Indonesia Fintech Market Size, Share, Trends and Forecast by Deployment Mode, Technology, Application, End User, and Region, 2025-2033

Indonesia Fintech Market Overview:

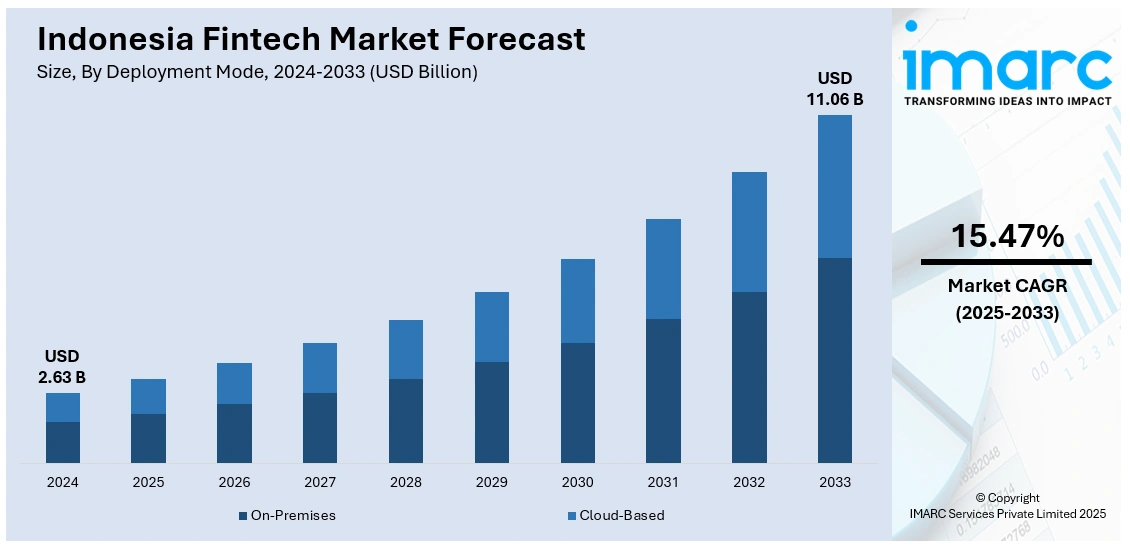

The Indonesia fintech market size reached USD 2.63 Billion in 2024. The market is projected to reach USD 11.06 Billion by 2033, exhibiting a growth rate (CAGR) of 15.47% during 2025-2033. The market is experiencing rapid transformation, driven by growing digital adoption, evolving consumer behaviors, and supportive government initiatives. Digital payments, lending, and wealth management are some of the areas witnessing enhanced innovation and investment. Technological innovations such as AI and blockchain are supporting improved service efficiency and security. Regional growth continues to drive market dynamics, offering new opportunities for players. Such trends are particularly affecting the Indonesia fintech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.63 Billion |

| Market Forecast in 2033 | USD 11.06 Billion |

| Market Growth Rate 2025-2033 | 15.47% |

Indonesia Fintech Market Trends:

Increasing Digital Payment Adoption

In January 2025, Indonesia recorded over 20 trillion digital payment transactions, signaling a significant shift from cash to digital methods across the country. This is being fueled by the widespread adoption of QRIS (Quick Response Code Indonesian Standard), digital wallets, and mobile banking systems, which have become the indispensible tools for both consumers and businesses. These payment alternatives are convenient, fast, and more secure, encouraging even individuals in remote areas to use digital financial services. Consequently, digital payments are no longer confined to metropolitan areas but are now widespread across the country. The higher transaction volumes are a testament to growing confidence in fintech platforms, facilitated by government efforts encouraging cashless transactions. This growth plays an important part in enhancing financial inclusion, with more Indonesians able to be part of the formal economy. Continued growth in digital payment usage is driving Indonesia fintech market growth, highlighting how technology is transforming the financial ecosystem by enabling affordable and safe payment options for millions of users.

To get more information on this market, Request Sample

Expansion of Embedded Finance Solutions

In March 2024, embedded finance services accounted for 35 percent of Indonesia's digital financial transactions, reflecting the increasing embedding of financial products in non-financial platforms such as e-commerce and ride-hailing applications. The embedded methodology allows consumers to receive payments, lending, and insurance services directly within daily-use platforms, without the necessity of standalone apps or bank visits. In turn, such solutions provide more convenience, efficiency, and immediacy, heavily sought by younger and digitally born users. These integrations changed the way financial services are offered and consumed, going beyond such traditional single product fintech standalones. Such growing adoption of embedded finance mirrors broader Indonesia fintech market trends in terms of such themes as innovation and smooth user experiences. Through the integration of finance into routine digital activities, the market is bringing financial services closer to a broader set of people, enabling greater use and confidence. This is an indicator of how fintech has helped build a more inclusive and adaptive financial system that responds to changing consumer needs.

