Indonesia Foreign Exchange Market Size, Share, Trends and Forecast by Counterparty, Type, and Region, 2026-2034

Indonesia Foreign Exchange Market Overview:

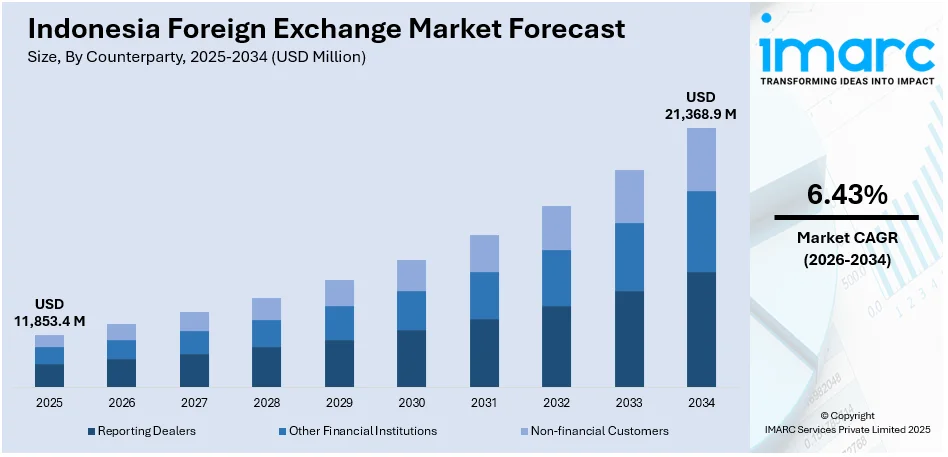

The Indonesia foreign exchange market size reached USD 11,853.4 Million in 2025. The market is projected to reach USD 21,368.9 Million by 2034, exhibiting a growth rate (CAGR) of 6.43% during 2026-2034. The market is fueled by increased cross-border trade, Bank Indonesia’s efforts to maintain exchange rate stability, and greater participation from institutional investors. Apart from that, growing digital platform adoption and improved regulatory transparency have also enhanced liquidity and efficiency. Besides, economic reforms and steady capital inflows continue to support the market, which is also a significant factor augmenting the Indonesia foreign exchange market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 11,853.4 Million |

| Market Forecast in 2034 | USD 21,368.9 Million |

| Market Growth Rate 2026-2034 | 6.43% |

Indonesia Foreign Exchange Market Trends:

Increased Digitalization and Retail Participation

The market is experiencing a notable surge in digital transformation, which is encouraging greater retail investor participation. The proliferation of mobile trading apps and user-friendly digital platforms has democratized access to forex trading. Furthermore, enhanced internet penetration is providing a boost to market development. As of January 2025, there were about 212 Million internet users in Indonesia, accounting for 74.6% of the country’s total population. Initially dominated by institutional investors, the market is now witnessing a broader base of participants, including millennials and tech-savvy individuals seeking alternative investment opportunities. Apart from this, regulatory initiatives have further supported this trend by promoting transparency and investor education. Additionally, the rise of fintech companies offering competitive spreads and real-time trading analytics is contributing to market dynamism. These digital tools have not only increased transaction volumes but have also allowed for more efficient trade execution and risk management. Apart from this, the rapid growth in retail trading also necessitates robust oversight to mitigate speculative behavior and ensure the stability of the financial system, especially in times of macroeconomic volatility.

To get more information on this market Request Sample

Exchange Rate Volatility Driven by Global Economic Shifts

The market is highly sensitive to global macroeconomic dynamics, with exchange rate volatility becoming a defining trend. According to an industry report, the exchange rate in Indonesia at the end of 2024 stood at IDR 16,095, compared to IDR 15,397 at the end of 2023 and IDR 12,385 a decade earlier. Over the past ten years, the exchange rate averaged approximately IDR 14,258 External factors such as U.S. Federal Reserve interest rate decisions, global inflationary pressures, and shifts in commodity prices, especially crude oil and palm oil, which significantly impact Indonesia’s trade balance, have led to increased fluctuations in the rupiah. As a commodity-exporting nation, Indonesia’s currency performance is intricately tied to global demand patterns and geopolitical developments, including China’s economic trajectory and Middle East tensions. Moreover, periods of capital inflows, triggered by risk-on sentiment in global markets, are often counterbalanced by outflows during risk-off phases, leading to sharp and sometimes unpredictable currency movements. The volatility has heightened the importance of hedging instruments and risk management strategies for corporates and investors operating in the market.

