Indonesia Agribusiness Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

Indonesia Agribusiness Market Overview:

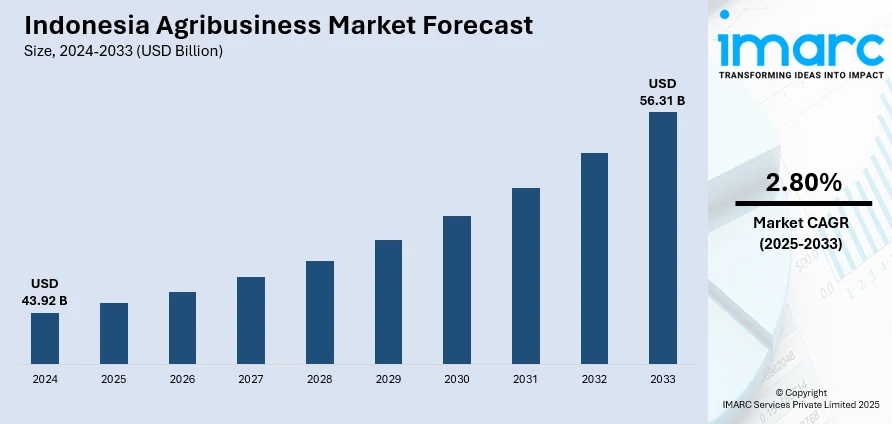

The Indonesia agribusiness market size reached USD 43.92 Billion in 2024. The market is projected to reach USD 56.31 Billion by 2033, exhibiting a growth rate (CAGR) of 2.80% during 2025-2033. With continuous improvements in farming practices, irrigation, and post-harvest management, Indonesia is leveraging its agricultural wealth to meet rising domestic food demand. Besides this, the development of better cold storage facilities and temperature-controlled warehouses, which aid in maintaining the quality and nutritional value of food items, is contributing to the expansion of the Indonesia agribusiness market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 43.92 Billion |

| Market Forecast in 2033 | USD 56.31 Billion |

| Market Growth Rate 2025-2033 | 2.80% |

Indonesia Agribusiness Market Trends:

Large and diverse agricultural resource base

Indonesia’s large and diverse agricultural resource base is providing a strong foundation for both domestic consumption and export-oriented production. The country benefits from fertile soil, a tropical climate, and vast arable land, allowing the cultivation of a wide variety of crops, such as rice, corn, palm oil, cocoa, coffee, rubber, and spices, alongside extensive livestock and fisheries resources. Statistics Indonesia BPS reported that Indonesia's rice output was expected to hit 13.95 Million Tons from January to April 2025. This diversity supports multiple agribusiness segments, ranging from staple food production to high-value cash crops and aquaculture, reducing reliance on imports and enhancing food security. The abundance of raw materials is fueling downstream industries like food processing, biofuels, and natural rubber manufacturing, creating significant value addition and employment. Indonesia’s geographic spread across thousands of islands also enables region-specific agricultural specializations, strengthening supply resilience. Moreover, the availability of large-scale commodities, such as palm oil and seafood, is boosting the country’s export earnings, attracting foreign investments in processing infrastructure. This resource base also supports smallholder farmers and cooperatives, integrating them into value chains and expanding rural incomes. With continuous improvements in farming practices, irrigation, and post-harvest management, Indonesia is set to further leverage its agricultural wealth to meet rising domestic demand and capture global market opportunities, ensuring steady growth of its agribusiness sector.

To get more information on this market, Request Sample

Increasing development of cold chain infrastructure

Rising development of cold chain infrastructure is propelling the Indonesia agribusiness market growth. With better cold storage facilities, refrigerated transport, and temperature-controlled warehouses, products like fresh fruits, vegetables, dairy, seafood, and meat can maintain their quality and nutritional value over longer periods. This reduces post-harvest losses and increases the availability of fresh items in domestic and export markets. Enhanced cold chain systems also enable agribusinesses to expand into higher-value segments, such as premium seafood, exotic fruits, and processed dairy, which require strict temperature management. For exports, cold chain infrastructure ensures compliance with international quality and safety standards, boosting Indonesia’s competitiveness in global markets. In addition, it is supporting the growth of modern retail, e-commerce services, and processed food industries, which rely on consistent product freshness. As per the IMARC Group, the Indonesia e-commerce market size was valued at USD 354.6 Billion in 2024. By improving efficiency and reducing wastage, the broadening of cold chain infrastructure is not only increasing profitability for producers and exporters but also strengthening Indonesia’s position as a reliable supplier in both regional and global agribusiness value chains.

