to-retail conglomerate in India, along with Peak Sustainability Ventures, a global climate investment firm based in Mumbai, have teamed up to establish a large-scale torrefaction facility for cotton stalks in Gujarat. This plant will have an annual capacity of over 40,000 tonnes, aimed at advancing Arvind’s decarbonization objectives and fostering torrefaction on a larger scale in India.

Expansion of Technical Textiles Beyond Traditional Clothing Applications

Specialized textile products designed for specific functional performance characteristics are gaining prominence across industrial, medical, agricultural, and infrastructure sectors, moving beyond conventional apparel applications. Geotextiles are being deployed in road construction and soil stabilization projects, medical textiles serve surgical and hygiene applications in healthcare facilities, and agricultural textiles provide crop protection solutions, collectively expanding the addressable market beyond traditional clothing and home furnishing segments while commanding premium pricing for specialized performance attributes. IMARC Group predicts that the India geotextiles market is predicted to attain USD 658.85 Million by 2033.

Market Outlook 2026-2034:

India's textile and apparel sector is positioned for sustained expansion driven by domestic consumption growth, manufacturing capacity additions, export competitiveness improvements, and product portfolio diversification toward higher-value segments. The demographic dividend of a young population entering peak consumption years, accelerating urbanization patterns shifting households toward organized retail purchasing behaviors, and digital commerce platforms expanding market access beyond traditional distribution networks collectively strengthen demand fundamentals across product categories. The market generated a revenue of USD 248.70 Billion in 2025 and is projected to reach a revenue of USD 656.31 Billion by 2034, growing at a compound annual growth rate of 11.38% from 2026-2034. Manufacturing landscape evolution through strategic investments in state-of-the-art spinning and weaving equipment, adoption of sustainable production technologies addressing environmental concerns, and development of design capabilities enabling differentiation in competitive markets will enhance industry positioning.

Indian Textile and Apparel Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Raw Material |

Natural Fibres |

56% |

|

Application |

Clothing Textiles |

40% |

|

Product Type |

Fabric |

38% |

|

State |

Maharashtra |

20% |

Raw Material Insights:

- Natural Fibres

- Man-Made Fibres

Natural fibres dominate with a market share of 56% of the total Indian textile and apparel market in 2025.

Natural fibres maintain their commanding position through India's extensive cotton cultivation infrastructure spanning millions of hectares across Gujarat, Maharashtra, Telangana, and Punjab, where favorable climatic conditions and centuries of agricultural expertise produce significant annual cotton yields. The country's rich heritage in cotton processing, established ginning and spinning facilities, and farmer familiarity with cultivation practices create a self-sustaining ecosystem that supplies raw materials to textile mills at competitive costs while supporting rural livelihoods across agricultural communities.

Beyond cotton, natural fibre diversity encompasses wool production in northern states, silk reeling in Karnataka and West Bengal, jute cultivation in eastern regions, and emerging interest in sustainable alternatives like hemp and bamboo. Traditional handloom sectors particularly favor natural fibres for their workability, breathability, and cultural significance in heritage textile production. Government initiatives promoting organic cotton farming through subsidy schemes and certification programs further strengthen the natural fibre segment by addressing environmental concerns and enabling premium positioning in domestic and international markets where consumers increasingly value sustainable sourcing practices and chemical-free production methods.

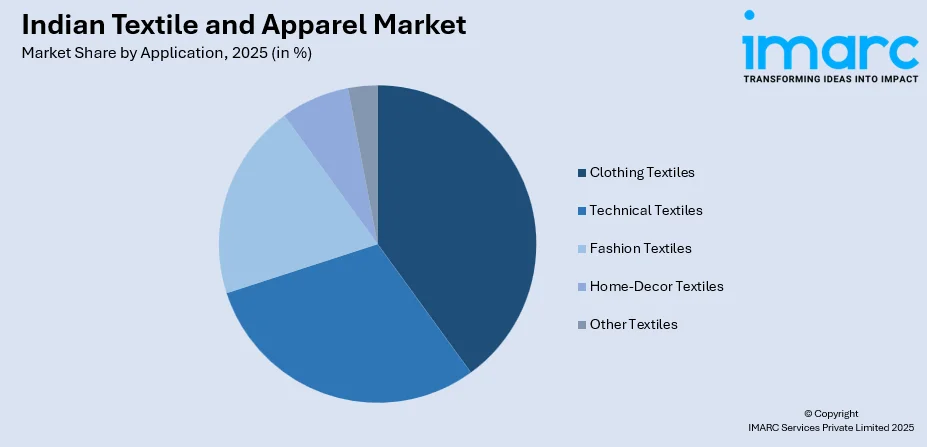

Application Insights:

