Indonesia Battery Market Size, Share, Trends and Forecast by Technology, Application, and Region, 2026-2034

Indonesia Battery Market Size and Share:

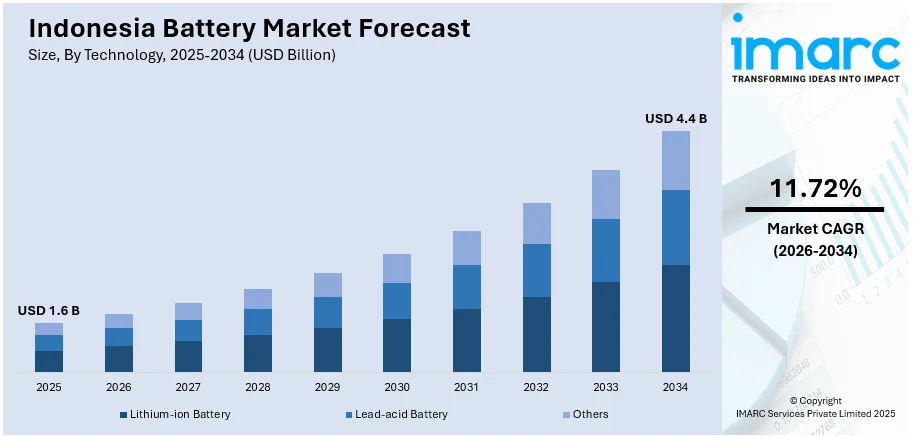

The Indonesia battery market size was valued at USD 1.6 Billion in 2025. Looking forward, IMARC Group estimates the market to reach USD 4.4 Billion by 2034, exhibiting a CAGR of 11.72% during 2026-2034. The market is driven by rising demand for electric vehicles, growing investments in domestic battery production, and the abundance of key raw materials like nickel. Government incentives, improved logistics, and foreign participation are further accelerating infrastructure and technology deployment. Expanding use of renewable energy, stricter emissions rules, and a shift toward localized supply chains are expected to strengthen long-term growth, further augmenting the Indonesia battery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 1.6 Billion |

|

Market Forecast in 2034

|

USD 4.4 Billion |

| Market Growth Rate 2026-2034 | 11.72% |

The market is primarily driven by the rising demand for electric vehicles and portable electronics across the country. In line with this, increasing investments in domestic battery manufacturing facilities are also providing an impetus to the market. Moreover, the presence of abundant nickel reserves, a key battery raw material, is also acting as a significant growth-inducing factor for the market. In addition to this, the active collaboration between public and private sectors to boost energy storage infrastructure is resulting in higher local production capacity. The Indonesia battery market forecast reflects a strong push from both industry and government stakeholders toward achieving greater energy independence and sustainability goals. For instance, on April 23, 2025, EcoSecurities and PT Energi Selalu Baru (ESB) launched the "Indonesia Sustainable Ride" program to distribute several hundred thousand battery-powered Volta electric motorcycles across Indonesia by 2030, targeting a reduction of over 130,000 tonnes of CO₂ emissions within the first five years. The motorcycles will be used for commercial purposes and supported by a nationwide battery swap system (Sistem Ganti Baterai).

To get more information on this market Request Sample

The consistent growth in ride-hailing and delivery services is fueling the demand for electric motorbikes and corresponding battery solutions, forming the basis of the broader Indonesia battery market outlook. Besides this, the growing adoption of renewable energy projects requiring efficient storage solutions is creating lucrative opportunities in the market. On May 23, 2025, the Indonesian government approved 18 downstreaming projects valued at nearly USD 45 Billion, covering nickel, bauxite, coal gasification, agriculture, fisheries, and the national EV battery supply chain. Groundbreaking for the CATL battery ecosystem, backed by state-owned enterprises and financed primarily through Danantara, is scheduled for June 2025. Some of the other factors contributing to the market include educational campaigns promoting the benefits of EV adoption, increasing middle-class income, and the rising need for reliable power backup in remote regions.

Indonesia Battery Market Trends:

Rising Demand for Electric Vehicles (EVs)

The growing demand for electric vehicles (EVs) in Indonesia is significantly boosting the need for batteries, particularly lithium-ion types. As the country moves toward cleaner transportation solutions, both government policies and consumer preferences are shifting in favor of electric mobility. According to the International Institute for Sustainable Development (IISD), the Government of Indonesia plans to deploy 2 million electric cars and 12 million electric two-wheelers in the country by 2030. Incentives such as tax breaks, subsidies, and infrastructure development for EV charging stations are encouraging more adoption. For instance, in March 2024, Indonesia's Ministry of Finance introduced tax incentives for electric vehicles, including a luxury tax removal for 2024 and import tax waivers until 2025. The target is to produce 600,000 EVs by 2030 and achieve 140GWh of battery capacity. According to Indonesia battery market analysis, the market will witness accelerated growth due to these incentives, with increasing domestic production capabilities and investments in battery manufacturing. Additionally, rising environmental awareness and the global push to reduce carbon emissions are further driving the EV market growth. Lithium-ion batteries, known for their efficiency as well as high energy density, are becoming the preferred choice to power electric vehicles, fueling overall market growth.

