Indonesia Bancassurance Market Size, Share, Trends and Forecast by Product Type, Model Type, and Region, 2025-2033

Indonesia Bancassurance Market Overview:

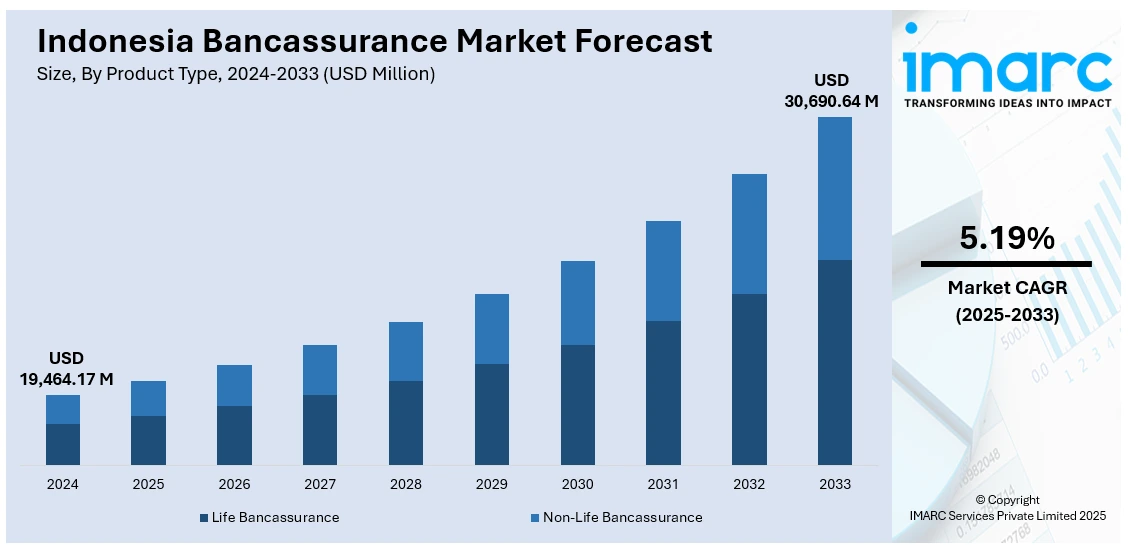

The Indonesia bancassurance market size reached USD 19,464.17 Million in 2024. Looking forward, the market is projected to reach USD 30,690.64 Million by 2033, exhibiting a growth rate (CAGR) of 5.19% during 2025-2033. The market is driven by Indonesia’s expanding middle class, national financial inclusion programs, and the widespread reach of banking networks. Rising demand for Sharia-compliant products has strengthened Islamic bancassurance offerings, supported by government-backed growth in Sharia banking. Mobile-first distribution models, including partnerships with fintechs and integration into super-apps, have broadened access and improved policy servicing, thus augmenting the Indonesia bancassurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 19,464.17 Million |

| Market Forecast in 2033 | USD 30,690.64 Million |

| Market Growth Rate 2025-2033 | 5.19% |

Indonesia Bancassurance Market Trends:

Expanding Middle Class and Financial Inclusion Efforts

Indonesia’s bancassurance sector is benefiting from the rapid expansion of its middle class, which is driving greater demand for savings, protection, and investment-linked insurance products. Government initiatives such as the National Strategy for Financial Inclusion aim to boost insurance penetration, particularly in underserved rural areas. Banks, which enjoy extensive branch networks across the archipelago, serve as ideal partners for insurers seeking broad market access. Collaborations between large domestic banks, like Bank Mandiri and BRI, and leading insurers are helping create affordable, customized policies. For instance, In April 2024, Allianz Life Indonesia and Bank HSBC Indonesia launched the "Premier Legacy Assurance," a traditional whole life insurance product aimed at maximizing inheritance planning for HSBC Premier customers. The product offers key features such as the Booster Benefit, which increases the sum assured by 20% every five years, reaching up to 300% of the initial sum assured, addressing concerns about inflation and asset fluctuations. This digital push is reinforced by high smartphone penetration and growing comfort with financial transactions via apps. Collaborations with fintech players have further enhanced customer experience through AI-driven insurance recommendations and paperless onboarding. Indonesia bancassurance market growth is being accelerated by inclusive financial policies, rising disposable incomes, and widespread banking coverage.