Growth in Digital Lending to SMEs

In 2024, online lending platforms experienced a strong surge in usage by small and medium-sized businesses (SMEs) throughout Indonesia, providing much-needed access to funding that was not easily attained previously via traditional banking options. Online lending platforms provide quicker loan approvals and more flexible requirements, supporting numerous SMEs in bridging obstacles such as stringent collateral guidelines and cumbersome paperwork. This transformation allows more entrepreneurs to make investments in their companies, innovate, and increase operations, particularly in the areas with inadequate banking infrastructure. Increasing digital lending dependence proves fintech's significant role in increasing financial inclusion and enhancing economic growth at the grass-root level. This phenomenon points to Indonesia fintech market development, indicating how fintech solutions are more uniquely suited to serve under-banked groups such as SMEs. The growth of online lending is also part of a larger Indonesia fintech market toward more efficient and accessible financial services that are transforming the economic profile of the country and empowering millions of entrepreneurs.

Indonesia Fintech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on deployment mode, technology, application, and end user.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Insights:

- Application Programming Interface

- Artificial Intelligence

- Blockchain

- Robotic Process Automation

- Data Analytics

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes application programming interface, artificial intelligence, blockchain, robotic process automation, data analytics, and others.

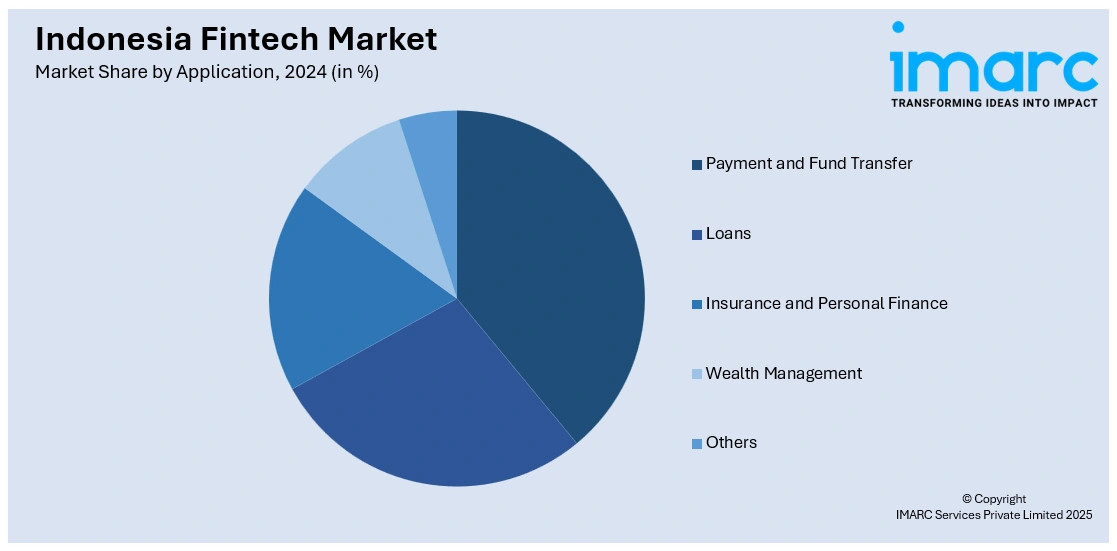

Application Insights:

- Payment and Fund Transfer

- Loans

- Insurance and Personal Finance

- Wealth Management

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes payment and fund transfer, loans, insurance and personal finance, wealth management, and others.

End User Insights:

- Banking

- Insurance

- Securities

- Others

A detailed breakup and analysis of the market based on the end user has also been provided in the report. This includes banking, insurance, securities, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Fintech Market News:

- August 2025: Indonesia’s Indosat Ooredoo Hutchison has partnered with Tanla Platforms to deploy Wisely.ai, an AI-powered anti-spam and anti-scam solution. This multi-year agreement aims to protect nearly 100 million users from fraudulent activities across SMS, voice, and VoIP channels. Using advanced machine learning and NVIDIA GPU infrastructure, the platform detects and mitigates digital fraud in real time. The solution integrates seamlessly with SIM cards and mobile devices, covering both A2P and P2P communications. This partnership marks Tanla’s significant expansion into Southeast Asia.

- Dember 2024: Funding Societies, a Singapore-based fintech firm operating as Modalku in Indonesia, has secured a $25 million equity investment from Japan’s Cool Japan Fund. This marks CJF's inaugural venture into Southeast Asian fintech. The funds will enhance Funding Societies' SME lending and payments services across Indonesia, Malaysia, Thailand, and Vietnam. The company plans to leverage AI to streamline loan applications and support Japanese businesses expanding in the region. This partnership underscores the growing international interest in Southeast Asia's digital finance sector.

Indonesia Fintech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technologies Covered | Application Programming Interface, Artificial Intelligence, Blockchain, Robotic Process Automation, Data Analytics, Others |

| Applications Covered | Payment and Fund Transfer, Loans, Insurance and Personal Finance, Wealth Management, Others |

| End Users Covered | Banking, Insurance, Securities, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia fintech market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia fintech market on the basis of deployment mode?

- What is the breakup of the Indonesia fintech market on the basis of technology?

- What is the breakup of the Indonesia fintech market on the basis of application?

- What is the breakup of the Indonesia fintech market on the basis of end user?

- What is the breakup of the Indonesia fintech market on the basis of region?

- What are the various stages in the value chain of the Indonesia fintech market?

- What are the key driving factors and challenges in the Indonesia fintech market?

- What is the structure of the Indonesia fintech market and who are the key players?

- What is the degree of competition in the Indonesia fintech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia fintech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia fintech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia fintech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)