Indonesia Carbon Black Market Size, Share, Trends and Forecast by Type, Grade Wise Application, and Region, 2025-2033

Indonesia Carbon Black Market Overview:

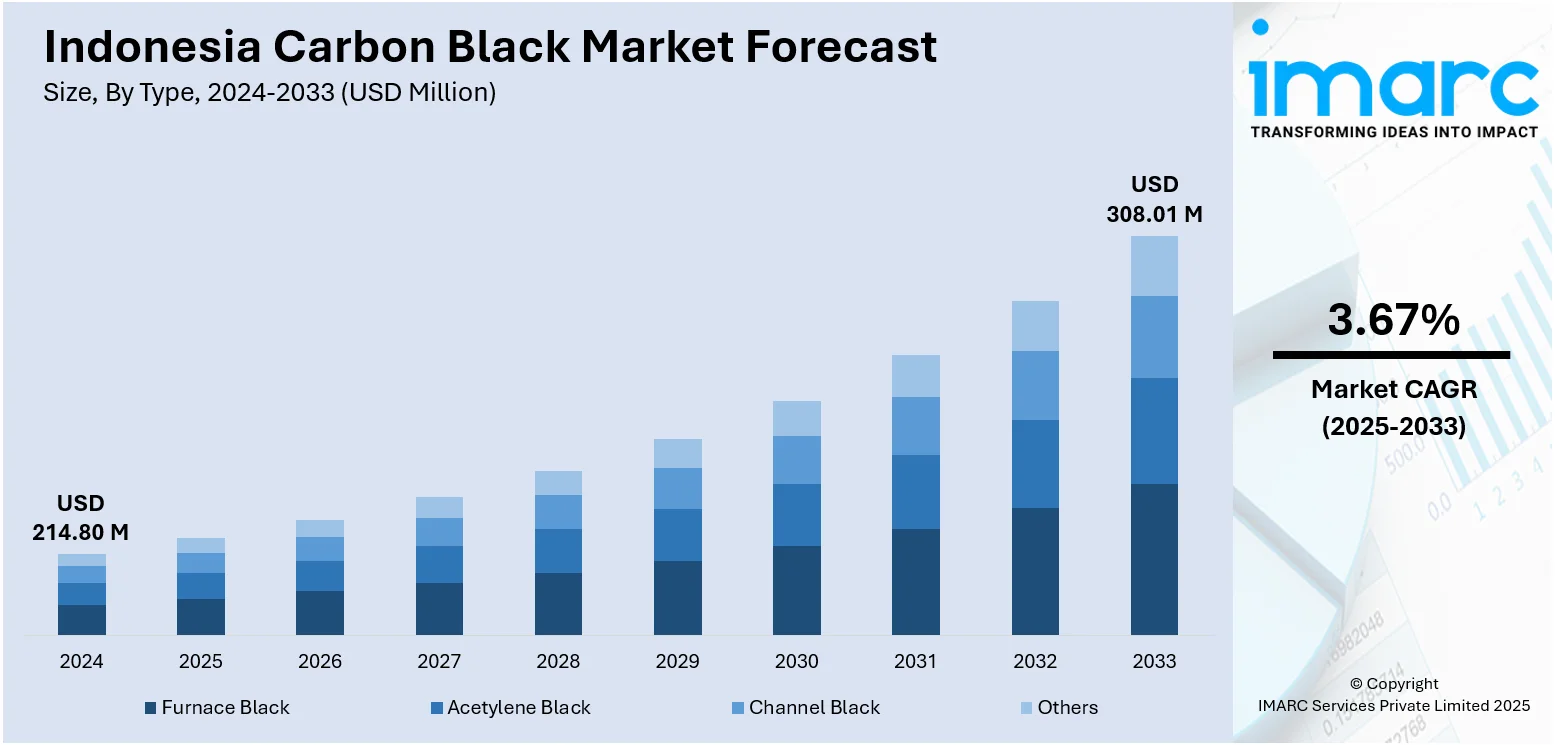

The Indonesia carbon black market size reached USD 214.80 Million in 2024. Looking forward, the market is projected to reach USD 308.01 Million by 2033, exhibiting a growth rate (CAGR) of 3.67% during 2025-2033. The market is witnessing robust demand from downstream plastic, coatings, and packaging sectors, supported by strong domestic manufacturing and urban infrastructure expansion. Additionally, electronics, printing, and conductive polymer applications are pushing specialty-grade demand. As industrial players pursue quality, durability, and compliance, carbon black’s role is expanding into higher-value applications, and these developments are expected to significantly boost the Indonesia carbon black market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 214.80 Million |

| Market Forecast in 2033 | USD 308.01 Million |

| Market Growth Rate 2025-2033 | 3.67% |

Indonesia Carbon Black Market Trends:

Expanding Downstream Plastic and Packaging Industry

Indonesia's rapidly growing plastic manufacturing ecosystem has become a central driver of carbon black consumption. As domestic demand for rigid and flexible packaging, consumer goods, and automotive components increases, local converters are using carbon black to enhance UV stability, color uniformity, and surface protection. In August 2024, Propan Raya participated in IndoBuildTech Expo 2024 in Tangerang, Indonesia, showcasing its latest innovations in coatings and paints, including direct-to-metal products and aerosol paint series, which utilize advanced pigmentation and protective technologies relevant to the carbon black market. The company highlighted new product lines such as epoxy floor coatings, anti-slip coatings, and metal protective paints. In line with this, plastic processors also value the role of carbon black in improving heat resistance and structural integrity, especially in products exposed to tropical climates. Demand is also growing in multilayer films and HDPE containers, where carbon black grades help ensure opacity, environmental shielding, and dimensional consistency. The plastic packaging sector, in particular, benefits from grades that meet stringent safety and regulatory specifications. Investments in new polymer blending facilities in Java and Sumatra have further spurred the uptake of high-performance carbon black as converters seek reliable and affordable pigment alternatives. Indonesia’s geographical exposure to sun, humidity, and high temperatures has made carbon black indispensable in outdoor-use plastic applications. With plastic output scaling up for domestic and export use, this vertical remains key to long-term Indonesia carbon black market growth.

To get more information on this market, Request Sample

Construction and Infrastructure-Led Coating Demand

The booming infrastructure and housing sector in Indonesia has fueled demand for construction-grade carbon black across paints, coatings, adhesives, and sealants. As of October 2024, Indonesia’s coatings industry had a total production capacity of 1.004 Million Tons, with water-based decorative coatings representing approximately 67% of this figure. Solvent-based decorative coatings made up 8%, wood coatings 7%, marine and offshore protective coatings 6%, and coil coatings 4%. Paint production in Indonesia is projected to surpass 1 Million Tons in 2024. Coating formulators increasingly turn to fine-dispersed carbon black to deliver UV protection, moisture barrier properties, and deep black aesthetics for roofing, exterior paints, flooring, and industrial metal structures. Adhesive and waterproofing membrane manufacturers utilize it to improve performance in humid tropical environments, preventing degradation from sunlight and chemical exposure. With the growth of modern high-rise construction in Jakarta, Bandung, and Surabaya, there is rising demand for weather-resilient coatings and sealants that retain elasticity and appearance. Additionally, manufacturers are integrating low-PAH carbon black grades to ensure compliance with evolving environmental regulations and to cater to export-oriented chemical products. Indonesia’s growth in the industrial coatings segment is further linked to domestic steel and shipbuilding activities, where carbon black ensures surface protection, corrosion resistance, and thermal endurance. These coating-related applications are enabling diversification beyond traditional rubber markets, driving more stable regional carbon black demand.

Indonesia Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and grade wise application.

Type Insights:

- Furnace Black

- Acetylene Black

- Channel Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, acetylene black, channel black, and others.

