Indonesia Advertising Market Size, Share, Trends and Forecast by Type and Region, 2025-2033

Indonesia Advertising Market Overview:

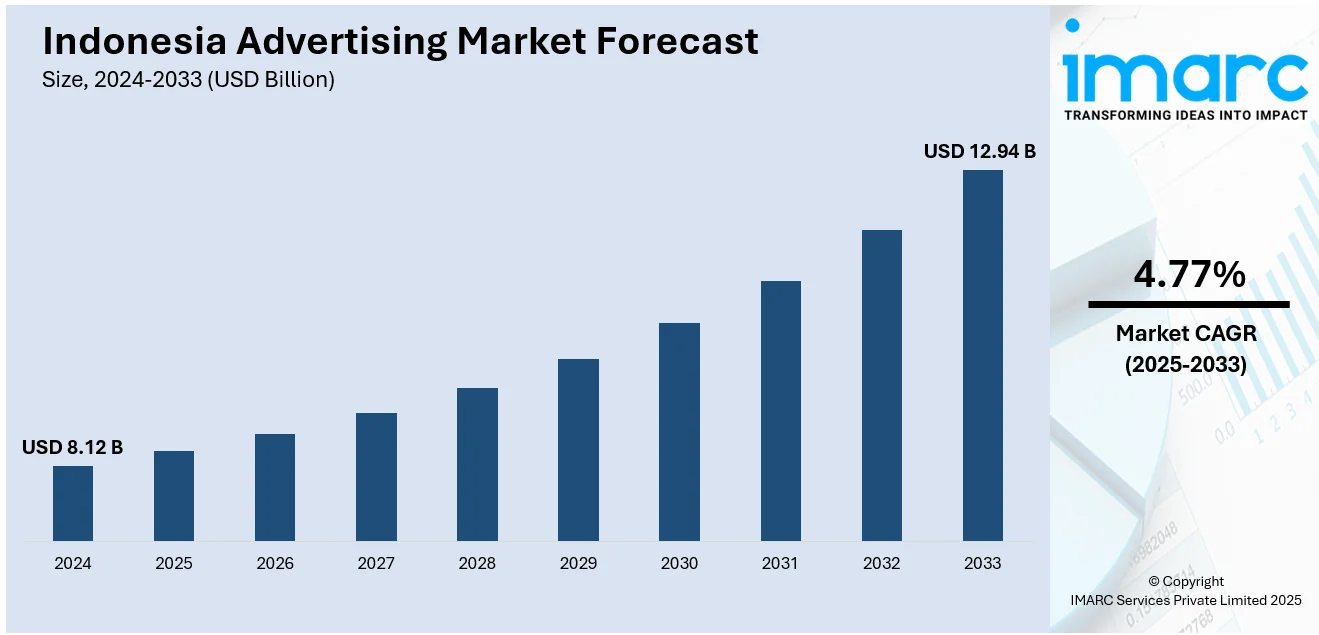

The Indonesia advertising market size reached USD 8.12 Billion in 2024. The market is projected to reach USD 12.94 Billion by 2033, exhibiting a growth rate (CAGR) of 4.77% during 2025-2033. The market is transforming at a fast pace, driven by digital growth and shifting consumer trends. Digital media today drives advertising campaigns, with programmatic and AI-based approaches optimizing targeting and personalization. Video marketing and influencer marketing are growing increasingly in use, assisting brands in reaching customers efficiently. Sustainability and data privacy are turning into top priorities. These events all lend overall support to the increase and dynamism of the Indonesia advertising market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8.12 Billion |

| Market Forecast in 2033 | USD 12.94 Billion |

| Market Growth Rate 2025-2033 | 4.77% |

Indonesia Advertising Market Trends:

Indonesia’s Reputation as a Safe Advertising Market

In May 2025, Indonesia gained recognition the reputation as being among the safest of digital advertiser markets in the world during a worldwide surge in ad fraud. Mobile web campaigns registered only 0.1% fraud; a very low rate compared to the rest of the world's markets. The low rate of fraud is indicative of Indonesia's well-established digital infrastructure and stringent advertising standards, giving marketers even more faith in their investments. Advertisers find value in higher-quality traffic and more consistent audience interaction, which makes the country among Indonesia's digital campaign-friendly destinations. In addition, good viewability rates, particularly on mobile devices, help increase the overall ad effectiveness of placements in the market. These elements together provide a trustworthy setting that reduces wasted advertising spend and enhances return on investment. The nation's high emphasis on quality and transparency is compelling more brands to seek out and deepen their presence in the country. These trends significantly contribute to the Indonesia advertising market growth, highlighting the market's changing image as a safe and effective environment for digital advertising.

To get more information on this market, Request Sample

Digital Advertising's Growing Share

In December 2024, reports estimated that online advertising would account for Indonesia's overall advertising expenditure by the year 2025. This transition stems from the rapid digital adoption of the nation in response to rising internet use and mobile phone usage. Consumers spend more time online on social media, video streaming, and e-commerce platforms, leading to advertisers allocating their budgets accordingly. Digital media provides focused targeting and measurable results, making it easy for brands to fine-tune campaigns effectively. While established media like television and print are still important, their percentage is slowly eroding as digital becomes dominant. The emergence of new formats like programmatic advertising and retail media underscores this transformation by enabling advertisers to target audiences more personally and in a timely manner. These shifts emphasize changing consumers' behaviors and the necessity for marketers to embrace new methods. Overall, this trend contributes to shaping current Indonesia advertising market trends, pointing towards continued growth and change in the industry.