Strengthening Regulatory Oversight and Market Infrastructure

The concerted effort to strengthen regulatory frameworks and upgrade market infrastructure is positively impacting the Indonesia foreign exchange market growth. Bank Indonesia has introduced various initiatives aimed at enhancing the resilience, efficiency, and credibility of the forex ecosystem. These include tighter rules on foreign exchange transactions, clearer reporting requirements for corporates, and the promotion of hedging practices to manage currency risks. Moreover, the development of a more transparent and liquid domestic forex market is being supported by the introduction of the domestic non-deliverable forward (DNDF) instruments, which help stabilize the rupiah without relying excessively on foreign exchange reserves. Simultaneously, technology upgrades in transaction processing and settlement systems are contributing to improved operational efficiency and investor confidence. The integration of more robust surveillance mechanisms and real-time monitoring tools is also aiding in curbing illicit forex practices. These regulatory and infrastructural improvements are crucial in aligning the market with global standards and fostering long-term investor trust.

Indonesia Foreign Exchange Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on counterparty and type.

Counterparty Insights:

- Reporting Dealers

- Other Financial Institutions

- Non-financial Customers

The report has provided a detailed breakup and analysis of the market based on the counterparty. This includes reporting dealers, other financial institutions, and non-financial customers.

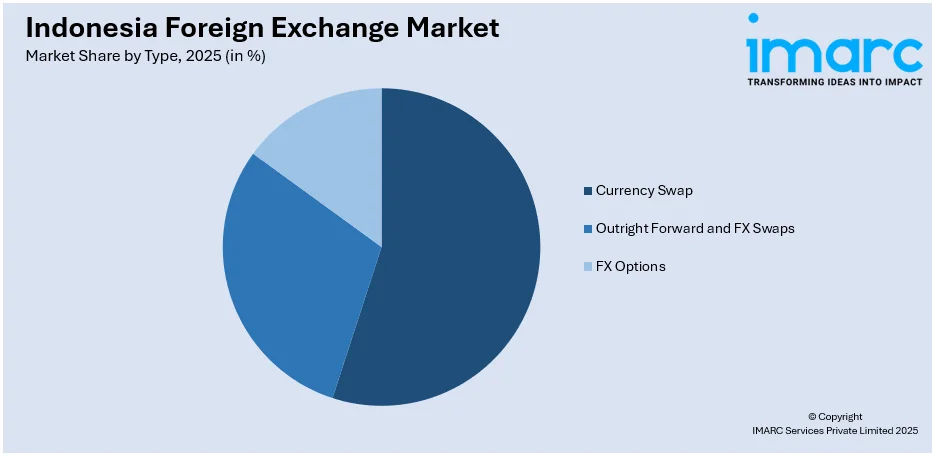

Type Insights:

Access the comprehensive market breakdown Request Sample

- Currency Swap

- Outright Forward and FX Swaps

- FX Options

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes currency swap, outright forward and FX swaps, and FX options.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Foreign Exchange Market News:

- March 2025: Indonesia implemented Government Regulation No. 8, mandating that exporters of natural resources keep all foreign exchange earnings within the country’s financial system for at least one year. The regulation is intended to strengthen the nation's foreign currency reserves and reinforce economic resilience. Since implementation, exporters have reported operational difficulties, and foreign investors are reassessing their positions in the commodity sector.

Indonesia Foreign Exchange Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Counterparties Covered | Reporting Dealers, Other Financial Institutions, Non-financial Customers |

| Types Covered | Currency Swap, Outright Forward and FX Swaps, FX Options |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia foreign exchange market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia foreign exchange market on the basis of counterparty?

- What is the breakup of the Indonesia foreign exchange market on the basis of type?

- What is the breakup of the Indonesia foreign exchange market on the basis of region?

- What are the various stages in the value chain of the Indonesia foreign exchange market?

- What are the key driving factors and challenges in the Indonesia foreign exchange market?

- What is the structure of the Indonesia foreign exchange market and who are the key players?

- What is the degree of competition in the Indonesia foreign exchange market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia foreign exchange market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia foreign exchange market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia foreign exchange industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)