Indonesia Electric Two-Wheeler Market Size, Share, Trends and Forecast by Vehicle Type, Battery Type, Voltage Type, Peak Power, Battery Technology, Motor Placement, and Region, 2025-2033

Indonesia Electric Two-Wheeler Market Overview:

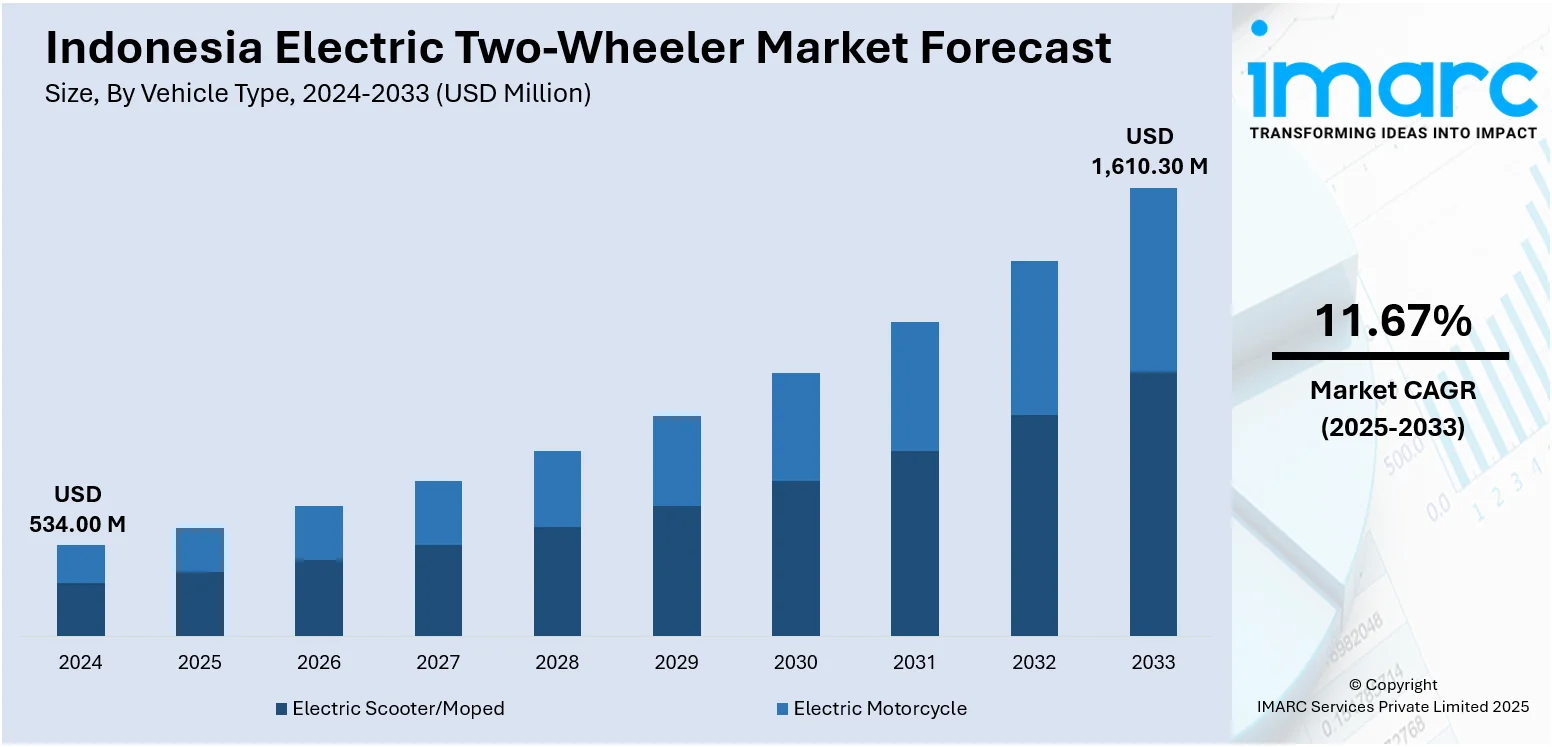

The Indonesia electric two-wheeler market size reached USD 534.00 Million in 2024. The market is projected to reach USD 1,610.30 Million by 2033, exhibiting a growth rate (CAGR) of 11.67% during 2025-2033. The market is driven by rising fuel prices, supportive government policies promoting electrification, and growing environmental concerns pushing for low-emission mobility solutions. Increasing urbanization and traffic congestion fuel demand for cost-efficient, compact, and eco-friendly transportation. Technological advancements in battery efficiency, declining electric vehicle (EV) component costs, and improved charging infrastructure further Indonesia electric two-wheeler market share. Additionally, local manufacturing initiatives and incentives, such as tax reductions and subsidies for electric vehicle purchases, enhance affordability, making electric two-wheelers an attractive option for Indonesian consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 534.00 Million |

| Market Forecast in 2033 | USD 1,610.30 Million |

| Market Growth Rate 2025-2033 | 11.67% |

Indonesia Electric Two-Wheeler Market Trends:

