India Truck Market Size, Share, Trends and Forecast by Vehicle Type, Tonnage Capacity, Fuel Type, Application, and Region, 2026-2034

India Truck Market Summary:

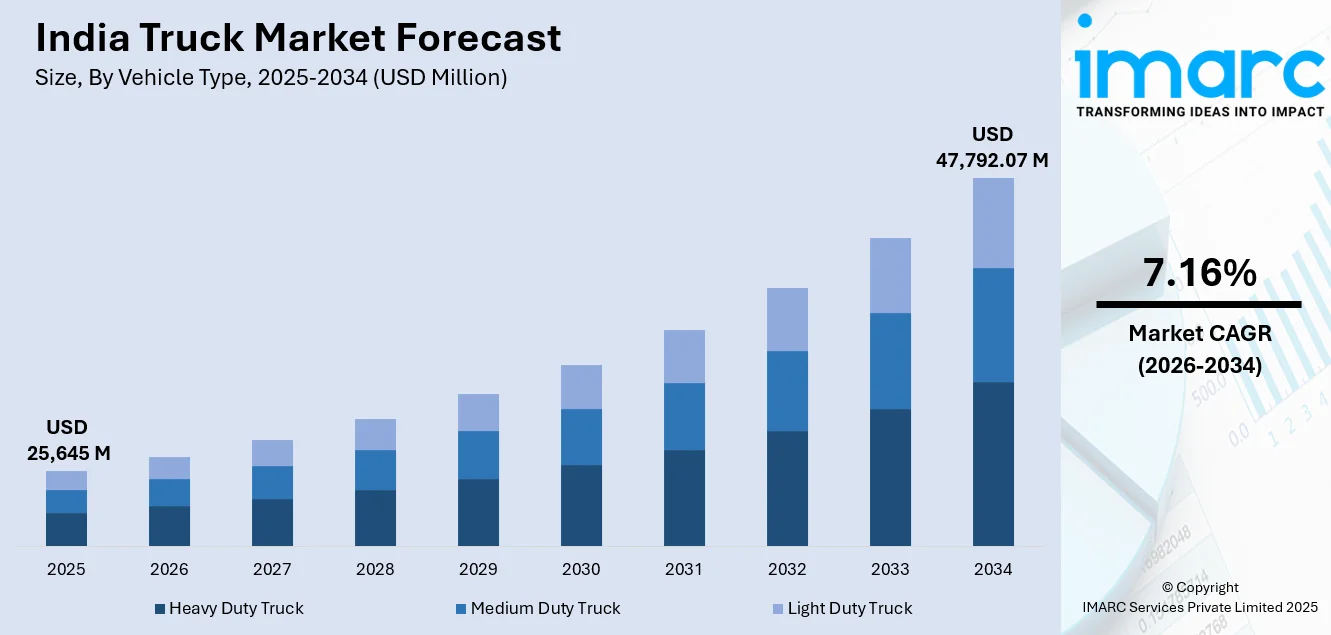

The India truck market size was valued at USD 25,645 Million in 2025 and is projected to reach USD 47,792.07 Million by 2034, growing at a compound annual growth rate of 7.16% from 2026-2034.

The market expansion is underpinned by accelerating e-commerce penetration driving last-mile delivery requirements, comprehensive infrastructure modernization through government initiatives and mandatory compliance with stringent Bharat Stage VI emission standards pushing fleet modernization. Industrial manufacturing growth across automotive, cement, and FMCG sectors necessitates reliable freight transportation, while digital logistics platforms and telematics integration enhance operational efficiency. Agricultural mechanization and rural connectivity improvements further stimulate demand for intermediate and light commercial vehicles across tier-two and tier-three cities, collectively expanding the India truck market share.

Key Takeaways and Insights:

- By Vehicle Type: Heavy duty truck dominates the market with a share of 41% in 2025, driven by infrastructure construction boom, mining operations expansion, and long-haul freight corridor development across national highways.

- By Tonnage Capacity: 7.5-16 tons leads the market with a share of 30% in 2025, dominating regional distribution networks, urban goods movement, and intermediate logistics serving tier-two cities.

