Indonesia Confectionery Market Size, Share, Trends and Forecast by Product Type, Age Group, Price Point, Distribution Channel, and Region, 2025-2033

Indonesia Confectionery Market Overview:

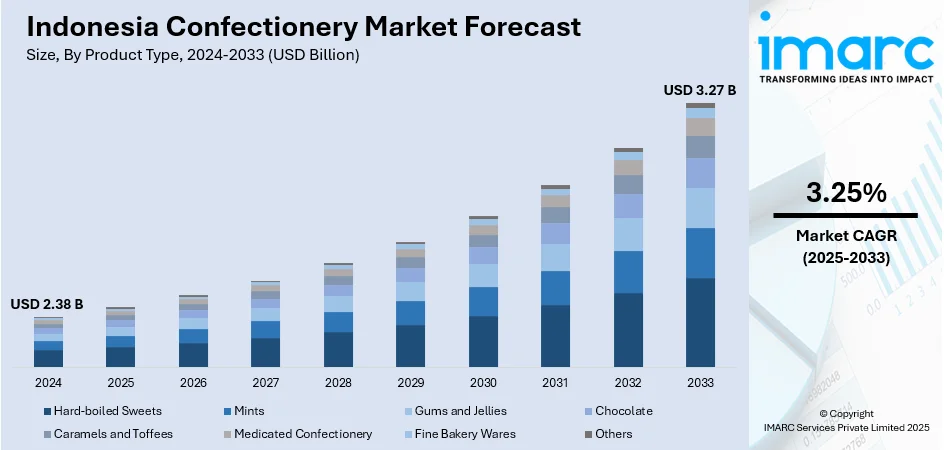

The Indonesia Confectionery market size reached USD 2.38 Billion in 2024. The market is projected to reach USD 3.27 Billion by 2033, exhibiting a growth rate (CAGR) of 3.25% during 2025-2033. The market is stimulated by growing urbanization, premium trends, and rising health awareness in consumers. Growing demand for localized tastes, functional ingredients, and treat formats is driving product innovation and retail diversification in urban areas. As consumers gravitate toward quality, wellness, and cultural significance in their confectionery consumption, the market continues to shift dynamically. With ongoing investments in product development and packaging, producers are actively competing for increasing Indonesia confectionery market share in the future years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.38 Billion |

| Market Forecast in 2033 | USD 3.27 Billion |

| Market Growth Rate 2025-2033 | 3.25% |

Indonesia Confectionery Market Trends:

Boosting Demand for Premium and Gourmet Confectionery

Increasingly wealthy and sophisticated Indonesian consumers are highly favoring premium and gourmet confectionery that provides distinctive taste experience, premium ingredients, and elegant packaging. As per the sources, in April 2025, Oreo introduced Space Dunk cookies in Southeast Asia, launching a cookie to space from Indonesia with Leo Indonesia to recreate the brand's most legendary dunk—into the Milky Way. Moreover, this has been witnessed among middle- and upper-class urban consumers looking for indulgent confectionery that fits into their changing lifestyle trends. Handcrafted chocolates, single-origin products, and limited-edition flavorings are gaining prominence in upscale retail outlets and specialty stores. Such offerings tend to highlight craftmanship, origin authenticity, and natural ingredients, indicative of the move toward more aware and quality-driven consumption. In addition, gifting culture and festivities are strengthening the appeal of luxury confectionery goods, particularly during festive seasons like Ramadan, Christmas, and Lunar New Year. Consequently, Indonesia confectionery market growth is being increasingly powered by product positioning innovation and high expectations for sophistication in both taste and presentation from consumers.

To get more information on this market, Request Sample

Health and Wellness Driving Product Reformulation

Healthy consumption is at the forefront of driving the transformation of the confectionery market in Indonesia. There is growing consumer interest in sugar-free, sugar-reduced, and plant-based variants that fit within wellness goals without sacrificing taste. There is a visible growth of functional confectionery products that include ingredients like probiotics, collagen, and vitamins. Healthier products are most sought after by younger generations as well as working professionals who want indulgence as well as nutrition. Clean-label ingredients and transparent sourcing are also becoming increasingly relevant as part of more extensive mindful consumption efforts. This change is reinforced by national health initiatives promoting lower sugar consumption and healthier eating, also impacting buying behavior. The use of superfoods and natural sweeteners is becoming more of a norm among trend-setting brands. These new Indonesia confectionery market trends indicate a shift to inclusivity in indulgence with health-anchored innovation fueling diversification of the portfolio across product lines. For instane, in April 2025, FLOR from ISMAYA Group launched its 24/Chiffon cake series in Jakarta, offering light, flavorful chiffon cakes in four flavors, combining nostalgia, sophistication, and contemporary dessert appeal.