Rise in Renewable Energy Storage

Renewable energy storage in Indonesia is becoming increasingly vital as the country expands its solar and wind power infrastructure. Efficient energy storage systems, particularly battery solutions, play a crucial role in capturing surplus energy generated from renewable sources. This stored energy can be deployed during periods of high demand or when renewable energy output is low, helping to maintain grid stability and ensure an uninterrupted power supply. For instance, in March 2024, Sembcorp Industries launched its first utility-scale solar and energy storage project in Indonesia through a joint venture with PLN Nusantara Renewables. The project, located in Nusantara, will feature 50 MW of solar power and 14 MWh of storage, generating 93 GWh of green energy yearly and reducing carbon emissions significantly. Large-scale battery systems are essential for mitigating intermittency issues associated with solar and wind energy, supporting Indonesia’s goal of integrating more renewable energy into its national grid and enhancing overall energy resilience. Collectively, these factors are significantly increasing the market share, with more industries and infrastructure relying on efficient battery solutions to meet energy needs and sustainability goals. The ongoing investments in renewable energy storage and battery manufacturing are creating favorable conditions for long-term Indonesia battery market growth.

Growth in Domestic Battery Manufacturing

The development of domestic battery manufacturing in Indonesia is gaining momentum due to the country's vast nickel reserves, a key component in battery production. The Indonesian government is actively promoting investments in battery manufacturing facilities to position itself as a major player in the global battery supply chain. For instance, in June 2024, the Indonesian Ministry of Energy and Mineral Resources inaugurated an electric vehicle battery factory in Tangerang. The factory, operated by PT TDL Energy Indonesia, aims to boost electric motorcycle conversions and achieve net-zero emissions. It is the first in the country to reach a 20% domestic component level, with plans for further increases. By leveraging its abundant raw materials, Indonesia aims to reduce reliance on imports, foster local job creation, and become a leader in the electric vehicle (EV) and energy storage markets. This initiative supports the growing demand for batteries in both domestic and international markets, strengthening Indonesia's industrial base. According to Indonesia battery market forecast, the market is expected to experience substantial growth, driven by these factors, along with the country’s push to become a leading player in EV battery manufacturing due to its abundant nickel reserves.

Indonesia Battery Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia battery market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on technology and application.

Analysis by Technology:

- Lithium-ion Battery

- Lead-acid Battery

- Others

Lithium-ion batteries are at the forefront of Indonesia’s energy storage transformation, driven by rising demand in electric vehicles (EVs), renewable integration, and consumer electronics. With the government’s aggressive push toward EV adoption and localized battery production, lithium-ion technology has become central to national strategies. Global manufacturers are investing in nickel-rich supply chains in Sulawesi, enhancing vertical integration. Additionally, Indonesia’s ambitions to become an EV battery hub in Southeast Asia have intensified R&D and infrastructure development. The growing shift from fossil fuel vehicles to hybrid and electric variants directly boosts lithium-ion demand, strengthening its role in Indonesia's overall battery market growth.

Lead-acid batteries remain significant in the Indonesia battery industry due to their affordability, mature technology, and extensive use in backup power, motorcycles, and uninterruptible power supplies (UPS). Industrial sectors, especially telecom and data centers, rely on these batteries for short-duration energy needs. While newer technologies are emerging, lead-acid batteries continue to dominate applications requiring low cost and high discharge capability. The continued expansion of infrastructure and automotive sectors sustains their relevance. Moreover, the domestic recycling ecosystem for lead-acid units supports circular economy practices, ensuring their continued use.

