Indonesia Drones Market Size, Share, Trends and Forecast by Type, Component, Payload, Point of Sale, End-Use Industry, and Region, 2025-2033

Indonesia Drones Market Overview:

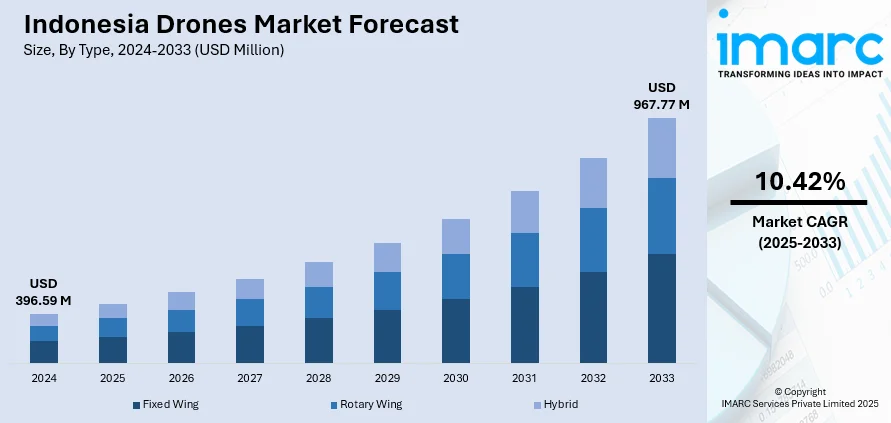

The Indonesia drones market size reached USD 396.59 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 967.77 Million by 2033, exhibiting a growth rate (CAGR) of 10.42% during 2025-2033. The market is fueled by the growing demand in agriculture, infrastructure, defense, and logistics industries. Digital transformation and smart farming push by the government is also boosting adoption, while indigenous drone producers and startups are growing to cater to domestic demand. As AI integration and autonomous capabilities become the norm, Indonesia is rapidly transforming into a competitive player in Southeast Asia, further increasing the Indonesia drones market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 396.59 Million |

| Market Forecast in 2033 | USD 967.77 Million |

| Market Growth Rate 2025-2033 | 10.42% |

Indonesia Drones Market Trends:

Fast Growth of Precision Agriculture with Locally Adapted Solutions

Indonesia's drone industry is witnessing strong expansion, particularly in agriculture where precision farming is becoming ever more crucial. Rice paddies and vast palm oil estates are using drones with multispectral and thermal imaging capabilities, allowing for precise identification of crop stress, irrigation tracking, and pest detection beyond human eyesight. Operators are adopting drone‑as‑a‑service (DaaS) models to bypass steep initial investments—enabling smallholder farmers on islands such as Sumatra, Java, and Sulawesi to enjoy advanced drones at minimal investment. Such service models are frequently packaged with farm management software platforms that capture real‑time field insights, correlating drone images to soil sensors and yield forecast tools. This combination enables data‑based decisions to enhance input effectiveness and lower dependency on labor in rural areas striving for food security. Drones have been used in Indonesia's agricultural economy to tally palm oil palms, survey enormous tracts of plantation land, and conduct selective spraying, which are efforts that substantially reduce operation risk in remote, scattered areas of farming and ensure export quality standards, while consequently contributing to the Indonesia drones market growth.

To get more information on this market, Request Sample

Indigenous Innovation and Government‑Supported Ecosystem Building

Local drone manufacturers are picking up pace as Indonesia prepares to emerge as a Southeast Asian drone innovation hub. Bandung's BETA‑UAS, established by local engineering alumni, is developing drones for uses from aerial mapping to cargo shipment, energy infrastructure inspection, emergency response, and government use in new capital region development. Simultaneously, local academic and technology institutions, such as national research institutions and PT Dirgantara Indonesia, are working on a national UAV fleet such as Elang Hitam and PUNA series models designed for surveillance, mapping, and defense purposes. These initiatives are facilitated by collaborative networks among academia, startups, and government ministries aiming to keep IP and localize part sourcing. To kick-start the local economy, governments are providing tax relief, reduced licensing, and export promotion, while also promoting foreign investment and enhancing domestic industry competitiveness.

Defense‑Focused AI and High‑Quality Drone Market Transformation

Indonesia's strategic and military imperatives are driving a change toward high-end unmanned systems coupled with AI technologies. The military is investing in autonomous‑capable drones, modular payloads for surveillance, electronic warfare, deep strikes, and swarm‑capable architectures for networked operations. Cooperations with foreign companies have enabled foreign models such as Turkish Anka and Bayraktar systems to be assembled domestically, along with technology transfer to actors such as PT DI. This strategy speeds up local development of loyal-wingman and stealth UAV systems, with fewer imports. Defense officials are also urging the development of drones with vertical takeoff and landing (VTOL) capability to operate in Indonesia's challenging topography, from compact archipelagos to mountainous border areas. At the same time, domestic companies like PT Vertikal Teknologi Inovasi are raising funds to develop AI‑driven reconnaissance and propulsion platforms for civilian and military purposes, propelling Indonesia toward a future when it will be able to export intelligent drone platforms within the region.