Access the comprehensive market breakdown Request Sample

- Clothing Textiles

- Technical Textiles

- Fashion Textiles

- Home-Decor Textiles

- Other Textiles

Clothing textiles leads with a share of 40% of the total Indian textile and apparel market in 2025.

Clothing textiles maintain market leadership through India's demographic advantages of a vast population exceeding one billion consumers, rising middle-class prosperity increasing per-capita apparel expenditure, and cultural diversity requiring varied clothing styles for different regions, occasions, and climatic zones. Urban consumption patterns show increasing frequency of wardrobe updates driven by fashion consciousness, while rural markets demonstrate growing transition from traditional unstitched fabrics toward ready-made garments as retail penetration expands and affordability improves through competitive pricing from organized manufacturers.

The segment encompasses diverse product categories from basic cotton garments for mass-market consumers to premium ethnic wear incorporating embroidery and embellishments for festive occasions, creating multiple price points that serve different socioeconomic segments. Export-oriented garment manufacturing clusters in Tirupur, Bengaluru, and National Capital Region produce significant volumes for international fashion brands, while domestic-focused manufacturers supply regional preferences through wholesale markets and growing organized retail chains. Women's apparel represents particularly dynamic growth as workforce participation increases, wedding textile consumption remains culturally significant, and fashion awareness spreads through digital media platforms connecting consumers with style trends.

Product Type Insights:

- Yarn

- Fabric

- Fibre

- Others

Fabric exhibits a clear dominance with a 38% share of the total Indian textile and apparel market in 2025.

Fabric represents the critical intermediate stage where woven or knitted textiles become marketable materials for downstream garment manufacturers, home furnishing producers, and industrial users, commanding substantial value addition through weaving techniques, finishing processes, and design applications. India's extensive weaving infrastructure includes power looms concentrated in Gujarat, Maharashtra, and Tamil Nadu producing commodity fabrics at scale, handlooms preserving traditional weaving techniques in Uttar Pradesh, Odisha, and Assam creating premium heritage textiles, and modern shuttle less looms delivering high-quality fabrics for export markets requiring precise specifications.

The fabric segment serves diverse end-use requirements from basic cotton shirting and suiting materials for mass-market apparel to sophisticated jacquard weaves for upholstery applications and technical fabrics incorporating performance features like moisture-wicking or antimicrobial treatments. Regional specializations have emerged where specific clusters develop expertise in particular fabric types, creating competitive advantages through concentrated skills, specialized equipment, and established buyer relationships. Fabric producers increasingly invest in finishing technologies that enhance aesthetic appeal and functional properties, including mercerization for cotton luster, sanforization for shrinkage control, and various coating applications that add water resistance or flame retardancy.

State Insights:

- Maharashtra

- Uttar Pradesh

- Tamil Nadu

- Gujarat

- Karnataka

- Others

Maharashtra leads with a share of 20% of the total Indian textile and apparel market in 2025.

Maharashtra's leadership position stems from concentrated industrial infrastructure developed over decades, particularly around Mumbai and Pune metropolitan areas where textile mills established during colonial era evolved into modern integrated facilities combining spinning, weaving, and processing operations. The state benefits from excellent connectivity through major ports facilitating raw material imports and finished goods exports, established financial institutions providing capital access for capacity expansion and technology upgradation, and skilled labor pools familiar with textile manufacturing operations across various production stages.

