Indonesia Data Center Market Size, Share, Trends and Forecast by Data Center Size, Tier Type, Absorption, and Region, 2026-2034

Indonesia Data Center Market Size and Share:

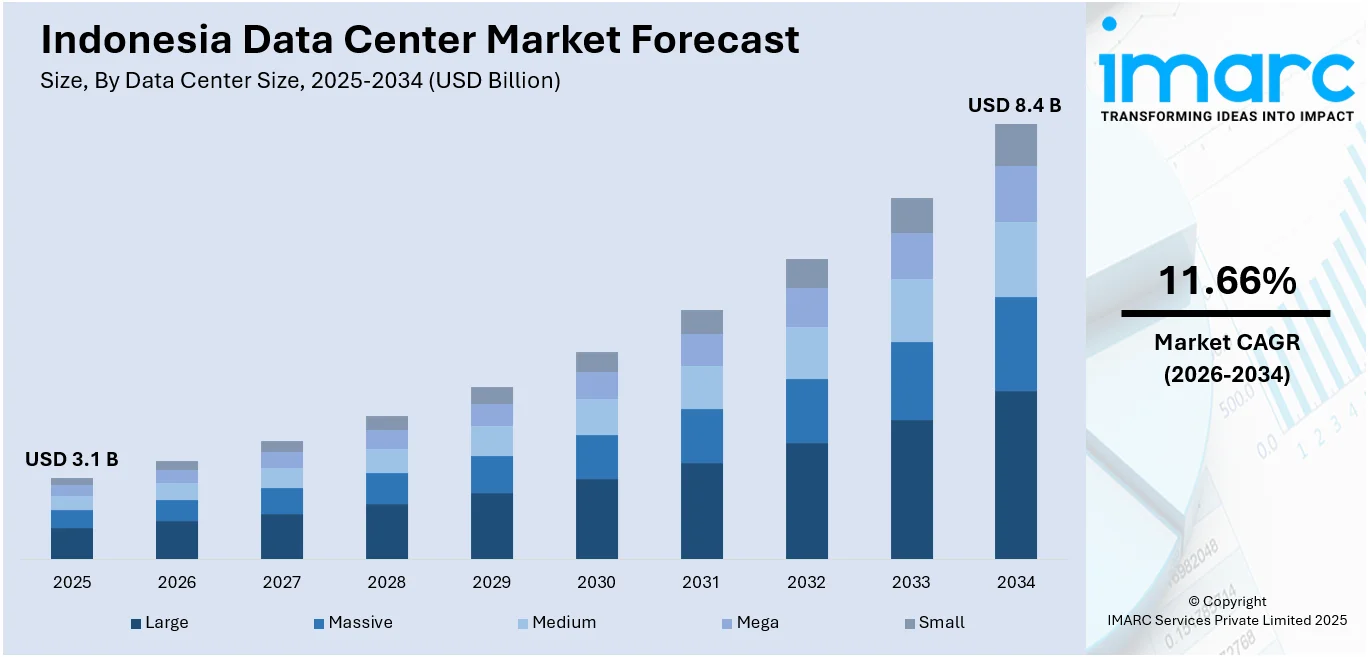

Indonesia data center market size reached USD 3.1 Billion in 2025. The market is expected to reach USD 8.4 Billion by 2034, exhibiting a growth rate (CAGR) of 11.66% during 2026-2034. The market growth is attributed to the growing need for reliable connectivity and data access due to the increasing popularity of remote work culture, rising adoption of cloud computing services, and increasing concerns about data security and privacy.

Market Insights:

- Based on region, the market is divided into Java, Sumatra, Kalimantan, Sulawesi, and others.

- On the basis of data center size, the market is categorized as large, massive, medium, mega, and small.

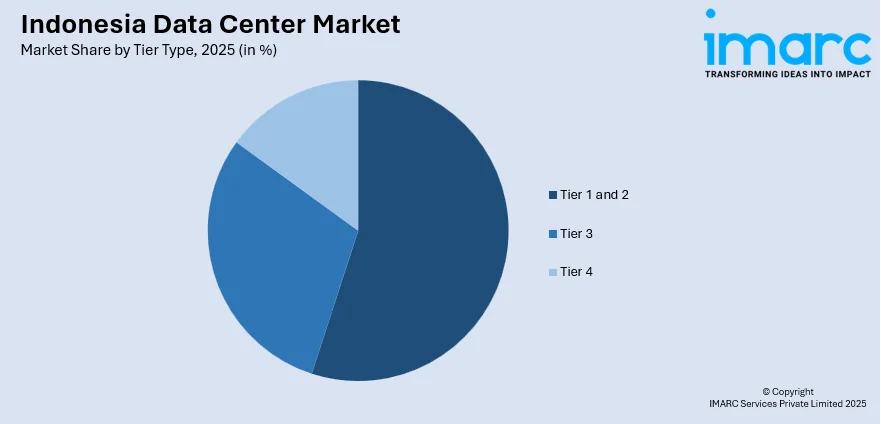

- Based on tier type, the market is segmented into tier 1 and 2, tier 3, and tier 4.

