Indonesia E-Commerce Market Size, Share, Trends and Forecast by Type, and Region, 2026-2034

Indonesia E-Commerce Market Summary:

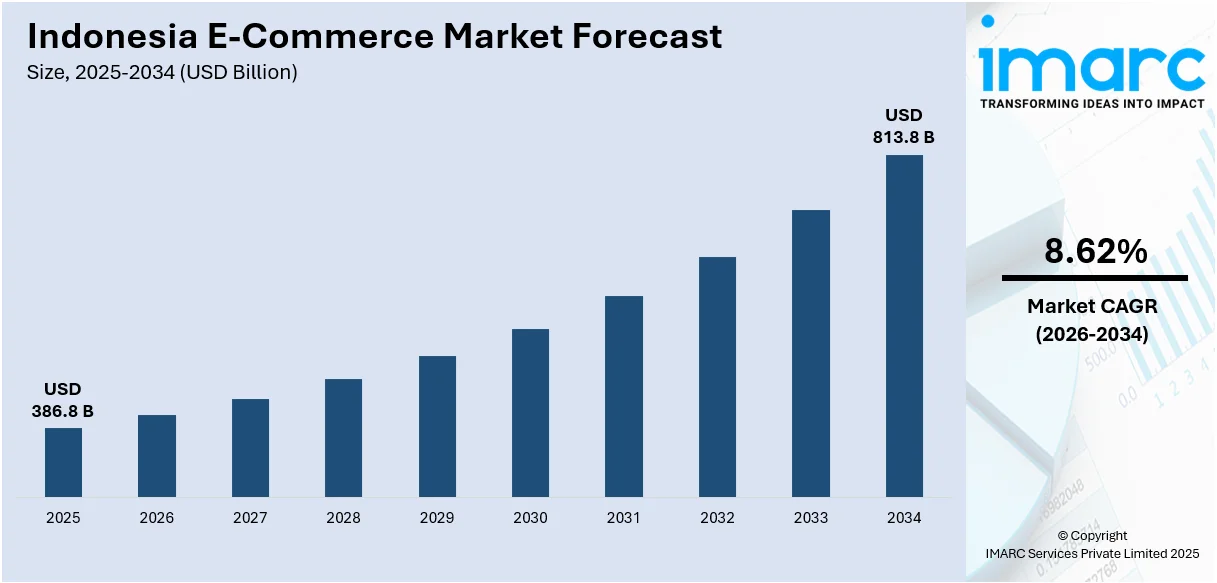

The Indonesia e-commerce market size was valued at USD 386.8 Billion in 2025. Looking forward, the market is projected to reach USD 813.8 Billion by 2034, exhibiting a CAGR of 8.62% during 2026-2034. The market's growth is attributed to rapid internet and smartphone penetration, a growing young and tech-savvy population, rising digital transactions via mobile devices, and supportive government digital initiatives. Innovations in logistics and payment infrastructure, combined with the rise of social commerce, are also fueling expansion.

Market Insights:

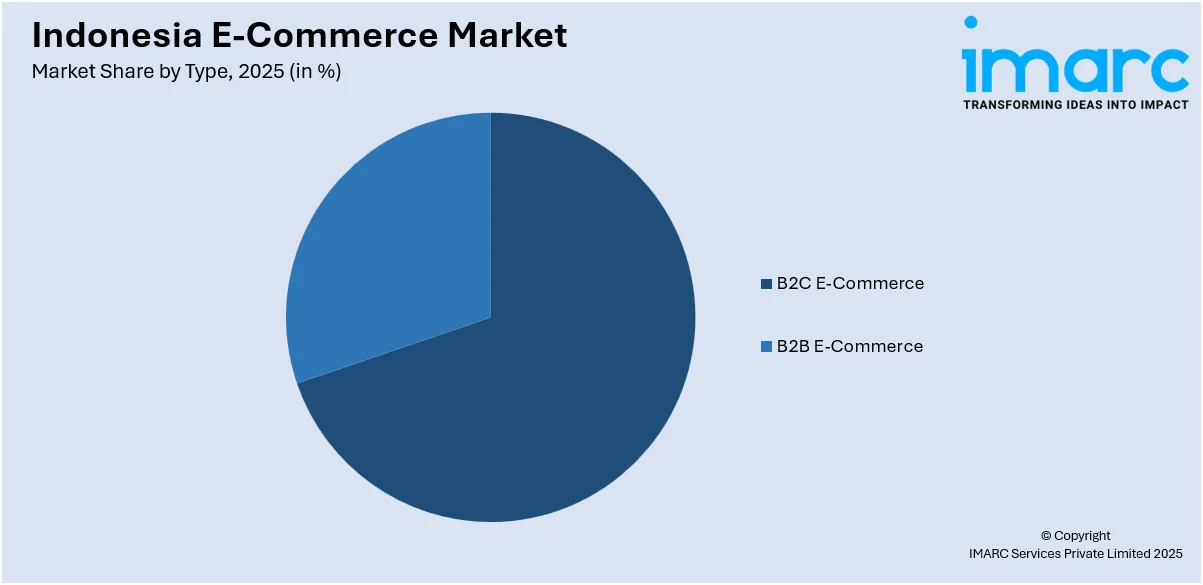

- Key segments include B2C (beauty, electronics, fashion, food, furniture) and B2B e-commerce.

