Indonesia Bottled Water Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Indonesia Bottled Water Market Size and Share:

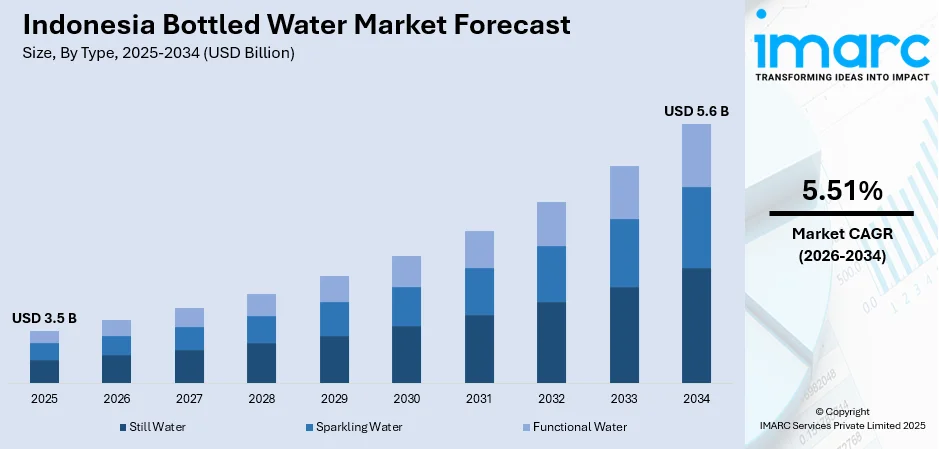

Indonesia bottled water market size reached USD 3.5 Billion in 2025. The market is expected to reach USD 5.6 Billion by 2034, exhibiting a growth rate (CAGR) of 5.51% during 2026-2034. The market growth is attributed to the consumers becoming more concerned than ever about the quality and safety of their water. Also, rapid urban growth, changing lifestyles, and a greater general focus on health and wellness is fueling the market. These shifts, combined with ongoing infrastructure development, are creating powerful, sustained growth in the water quality market as consumers actively seek solutions they can trust.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 3.5 Billion |

|

Market Forecast in 2034

|

USD 5.6 Billion |

| Market Growth Rate 2026-2034 | 5.51% |

Market Insights:

- On the basis of region, the market has been divided into Java, Sumatra, Kalimantan, Sulawesi, and Others.

- On the basis of type, the market has been divided into still water, sparkling water, and functional water.

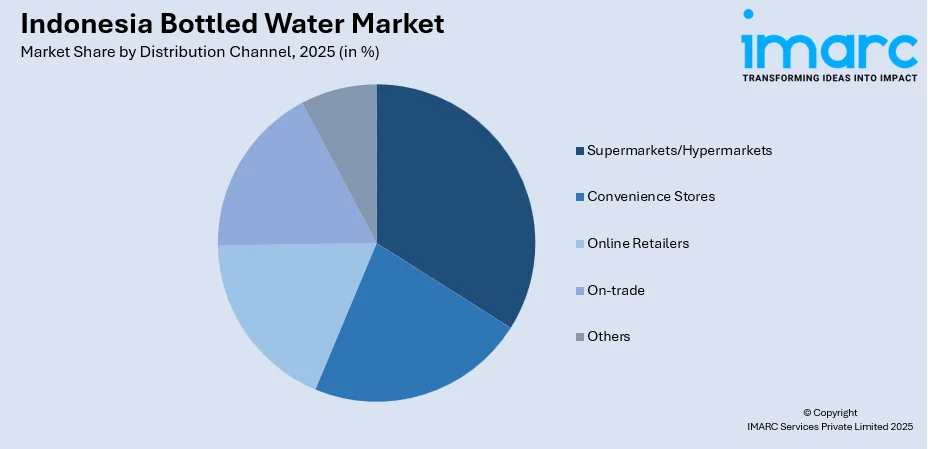

- On the basis of distribution channel, the market has been divided into supermarkets/hypermarkets, convenience stores, online retailers, on-trade, and others.

