Indonesia Aquaculture Market Size, Share, Trends and Forecast by Fish Type, Environment, Distribution Channel, and Region, 2025-2033

Indonesia Aquaculture Market Overview:

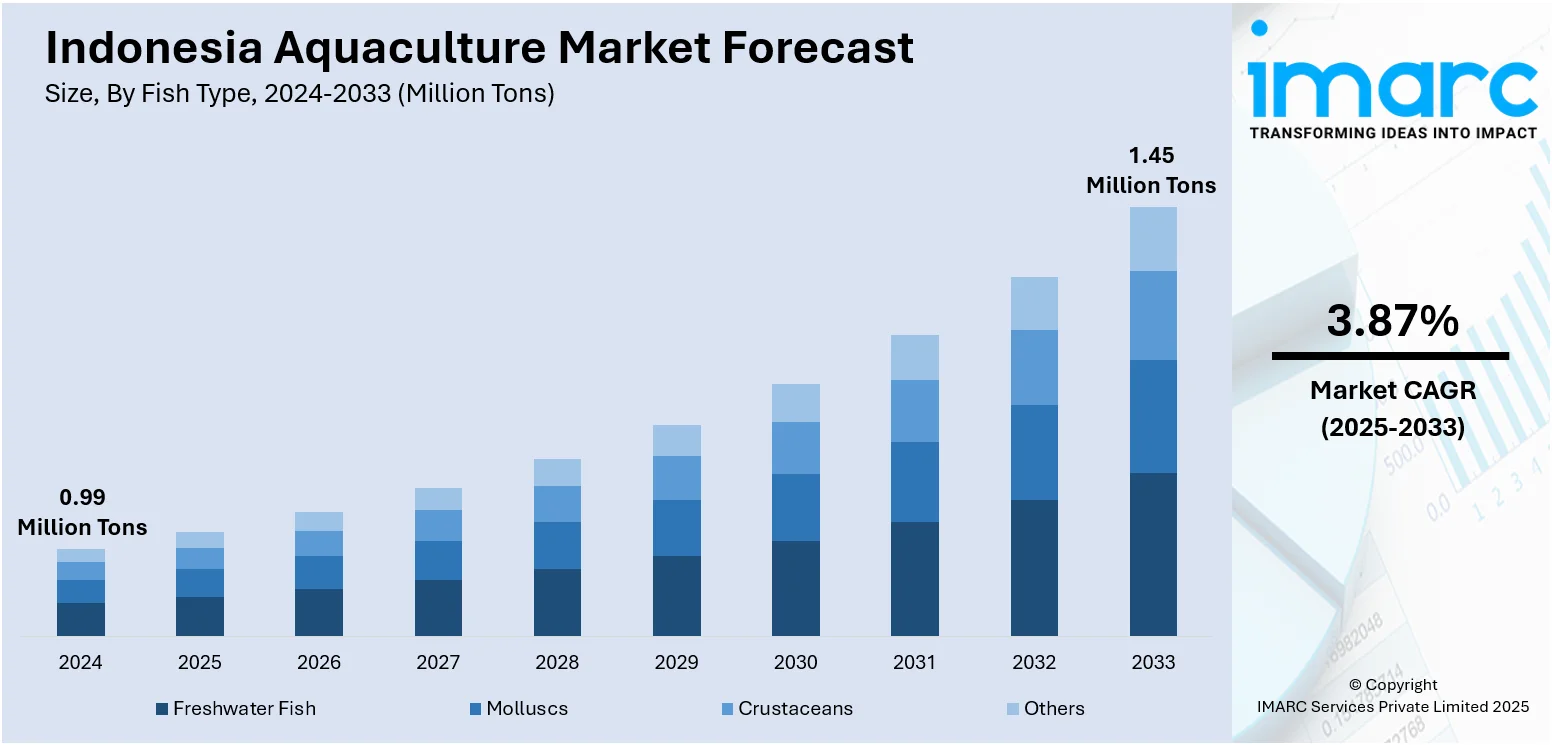

The Indonesia aquaculture market size reached 0.99 Million Tons in 2024. Looking forward, the market is projected to reach 1.45 Million Tons by 2033, exhibiting a growth rate (CAGR) of 3.87% during 2025-2033. The industry is expanding dramatically under the influence of shrimp, tilapia, and carp culture. Support from the government and technology implementation enhance production despite issues such as disease and environmental challenges. Rising domestic consumption and exports drive Indonesia aquaculture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 0.99 Million Tons |

| Market Forecast in 2033 | 1.45 Million Tons |

| Market Growth Rate 2025-2033 | 3.87% |

Indonesia Aquaculture Market Trends:

Expansion of Shrimp and Tilapia Farming

Indonesia's aquaculture industry is seeing high growth fueled by the increase in shrimp and tilapia farming. According to industry reports, Indonesia is a world leader in shrimp aquaculture, with 7.07 million metric tons of production anticipated by 2030. These species are very popular domestically and overseas because of their demand and economic value. Shrimp culture requires advantage in terms of technology, such as biofloc technology and hatchery improvements, for increased output and disease control. Tilapia culture is also increasing in freshwater and brackish water environments because of government schemes for sustainable aquaculture practices. The increasing middle class and growth in seafood consumption require more production. This expansion is a key factor contributing to Indonesia aquaculture market growth, positioning the country as one of Asia’s leading seafood producers.

To get more information on this market, Request Sample

Rising Domestic Demand and Export Expansion

Indonesia's growing population and increasing consumption of seafood are driving domestic aquaculture demand. Being a staple in the local diet, fish and seafood demand for fresh and processed forms is increasing, particularly in urban centers. Meanwhile, Indonesia is diversifying its export markets, with a major focus on shrimp, seaweed, and other high-value species. Export growth is being promoted by the government through better infrastructure, trade agreements, and the implementation of quality controls to ensure international standards. At AquaFarm 2025 in Italy, Indonesia advanced its goal of boosting global collaboration in fisheries and aquaculture. The visit supported the country’s strategy to expand exports, which hit USD 4.23 Billion by September 2024. As part of this push, Indonesia will host Indo Fisheries 2025 in Surabaya, featuring 300+ exhibitors from 30 countries. The event aims to promote innovation, sustainability, and cross-sector partnerships across fisheries, livestock, feed, and agriculture, reinforcing Indonesia’s growing international presence in the fisheries industry.

Indonesia Aquaculture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on fish type, environment, and distribution channel.

Fish Type Insights:

- Freshwater Fish

- Molluscs

- Crustaceans

- Others

The report has provided a detailed breakup and analysis of the market based on the fish type. This includes freshwater fish, molluscs, crustaceans, and others.

Environment Insights:

- Fresh Water

- Marine Water

- Brackish Water

A detailed breakup and analysis of the market based on the environment have also been provided in the report. This includes fresh water, marine water, and brackish water.

