Indonesia Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Indonesia Co-Working Office Space Market Overview:

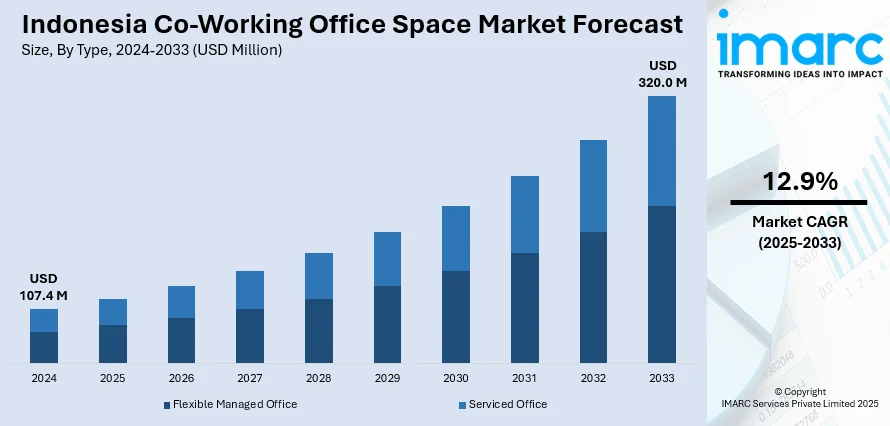

The Indonesia co-working office space market size reached USD 107.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 320.0 Million by 2033, exhibiting a growth rate (CAGR) of 12.9% during 2025-2033. The movement towards remote and hybrid work patterns is fueling the growth of the market in Indonesia. This, along with the fast-growing entrepreneurial and start-up ecosystem of Indonesia, is contributing significantly towards the development of the co-working office setups. Apart from this, government policies and initiatives to support the digital economy are expanding the Indonesia co-working office space market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 107.4 Million |

| Market Forecast in 2033 | USD 320.0 Million |

| Market Growth Rate (2025-2033) | 12.9% |

Indonesia Co-Working Office Space Market Trends:

Growing Use of Remote and Hybrid Work Patterns

The movement towards remote and hybrid work patterns is fueling the growth of the co-working office space market in Indonesia. Companies are embracing flexible work arrangements under which staff spend a portion of their worktime at home and the rest in the office. This increasing desire for flexibility is encouraging companies to view co-working spaces as good substitutes for conventional office setup. By offering an array of services, such as high-speed internet, meeting rooms, and community interaction, co-working offices are responding to the demands of professionals looking for flexibility in their work environments. With business houses curtailing the requirement for huge, long-term office areas, demand for short-term, flexible office arrangements is increasing and, therefore, co-working offices are becoming a viable choice for startups, small and medium-sized enterprises (SMEs), and freelancers. The market is consistently evolving as per this trend, providing tailor-made solutions for enterprises that seek to lower overhead expenses and enhance operational efficiency. In 2025, Nuanu, a new creative hub in Bali dedicated to community growth, revealed its partnership with SETTER, a top co-working space and smart office network in Bali, to initiate an architecture contest. The creative contest focuses on developing and crafting a premier co-working environment in Bali, intended to function as a center for creativity, teamwork, and motivation. The co-working space will include cutting-edge offices and work areas along with spots for creative pursuits, advanced podcast and video recording studios, and areas for relaxation.

To get more information on this market, Request Sample

Growth of Entrepreneurial and Start-up Ecosystem

The fast-growing entrepreneurial and start-up ecosystem of Indonesia is also contributing significantly towards the development of the co-working office spaces. As these spaces save money and are scalable, small business entrepreneurs prefer to operate from a co-working space as their principal location. Co-working spaces provide the perfect hub for new companies because they offer shared office infrastructure, networks, and business support services such as mentorship as well as collaboration with like-minded professionals. Indonesian start-ups, especially in urban areas such as Jakarta and Surabaya, are taking advantage of the vibrant working culture that shared workspaces create. As per StartupBlink, Jakarta ranks first in the startup ecosystem, comprising 80% startups present in Indonesia. This positioning of Jakarta is encouraging more companies to open their co-working spaces and cafes for people to collaborate and share ideas about businesses.

Government Policies and Support for Digital Economy

Government policies and initiatives to support the digital economy are bolstering the Indonesia co-working office space market growth. The government of Indonesia is actively encouraging digitalization in sectors and industries, with programs like the 100 Smart Cities program and the "100 Start-up Movement" taking the forefront. Moreover, as per the International Trade Administration, the nation’s digital economy is expected to hit $146 billion by 2025, fueled by swift advancements in artificial intelligence (AI), digital infrastructure, fintech, and software-as-a-service (SaaS) platforms. Because of this, the co-working space is increasingly seen as a strategic asset by businesses that want to access the digital economy. The prevalence of co-working offices tailored towards digital professionals with amenities like fast internet, technical support, and shared working areas is making these spaces more attractive. This increasing government emphasis on digital innovation is speeding up the demand for open and interactive office spaces, further driving the growth of the co-working office space industry in Indonesia.

Indonesia Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

The report has provided a detailed breakup and analysis of the market based on type. This includes flexible managed office and serviced office.

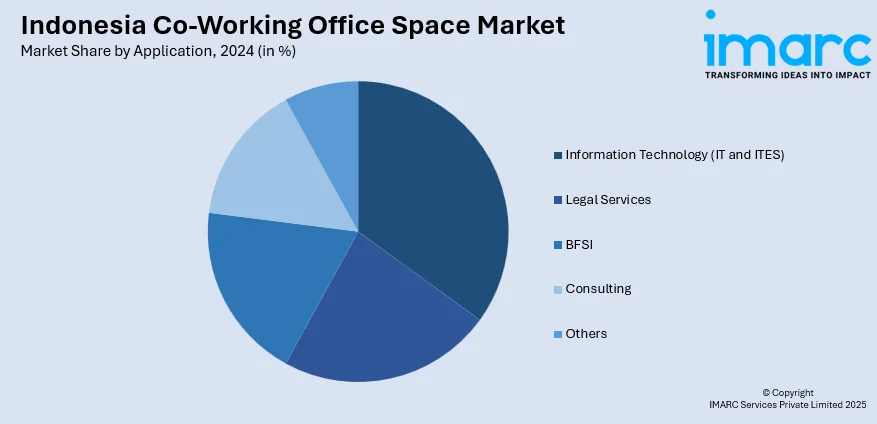

Application Insights:

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia co-working office space market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The co-working office space market in Indonesia was valued at USD 107.4 Million in 2024.

The Indonesia co-working office space market is projected to exhibit a CAGR of 12.9% during 2025-2033, reaching a value of USD 320.0 Million by 2033.

Key factors driving the Indonesia co-working office space market include rising demand from startups and freelancers, growing foreign direct investment, and increasing expansion of digital and creative industries. Additionally, rising business travel, flexible lease preferences, and the need for affordable, scale-up office solutions are boosting growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)