Indonesia Children’s Entertainment Centers Market Size, Share, Trends and Forecast by Visitor Demographics, Facility Size, Revenue Source, Activity Area, and Region, 2025-2033

Indonesia Children’s Entertainment Centers Market Overview:

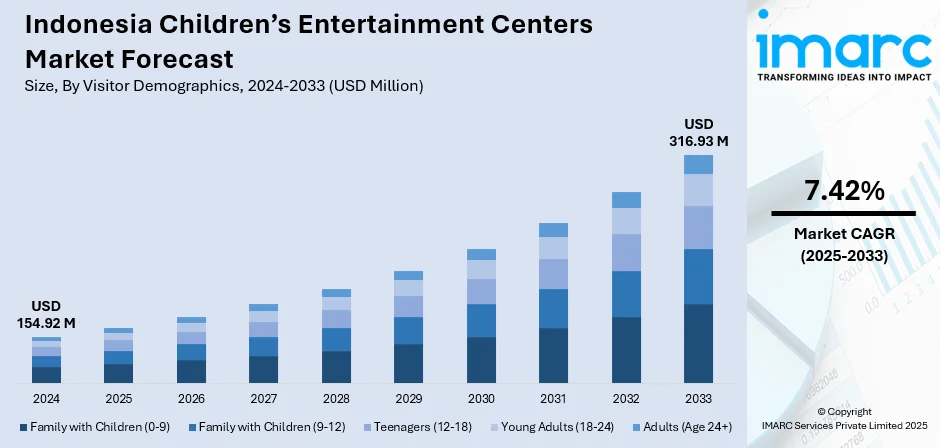

The Indonesia children’s entertainment centers market size reached USD 154.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 316.93 Million by 2033, exhibiting a growth rate (CAGR) of 7.42% during 2025-2033. Rising disposable incomes, growing urban middle-class families, and an increasing focus on family leisure activities are some of the factors contributing to the Indonesia children’s entertainment centers market share. Rapid mall development, tourism growth, and demand for safe indoor play areas further fuel expansion, supported by interactive technologies and themed experiences.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 154.92 Million |

| Market Forecast in 2033 | USD 316.93 Million |

| Market Growth Rate 2025-2033 | 7.42% |

Indonesia Children’s Entertainment Centers Market Trends:

Expanding Creative Play and Learning Spaces

Children’s entertainment venues in Indonesia are increasingly blending active play with early learning experiences. A newly launched center in West Java introduces imaginative zones like interactive water play and themed role-play areas designed to nurture creativity and curiosity in young children. The focus is on STEAM-inspired activities that encourage problem-solving, exploration, and social interaction in a fun and engaging environment. Recent openings in other urban locations show a growing emphasis on family-oriented spaces where education is seamlessly combined with recreation. Parents are drawn to these destinations for their ability to offer meaningful, safe, and interactive experiences that go beyond traditional playgrounds, creating memorable moments for both children and families. These factors are intensifying the Indonesia children’s entertainment centers market growth. For example, in May 2024, Play 'N' Learn opened its largest Indonesian children’s entertainment center at Summarecon Mall Bandung, West Java. Covering 1,112 square meters, the venue introduces creative play zones like Sally's Water Play Lab and Role Play Town. This launch, following recent openings in Serpong and Cibubur, highlights the brand’s focus on STEAM-based active learning, creativity, and family-friendly edutainment for children under seven across Indonesia.

To get more information on this market, Request Sample

Immersive Edutainment Redefining Family Recreation

Indonesia is seeing a shift toward entertainment centers that prioritize hands-on learning and interactive play. New venues are being designed as vibrant hubs where children can explore, create, and experiment in safe, stimulating settings. Instead of traditional play areas, these spaces feature curated zones that merge role-playing activities with creative experiments, sparking curiosity and imagination. The concept draws inspiration from early childhood education principles, with a strong focus on blending fun with skill-building experiences. Parents value these spaces for providing opportunities to strengthen family connections while supporting a child’s cognitive and social development. The growing popularity of STEAM-based activities signals a move toward purposeful recreation, where every activity encourages discovery, teamwork, and problem-solving. By expanding to key urban locations, these centers are becoming go-to destinations for families seeking meaningful alternatives to screen time. The evolving approach combines entertainment with education in ways that resonate with modern parenting priorities, fostering environments where learning naturally unfolds through immersive play and shared family experiences.

Indonesia Children’s Entertainment Centers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on visitor demographics, facility size, revenue source, and activity area.

Visitor Demographics Insights:

- Family with Children (0-9)

- Family with Children (9-12)

- Teenagers (12-18)

- Young Adults (18-24)

- Adults (Age 24+)

The report has provided a detailed breakup and analysis of the market based on the visitor demographics. This includes family with children (0-9), family with children (9-12), teenagers (12-18), young adults (18-24), and adults (age 24+).