Cultural Integration and Localized Flavor Preferences

Indonesia's rich cultural heritage and diverse regional palates are significantly influencing the development of localized and culturally inspired confectionery products. Manufacturers are increasingly incorporating traditional ingredients such as pandan, coconut, gula melaka (palm sugar), durian, and ginger into modern confectionery formats like chocolates, hard candies, and chewy sweets. These locally adapted flavors resonate well with consumers who seek nostalgic or culturally relevant taste experiences while enjoying contemporary treats. In addition, seasonal products throughout religious and national celebrations continue to influence consumer participation, with brands crafting products inspired by Indonesian tradition and aesthetics. The cultural connection strengthens brand loyalty and enhances product differentiation in a competitive market. Further, cross-cultural culinary influences are also gaining traction, with hybrid flavor profiles of Indonesian and international characteristics. This intensifying emphasis on cultural authenticity and narrative-driven flavor experiences is developing emotional resonance and shopper interest, further driving Indonesia confectionery market innovation and growth in the Indonesian confectionery market.

Indonesia Confectionery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, age group, price point, and distribution channel.

Product Type Insights:

- Hard-boiled Sweets

- Mints

- Gums and Jellies

- Chocolate

- Caramels and Toffees

- Medicated Confectionery

- Fine Bakery Wares

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes hard-boiled sweets, mints, gums and jellies, chocolate, caramels and toffees, medicated confectionery, fine bakery wares, and others.

Age Group Insights:

- Children

- Adult

- Geriatric

A detailed breakup and analysis of the market based on the age group have also been provided in the report. This includes children, adult, and geriatric.

Price Point Insights:

- Economy

- Mid-range

- Luxury

The report has provided a detailed breakup and analysis of the market based on the price point. This includes economy, mid-range, and luxury.

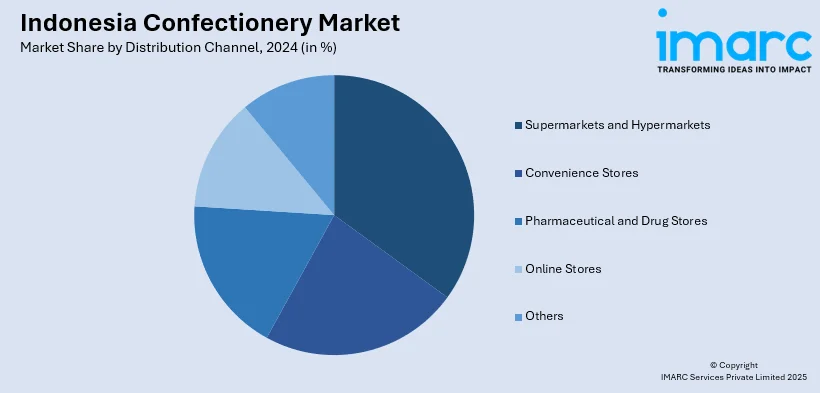

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Pharmaceutical and Drug Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, pharmaceutical and drug stores, online stores, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Confectionery Market News:

- In October 2024 — Cargill opened a new cocoa manufacturing line at its Gresik facility in Indonesia to cater to increasing demand in Asia for indulgent food. The expansion allows for tailored cocoa powders and liquors for bakery, confectionery, and beverages, enhancing Cargill's "Asia for Asia" innovation and supply strength.

- In August 2024, Indomilk FnB Solutions launched Indomilk Good Milk UHT and Australian Butter Baking at the Dessert Omakase launch in Jakarta. These dairy products are formulated to bring better flavor, texture, and aroma to high-end bakery and dessert offerings, complementing Indonesia's developing food service and artisanal confectionery markets.

Indonesia Confectionery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Hard-Boiled Sweets, Mints, Gums and Jellies, Chocolate, Caramels and Toffees, Medicated Confectionery, Fine Bakery Wares, Others |

| Age Groups Covered | Children, Adult, Geriatric |

| Price Points Covered | Economy, Mid-Range, Luxury |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Pharmaceutical and Drug Stores, Online Stores, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia Confectionery market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia confectionery market on the basis of product type?

- What is the breakup of the Indonesia confectionery market on the basis of age group?

- What is the breakup of the Indonesia confectionery market on the basis of price point?

- What is the breakup of the Indonesia confectionery market on the basis of distribution channel?

- What is the breakup of the Indonesia confectionery market on the basis of region?

- What are the various stages in the value chain of the Indonesia confectionery market?

- What are the key driving factors and challenges in the Indonesia confectionery market?

- What is the structure of the Indonesia confectionery market and who are the key players?

- What is the degree of competition in the Indonesia confectionery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia confectionery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia confectionery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia confectionery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)