Indonesia Diabetes Drugs Market Size, Share, Trends and Forecast by Type, Distribution Channel, and Region, 2026-2034

Indonesia Diabetes Drugs Market Size and Share:

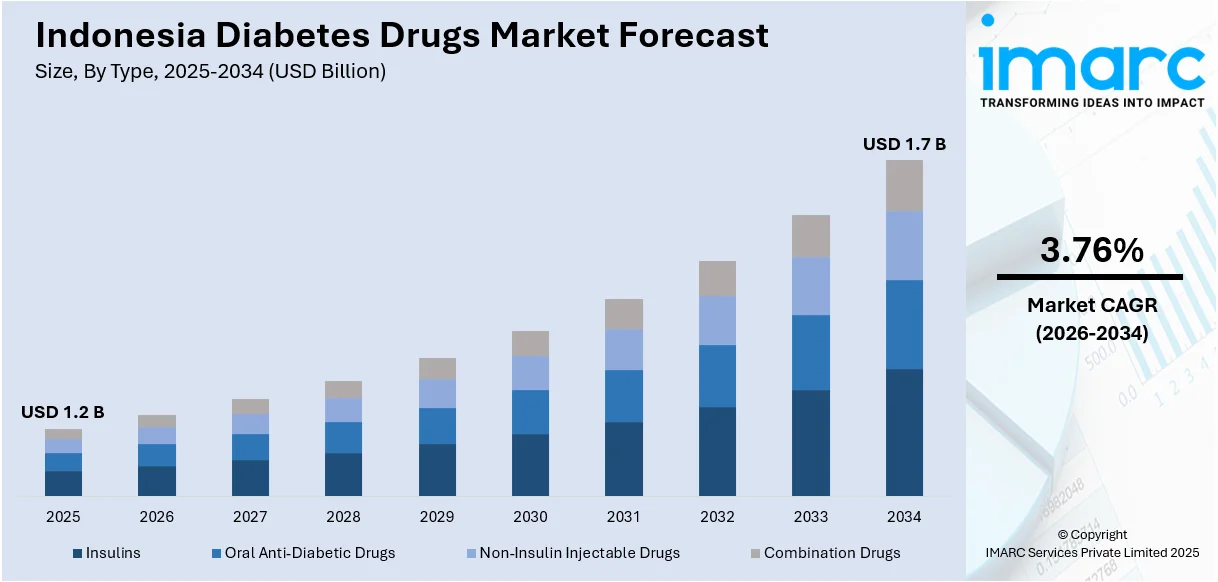

The Indonesia diabetes drugs market size reached USD 1.2 Billion in 2025. The market is expected to reach USD 1.7 Billion by 2034, exhibiting a growth rate (CAGR) of 3.76% during 2026-2034. The market growth is attributed to increasing diabetes prevalence across the population, rising healthcare expenditure, increasing awareness and education through public campaigns, rapid urbanization and westernization, and expanding health insurance coverage regulatory compliance.

Market Insights:

- On the basis of region, the market is divided into Java, Sumatra, Kalimantan, Sulawesi, and Others

- Based on types, the market is segmented into insulins, oral anti-diabetic drugs, non-insulin injectable drugs, and combination drugs

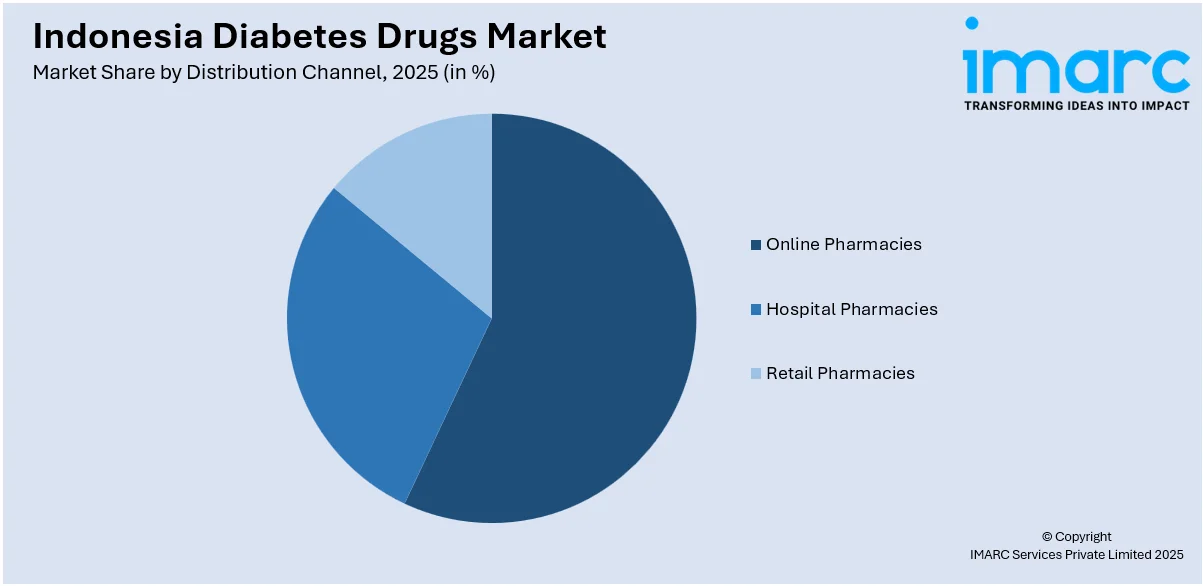

- On the basis of distribution channels, the market is categorized as online pharmacies, hospital pharmacies, and retail pharmacies