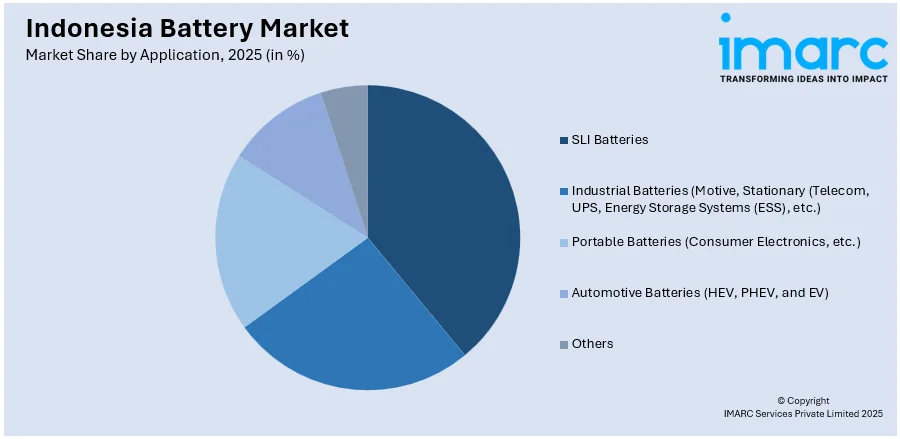

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- SLI Batteries

- Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.)

- Portable Batteries (Consumer Electronics, etc.)

- Automotive Batteries (HEV, PHEV, and EV)

- Others

Starting, lighting, and ignition (SLI) batteries are widely used in conventional internal combustion engine (ICE) vehicles, which still dominate Indonesia’s automotive landscape. These batteries provide short bursts of power to start engines and power accessories, especially in motorcycles and cars. Despite the rise of electric vehicles, Indonesia’s extensive fleet of ICE vehicles maintains steady SLI battery demand. Additionally, the replacement cycle for SLI batteries ensures recurring sales. Their compatibility with lead-acid technology also makes them affordable and widely available. As vehicle ownership rises nationwide, especially in rural and semi-urban regions, SLI batteries continue to sustain a significant portion of market growth.

Industrial batteries are essential across Indonesia’s telecom, energy, logistics, and infrastructure sectors. Stationary batteries power telecom towers, UPS systems, and energy storage systems (ESS), especially in remote and off-grid regions. Motive batteries are widely used in material handling equipment and mining operations. With increased industrial automation and investments in energy reliability, these batteries are in high demand. They also support renewable energy integration and peak load management in commercial settings. As Indonesia scales up smart grid and data center capacity, industrial batteries play a growing role in system stability. These multifaceted applications are vital to sustaining Indonesia battery market growth.

Indonesia’s booming consumer electronics market significantly drives demand for portable batteries, particularly in mobile phones, laptops, and wearable devices. The widespread digital transformation and rise of remote working have increased the need for reliable, rechargeable power sources. Portable lithium-ion batteries dominate this segment due to their lightweight nature and long life. Increasing smartphone penetration, especially among youth in urban centers, fuels battery replacement and upgrades cycles. Additionally, portable power banks and accessories see sustained sales in regions with inconsistent electricity supply. This continuous demand across devices cements portable batteries as an indispensable contributor to the evolving battery market landscape.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Java, being Indonesia’s most populous and industrialized island, is a core demand center for batteries. The high concentration of urban infrastructure, electric vehicle adoption, and industrial activities fuels sustained battery consumption, especially in SLI and portable battery segments. Java also hosts multiple automotive manufacturing facilities, fostering consistent lithium-ion and lead-acid battery demand. As businesses shift toward cleaner energy and battery backup systems, Java’s commercial and residential sectors are adopting energy storage solutions. Government pilot projects on renewable grid integration also favor Java. This robust ecosystem ensures Java remains central to the country’s battery market expansion and long-term growth.

Sumatra contributes to Indonesia’s battery market through its growing industrial base and expansion in transportation infrastructure. The region’s emerging manufacturing hubs and increasing telecommunication installations generate steady demand for industrial batteries. Additionally, Sumatra’s significant mining activities, particularly for coal and minerals, depend on reliable battery-operated machinery and backup systems. Rising rural electrification and off-grid energy storage projects in Sumatra also boost demand for lead-acid and other cost-effective battery solutions. As regional connectivity improves, automotive battery demand is increasing. These diverse applications across industrial and energy sectors ensure that Sumatra plays a foundational role in supporting market dynamics nationally.

Kalimantan is witnessing growing importance in the market due to its resource wealth, especially nickel—critical for lithium-ion battery production. The region is central to government plans for EV battery value chain localization, including refining and precursor material production. Industrial development, driven by Indonesia’s new capital city Nusantara, will require significant energy infrastructure, further raising battery demand. Remote energy projects, mining operations, and mobility applications create a consistent market for both lithium-ion and lead-acid batteries. Kalimantan’s strategic resource and infrastructure developments will significantly shape Indonesia’s upstream and downstream battery market growth over the coming years.