Government Policies and Incentives

The adoption of electric two-wheelers in Indonesia is strongly driven by supportive government policies and incentives. Under the Low Carbon Emission Vehicle (LCEV) roadmap and Presidential Regulation No. 55/2019, the government promotes electrification through tax exemptions, import duty reductions, and direct purchase subsidies, making EVs more affordable. These measures, alongside incentives for localizing component production, are strengthening the domestic EV ecosystem. In 2023, two-wheeled EV sales surged 262%, rising from 17,000 units in 2022 to 62,000 units, largely due to subsidy programs offering Rp 7 million (~US $444) per vehicle. Additional efforts include expanding public charging networks and fostering public-private partnerships to improve infrastructure. Collectively, these initiatives ease financial burdens for manufacturers and buyers, accelerating market growth and making electric two-wheelers an increasingly practical and attractive transportation choice for Indonesia’s urban population.

To get more information on this market, Request Sample

Rising Fuel Costs and Economic Considerations

Another significant Indonesia electric two-wheeler market is the rising fuel prices, which increase the total cost of ownership for conventional motorcycles. Electric two-wheelers offer significant long-term cost savings due to lower operating expenses, reduced maintenance needs, and cheaper “refueling” through electricity compared to gasoline. For daily commuters and delivery drivers key motorcycle users in Indonesia—these cost efficiencies are a compelling factor. Additionally, as urban areas face economic pressures, consumers are increasingly seeking affordable yet reliable mobility solutions. The Indonesian government’s plans to gradually phase out fuel subsidies further highlight the financial advantage of switching to EVs. With electricity being more stable in cost compared to volatile fuel prices, electric two-wheelers present an economically sustainable option, encouraging consumers and businesses, particularly in logistics and ride-hailing sectors, to transition toward EVs for operational efficiency and savings.

Urbanization and Environmental Awareness

Rapid urbanization in Indonesia, particularly in Jakarta, Surabaya, and Bandung, is fueling demand for compact, efficient, and low-emission transportation. In Jakarta, vehicle emissions from cars and motorbikes account for 75% of total air pollution, contributing about 45% of PM₂.₅ levels, with motorcycles making up 70–80% of motor vehicles. Traditional motorcycles, though widely used, significantly worsen air quality and congestion. Rising public awareness, coupled with government campaigns for cleaner mobility, is encouraging a shift toward electric options. Electric two-wheelers, offering zero tailpipe emissions and quieter operation, directly tackle urban air and noise pollution while reducing carbon footprints. NGOs and advocacy groups further promote eco-friendly transportation thus aiding the Indonesia electric two-wheeler market growth. As sustainability, affordability, and convenience gain importance among urban residents, electric two-wheelers are emerging as a socially responsible and practical solution, aligning with national goals for greener, healthier urban transportation.

Indonesia Electric Two-Wheeler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vehicle type, battery type, voltage type, peak power, battery technology, and motor placement.

Vehicle Type Insights:

- Electric Scooter/Moped

- Electric Motorcycle

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes electric scooter/moped and electric motorcycle.