- By Fuel Type: Diesel represents the largest segment with a market share of 78% in 2025, underpinned by established refueling infrastructure, superior torque characteristics for heavy loads, and proven total cost of ownership.

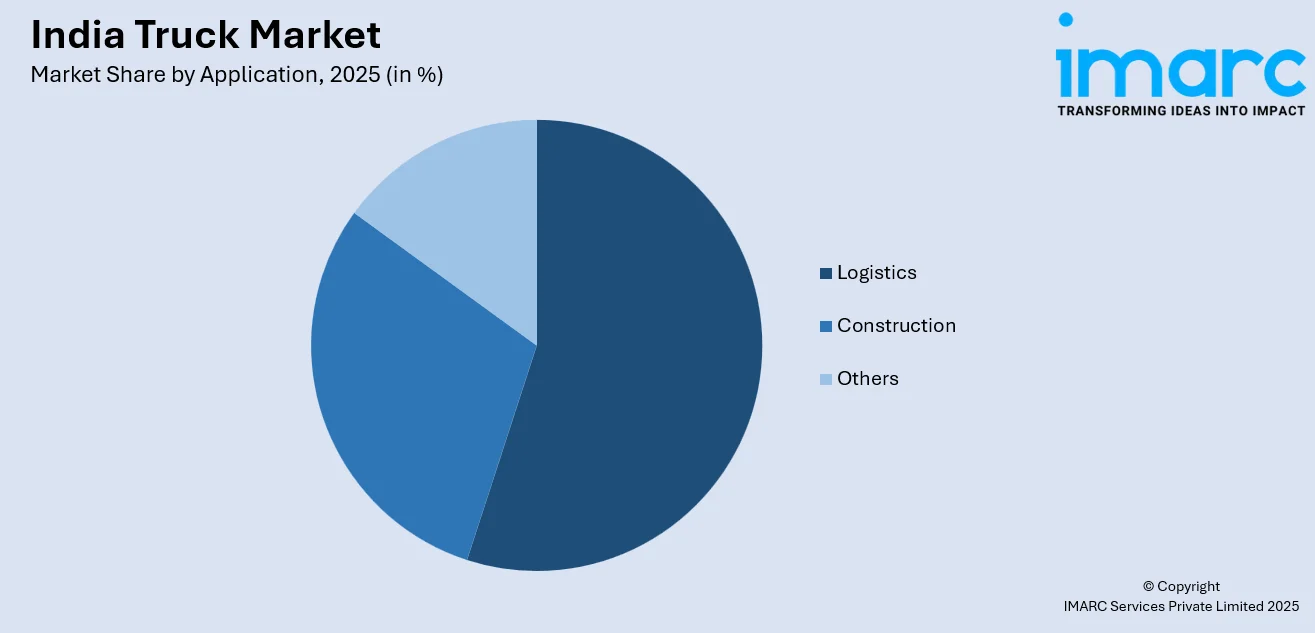

- By Application: Logistics leads the market with a share of 50% in 2025, reflecting e-commerce proliferation, organized retail expansion, and just-in-time inventory management adoption.

- By Region: North India represents the largest segment with a market share of 29% in 2025, supported by agricultural produce transportation from Punjab and Haryana, industrial corridors in Uttar Pradesh, and robust manufacturing activity.

- Key Players: The India truck market exhibits concentrated competition, with domestic manufacturers leveraging extensive dealer networks, localized manufacturing capabilities, and comprehensive after-sales service infrastructure across urban and rural markets.

To get more information on this market Request Sample

The industry demonstrates strong resilience amid economic fluctuations, benefiting from infrastructure-linked government spending, replacement demand from aging fleets, and modal shift from rail to road for time-sensitive cargo. In 2024, Ashok Leyland commenced supply of 180 electric trucks valued at approximately Rs 150 crore to Group BillionE for operations on Chennai-Bengaluru and Chennai-Vijayawada routes, featuring advanced driver assistance systems and dual-port charging capabilities. This development signals accelerating electrification momentum within commercial vehicle segments. Manufacturing hubs in Maharashtra and Gujarat anchor western production capacity, while automotive clusters in Tamil Nadu and Karnataka support southern market dynamics. Technology integration through IoT-enabled telematics, predictive maintenance algorithms, and digital freight matching platforms transforms traditional fleet operations, enhancing fuel efficiency by ten to fifteen percent and reducing vehicle downtime through proactive component replacement scheduling.