- On the basis of absorption, the market is categorized as non-utilized and utilized.

Market Size and Forecast:

- 2025 Market Size: USD 3.1 Billion

- 2034 Projected Market Size: USD 8.4 Billion

- CAGR (2026-2034): 11.66%

A data center is a vital component in information technology (IT) operations. It is equipped with advanced cooling, power supply, and redundancy systems to guarantee uninterrupted service and safeguard against potential downtime. It is a purpose-built facility that is designed to house and manage critical computer systems, servers, storage devices, networking equipment, and associated components of an organization. It ensures the availability, security, and seamless functioning of vast amounts of data and applications that improve business operations. It supports cloud computing, data storage, and processing, which makes it a vital asset for businesses seeking to thrive in the digital age. It offers redundant power supplies, backup generators, and advanced cooling systems to ensure that servers and critical infrastructure remain operational even during power outages or equipment failures. It allows businesses to easily expand their IT resources by adding more servers or storage capacity within the data center environment. It also enables organizations to adapt to changing business needs without the cost and complexity of building new facilities. It eliminates the need for individual server rooms in multiple locations and reduces infrastructure and maintenance costs. As it allows companies to run resource-intensive applications and process large volumes of data quickly and efficiently, the demand for data centers is rising in Indonesia.

To get more information on this market Request Sample

At present, the growing demand for data centers, as they offer advanced disaster recovery and backup solutions, represents one of the major factors influencing the market positively in Indonesia. In addition, the rising adoption of data centers, as they provide a secure and compliant environment for sensitive data, is bolstering the market growth in the country. Apart from this, the escalating demand for advanced data center infrastructures to support the increasing data and computing requirements is offering a favorable Indonesia data center market outlook. Additionally, the rising adoption of cloud computing services in Indonesia is offering lucrative growth opportunities to industry investors. Moreover, the increasing utilization of data centers to extract valuable insights from the Internet of Things (IoT) devices is contributing to the market growth in the country. Besides this, there is a rise in the demand for energy-efficient data centers that benefit in reducing operating costs and maintaining environmental sustainability. This, coupled with increasing concerns about data security and privacy, is impelling the market growth in the country. In line with this, the rising need for reliable connectivity and data access due to the increasing popularity of remote work culture is strengthening the market growth in Indonesia.

Indonesia Data Center Market Trends:

Surge in Hyperscale and Cloud Demand

The market is witnessing a significant shift towards hyperscale infrastructure, propelled by the increasing demand for cloud computing, digital services, and enterprise digitalization. As local and regional businesses adopt cloud-first strategies, demand for high-density, scalable, and low-latency infrastructure is rising. Global cloud service providers increasingly rely on large-scale data centers to deliver reliable performance, driving investments into facilities offering 10 MW+ IT load capacities. Moreover, regulatory requirements around data sovereignty further accelerate local deployment, encouraging foreign hyperscalers to partner with local developers or establish direct presence. These hyperscale facilities prioritize modular designs, AI-enabled power and cooling optimization, and direct connectivity to international subsea cables. Apart from this, the increasing use of AI, big data, and high-performance computing workloads also necessitates custom-built hyperscale campuses with greater power redundancy and automation. Consequently, this trend is facilitating the Indonesia data center market growth, compelling operators to shift from legacy enterprise models toward next-generation, cloud-centric architectures capable of serving both global and domestic hyperscale clients.

Emphasis on Sustainability and Green Infrastructure

Sustainability has emerged as a defining trend in the market, fueled by both environmental responsibility and the economic advantages of efficient energy use. Operators are integrating renewable energy sources, such as solar and hydropower, into their designs to meet both corporate ESG targets and client sustainability mandates. Besides that, innovations in cooling, ranging from liquid and immersion cooling to advanced airflow management systems, are being adopted to reduce Power Usage Effectiveness (PUE) and operational emissions. Also, green certifications are increasingly pursued to enhance credibility and appeal to environmentally conscious customers. Furthermore, the Indonesian government is also offering incentives for green data center development, including policies tied to its national carbon neutrality goals. This, in turn, is augmenting the Indonesia data center market share. As hyperscale demand intensifies, green infrastructure is not just a differentiator but a necessity, particularly for global clients requiring transparency in energy sourcing. This trend is compelling data center operators to rethink power procurement, facility design, and operational processes for long-term sustainability.