- Mobile-first shopping behavior is accelerating, with live commerce and social platform integration gaining traction.

- Java leads digital activity due to dense population, high internet usage, and advanced logistics.

- Sumatra, Kalimantan, and Sulawesi show strong growth potential with improving connectivity and expanding middle class.

Market Size & Forecast:

- 2025 Market Size: USD 386.8 Billion

- 2034 Projected Market Size: USD 813.8 Billion

- CAGR (2026–2034): 8.62%

The widespread use of smartphones and improved internet access have made online shopping more convenient and accessible nationwide, driving the e-commerce market size in Indonesia. A young, tech-savvy population is driving demand for digital platforms, seeking convenience, variety, and personalized experiences. Economic growth and an expanding middle class are also fueling online consumer spending, as more Indonesians have disposable income and are embracing digital lifestyles. In addition, the government is actively supporting the digital economy through initiatives aimed at strengthening e-commerce infrastructure and encouraging digital transformation in businesses. For instance, in December 2023, TikTok, the leading international entertainment platform, and PT GoTo Gojek Tokopedia Tbk, Indonesia's foremost digital ecosystem, announced a strategic relationship that will help both sides and foster long-term growth for the country's MSME sector and digital economy and contribute to the Indonesia e-commerce market share.

To get more information on this market Request Sample

The development of user-friendly digital payment solutions, like buy-now-pay-later services and mobile wallets, has also made online transactions easier and more secure, boosting consumer trust in e-commerce platforms. For instance, in January 2024, Shopify, a worldwide e-commerce powerhouse, partnered with SIRCLO, an omnichannel commerce enabler in Indonesia, to expand its e-commerce capabilities. According to SIRCLO's latest announcement, this partnership will revolutionize online shopping by leveraging each company's unique characteristics to provide Indonesia with top-notch e-commerce platforms. Moreover, the growing social commerce, where social media and online shopping intersect, enables brands and sellers to connect directly with consumers, fostering engagement and loyalty. E-commerce platforms are continuously innovating by offering personalized recommendations, faster delivery services, and integrating entertainment elements like live streaming to enhance the shopping experience.

Indonesia E-Commerce Market Trends:

Increasing Penetration of the Internet and Smartphones

The extensive accessibility of low-cost smartphones and improved internet connectivity make internet shopping available to a wider audience, driving significant growth in the e-commerce sector. According to the World Health Organization (WHO), in Indonesia, as of 2023, the population is 277,534,117; by 2050, it is expected to have grown by 14% to 317,225,208. For example, the Indonesian Internet Service Providers Association (APJII) stated in January 2024 that, according to its most recent survey, Internet penetration in India increased from 78.1% in 2023 to 79.5% in 2024. This is expected to boost the Indonesia e-commerce market forecast over the coming years.

Rising Disposable Income and Middle Class

The expanding middle-class population base of Indonesia, with their increasing disposable income, is increasingly turning to e-commerce for its convenience, variety, and competitive pricing, which is boosting the demand for online goods and services. For instance, the World Bank report titled “Aspiring Indonesian Expanding the Middle Class” stated that 1 in 5 Indonesians is a part of the middle class. This middle class is growing faster compared to the other groups. Based on the report, there are 28 million (10.7%) Indonesian people who fall into the poor group. In total, 61.6 million (23.3%) individuals belong to the vulnerable category. Additionally, there are 53.6 million (20.5%) Indonesians in the middle class and 3.1 million (1.2%) who fall into the upper-class category. This is fueling the Indonesia e-commerce market statistics significantly.

Growing Digital Initiatives and Government Support

Government initiatives, including the “Making Indonesia 4.0” program, aim to enhance digital infrastructure and promote the adoption of e-commerce, providing a conducive environment for market expansion and innovation. For instance, on December 18, President Joko Widodo announced Presidential Regulation Number 82 of 2023, the Acceleration of Digital Transformation and Integration of National Digital Services, which further advances the Government of Indonesia (GOI) digital government plan. Governmental organizations will use this guideline as a guide for developing public service applications. The Security Printing and Minting Corporation of Indonesia (Peruri) was also designated by the Presidential Decree to serve as the government's technological agency (GoveTech). The government has identified nine priority superapps that are intended to assist nine public services, according to the Presidential Decree. These super apps will cover integrated public services as well as essential digital public infrastructure services, creating a positive impact on the Indonesia e-commerce market outlook.

Indonesia E-Commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Indonesia e-commerce market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on type.

Analysis by Type:

Access the comprehensive market breakdown Request Sample

- B2C E-Commerce

- Beauty and Personal Care

- Consumer Electronics

- Fashion and Apparel

- Food and Beverage

- Furniture and Home

- Others

- B2B E-Commerce

In the market, the demand for B2C e-commerce is influenced by the increasing Internet and platform usage, allowing easier access to online shopping. The rising disposable income enhances purchasing power across consumer electronics, beauty and personal care, food and beverage, fashion and apparel, and furniture and home sectors. Social media influence and digital marketing strategies boost consumer engagement and sales in these categories, which is boosting the Indonesia e-commerce market growth.