India Truck Market Trends:

Accelerating Zero-Emission Vehicle Transition

The market for electric trucks is seeing unprecedented market entry pace for commercial vehicles, thanks to purchase incentives for governments, and constraints on battery costs for organizations as a pressing requirement for a sustainable future. Also, companies are launching different variants of trucks for purchase, like three-ton city delivery trucks and heavy forty-nine-ton trucks with a tractor head for heavy trucks and transportation services. The zero-emission norm for metro cities like Delhi-NCR and Mumbai Metropolitan Region is compelling last-mile logistics companies and organizations with captive consumption patterns for cement industries and transporting heavy minerals and goods through last-mile truck deliveries using zero emission-generated trucks for transporting goods and materials at factories and other captive consumption-based companies and organizations.

Advanced Telematics and Connected Vehicle Integration

The management of the fleets is being transformed through the use of the latest IoT sensors, artificial intelligence, and cloud-based analysis platforms for efficient real-time analysis. The cloud-based solutions for the management of the fleets are also being adopted, providing a payment structure according to usage, especially when considering the fragmented structure of the truck ownership business. The telematics solutions boast the capabilities of integrated fuel management analysis, predictive maintenance, route optimization, and automated preparation of the required documents for easy flow through the system, allowing for the benefit of cost savings through efficient functioning. Additionally, the video telematics solutions, equipped with two-way cameras, offer improved road safety through instant analysis for the driver, focusing on braking, departure, and distracted driving, besides providing unbiased evidence for insurance claims. Further, the availability of energy-efficient advanced trucks is promoting the growth of the market. In 2025, Blue Energy Motors, the leading green truck manufacturer in India, introduced its new electric heavy-duty truck, equipped with a battery replacement facility. The Hon’ble Chief Minister of the state of Maharashtra, Shri Devendra Fadnavis, dedicated the truck launch to Blue Energy Motors, a cutting-edge facility in Chakan, Pune, having a capacity of 10,000 units.

Infrastructure Expansion Driving Freight Corridor Development

Comprehensive highway network expansion reshapes intercity logistics dynamics, reducing transit times and enabling higher truck utilization rates across economic corridors. In FY24, the National Highways Authority of India invested Rs 2,07,000 crore in national highway construction, marking a 21% increase from the previous fiscal year. Bharatmala program completion of 19,201 km of economic corridors by 2025 enhances connectivity between production clusters and consumption centers, while new axle-load regulations permit higher gross vehicle weights, improving payload economics for fleet operators. Multi-lane expressway development between Delhi-Mumbai, Chennai-Bengaluru, and Kolkata-Lucknow corridors enables overnight intercity freight movement, displacing traditional two-day transit patterns. Dedicated freight corridors alongside railway networks reduce road congestion on high-density routes, while greenfield expressway projects incorporate modern truck terminals with standardized amenities.

Market Outlook 2026-2034:

The India truck market is poised for robust expansion through 2033, propelled by government infrastructure spending, organized logistics sector growth, and technology-driven operational efficiency improvements. The market generated a revenue of USD 25,645 Million in 2025 and is projected to reach a revenue of USD 47,792.07 Million by 2034, growing at a compound annual growth rate of 7.16% from 2026-2034. Heavy-duty truck segments will benefit from cement production expansion, steel manufacturing growth, and coal transportation requirements, while light and medium commercial vehicles capture urban logistics proliferation and last-mile delivery intensification. Alternative fuel adoption will accelerate, with compressed natural gas, liquefied natural gas, and battery-electric variants collectively expanding from fifteen percent current penetration to thirty percent by 2030.

India Truck Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Vehicle Type |

Heavy Duty Truck |

41% |

|

Tonnage Capacity |

7.5 – 16 Tons |

30% |

|

Fuel Type |

Diesel |

78% |

|

Application |

Logistics |

50% |

|

Region |

North India |

29% |

Vehicle Type Insights:

- Heavy Duty Truck

- Medium Duty Truck

- Light Duty Truck

Heavy duty truck dominates with a market share of 41% of the total India truck market in 2025.