Mumbai's historical significance as India's commercial capital attracted textile entrepreneurship and investment, creating an ecosystem where ancillary industries supplying machinery, chemicals, and packaging materials developed alongside primary textile manufacturers. While some legacy mills in urban Mumbai transitioned toward real estate development, manufacturing capacity shifted to peripheral areas and cities where specialized clusters emerged focusing on power loom fabrics, towels, and synthetic textiles. Maharashtra also houses significant garment manufacturing units serving domestic retail chains and international buyers, while the state's proximity to cotton-growing regions ensures raw material availability that supports competitive cost structures for spinning and weaving operations.

Market Dynamics:

Growth Drivers:

Why is the Indian Textile and Apparel Market Growing?

Rising Disposable Incomes and Expanding Middle-Class Consumer Base

Economic growth trajectory translating into higher household earnings enables Indian consumers to allocate increased budgets toward clothing purchases beyond basic necessities, driving demand for fashion-oriented apparel, branded products, and frequent wardrobe updates that reflect personal style preferences. The expanding middle-class population, projected to constitute significant demographic majority in coming years, demonstrates consumption patterns similar to developed markets with multiple apparel categories for different occasions, seasonal wardrobe changes, and growing awareness of international fashion trends through digital media exposure. Urban consumers particularly show willingness to pay premium prices for quality fabrics, contemporary designs, and established brand names, while improving rural prosperity creates new market opportunities as agricultural income growth and government welfare programs enhance purchasing power in previously underserved regions, collectively expanding the addressable market for textile and apparel manufacturers across price segments. India ranks as one of the fastest-growing significant economies globally and is poised to maintain this growth. Aiming for high middle-income status by 2047, the centenary of its independence, the nation is leveraging robust foundations of economic growth, structural reforms, and societal advancement.

Government Policy Support Through Production Incentives and Infrastructure Development Initiatives

Comprehensive policy framework encompassing production-linked incentive schemes offering financial benefits for capacity additions and employment generation, establishment of textile parks providing ready infrastructure with common facilities for dyeing, printing, and effluent treatment, and strategic trade agreements facilitating preferential market access to key export destinations collectively strengthen industry competitiveness. The Indian textile and apparel manufacturing industry evolved its domains as investments are directed at reaching a goal of ₹40000 crore ($4.8 billion) in capital funding. The Press Information Bureau (PIB) shared information regarding the Make in India initiatives in its publication dated April 1, 2025. Regulatory reforms simplifying compliance procedures, labor law modifications providing operational flexibility, and targeted skill development programs addressing workforce quality challenges create enabling environment for both large integrated manufacturers and small-medium enterprises to expand operations, adopt modern technologies, and improve productivity levels.

Technological Advancements Enhancing Manufacturing Efficiency and Product Innovation Capabilities

Adoption of automated spinning systems incorporating robotics for material handling, computerized looms enabling complex pattern creation without manual intervention, and digital printing technologies allowing small-batch customization without traditional screen preparation investments collectively transform production economics by reducing labor intensity, improving quality consistency, and enabling rapid response to changing fashion trends. With the global textile sector coming together at ITMA ASIA 2025 in Singapore, Yash Textile Machines is poised to return strongly to the international scene, celebrating 25 years of innovation, automation, and engineering excellence. The firm will present its newest innovation, the Fully Automatic Roll Packing Machine, a cutting-edge answer aimed at transforming packing effectiveness and fabric management for contemporary textile factories. Guests can witness the machine in action at Hall 8, Stall C202, where Yash will showcase how automation, accuracy, and smart integration are transforming textile finishing processes.

Market Restraints:

What Challenges the Indian Textile and Apparel Market is Facing?

Fragmented Industry Structure with Predominance of Small-Scale Units Limiting Economies of Scale

The textile sector's organizational structure characterized by numerous small and medium enterprises operating independently creates challenges in achieving cost competitiveness through volume production, negotiating favorable raw material pricing, accessing affordable capital for technology upgrades, and meeting stringent quality specifications required by large retail chains and international buyers. Limited financial resources constrain investments in modern equipment, environmental compliance systems, and skilled workforce development, while lack of professional management practices affects operational efficiency and product consistency that global buyers increasingly demand.