The rising digital transformation of businesses seeking efficiency and cost savings is further driving the demand for B2B e-commerce in the market across Indonesia. Improved Internet infrastructure and increasing adoption of digital tools facilitate seamless transactions. The rise of small and medium enterprises (SMEs) expands the market, as they increasingly prefer online procurement for convenience and wider reach.

Regional Analysis:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The demand for e-commerce in Java is driven by Internet connection and smartphone penetration, which is facilitating online shopping. The high population density and urbanization of Java are providing a large customer base. The growing middle class with increased disposable income is boosting the demand for diverse products. Efficient logistics and delivery networks enhanced physicality and community. According to the Green Data Centre Indonesia, Java has the highest number of Internet users at almost 40% in Indonesia.

In Sumatra, the demand for e-commerce is influenced by improving Internet infrastructure and increasing smartphone penetration, making online shopping more accessible. According to the Green Data Centre Indonesia, after Java, Sumatra is next with about 30% of Internet users in Indonesia. The expanding logistics network enhances delivery efficiency across the island are driving the Indonesia e-commerce market. The rising middle class and growing disposable income boost consumer spending on e-commerce platforms.

The expanding Internet and smartphone penetration, improving access to online shopping which is driving the demand for e-commerce in Kalimantan. The development of logistics and transportation infrastructure improves delivery efficiency, catering to dispersed populations. Government initiatives promoting digital economy adoption, and the rising influence of social media and digital marketing also contribute to e-commerce growth.

In Sulawesi, the demand for e-commerce is fueled by growing smartphone usage and improving Internet connectivity, facilitating online shopping. Government initiatives supporting digitalization, and the increasing influence of social media and digital marketing further stimulate e-commerce growth. The convenience and variety offered by online shopping appealed to the diverse consumer base in Sulawesi. Economic development and rising disposable income boost consumer spending on e-commerce platforms.

Competitive Landscape:

The competitive landscape of Indonesia e-commerce market is highly competitive, and dominated by key players such as Shopee, Lazada, and Tokopedia, which offer exclusive product ranges and robust logistics. Local giants, including Blibli and Bukalapak also hold significant market shares. The competition is intensified by global entrants like Amazon and Alibaba, pushing innovation and customer service improvements. For instance, in April 2024, Igloo and Tokopedia established a partnership to increase the convenience and accessibility of purchasing protection products for customers throughout Indonesia. The goal of this partnership is to reach over 14 million micro, small, and medium-sized businesses (MSMEs) in 99% of districts.

The Indonesia e-commerce market report provides a comprehensive analysis of the competitive landscape in the market with detailed profiles of all major companies.

Latest News and Developments:

- March 2025: Jayud Global Logistics Limited reported that its exclusive contracted air cargo service between Jakarta, Indonesia, and Fuzhou, China, completed its first flight. The Fuzhou-Jakarta route aims to capitalize on Southeast Asia's burgeoning e-commerce industry, particularly Indonesia, supporting the sector's explosive expansion in the region.

- March 2025: AnyMind Group declared that Moyuum, a Korean baby products brand, chose AnyMind Group as its exclusive and official e-commerce distributor in Indonesia. This would facilitate Moyuum's growth in Indonesia and increase their customer base by utilizing AnyMind's e-commerce enabling solutions in the Indonesian market.

- October 2024: Rohto Indonesia and Kobayashi Indonesia announced that they will start using AnyMind Group’s live e-commerce services through an Indonesian company called Digital Distribusi Indonesia (DDI) facilitateing e-commerce that was acquired by AnyMind Group in 2023. Each company will be able to utilize DDI's solutions, which include production studios, live shopping strategy, and human live-stream hosts, to provide exceptional live shopping to Indonesian consumers.

- September 2024: YouTube and e-commerce company Shopee announced plans to launch an e-commerce service in Indonesia. This launch will allow Indonesian consumers to purchase various products that they view on YouTube through direct links to Shopee.

- April 2024: Lazada, a Southeast Asian e-commerce platform, partnered strategically with Aha Commerce, an Indonesian e-commerce comprehensive solution provider. Through this partnership, local brands will be encouraged to go digital, and Lazada will be a good platform for local sellers and brands to grow their e-commerce companies.

Indonesia E-Commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sneaker market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India sneaker market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the sneaker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The e-commerce market in Indonesia was valued at USD 386.8 Billion in 2025.

The Indonesia e-commerce market is projected to exhibit a CAGR of 8.62% during 2026-2034, reaching a value of USD 813.8 Billion by 2034.

Indonesia's e-commerce market is propelled by widespread smartphone and internet adoption, a young, tech-savvy population, and rising disposable incomes. Government initiatives like "Making Indonesia 4.0" enhance digital infrastructure, while mobile wallets and BNPL options boost online transactions. Social commerce and platform innovations further drive growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)