Indonesia Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

Indonesia Board Games Market Overview:

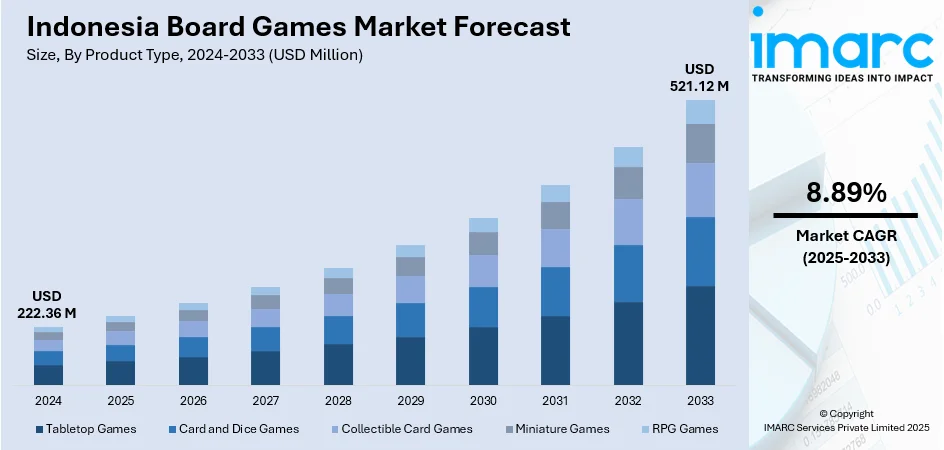

The Indonesia board games market size reached USD 222.36 Million in 2024. The market is projected to reach USD 521.12 Million by 2033, exhibiting a growth rate (CAGR) of 8.89% during 2025-2033. At present, rising youth population is positively influencing the market by creating a strong and dynamic customer base eager for engaging, interactive, and social entertainment. Besides this, the broadening of retail outlets is contributing to the expansion of the Indonesia board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 222.36 Million |

| Market Forecast in 2033 | USD 521.12 Million |

| Market Growth Rate 2025-2033 | 8.89% |

Indonesia Board Games Market Trends:

Growing youth population

Rising youth population is fueling the market growth in Indonesia. According to industry reports, as of March 2024, Indonesia hosted a dynamic youth demographic, with 64.16 Million people aged 16 to 30, making up 23.18% of the total population. Young people, particularly students and early-career professionals, are actively seeking recreational activities that combine fun with social bonding, and board games serve this need effectively. With a high interest in offline alternatives to screen-based entertainment, the youth is turning to board games as a refreshing and intellectually stimulating option. They explore a wide assortment of game genres, ranging from strategy and role-playing to party and educational games. Board game cafés and community events are thriving in urban centers as gathering spots for young players, fostering a vibrant gaming culture. Youth-driven demand is also encouraging local creators to design culturally relevant games that resonate with Indonesian stories and humor. Social media, heavily used by the youth, plays a major role in popularizing new games through content sharing, reviews, and live sessions. As peer influence and community engagement are growing, more young individuals are being introduced to board games. With their enthusiasm, curiosity, and willingness to try new experiences, Indonesia’s rising youth population is significantly contributing to the broadening of the market.

To get more information on this market, Request Sample

Expansion of retail outlets

The broadening of retail channels is impelling the Indonesia board games market growth. According to the IMARC Group, the Indonesia retail market size reached USD 361.1 Billion in 2024. As shopping malls, bookstores, toy shops, and specialty hobby stores are increasing in number, they are offering dedicated shelf space for board games, attracting both casual buyers and enthusiasts. Organized retail chains present board games as attractive, gift-worthy, and educational products, which encourages impulse buying and family-oriented purchases. In-store displays, promotional events, and demo tables help new players learn and try games before buying, creating greater engagement. The growing presence of modern retail in both urban and semi-urban areas assists in introducing board games to a broader demographic, including families, students, and young professionals. Retail expansion also allows local and international publishers to test new products. With improved supply chains and inventory management, popular and niche games are readily available. Retailers are often collaborating with publishers for special editions and bundled offers, increasing customer interest.

Indonesia Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

A detailed breakup and analysis of the market based on the game type have also been provided in the report. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

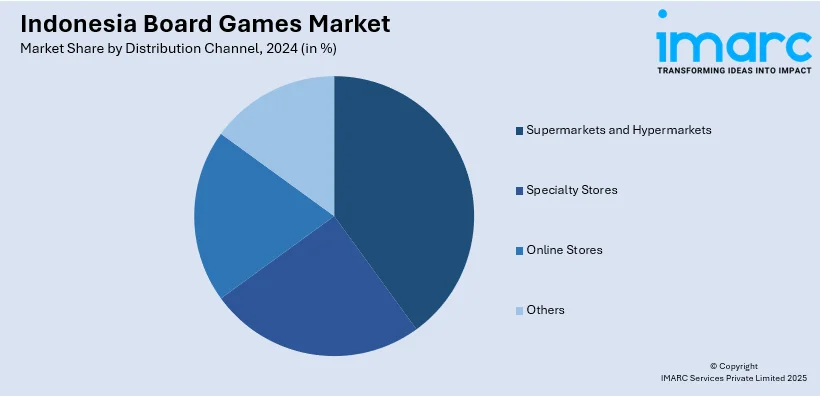

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Board Games Market News:

- In May 2025, Monopoly released its Bali Edition, which showcased famous landmarks and globally recognized hotels, while retaining the traditional aspects of the board game. Bali Edition represented a groundbreaking approach to enhancing Indonesian tourism, utilizing a creative platform that could engage a worldwide audience. By incorporating Bali into a board game enjoyed by millions of people, the brand intended to foster emotional ties and ignite curiosity in travel via narrative and gameplay.

Indonesia Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia board games market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia board games market on the basis of product type?

- What is the breakup of the Indonesia board games market on the basis of game type?

- What is the breakup of the Indonesia board games market on the basis of age group?

- What is the breakup of the Indonesia board games market on the basis of distribution channel?

- What is the breakup of the Indonesia board games market on the basis of region?

- What are the various stages in the value chain of the Indonesia board games market?

- What are the key driving factors and challenges in the Indonesia board games market?

- What is the structure of the Indonesia board games market and who are the key players?

- What is the degree of competition in the Indonesia board games market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)