Indonesia Drones Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, component, payload, point of sale, and end-use industry.

Type Insights:

- Fixed Wing

- Rotary Wing

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the type. This includes fixed wing, rotary wing, and hybrid.

Component Insights:

- Hardware

- Software

- Accessories

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and accessories.

Payload Insights:

- <25 Kilograms

- 25-170 Kilograms

- >170 Kilograms

A detailed breakup and analysis of the market based on the payload have also been provided in the report. This includes <25 kilograms, 25-170 kilograms, and >170 kilograms.

Point of Sale Insights:

- Original Equipment Manufacturers (OEM)

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the point of sale. This includes original equipment manufacturers (OEM) and aftermarket.

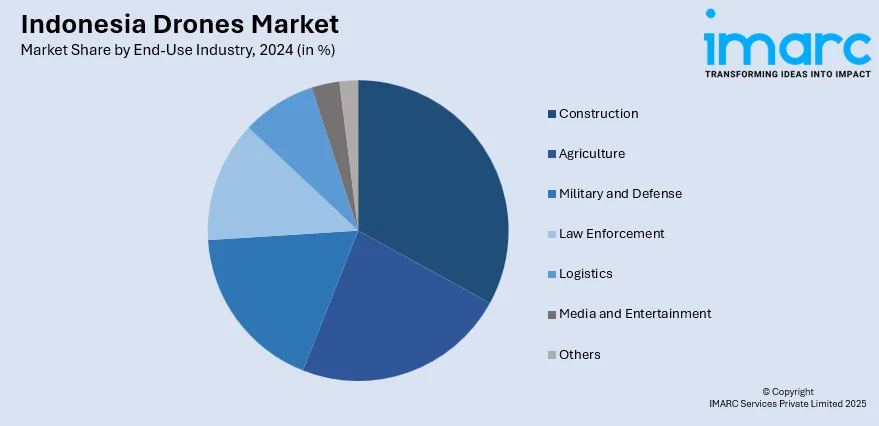

End-Use Industry Insights:

- Construction

- Agriculture

- Military and Defense

- Law Enforcement

- Logistics

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, agriculture, military and defense, law enforcement, logistics, media and entertainment, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which includes Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Drones Market News:

- In May 2025, Terra Drone Corporation, the top drone service provider, revealed that its subsidiary, Terra Drone Indonesia, has partnered with advanced materials developer Midwest Composites to co-create a drone airframe cover designed for agricultural application in the palm oil sector. After development, the cover has now officially begun its deployment in the field. The item substitutes traditional plastic coverings and is composed of a bio-composite material that can lower CO₂ emissions during production by as much as 73.2%. It provides excellent durability, even in the demanding agricultural conditions of tropical areas, resulting in reduced environmental impact and consistent field performance.

- In June 2025, Exail Technologies was chosen by the Indonesian Navy to supply various robotic systems for its underwater mine countermeasure initiative. The navy will obtain a next-generation system that includes both surface and underwater drones from UMIS, as reported. Exail states that this agreement constitutes a highly important order, comparable in magnitude to the one obtained in the United Arab Emirates in 2024.

- In February 2025, Indonesia was the first to obtain a new advanced drone, the Bayraktar TB3, from the Turkish defense firm Baykar. Turkish defense company Baykar's Bayraktar drones will be exported to Indonesia under a deal made between Baykar and the Indonesian defense firm Republikorp.

- In July 2025, Indonesia stood on the verge of a significant naval advancement, as Jakarta considered an audacious plan to purchase and repurpose Italy’s decommissioned aircraft carrier, the ITS Giuseppe Garibaldi (C-551), into a specialized warship for drone and helicopter operations—an action that could significantly alter the dynamics of maritime authority in the South China Sea. In mid-July 2025, a high-ranking delegation from Italy's Fincantieri shipbuilding group arrived in Jakarta for important discussions, submitting an official proposal to the Indonesian Ministry of Defence to transform the 13,850-ton warship into a versatile naval platform tailored for unmanned aerial systems (UAS) and rotary-wing operations.

Indonesia Drones Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fixed Wing, Rotary Wing, Hybrid |

| Components Covered | Hardware, Software, Accessories |

| Payloads Covered | <25 Kilograms, 25-170 Kilograms, >170 Kilograms |

| Points of Sales Covered | Original Equipment Manufacturers (OEM), Aftermarket |

| End-Use Industries Covered | Construction, Agriculture, Military and Defense, Law Enforcement, Logistics, Media and Entertainment, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia drones market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia drones market on the basis of type?

- What is the breakup of the Indonesia drones market on the basis of component?

- What is the breakup of the Indonesia drones market on the basis of payload?

- What is the breakup of the Indonesia drones market on the basis of point of sale?

- What is the breakup of the Indonesia drones market on the basis of end-use industry?

- What is the breakup of the Indonesia drones market on the basis of region?

- What are the various stages in the value chain of the Indonesia drones market?

- What are the key driving factors and challenges in the Indonesia drones market?

- What is the structure of the Indonesia drones market and who are the key players?

- What is the degree of competition in the Indonesia drones market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia drones market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia drones market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia drones industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)