To get more information on this market, Request Sample

Sharia-Compliant Bancassurance Products

Indonesia, with the world’s largest Muslim population, presents significant growth potential for Sharia-compliant insurance (takaful) products distributed through banks. Islamic banking penetration is growing steadily, supported by government policies encouraging Sharia finance adoption. Bancassurance players are capitalizing on this trend by offering products such as family takaful, education savings plans, and health protection in compliance with Islamic principles. In September 2024, Prudential plc announced a strategic bancassurance partnership with Bank Syariah Indonesia (BSI) to expand its presence in the ASEAN region. Through this collaboration, Prudential will become the Syariah life insurance provider for BSI starting in 2025, targeting BSI's 20 million customers across over 1,000 branches. This partnership aims to boost Prudential's share in the rapidly growing bancassurance sector and deepen its reach in Indonesia's under-penetrated Syariah financial services market. In addition to this, Indonesia’s strong mobile-first culture is influencing how bancassurance products are marketed and sold. Banks and insurers are leveraging super-app ecosystems, digital wallets, and mobile banking platforms to enable instant policy purchase, premium payment, and claims tracking. The digital-first approach is proving effective in reaching younger consumers while maintaining the credibility of established banking partners. Partnerships between Islamic banks like Bank Syariah Indonesia and insurers specializing in Sharia-compliant coverage have created a competitive advantage in addressing faith-based consumer preferences, particularly among younger, urban Muslims seeking both ethical and financially secure solutions.

Indonesia Bancassurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and model type.

Product Type Insights:

- Life Bancassurance

- Non-Life Bancassurance

The report has provided a detailed breakup and analysis of the market based on the product type. This includes life bancassurance and non-life bancassurance.

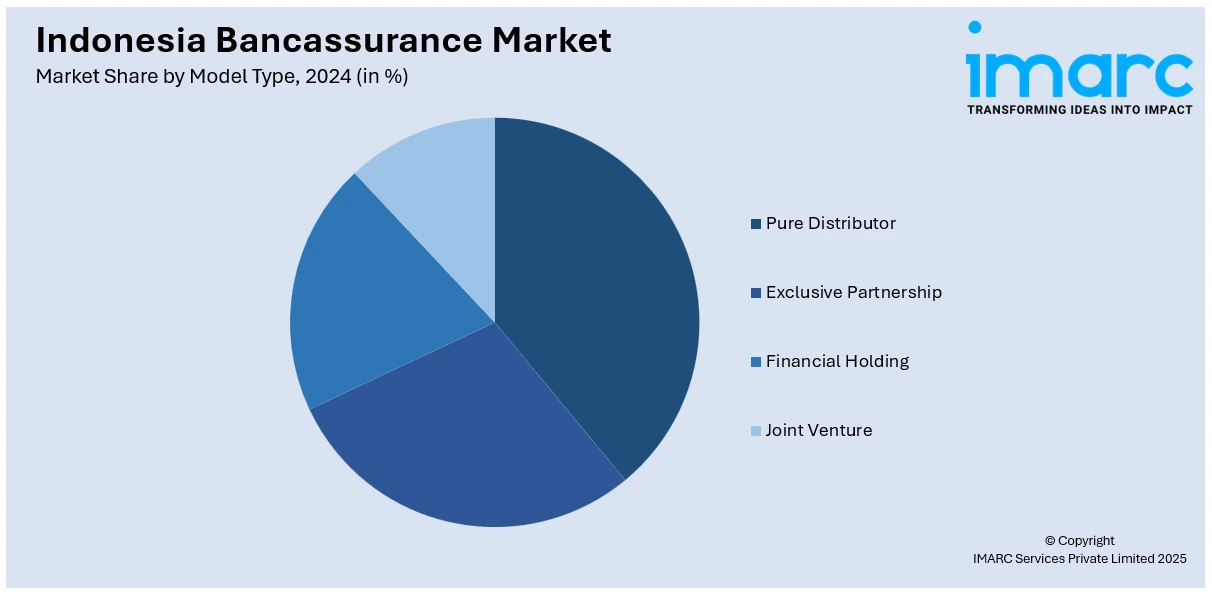

Model Type Insights:

- Pure Distributor

- Exclusive Partnership

- Financial Holding

- Joint Venture

The report has provided a detailed breakup and analysis of the market based on the model type. This includes pure distributor, exclusive partnership, financial holding, and joint venture.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Bancassurance Market News:

- In March 2024, Allianz Life Indonesia and Bank BTPN extended their bancassurance partnership, continuing to offer life insurance solutions to over 20 Million customers. The partnership has paid out over IDR 132 Billion (approximately USD 8.6 Million) in claims and saw an 8% growth in Annualized Premium Equivalent (APE) in 2023.

Indonesia Bancassurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Life Bancassurance, Non-Life Bancassurance |

| Model Types Covered | Pure Distributor, Exclusive Partnership, Financial Holding, Joint Venture |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia bancassurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia bancassurance market on the basis of product type?

- What is the breakup of the Indonesia bancassurance market on the basis of model type?

- What is the breakup of the Indonesia bancassurance market on the basis of region?

- What are the various stages in the value chain of the Indonesia bancassurance market?

- What are the key driving factors and challenges in the Indonesia bancassurance market?

- What is the structure of the Indonesia bancassurance market and who are the key players?

- What is the degree of competition in the Indonesia bancassurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia bancassurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia bancassurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia bancassurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)