Sulawesi plays a crucial upstream role in the market, primarily due to its abundant nickel reserves, making it a hotspot for lithium-ion battery raw material sourcing. The establishment of industrial parks and smelters, backed by foreign investments, positions Sulawesi as a key player in the global battery supply chain. These facilities not only export materials but increasingly support domestic production efforts. Additionally, localized power systems, mining operations, and electrification programs in rural areas maintain steady battery demand. Sulawesi’s mining-backed battery ecosystem and strategic value chain contribution elevate its importance in Indonesia’s battery sector growth trajectory.

Competitive Landscape:

Key players in the market are actively investing in domestic manufacturing facilities and forming strategic partnerships to strengthen local supply chains. Local companies are doing collaborations with global firms for developing integrated battery ecosystems, including upstream mining, midstream processing, and downstream cell production. These players are also focused on advancing lithium-ion battery technologies tailored for electric vehicles and renewable energy storage. Efforts include technology transfer agreements, workforce skill development, and alignment with government incentives under Indonesia’s EV roadmap. By prioritizing vertical integration and innovations, market leaders are aiming to reduce import dependence, improve cost-efficiency, and support national electrification goals.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia battery market with detailed profiles of all major companies, including:

- Energizer Holdings, Inc.

- Furukawa Battery Indonesia (The Furukawa Battery Co., Ltd)

- PT. Century Batteries Indonesia

- PT. Indonesian Motobatt

- PT. New Indobatt Energy Nusantara

- PT. Yuasa Industrial Battery Indonesia

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

Latest News and Developments:

- May 2025: Contemporary Amperex Technology Co Limited (CATL), a manufacturer of EV batteries based in China, announced that it is seeking an investment of USD 1 billion to finance the construction of a battery cell production plant in Karawang, West Java, Indonesia. The facility is scheduled to begin commercial production by 2027.

- May 2025: Contemporary Amperex Technology Co. Ltd. (CATL), an electric vehicle (EV) battery manufacturer, announced that it would expand its battery production facility in Indonesia with a USD 1 billion loan. The expansion also aims to bolster CATL's presence in the broader Southeast Asian region.

- April 2025: South Korea's LG Group announced that it would invest an additional USD 1.7 billion in its West Java battery cell factory, increasing the total investment to USD 2.8 billion. The West Java plant, a joint venture with Hyundai Motor Group under HLI Green Power, is a battery cell production facility with a capacity of 10 GWh.

- January 2025: Rept Battero, a battery manufacturer based in China, announced plans to build an 8 GWh gigafactory in Indonesia with a focus on the production of lithium-ion cells for battery energy storage systems (BESS). The battery factory will be built and invested in by PT Rept Battero Indonesia, a non-wholly-owned division of Rept Battero.

- January 2025: Wuling Automobile Company Ltd. formally began assembling battery packs for EVs at its battery production facility in Indonesia. This is a part of the company’s localization initiative.

- August 2024: The Indonesian government inaugurated a China-built anode plant for EV batteries, funded by BTR New Material Group and Stellar Investment. With an initial investment of USD 478 million, the plant aims to produce 80,000 metric tons annually, enhancing Indonesia's burgeoning electric vehicle industry and attracting further investment.

Indonesia Battery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Lithium-ion Battery, Lead-acid Battery, Others |

| Applications Covered | SLI Batteries, Industrial Batteries (Motive, Stationary (Telecom, UPS, Energy Storage Systems (ESS), etc.), Portable Batteries (Consumer Electronics, etc.), Automotive Batteries (HEV, PHEV, and EV), Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Companies Covered | Energizer Holdings, Inc., Furukawa Battery Indonesia (The Furukawa Battery Co., Ltd), PT. Century Batteries Indonesia, PT. Indonesian Motobatt, PT. New Indobatt Energy Nusantara, PT. Yuasa Industrial Battery Indonesia, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia battery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The battery market in Indonesia was valued at USD 1.6 Billion in 2025.

The growth of Indonesia’s battery market is driven by the rapid expansion of electric vehicle adoption, increasing investment in renewable energy storage systems, and rising demand for consumer electronics. Government policies supporting domestic battery manufacturing and incentives for EV production are also fueling industry expansion. Additionally, the country’s abundant nickel reserves and efforts to develop an integrated battery supply chain are attracting global investment. These developments are reinforcing Indonesia’s position as a regional battery production hub.

The battery market in Indonesia is expected to exhibit a CAGR of 11.72% during 2026-2034, reaching a value of USD 4.4 Billion by 2034.

The report provides a comprehensive analysis of the competitive landscape in the Indonesia battery market, with detailed profiles of key players including Energizer Holdings, Inc., Furukawa Battery Indonesia, PT. Century Batteries Indonesia, PT. Indonesian Motobatt, PT. New Indobatt Energy Nusantara, and PT. Yuasa Industrial Battery Indonesia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)