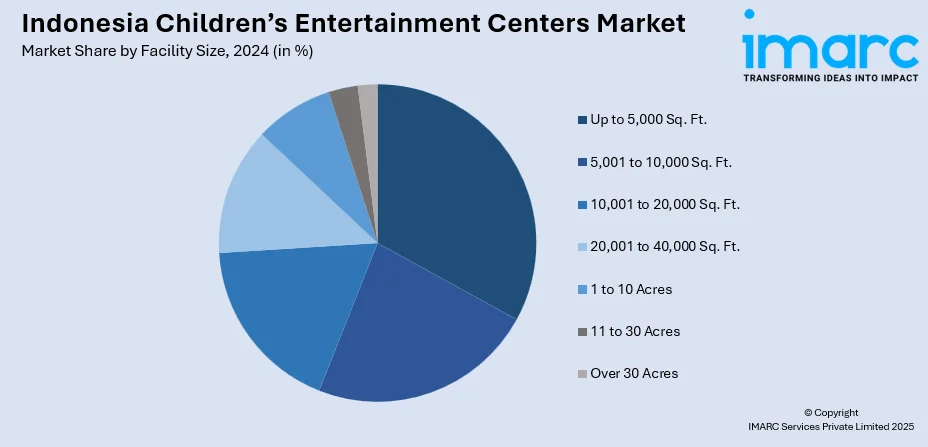

Facility Size Insights:

- Up to 5,000 Sq. Ft.

- 5,001 to 10,000 Sq. Ft.

- 10,001 to 20,000 Sq. Ft.

- 20,001 to 40,000 Sq. Ft.

- 1 to 10 Acres

- 11 to 30 Acres

- Over 30 Acres

The report has provided a detailed breakup and analysis of the market based on the facility size. This includes up to 5,000 sq. ft., 5,001 to 10,000 sq. ft., 10,001 to 20,000 sq. ft., 20,001 to 40,000 sq. ft., 1 to 10 acres, 11 to 30 acres, and over 30 acres.

Revenue Source Insights:

- Entry Fees and Ticket Sales

- Food and Beverages

- Merchandising

- Advertising

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue source. This includes entry fees and ticket sales, food and beverages, merchandising, advertising, and others.

Activity Area Insights:

- Arcade Studios

- AR and VR Gaming Zone

- Physical Play Activities

- Skill/Competition Games

- Others

A detailed breakup and analysis of the market based on the activity area have also been provided in the report. This includes arcade studios, AR and VR gaming zone, physical play activities, skill/competition games, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Children’s Entertainment Centers Market News:

- In April 2025, Entertainment District, the latest attraction in PIK 2, Tangerang Regency, blends sports, entertainment, and lifestyle. Positioned across from Indonesia Design District, it features Bowl.inc with 30 competition-standard lanes, Cow Play Cow Moo arcade from Singapore, Kart.inc, and Whistler Garden. Future additions include Animal.inc Cafe, Fish.inc indoor fishing, and Eragon sports bar, creating a vibrant destination for youth, families, and community gatherings.

Indonesia Children’s Entertainment Centers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Visitor Demographics Covered | Family With Children (0-9), Family With Children (9-12), Teenagers (12-18), Young Adults (18-24), Adults (Age 24+) |

| Facility Sizes Covered | Up to 5,000 Sq. Ft., 5,001 to 10,000 Sq. Ft., 10,001 to 20,000 Sq. Ft., 20,001 to 40,000 Sq. Ft., 1 to 10 Acres, 11 to 30 Acres, Over 30 Acres |

| Revenue Sources Covered | Entry Fees and Ticket Sales, Food and Beverages, Merchandising, Advertising, Others |

| Activity Areas Covered | Arcade Studios, AR and VR Gaming Zone, Physical Play Activities, Skill/Competition Games, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia children’s entertainment centers market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia children’s entertainment centers market on the basis of visitor demographics?

- What is the breakup of the Indonesia children’s entertainment centers market on the basis of facility size?

- What is the breakup of the Indonesia children’s entertainment centers market on the basis of revenue source?

- What is the breakup of the Indonesia children’s entertainment centers market on the basis of activity area?

- What is the breakup of the Indonesia children’s entertainment centers market on the basis of region?

- What are the various stages in the value chain of the Indonesia children’s entertainment centers market?

- What are the key driving factors and challenges in the Indonesia children’s entertainment centers market?

- What is the structure of the Indonesia children’s entertainment centers market and who are the key players?

- What is the degree of competition in the Indonesia children’s entertainment centers market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia children’s entertainment centers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia children’s entertainment centers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia children’s entertainment centers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)