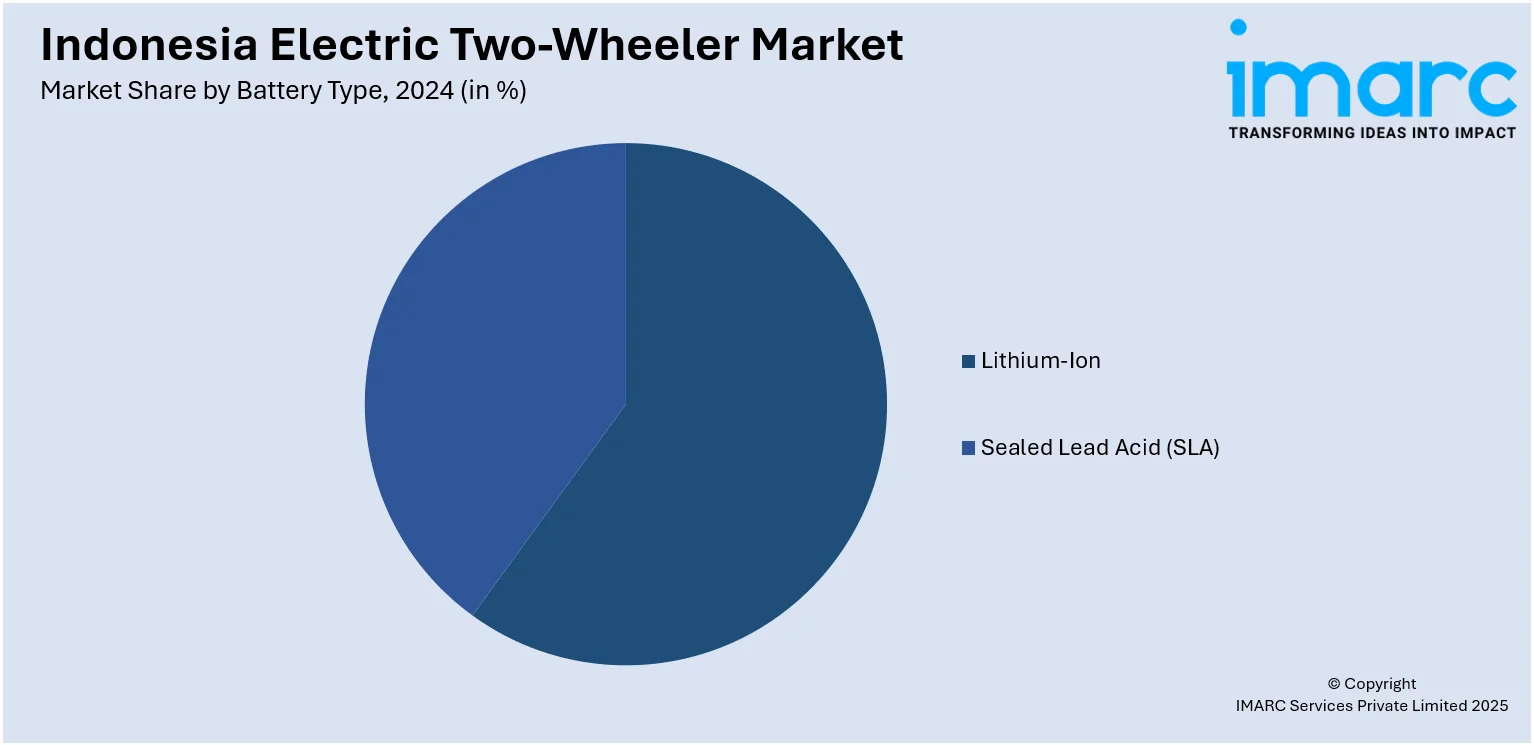

Battery Type Insights:

- Lithium-Ion

- Sealed Lead Acid (SLA)

A detailed breakup and analysis of the market based on the battery type have also been provided in the report. This includes lithium-ion and sealed lead acid (SLA).

Voltage Type Insights:

- <48V

- 48-60V

- 61-72V

- 73-96V

- >96V

A detailed breakup and analysis of the market based on the voltage type have also been provided in the report. This includes <48V, 48-60V, 61-72V, 73-96V, and >96V.

Peak Power Insights:

- <3 kW

- 3-6 kW

- 7-10 kW

- >10 kW

A detailed breakup and analysis of the market based on the peak power have also been provided in the report. This includes <3 kW, 3-6 kW, 7-10 kW, and >10 kW.

Battery Technology Insights:

- Removable

- Non-Removable

A detailed breakup and analysis of the market based on the battery technology have also been provided in the report. This includes removable and non-removable.

Motor Placement Insights:

- Hub Type

- Chassis Mounted

A detailed breakup and analysis of the market based on the motor placement have also been provided in the report. This includes hub type and chassis mounted.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Electric Two-Wheeler Market News:

- In June 2025, Omoway, founded by former Xpeng executives, raised an eight-figure USD sum from ZhenFund, HongShan, and Hui Capital to develop its smart electric motorcycles. The company unveiled its first prototype, the Omo X, in Jakarta, showcasing autonomous driving capabilities. Mass production and the Indonesia market launch are planned for 2026. Positioned as Omoway’s global entry point, Indonesia’s rapidly growing EV market offers strong potential for heavy-duty, long-range electric motorcycles.

- In June 2025, TVS Motor Company's iQube all-electric scooter marked its entry into the Indonesian electric two-wheeler market. The scooter has a 115 km range, a top speed of 78 kmph, and quick acceleration. It is priced at an introductory IDR 29.9 million (about ₹1.6 lakh). Locally assembled at the East Karawang factory, reservations are now being accepted. TVS aims to support Indonesia’s growing EV adoption, which has seen a 101% CAGR in three years, with reliable products and expanded sales and after-sales EV capabilities.

Indonesia Electric Two-Wheeler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Electric Scooter/Moped, Electric Motorcycle |

| Battery Types Covered | Lithium-Ion, Sealed Lead Acid (SLA) |

| Voltage Types Covered | <48V, 48-60V, 61-72V, 73-96V, >96V |

| Peak Powers Covered | <3 kW, 3-6 kW, 7-10 kW, >10 kW |

| Battery Technologies Covered | Removable, Non-Removable |

| Motor Placements Covered | Hub Type, Chassis Mounted |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia electric two-wheeler market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia electric two-wheeler market on the basis of vehicle type?

- What is the breakup of the Indonesia electric two-wheeler market on the basis of battery type?

- What is the breakup of the Indonesia electric two-wheeler market on the basis of voltage type?

- What is the breakup of the Indonesia electric two-wheeler market on the basis of peak power?

- What is the breakup of the Indonesia electric two-wheeler market on the basis of battery technology?

- What is the breakup of the Indonesia electric two-wheeler market on the basis of motor placement?

- What is the breakup of the Indonesia electric two-wheeler market on the basis of region?

- What are the various stages in the value chain of the Indonesia electric two-wheeler market?

- What are the key driving factors and challenges in the Indonesia electric two-wheeler market?

- What is the structure of the Indonesia electric two-wheeler market and who are the key players?

- What is the degree of competition in the Indonesia electric two-wheeler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia electric two-wheeler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia electric two-wheeler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia electric two-wheeler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)