Heavy duty trucks constitute the cornerstone of India's long-haul freight transportation, addressing the critical requirement for moving substantial cargo volumes across extended distances. These vehicles excel in inter-state transportation, connecting manufacturing hubs with distribution centers and ports. Their robust construction and powerful drivetrains enable consistent performance across India's diverse road conditions, from well-maintained national highways to challenging rural routes. The segment benefits from the country's expanding industrial base, which generates continuous demand for transporting raw materials, finished goods, and bulk commodities.

The dominance of heavy duty trucks reflects their economic efficiency in reducing per-ton transportation costs for high-volume freight operations. Fleet operators in sectors such as steel, cement, petroleum products, and consumer goods rely extensively on these vehicles for their superior payload capacity. The segment also responds to evolving regulatory frameworks through technological upgrades, incorporating advanced braking systems, improved fuel efficiency mechanisms, and compliance with emission standards. As India's freight density continues to increase along major industrial corridors, heavy duty trucks remain indispensable for maintaining supply chain continuity and supporting economic growth across manufacturing and logistics sectors.

Tonnage Capacity Insights:

- 3.5 – 7.5 Tons

- 7.5 – 16 Tons

- 16 – 30 Tons

- Above 30 Tons

7.5 – 16 Tons lead with a share of 30% of the total India truck market in 2025.

Trucks within the seven-and-a-half to sixteen-ton capacity range represent the optimal balance between payload capability and operational flexibility, making them exceptionally versatile across diverse transportation requirements. This tonnage category serves as the workhorse for regional distribution networks, connecting tier-two and tier-three cities with metropolitan consumption centers. Their maneuverability advantage over heavier vehicles enables efficient operations in semi-urban environments where road infrastructure may present constraints, while still offering sufficient capacity for economically viable freight movement.

The segment's leadership position stems from its ability to address the needs of rapidly expanding sectors including organized retail, pharmaceuticals, fast-moving consumer goods, and industrial components distribution. These trucks facilitate hub-and-spoke logistics models, enabling efficient last-mile connectivity from distribution warehouses to retail outlets and manufacturing facilities. The tonnage range proves particularly effective for time-sensitive deliveries where route flexibility and access to restricted urban zones provide competitive advantages. As India's consumption patterns drive increased freight movement to emerging urban clusters and the e-commerce sector demands responsive distribution capabilities, this tonnage category continues to experience sustained adoption across organized and traditional logistics operations.

Fuel Type Insights:

- Diesel

- Petrol

- CNG & LNG

Diesel exhibits a clear dominance with a 78% share of the total India truck market in 2025.

Diesel propulsion maintains its overwhelming dominance in India's truck market due to fundamental advantages in torque delivery, fuel efficiency, and operational economics that align perfectly with commercial freight requirements. The technology's superior performance characteristics enable trucks to handle heavy loads across varied terrain while maintaining consistent power output. Diesel engines demonstrate exceptional durability and longevity, critical factors for commercial operators seeking to maximize vehicle lifespan and minimize downtime. The widespread availability of diesel fuel across India's extensive network of refueling stations eliminates range anxiety, enabling uninterrupted operations across remote and rural routes where alternative fuel infrastructure remains underdeveloped.

The segment's market position is reinforced by decades of technological refinement that have progressively improved combustion efficiency, reduced particulate emissions, and enhanced engine reliability. Modern diesel trucks incorporate advanced fuel injection systems, turbocharging technologies, and after-treatment solutions that address environmental concerns while preserving the performance characteristics essential for freight transportation. The cost-per-kilometer advantage of diesel remains compelling for fleet operators managing thin profit margins in competitive logistics markets. Despite gradual policy emphasis on alternative fuels, diesel technology continues to evolve through cleaner combustion strategies and compliance with increasingly stringent emission norms, ensuring its continued relevance in India's commercial vehicle landscape for the foreseeable future.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Construction

- Logistics

- Others

Logistics leads with a share of 50% of the total India truck market in 2025.