Growing Role of AI in Advertising

In January of 2025, a nationwide survey spotlighted the way in which digitalization would transform fundamental operations throughout Indonesia with a special emphasis on AI and automation. This transformation is increasingly being seen in the nation's ad space. Marketers are embracing AI solutions to enhance the way they track audience behavior, divide markets, and personalize their campaigns in real time. Automation is simplifying processes such as ad placement, budgeting, and reporting, enabling marketing teams to react more speedily and effectively. AI is also making it possible to produce more dynamic, responsive content that adjusts according to the user's behavior. Chatbots and virtual assistants are increasingly being used in customer experience, boosting engagement while gathering useful behavior data. These solutions enable better decisions and increased efficiency for campaign lifecycles. As more Indonesian advertisers turn to AI to enhance targeting and creative content, the sector continues shifting towards smarter, data-driven strategies. This trend is a significant catalyst for expansion, reflecting the industry's dedication to innovation and technology adoption.

Indonesia Advertising Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type.

Type Insights:

- Television Advertising

- Print Advertising

- Newspaper Advertising

- Magazine Advertising

- Radio Advertising

- Outdoor Advertising

- Internet Advertising

- Search Advertising

- Display Advertising

- Classified Advertising

- Video Advertising

- Mobile Advertising

- Cinema Advertising

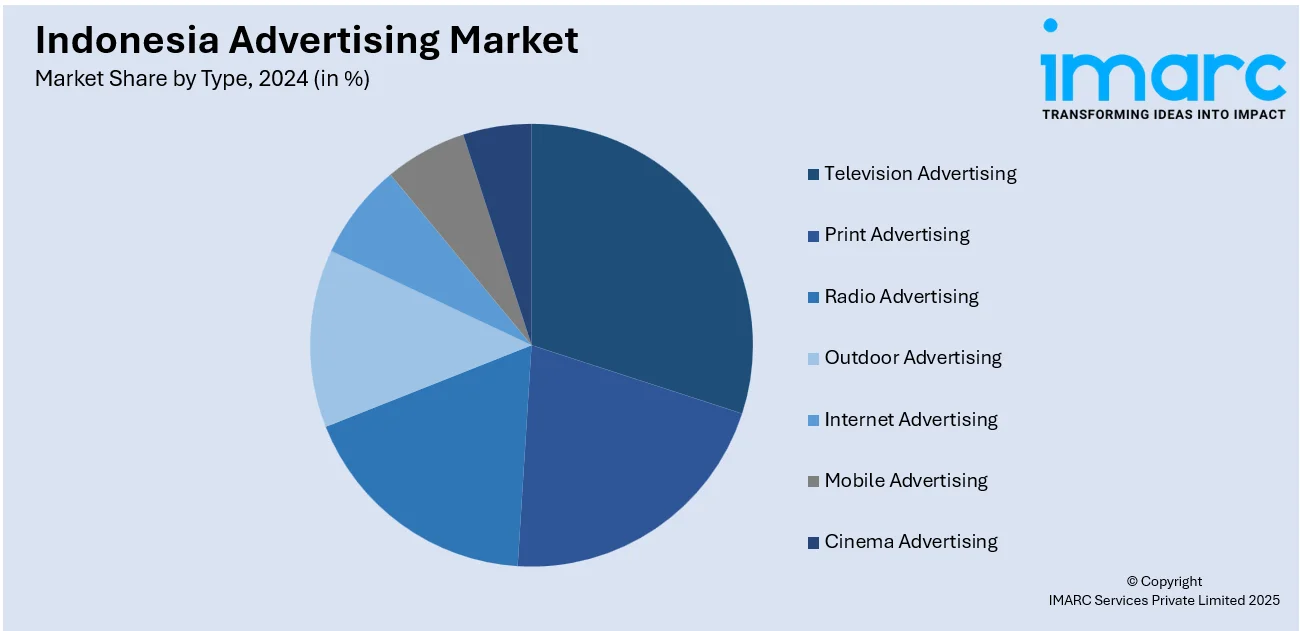

The report has provided a detailed breakup and analysis of the market based on the type. This includes television advertising, print advertising (newspaper advertising and magazine advertising), radio advertising, outdoor advertising, internet advertising (search advertising, display advertising, classified advertising, and video advertising), mobile advertising, and cinema advertising.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Advertising Market News:

- May 2025, Sri Widowati is appointed as the GroupM Indonesia CEO. She was previously the Vice President of Marketing at Danone Indonesia and handled brand strategy and innovation. As an experienced leader who has worked with large corporations such as Unilever, Meta, and L'Oréal, Sri is known for her strategic thinking and people management. She will be likely to increase GroupM Indonesia's standing and initiate growth in the advertising business of the developing nation.

- March 2024, EYE Indonesia is transforming the out-of-home advertising marketplace with a mix of digital technology and savvy media planning. Supported by one of the world's foremost media groups, the company combines programmatic capabilities and dynamic content delivery with its digital screens. Its LED videotron network delivers compelling, real-time brand experiences in densely trafficked public spaces. With a concentration on creative execution and campaign insight, EYE Indonesia assists media buyers with delivering effective campaigns. The firm keeps driving expansion and innovation in Indonesia's outdoor ad business.

Indonesia Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia advertising market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia advertising market on the basis of type?

- What is the breakup of the Indonesia advertising market on the basis of region?

- What are the various stages in the value chain of the Indonesia advertising market?

- What are the key driving factors and challenges in the Indonesia advertising market?

- What is the structure of the Indonesia advertising market and who are the key players?

- What is the degree of competition in the Indonesia advertising market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia advertising market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia advertising market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia advertising industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)