Market Size and Forecast:

- 2025 Market Size: USD 1.2 Billion

- 2034 Projected Market Size: USD 1.7 Billion

- CAGR (2026-2034): 3.76%

Diabetes drugs, also known as antidiabetic medications, are pharmaceutical substances designed to manage and control diabetes mellitus. These medications play a crucial role in helping individuals with diabetes regulate their blood sugar levels and minimize the associated health risks. There are several classes of diabetes drugs, each with its unique mechanism of action. One common class is oral antidiabetic drugs, which are taken by mouth in the form of pills or tablets. These include metformin, sulfonylureas, and DPP-4 inhibitors. Metformin, for example, works by reducing the liver's glucose production and increasing insulin sensitivity in the cells of the body. Another class consists of injectable medications such as insulin and GLP-1 receptor agonists. Insulin is essential for individuals with type 1 diabetes and may also be necessary for those with type 2 diabetes who cannot manage their blood sugar adequately with oral medications alone. SGLT-2 inhibitors and thiazolidinediones are additional classes of diabetes drugs that work by targeting specific mechanisms in the body to help lower blood sugar levels.

To get more information on this market Request Sample

One of the primary drivers of the diabetes drugs market in Indonesia is the alarming increase in the prevalence of diabetes. Factors, such as sedentary lifestyles, changing dietary habits, and a growing aging population, have contributed to a higher incidence of both type 1 and type 2 diabetes. Additionally, as the economy of Indonesia grows, so does the disposable income of its population. This has led to increased healthcare spending, including on medications for chronic conditions like diabetes. The Indonesia diabetes drugs market growth trajectory is supported by improved access to healthcare services and medications has escalated the demand for diabetes drugs. Other than this, public awareness campaigns and educational initiatives by both the government and non-governmental organizations have played a vital role in educating Indonesians about diabetes. As awareness grows, more individuals are seeking medical attention and appropriate medications for diabetes management. Besides this, expanding health insurance coverage, both through government schemes and private insurers, has made it easier for individuals to access diabetes medications and healthcare services. This has removed financial barriers to treatment. In line with this, Indonesia is undergoing an epidemiological transition, with a shift from infectious diseases to non-communicable diseases like diabetes. This transition places a greater emphasis on chronic disease management, including diabetes, and drives the market for related drugs. This, in tun, enhances the Indonesia diabetes drugs market outlook. Furthermore, advancements in diabetes treatment options, including new drug formulations and delivery systems, have improved the effectiveness and convenience of diabetes management. These innovations have encouraged patients to adhere to treatment regimens.

Indonesia Diabetes Drugs Market Trends:

Digital Health Integration and Telemedicine Adoption

The landscape of diabetes care in Indonesia is being transformed by the increasing use of digital health solutions and telemedicine. Healthcare providers are adopting digital monitoring devices, including remote patient management and real-time monitoring of glucose, that facilitate patient care outside the clinic setting. These interventions have been particularly useful throughout Indonesia's vast archipelago, where healthcare access can be challenging in distant areas. Through telemedicine platforms, physicians are able to write and track diabetes medication more effectively, adjusting treatment plans to suit the individual needs of each patient. The Indonesia diabetes drugs market report shows that telemedicine is accelerating consultations, reducing travel time and expenses for patients. Additionally, mobile health apps are providing patients with functional assistance in the form of reminders, dose monitoring, and educational materials. This digital transformation is also creating new possibilities for pharmaceutical manufacturers, from networked drug delivery devices to smart insulin pens that communicate with digital platforms, thereby positively influencing treatment compliance and patient results.

Biosimilar Insulin Market Expansion

The growth of biosimilar insulin is transforming the market as health systems demand cheaper alternatives without compromising on quality. Biosimilar adoption in Indonesia has been a major driver of government measures aimed at reducing healthcare expenditures, increasing accessibility of insulin therapy via public and private outlets. High-quality biosimilar regulatory approvals have proven to be as safe and effective as branded products. This, in turn, is driving competition and expanding patient access, thus driving Indonesia diabetes drugs market growth. With clinical evidence still supporting their reliability, healthcare professionals are increasingly at ease prescribing such alternatives. Apart from this, the market is poised for further expansion as more biosimilars penetrate the market and physician education initiatives gain awareness. This change is especially relevant to Indonesia's universal healthcare system, as it has to strike a balance between increasing demand for diabetes treatment and the ability to control drug purchasing costs.