Market Size and Forecast:

- 2025 Market Size: USD 3.5 Billion

- 2034 Projected Market Size: USD 5.6 Billion

- CAGR (2026-2034): 5.51%

Bottled water refers to drinking water that is packaged in plastic or glass containers for convenient consumption. It is typically sourced from springs, wells, or municipal supplies, then subjected to a series of processes such as filtration, disinfection, and purification to ensure its quality and safety for human consumption. This industry has witnessed substantial growth due to the convenience it offers in providing potable water on the go, especially in areas where access to safe tap water might be limited. While various types of bottled water exist, including mineral water, purified water, spring water, and artesian water, the key distinction lies in their origins and treatment processes. Consumers often opt for bottled water as an alternative to tap water, either for its perceived purity or taste preferences.

To get more information on this market, Request Sample

Indonesia Bottled Water Market Trends:

The increasing concerns regarding water quality and safety have been a primary factor driving the Indonesia bottled water market growth. With the persisting challenges related to water contamination and inconsistent access to safe drinking water in certain regions, consumers are turning to bottled water as a reliable source of clean and potable drinking water. Additionally, the rising urbanization and changing lifestyles in Indonesia have led to a rise in the demand for convenient and readily available potable water. As urban populations continue to grow, the need for on-the-go hydration solutions has become more pronounced, propelling the consumption of bottled water across various demographic segments. Other than this, the growing awareness of health and wellness among consumers has fostered a shift toward healthier beverage choices, including bottled water. As individuals increasingly prioritize their well-being, the perception of bottled water as a healthier alternative to sugary beverages has bolstered its demand, particularly among health-conscious consumers and fitness enthusiasts. Besides this, the tourism sector in Indonesia has played a pivotal role in driving the demand for bottled water. As the country attracts a substantial number of domestic and international tourists, the need for convenient and safe drinking water options has intensified, leading to a significant upsurge in the consumption of bottled water within the hospitality and tourism industry. In line with this, the expanding middle-class population and the subsequent increase in disposable income is augmenting the Indonesia bottled water market share. As more individuals join the middle-income bracket, there has been a noticeable shift in consumer spending patterns, with a growing inclination toward premium and branded bottled water products. This trend has led to an elevation in the overall market demand and a preference for higher-quality offerings. Furthermore, the prevalent tropical climate in Indonesia has contributed significantly to the demand for bottled water. The high temperatures and humid conditions of the region throughout the year have augmented the need for adequate hydration, thereby driving the consumption of bottled water across various regions, both urban and rural.

Premium and Functional Product Evolution with Still Water Market Leadership

The Indonesian bottled water market is experiencing a significant transformation toward premium and functional products as consumers increasingly seek value-added hydration solutions that align with their health and wellness aspirations. Premium bottled water brands featuring enhanced packaging, superior filtration technologies, and distinctive branding are capturing greater market share among affluent consumers who prioritize quality and brand prestige over price considerations. Functional water variants incorporating vitamins, minerals, electrolytes, and natural flavor additions are gaining substantial traction, particularly among fitness enthusiasts, health-conscious millennials, and urban professionals seeking convenient nutrition supplementation through their daily hydration routine. Despite the emergence of innovative variants, still water maintains its dominant position in the Indonesian market, accounting for the largest market share due to its universal appeal, affordability, and widespread availability across all distribution channels and geographic regions. The still water segment benefits from established consumer preferences, extensive distribution networks, and competitive pricing strategies that make it accessible to diverse socioeconomic segments, while sparkling water and functional water categories represent growing but niche markets driven by urbanization, Western lifestyle adoption, and increasing disposable income among Indonesia's expanding middle class.