Logistics applications represent the primary driver of truck demand in India, reflecting the critical role of organized freight movement in supporting the nation's economic activities. This segment encompasses diverse transportation requirements including retail distribution, industrial supply chains, third-party logistics services, and e-commerce fulfillment operations. The formalization of India's logistics sector, accelerated by policy initiatives and technological adoption, has created sustained demand for reliable commercial vehicles capable of meeting stringent delivery timelines and service quality standards. Fleet operators serving logistics applications prioritize factors including payload efficiency, fuel economy, maintenance predictability, and compatibility with digital tracking systems.

The dominance of logistics applications is amplified by India's evolving consumption patterns, which generate increasing freight volumes moving through organized distribution channels. The expansion of organized retail formats, proliferation of e-commerce platforms, and growth of cold chain requirements for perishable goods have collectively transformed freight transportation into a sophisticated, technology-enabled industry. Logistics service providers increasingly demand vehicles that integrate seamlessly with warehouse management systems, enable real-time shipment visibility, and support data-driven operational optimization. As India's freight intensity continues to increase alongside economic growth, and as supply chain sophistication advances through infrastructure improvements and regulatory reforms, the logistics segment sustains its position as the predominant application driving truck market expansion.

Region Insights:

- North India

- West and Central India

- South India

- East India

North India exhibits a clear dominance with a 29% share of the total India truck market in 2025.

North India's leadership in truck market demand reflects its concentration of manufacturing industries, agricultural production zones, and strategic positioning as a transit corridor for national and international trade. The region encompasses major industrial clusters including the National Capital Region, Punjab's agricultural belt, and Uttar Pradesh's manufacturing zones, all of which generate substantial freight transportation requirements. North India's extensive highway network, including critical national corridors connecting to ports and border crossings, positions it as the primary gateway for goods movement between India's hinterland and external markets. The region's economic diversity spanning agriculture, manufacturing, and services creates multifaceted demand across different truck categories and tonnage specifications.

The region's market dominance is further reinforced by government infrastructure investments that enhance road connectivity and reduce logistics costs. Projects improving highway quality, developing industrial corridors, and establishing inland container depots create favorable operating environments for commercial vehicle fleets. North India's demographic characteristics, including significant urban centers with high consumption intensity and proximity to agricultural production areas, sustain year-round freight activity across diverse commodity categories. The region also serves as a hub for vehicle manufacturing and distribution, creating localized advantages in after-sales support and spare parts availability. As infrastructure development continues and industrial activity expands across the region's cities and towns, North India maintains its position as the largest contributor to India's truck market growth trajectory.

Market Dynamics:

Growth Drivers:

Why is the India Truck Market Growing?

E-commerce Proliferation and Last-Mile Logistics Intensification

Explosive growth in digital retail platforms fundamentally transforms urban goods distribution, necessitating extensive light and medium commercial vehicle fleets capable of executing time-definite deliveries across metropolitan catchment areas. Consumer expectations for same-day and next-day delivery compress logistics cycle times, compelling retailers to establish distributed warehouse networks positioned within proximity of demand clusters and deploy dedicated delivery vehicles for final-mile fulfillment. Quick-commerce platforms operating on thirty-minute delivery promises require hyperlocal inventory positioning and compact electric vehicles navigating congested urban neighborhoods, while return logistics for e-commerce purchases generate reverse supply chain movements adding incremental transportation demand. IMARC Group predicts that the India e-commerce market is projected to attain USD 651.10 Billion by 2034.

Government Infrastructure Investment Programs

Comprehensive public sector capital allocation toward transportation infrastructure modernization generates sustained demand for construction material movement, heavy equipment transportation, and project logistics across highway development, urban metro construction, and industrial corridor establishment initiatives. Bharatmala program implementation targeting economic corridor development, inter-corridor connectivity, and border area road networks creates multi-year construction timelines requiring continuous tipper truck deployment for earthmoving, aggregate transportation, and bitumen haulage activities. Smart Cities Mission investments in urban infrastructure including water supply networks, sewerage systems, and public transportation facilities necessitate specialized heavy commercial vehicles for equipment movement and material delivery within congested urban environments. In 2024, The Government of India has sanctioned 12 new smart city industrial projects on 28th August 2024 with an overall project expenditure of Rs. 28,602 crore (including land expenses) for the establishment of trunk infrastructure packages. According to the sanctioned institutional and financial structure of the Industrial Corridor Programme, the State Government allocates land, while the Government of India, via the National Industrial Corridor Development and Implementation Trust (NICDIT), contributes equity for the development of essential internal infrastructure elements.