Growth, Opportunities, and Challenges in the Indonesia Diabetes Drugs Market:

- Growth Drivers: The market is propelled by the rapidly increasing prevalence of diabetes, driven by urbanization, sedentary lifestyles, and dietary changes among the population. Rising healthcare expenditure and improved access to medical facilities across the archipelago are facilitating greater medication accessibility. Government initiatives to expand universal health insurance coverage through programs like Jaminan Kesehatan Nasional (JKN) have significantly reduced financial barriers in diabetes drugs market in Indonesia. Public awareness campaigns and educational programs are encouraging early diagnosis and consistent medication adherence among diabetic patients.

- Market Opportunities: The expanding telemedicine and digital health platforms present significant opportunities for innovative drug delivery and patient monitoring systems in Indonesia's geographically dispersed market. Development of affordable biosimilar insulin products offers substantial market penetration opportunities, particularly in price-sensitive segments of the healthcare system. Rural and underserved areas represent untapped markets where improved distribution networks and mobile health initiatives could dramatically expand patient reach.

- Market Challenges: According to the Indonesia diabetes drugs market forecast, the country’s complex regulatory environment and lengthy drug approval processes continue to pose significant barriers for new market entrants and innovative diabetes medications. The fragmented healthcare infrastructure across thousands of islands creates substantial logistical challenges for consistent drug distribution and availability. Price sensitivity among patients and pressure from government healthcare programs to contain costs limit premium pricing strategies for advanced diabetes treatments. Limited healthcare professional awareness about newer diabetes medications and treatment protocols restricts adoption of innovative therapeutic options.

Indonesia Diabetes Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type and distribution channel.

Type Insights:

- Insulins

- Basal or Long Acting Insulins

- Bolus or Fast Acting Insulins

- Traditional Human Insulins

- Biosimilar Insulins

- Oral Anti-Diabetic Drugs

- Biguanides

- Alpha-Glucosidase Inhibitors

- Dopamine D2 Receptor Agonist

- SGLT-2 Inhibitors

- DPP-4 Inhibitors

- Sulfonylureas

- Meglitinides

- Non-Insulin Injectable Drugs

- GLP-1 Receptor Agonists

- Amylin Analogue

- Combination Drugs

- Insulin Combinations

- Oral Combinations

The report has provided a detailed breakup and analysis of the market based on the type. This includes insulins (basal or long acting insulins, bolus or fast acting insulins, traditional human insulins, and biosimilar insulins), oral anti-diabetic drugs (biguanides, alpha-glucosidase inhibitors, dopamine D2 receptor agonist, SGLT-2 inhibitors, DPP-4 inhibitors, sulfonylureas, and meglitinides), non-insulin injectable drugs (GLP-1 receptor agonists and amylin analogue), and combination drugs (insulin combinations and oral combinations).

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online Pharmacies

- Hospital Pharmacies

- Retail Pharmacies

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online pharmacies, hospital pharmacies, and retail pharmacies.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- September 2025: Daewoong Pharmaceutical Indonesia (DPI) has achieved Good Manufacturing Practice (GMP) certification for its stem cell, natural killer (NK) cell, and exosome therapies, marking a significant advancement in the nation's cell therapy sector. This certification underscores DPI's commitment to adhering to international quality standards in the production of regenerative medicine. The facility's capabilities are poised to enhance Indonesia's position in the global biopharmaceutical landscape.

- December 2024: Recce Pharmaceuticals announced that it had received approval from Indonesia's Badan POM to initiate a Phase 3 clinical trial for RECCE® 327 (R327G), a topical gel designed to treat diabetic foot infections (DFIs). This trial follows promising results from earlier Phase I/II studies, where R327G demonstrated high efficacy and safety in treating mild skin and soft tissue DFIs. The Phase 3 trial aims to further evaluate the gel's effectiveness and support its potential registration in Indonesia.

- October 2024: LeaderMed Group and Combiphar have entered into a joint venture to initiate a Phase 3 clinical trial for LM-008, a novel GLP-1 dual agonist, in Indonesia. The partnership seeks to address the country’s growing diabetes and obesity challenges, which currently affect more than 36 Million individuals. The initiative has received guidance from the Indonesian Ministry of Health regarding accelerated approval pathways for LM-008. The Phase 3 trial is anticipated to commence in late 2024, marking a significant step in advancing innovative treatments for metabolic disorders in the region.

Indonesia Diabetes Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered |

|

| Distribution Channels Covered | Online Pharmacies, Hospital Pharmacies, Retail Pharmacies |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia diabetes drugs market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia diabetes drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia diabetes drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The diabetes drugs market in Indonesia was valued at USD 1.2 Billion in 2025.

The Indonesia diabetes drugs market is projected to exhibit a CAGR of 3.76% during 2026-2034, reaching a value of USD 1.7 Billion by 2034.

Key factors driving the Indonesia diabetes drugs market include the rising prevalence of diabetes due to lifestyle changes, an aging population, and increased urbanization. Additionally, growing awareness about diabetes management, advancements in drug formulations, and implementation of government policies to enhance healthcare access contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)