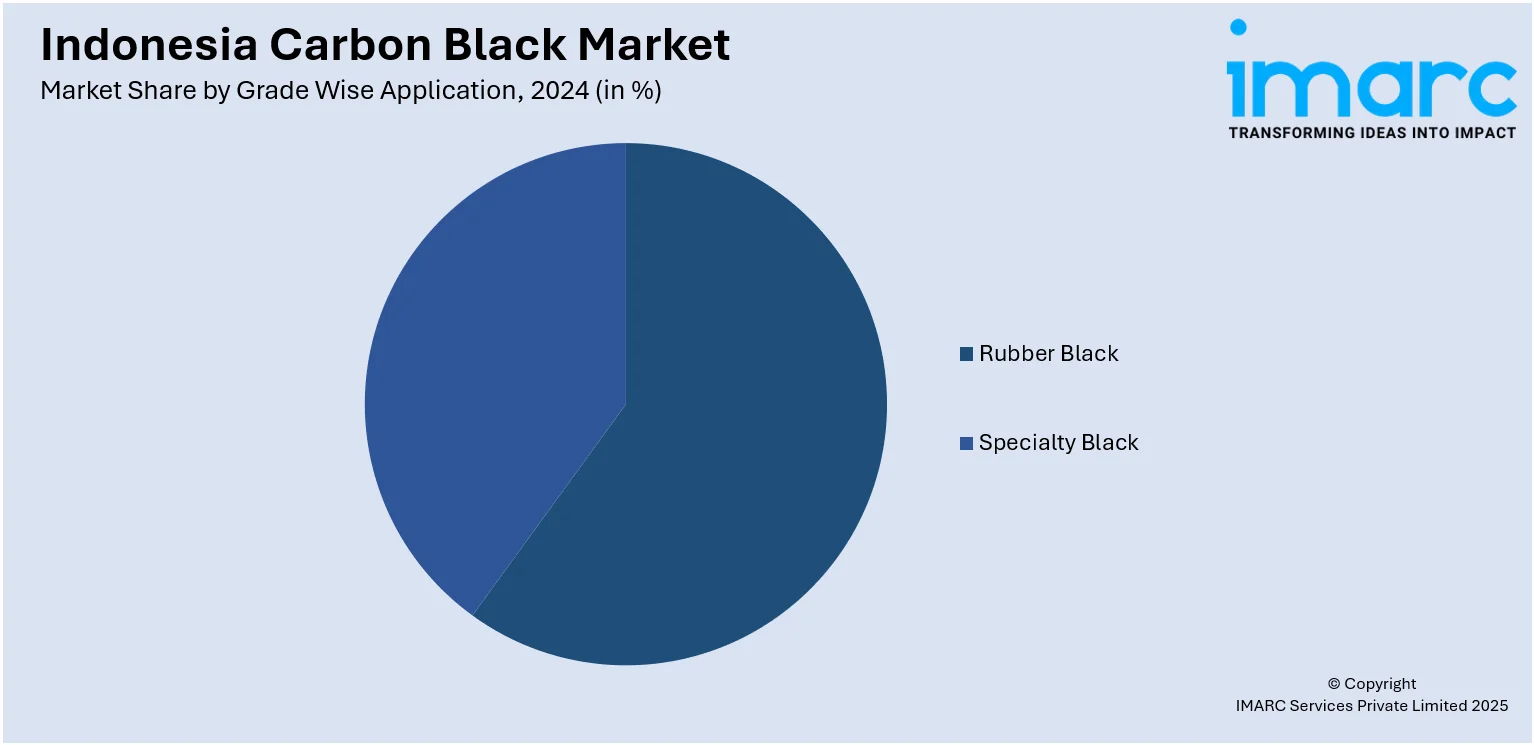

Grade Wise Application Insights:

- Rubber Black

- Tire Treads

- Inner Liner and Tubes

- Conveyor Belts

- Hoses

- Others

- Specialty Black

- Plastics

- Ink and Toners

- Paint and Coatings

- Wires and Cables

- Others

The report has provided a detailed breakup and analysis of the market based on the grade wise application. This includes rubber black (tire treads, inner liner and tubes, conveyor belts, hoses, and others) and specialty black (plastics, ink and toners, paint and coatings, wires and cables, and others).

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all major regional markets. This includes Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Carbon Black Market News:

- January 2025: Cabot resumed its previously suspended carbon black plant expansion project in Cilegon, Indonesia, aiming for completion by mid-2025 to address increasing demand in Southeast Asia. The USD 100 Million investment will add 80 kilotonnes of annual rubber black production capacity, nearly doubling the facility’s output. This expansion will reinforce Cabot’s role as Indonesia’s sole reinforcing carbons producer, improving supply efficiency and lead times for the local market.

Indonesia Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Acetylene Black, Channel Black, Others |

| Grade Wise Applications Covered |

|

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia carbon black market on the basis of type?

- What is the breakup of the Indonesia carbon black market on the basis of grade wise application?

- What is the breakup of the Indonesia carbon black market on the basis of region?

- What are the various stages in the value chain of the Indonesia carbon black market?

- What are the key driving factors and challenges in the Indonesia carbon black market?

- What is the structure of the Indonesia carbon black market and who are the key players?

- What is the degree of competition in the Indonesia carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)