Stringent Emission Regulations Driving Fleet Modernization

Implementation of progressively stringent emission standards compels commercial vehicle operators to retire older non-compliant vehicles and invest in modern platforms incorporating advanced after-treatment technologies, fuel-efficient powertrains, and electronic engine management systems. Bharat Stage VI norms mandate significant reductions in particulate matter and nitrogen oxide emissions compared to predecessor standards, necessitating selective catalytic reduction, diesel particulate filters, and sophisticated onboard diagnostics that cannot be retrofitted to legacy vehicles economically. The Union government has announced the second phase of mandatory greenhouse gas emission reduction goals for several of India’s highest carbon-emitting sectors, expanding the reach of the nation’s internal carbon market. On 13 January, the Ministry of Environment, Forest and Climate Change (MoEFCC) officially announced the revised Greenhouse Gases Emission Intensity (GEI) Target Rules, releasing them to the public three days after and completing a draft first presented in June 2025.

Market Restraints:

What Challenges the India Truck Market is Facing?

High Capital Investment and Financing Accessibility

Substantial upfront capital requirements for commercial vehicle acquisitions create financial barriers particularly acute for small fleet operators and owner-drivers who collectively represent approximately eighty percent of market participants yet lack access to institutional financing at competitive interest rates. Electric truck variants command two to three times the purchase price of comparable diesel platforms, positioning battery-electric technology beyond financial reach for fragmented operators managing thin operating margins and limited collateral for secured lending. Non-bank financial companies demand higher interest rates and shorter repayment tenures from small commercial vehicle borrowers perceived as higher credit risks, increasing monthly payment obligations that strain cash flow amid volatile freight rates and seasonal demand fluctuations. Working capital constraints limit operators' ability to maintain adequate vehicle inventories during demand surges, while deferred maintenance practices to preserve liquidity increase breakdown risks and reduce vehicle availability.

Inadequate Charging Infrastructure for Electric Transition

Limited public charging networks particularly along highway corridors and within tier-two cities significantly constrains battery-electric truck adoption beyond controlled urban deployment scenarios where dedicated depot charging infrastructure can support predictable operational patterns. Long charging durations ranging from one to three hours depending on battery capacity and charger power rating reduce effective vehicle utilization compared to diesel refueling completed within fifteen minutes, necessitating oversized fleets to maintain equivalent service capacity. Inconsistent electrical grid reliability and frequent power outages in certain regions create operational risks for fleet operators dependent on scheduled charging cycles to maintain delivery commitments, while high electricity tariffs during peak demand periods erode total cost of ownership advantages that theoretically favor electric powertrains. Land availability and grid connection costs for establishing truck-specific fast-charging stations at strategic highway locations present infrastructure investment barriers that delay network buildout absent coordinated public-private development initiatives.

Skilled Driver Shortage and Retention Challenges

Persistent scarcity of qualified commercial vehicle drivers possessing appropriate licenses, technical competencies for operating modern electronically controlled vehicles, and willingness to accept extended periods away from home constrains fleet expansion capabilities despite robust freight demand growth. Aging driver demographics with limited younger workforce entry exacerbates supply-demand imbalances, while alternative employment opportunities in urban areas offering superior compensation and working conditions reduce attractiveness of commercial driving careers. Operator reluctance to invest in driver training programs due to high attrition rates creates self-perpetuating skills gaps, particularly for specialized equipment including refrigerated transporters, tankers, and heavy-duty tippers requiring additional certifications. Inadequate highway amenities including clean rest facilities, safe parking areas, and basic services during overnight hauls contribute to driver dissatisfaction and elevated turnover rates, while irregular payment practices from certain brokers and fleet operators reduce profession attractiveness for potential entrants.