Indonesia Agribusiness Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- Grains

- Wheat

- Rice

- Coarse Grains – Ragi

- Sorghum

- Millets

- Oilseeds

- Rapeseed

- Sunflower

- Soybean

- Sesamum

- Others

- Dairy

- Liquid Milk

- Milk Powder

- Ghee

- Butter

- Ice-cream

- Cheese

- Others

- Livestock

- Pork

- Poultry

- Beef

- Sheep Meat

- Others

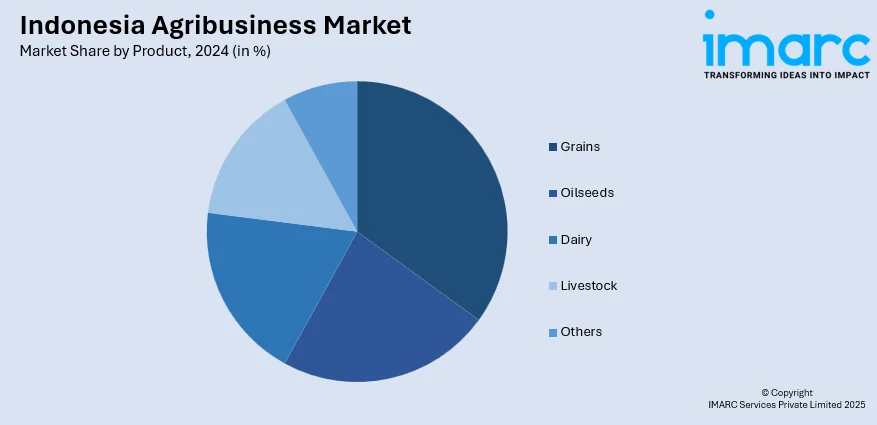

The report has provided a detailed breakup and analysis of the market based on the product. This includes grains (wheat, rice, coarse grains – ragi, sorghum, and millets), oilseeds (rapeseed, sunflower, soybean, sesamum, and others), dairy (liquid milk, milk powder, ghee, butter, ice-cream, cheese, and others), livestock (pork, poultry, beef, and sheep meat), and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Agribusiness Market News:

- In August 2025, the Minister of Agriculture, Trade and Investment of New Zealand, Todd McClay and Indonesian Minister of Agriculture Andi Amran Sulaiman signed a fresh bilateral agreement to enhance agricultural collaboration, reinforce trade connections, and generate new business prospects for farmers and agribusinesses in both nations. It would assist New Zealand firms in connecting directly with Indonesian partners and promote mutual investment in agriculture.

- In February 2025, Terra Drone Corporation revealed its selection for the ‘Project of Supporting Smart Agriculture Verification in Southeast Asia (Indonesia)’ by Japan's Ministry of Agriculture, Forestry and Fisheries (MAFF). The firm planned to establish a network with regional companies of Indonesia to promote business growth. Supported by the MAFF and local authorities in Indonesia, the company sought to carry out demonstrations utilizing Terra Agri’s drone technology for applying pesticides and fertilizers on palm oil plantations.

Indonesia Agribusiness Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia agribusiness market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia agribusiness market on the basis of product?

- What is the breakup of the Indonesia agribusiness market on the basis of region?

- What are the various stages in the value chain of the Indonesia agribusiness market?

- What are the key driving factors and challenges in the Indonesia agribusiness market?

- What is the structure of the Indonesia agribusiness market and who are the key players?

- What is the degree of competition in the Indonesia agribusiness market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia agribusiness market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia agribusiness market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia agribusiness industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)