Indonesia Data Center Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on data center size, tier type, and absorption.

Data Center Size Insights:

- Large

- Massive

- Medium

- Mega

- Small

The report has provided a detailed breakup and analysis of the market based on the data center size. This includes large, massive, medium, mega, and small.

Tier Type Insights:

Access the comprehensive market breakdown Request Sample

- Tier 1 and 2

- Tier 3

- Tier 4

A detailed breakup and analysis of the market based on the tier type have also been provided in the report. This includes tier 1 and 2, tier 3, and tier 4.

Absorption Insights:

- Non-Utilized

- Utilized

The report has provided a detailed breakup and analysis of the market based on the absorption. This includes non-utilized and utilized.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The competitive landscape of the market is evolving rapidly, driven by increasing demand for cloud services, digital transformation initiatives, and data localization regulations. The market competition is intensifying as both established and emerging players expand their infrastructure and service offerings. Most facilities are concentrated in the Greater Jakarta area, but new developments are emerging in regions like Batam and West Java to leverage strategic connectivity and lower operational costs. In addition to this, operators are differentiating through scalability, energy efficiency, and advanced cooling technologies to meet rising enterprise and hyperscale demand. Moreover, ley competitive factors include compliance with international standards, availability of reliable power and connectivity, and environmental sustainability practices. Additionally, the surge in AI, edge computing, and IoT is prompting investments in smaller, decentralized data centers. Regulatory support and strong demand from sectors like finance, e-commerce, and telecommunications are further shaping a dynamic, opportunity-rich, and innovation-driven competitive environment.

Latest News and Developments:

- July 2025: Anaplan announced the launch of a new data center in Indonesia, marking a significant expansion of its Asia‑Pacific infrastructure to support local businesses with enhanced planning capabilities. The facility is part of Anaplan’s USDD 500 Million multi‑year investment aimed at enabling real‑time decision‑making, improved data security, and regulatory compliance through local data residency. This expansion is supporting the growth of the data center market in Indonesia.

- June 2025: DCI Indonesia inaugurated its eighth data centre, named JK6, at the H1 Campus in Cibitung, east of Jakarta. The facility offers 36 MW of capacity and is described by the company as the single largest data centre ever built in Indonesia, featuring AI‑ready infrastructure including liquid‑cooling to support high‑density workloads. With JK6 now operational, DCI’s total installed capacity reaches 119 MW, reinforcing its status as Indonesia’s largest data centre operator.

- June 2025: Edgnex Data Centers announced a USD 2.3 Billion investment to build a 144 MW AI‑ready data centre in Jakarta, Indonesia. The facility targets high‑density AI rack capacity, energy efficiency with a projected PUE of 1.32, and is intended to support low‑latency cloud and AI services while addressing Indonesia’s infrastructure gap. This marks Edgnex’s second project in Indonesia and forms part of its broader strategy to reach over 300 MW of operational capacity across Southeast Asia by 2026.

- July 2024: BDx Indonesia, a joint venture formed by BDx Data Centers, Indosat Ooredoo Hutchison, and Lintasarta, completed Phase One of its CGK4 AI campus in Jatiluhur, marking the launch of Indonesia’s first AI-ready data center park powered by renewable energy and designed for scalability up to 500 MW. The initial phase provides approximately 70 MW of white space, featuring high power density capabilities of up to 120 kW per rack, advanced liquid-cooling systems, ultra-fast connectivity, eight-tier physical security measures, and Nvidia DGX-Ready certification.

Indonesia Data Center Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Data Center Sizes Covered | Large, Massive, Medium, Mega, Small |

| Tier Types Covered | Tier 1 and 2, Tier 3, Tier 4 |

| Absorptions Covered | Non-Utilized, Utilized |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia data center market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia data center market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia data center industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The data center market in Indonesia was valued at USD 3.1 Billion in 2025.

The Indonesia data center market is projected to exhibit a CAGR of 11.66% during 2026-2034, reaching a value of USD 8.4 Billion by 2034.

The market is driven by growing demand for cloud services, increased digital activity, and rising enterprise data requirements. Businesses are seeking secure and scalable infrastructure, while governments emphasize data localization. Favorable land availability and power access support large-scale setups. Investment in digital transformation is prompting both domestic and international players to expand storage capacity and speed.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)