Infrastructure Bottlenecks Including Power Supply Reliability and Logistics Network Efficiency

Manufacturing operations dependent on consistent electricity supply face production disruptions and increased operational costs from backup power generation requirements, while inadequate transportation infrastructure connecting production clusters to ports and consumption centers increases logistics expenses and delivery lead times. Inefficient cargo handling at ports, documentation complexities in customs procedures, and limited availability of specialized textile logistics services add to supply chain costs that erode competitiveness particularly for price-sensitive export markets where freight components significantly impact landed costs compared to competing countries with superior infrastructure networks.

Environmental Compliance Requirements Increasing Production Costs and Operational Complexity

Stringent regulations governing wastewater discharge from dyeing and processing units, restrictions on certain chemical usage in textile production, and mandatory adoption of pollution control technologies impose significant capital expenditure burdens particularly on smaller manufacturers with limited financial capacity. Implementation and maintenance of effluent treatment plants, transition toward eco-friendly dyes and chemicals, water recycling systems, and renewable energy installations require technical expertise and ongoing operational expenditure that affect profit margins, while evolving environmental standards necessitate continuous investments to maintain compliance as regulatory frameworks tighten in response to growing environmental consciousness and sustainability concerns.

Competitive Landscape:

The Indian textile and apparel market demonstrates a diverse competitive structure encompassing large integrated mills operating across the value chain from fiber processing to finished garments, specialized manufacturers focusing on specific product categories or processing stages, and numerous small-scale units serving regional markets through traditional production methods. Leading players leverage economies of scale, brand recognition, and vertical integration to serve organized retail channels and export markets, while maintaining operational flexibility through investments in technology modernization and sustainability initiatives. Competition intensifies across multiple dimensions including product quality and consistency, pricing competitiveness through efficient operations, ability to meet delivery timelines, design and innovation capabilities, and environmental credentials that increasingly influence purchasing decisions among conscious consumers and regulatory compliance requirements in export destinations. Some of the key market players include:

- Alok Industries Limited

- Arvind Limited

- Bombay Dyeing

- Garden Silk Mills Private Limited (GSMPL)

- Grasim Industries Limited (Aditya Birla Group)

- Raymond Limited

- Trident Limited India

- Vardhman Textiles Limited

- Welspun Living Limited

Recent Developments:

- In January 2026, The government launched the District-Led Textiles Transformation (DLTT) Plan, a strategic effort aimed at promoting inclusive and sustainable development throughout India's textile sector. The initiative was launched by the Textiles Ministry during the National Textile Ministers Conference held in Guwahati.

Indian Textile and Apparel Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Natural Fibres, Man-made Fibres |

| Applications Covered | Clothing Textiles, Technical Textiles, Fashion Textiles, Homer-Décor Textiles, Other Textiles |

| Product Type Covered | Yarn, Fabric, Fibre, Others |

| States Covered | Maharashtra, Uttar Pradesh, Tamil Nadu, Gujarat, Karnataka, Others |

| Companies Covered | Alok Industries Limited, Arvind Limited, Bombay Dyeing, Garden Silk Mills Private Limited (GSMPL), Grasim Industries Limited (Aditya Birla Group), Raymond Limited, Trident Limited India, Vardhman Textiles Limited, Welspun Living Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indian textile and apparel market size was valued at USD 248.70 Billion in 2025.

The Indian textile and apparel market is expected to grow at a compound annual growth rate of 11.38% from 2026-2034 to reach USD 656.31 Billion by 2034.

Natural fibres dominated the raw material segment with 56% market share in 2025, driven by India's extensive cotton cultivation infrastructure, established processing facilities across multiple states, and strong traditional preference for cotton-based textiles among domestic consumers and international buyers seeking natural fiber products for apparel and home furnishing applications.

Key factors driving the Indian textile and apparel market include rising disposable incomes expanding middle-class consumer base with increased apparel spending capacity, government production-linked incentive schemes supporting capacity expansion and technology modernization, and adoption of advanced manufacturing technologies enhancing operational efficiency while enabling product innovation across diverse textile categories.

Major challenges include fragmented industry structure with predominance of small-scale units limiting economies of scale and collective bargaining power, infrastructure bottlenecks affecting power supply reliability and logistics efficiency that increase operational costs, and stringent environmental compliance requirements necessitating significant capital investments in pollution control technologies and sustainable production practices that strain financial resources particularly for smaller manufacturers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)