Competitive Landscape:

The India truck market demonstrates moderate concentration with established domestic manufacturers maintaining dominant positions through extensive dealer networks, comprehensive after-sales service infrastructure, and deep localization enabling competitive pricing strategies suited to price-sensitive customer segments. Market leadership remains concentrated among three primary players collectively controlling significant market share, while challenger brands target specific tonnage categories or regional markets through differentiated product offerings and aggressive financing schemes. Strategic consolidation accelerates through targeted acquisitions, exemplified by major manufacturers expanding presence in specialized segments to diversify revenue streams and capture emerging opportunities in alternative fuel vehicles and technology-integrated platforms. Intense rivalry manifests through frequent new product launches incorporating advanced features, periodic promotional campaigns offering attractive financing terms, and continuous enhancements to warranty programs and service network coverage. Indigenous players leverage manufacturing scale, supply chain integration, and government procurement relationships, while international collaborations introduce global technology platforms adapted to Indian operating conditions. Some of the key players in the market include:

- Ashok Leyland Limited

- Daimler India Commercial Vehicles Pvt. Ltd

- Hino Motors Sales India Private Limited

- Mahindra & Mahindra

- Scania Commercial Vehicles India Pvt. Ltd.

- SML ISUZU Ltd.

- Tata Motors Limited

- VE Commercial Vehicles Limited

Recent Developments:

- In January 2026, India's commercial vehicle sector is entering a pivotal stage, with Tata Motors leveraging a series of India-specific launches to indicate its strategy for influencing the upcoming trend in trucks, safety, and electrification. The focal point of the initiative is the launch of a Cummins 8.5-litre engine in India, positioning the nation as just the second worldwide to adopt this powertrain. The engine will first appear in a 35-tonne deep-mining tipper, representing Tata Motors’ boldest step to date into high-capacity, high-function haulage.

- Adani Enterprises deployed the nation’s initial hydrogen fuel cell truck for cleaner transportation in mining logistics at the Chhattisgarh government’s coal block. Every truck, fitted with intelligent technology and three hydrogen tanks, is capable of transporting up to 40 tons of freight over a distance of 200 kilometers.

- In April 2025, Daimler India has declared its entry into the electric commercial vehicle market with the launch of the all-electric eCanter truck. The electric truck is set to debut in India within the next six to twelve months.

India Truck Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Vehicle Types Covered | Heavy Duty Truck, Medium Duty Truck, Light Duty Truck |

| Tonnage Capacities Covered | 3.5 – 7.5 Tons, 7.5 – 16 Tons, 16 – 30 Tons, Above 30 Tons |

| Fuel Types Covered | Diesel, Petrol, CNG & LNG |

| Applications Covered | Construction, Logistics, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Companies Covered | Ashok Leyland Limited, Daimler India Commercial Vehicles Pvt. Ltd, Hino Motors Sales India Private Limited, Mahindra & Mahindra, Scania Commercial Vehicles India Pvt. Ltd., SML ISUZU Ltd., Tata Motors Limited, VE Commercial Vehicles Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India truck market size was valued at USD 25,645 Million in 2025.

The India truck market is expected to grow at a compound annual growth rate of 7.16% from 2026-2034 to reach USD 47,792.07 Million by 2034.

Heavy duty truck dominated the market with 41% share in 2025, driven by infrastructure construction, mining operations, and long-haul freight transportation across national highway networks.

Key factors driving the India truck market include accelerating e-commerce proliferation necessitating extensive last-mile delivery networks, comprehensive government infrastructure investment programs under National Infrastructure Pipeline and Bharatmala initiatives generating sustained construction material transportation demand, stringent Bharat Stage VI emission regulations compelling fleet modernization toward compliant vehicles, industrial manufacturing expansion across automotive and FMCG sectors requiring reliable freight capacity, and advanced telematics integration enabling operational efficiency improvements through predictive maintenance and route optimization capabilities.

Major challenges include high upfront vehicle costs particularly for electric variants constraining adoption among fragmented small fleet operators, limited charging infrastructure in non-metro areas and along highway corridors restricting battery-electric deployment beyond urban applications, persistent skilled driver shortage amid aging workforce demographics and inadequate highway amenities, volatile diesel pricing impacting operating economics for conventional powertrains, fragmented ownership structure limiting access to institutional financing at competitive rates, inconsistent freight rate volatility affecting payback period calculations for capital investments, and working capital constraints reducing maintenance budgets thereby increasing breakdown-related downtime risks.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)