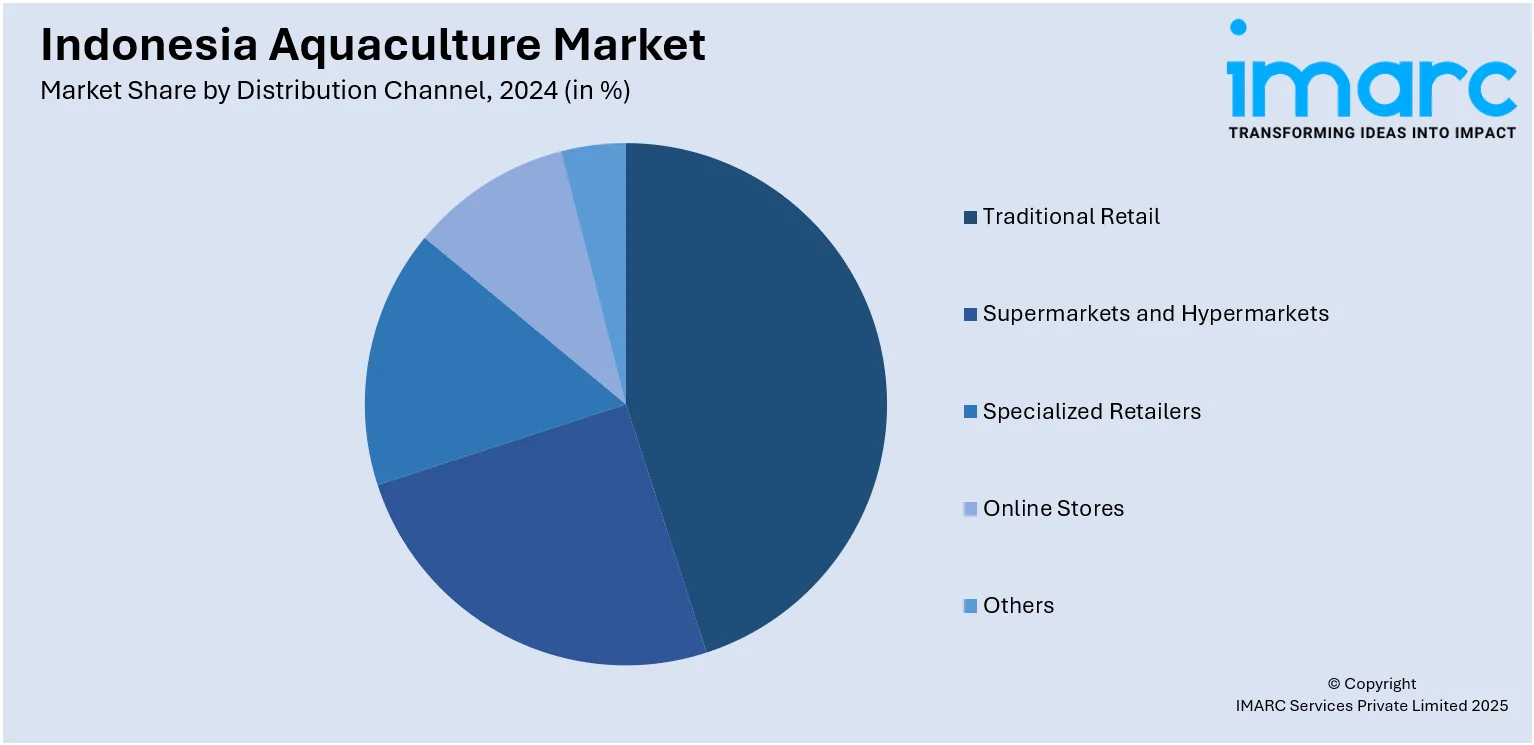

Distribution Channel Insights:

- Traditional Retail

- Supermarkets and Hypermarkets

- Specialized Retailers

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes traditional retail, supermarkets and hypermarkets, specialized retailers, online stores, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Aquaculture Market News:

- In August 2024, Regal Springs Indonesia partnered with BRIN to develop innovations for controlling Francisellosis, a serious bacterial disease affecting tilapia. The collaboration focuses on molecular detection and vaccine development, along with shared infrastructure and capacity building. This effort supports Regal Springs' goal of sustainable aquaculture, aligning with ASC and WHO standards, and aims to boost Indonesia's aquaculture productivity and global competitiveness.

Indonesia Aquaculture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Fish Types Covered | Freshwater Fish, Molluscs, Crustaceans, Others |

| Environments Covered | Fresh Water, Marine Water, Brackish Water |

| Distribution Channels Covered | Traditional Retail, Supermarkets and Hypermarkets, Specialized Retailers, Online Stores, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia aquaculture market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia aquaculture market on the basis of fish type?

- What is the breakup of the Indonesia aquaculture market on the basis of environment?

- What is the breakup of the Indonesia aquaculture market on the basis of distribution channel?

- What is the breakup of the Indonesia aquaculture market on the basis of region?

- What are the various stages in the value chain of the Indonesia aquaculture market?

- What are the key driving factors and challenges in the Indonesia aquaculture market?

- What is the structure of the Indonesia aquaculture market and who are the key players?

- What is the degree of competition in the Indonesia aquaculture market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia aquaculture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia aquaculture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia aquaculture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)