Government Initiatives Shaping Market Dynamics and Environmental Sustainability

The Indonesian government's comprehensive policy initiatives are significantly influencing the bottled water market through environmental regulations and public health programs that aim to balance consumer access to safe drinking water with sustainability concerns. The Clean Water for All Initiative launched in 2023 represents a major government commitment to improving municipal water infrastructure and expanding access to safe drinking water, potentially reducing long-term reliance on bottled water while simultaneously driving short-term demand in underserved areas during infrastructure development phases. The National Action Plan on Marine Debris (2021-2025) is creating substantial pressure on bottled water manufacturers to adopt sustainable packaging solutions, implement circular economy principles, and develop environmentally responsible production practices that address Indonesia's significant plastic waste challenges. The Bali Bottled Water Ban implemented in 2025 demonstrates the government's commitment to environmental protection through targeted restrictions on single-use plastic bottles in sensitive ecological areas, compelling manufacturers to innovate with alternative packaging materials and refillable bottle systems. These governmental initiatives are fundamentally reshaping industry dynamics by encouraging investment in sustainable technologies, promoting local production capabilities, and creating regulatory frameworks that balance economic growth with environmental stewardship, ultimately driving market evolution toward more sustainable and socially responsible bottled water solutions.

Growth, Opportunities, and Challenges in the Indonesia Bottled Water Market

- Growth Drivers of the Indonesia Bottled Water Market: The market is primarily driven by increasing concerns regarding water quality and safety, with persistent challenges related to water contamination and inconsistent access to safe drinking water in certain regions driving consumer demand for reliable bottled water solutions. Rapid urbanization and changing lifestyles, combined with growing health and wellness awareness among consumers, create substantial demand for convenient hydration options and healthier beverage alternatives. The expanding tourism sector, growing middle-class population with increased disposable income, and Indonesia's prevalent tropical climate contribute to sustained market growth across diverse demographic segments.

- Opportunities in the Indonesia Bottled Water Market: As per the Indonesia bottled water market forecast, significant opportunities exist in developing premium and functional water products that cater to health-conscious consumers seeking value-added hydration solutions with enhanced nutritional benefits. The shift toward sustainable packaging and environmentally responsible production practices presents lucrative prospects for manufacturers investing in innovative packaging technologies and circular economy principles. Government initiatives including the Clean Water for All Initiative create opportunities for strategic partnerships and infrastructure development projects that can expand market reach while supporting public health objectives.

- Challenges in the Indonesia Bottled Water Market: The industry faces substantial challenges from environmental regulations including the National Action Plan on Marine Debris and regional restrictions like the Bali Bottled Water Ban, requiring significant investments in sustainable packaging and production technologies. As per the Indonesia bottled water market analysis, competition from improving municipal water infrastructure and government initiatives to provide safe drinking water access may reduce long-term market demand. Managing the balance between affordability for diverse socioeconomic segments and the need for sustainable, environmentally responsible products poses ongoing operational and strategic challenges.

Indonesia Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Still Water

- Sparkling Water

- Functional Water

The report has provided a detailed breakup and analysis of the market based on the type. This includes still water, sparkling water, and functional water.

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retailers

- On-trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, online retailers, on-trade, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- June 2024: Indonesia formalized new regulations requiring BPA warnings and explicit storage instructions on bottled water packaged in polycarbonate containers, mandating all companies comply within a four-year transition period per the Food and Drug Agency (BPOM).

- August 2025: Waterhub, an Indonesian startup focused on clean drinking water, secured fresh funding to expand filtration machine deployment and is rapidly forming partnerships with bottled water producers to improve sustainable access and reduce single-use plastic dependence.

- December 2024: Le Minerale was chosen as the official mineral water partner for the Borobudur Marathon, supplying 10,500 runners and reinforcing its brand prestige at major national sporting events.

- February 2024: PT Sariguna Primatirta Tbk (CLEO) announced IDR 300 billion capex to build three new water factories in Palu, Pontianak, and Pekanbaru, expanding their network to 35 factories by the end of 2024 and supporting broader distribution reach and production capacity.

Indonesia Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Still Water, Sparkling Water, Functional Water |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Online Retailers, On-trade, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia bottled water market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bottled water market in Indonesia was valued at USD 3.5 Billion in 2025.

The Indonesia bottled water market is projected to exhibit a CAGR of 5.51% during 2026-2034, reaching a value of USD 5.6 Billion by 2034.

Major elements influencing the bottled water market in Indonesia are heightened health consciousness, increasing disposable income, and restricted access to safe drinking water in certain regions. Moreover, the growth of tourism, enhanced distribution systems, and evolving consumer habits aid in the consistent development of the market in both urban and rural areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)