Indonesia Freight and Logistics Market Size, Share, Trends and Forecast by Logistics Function, End Use Industry, and Region, 2026-2034

Indonesia Freight and Logistics Market:

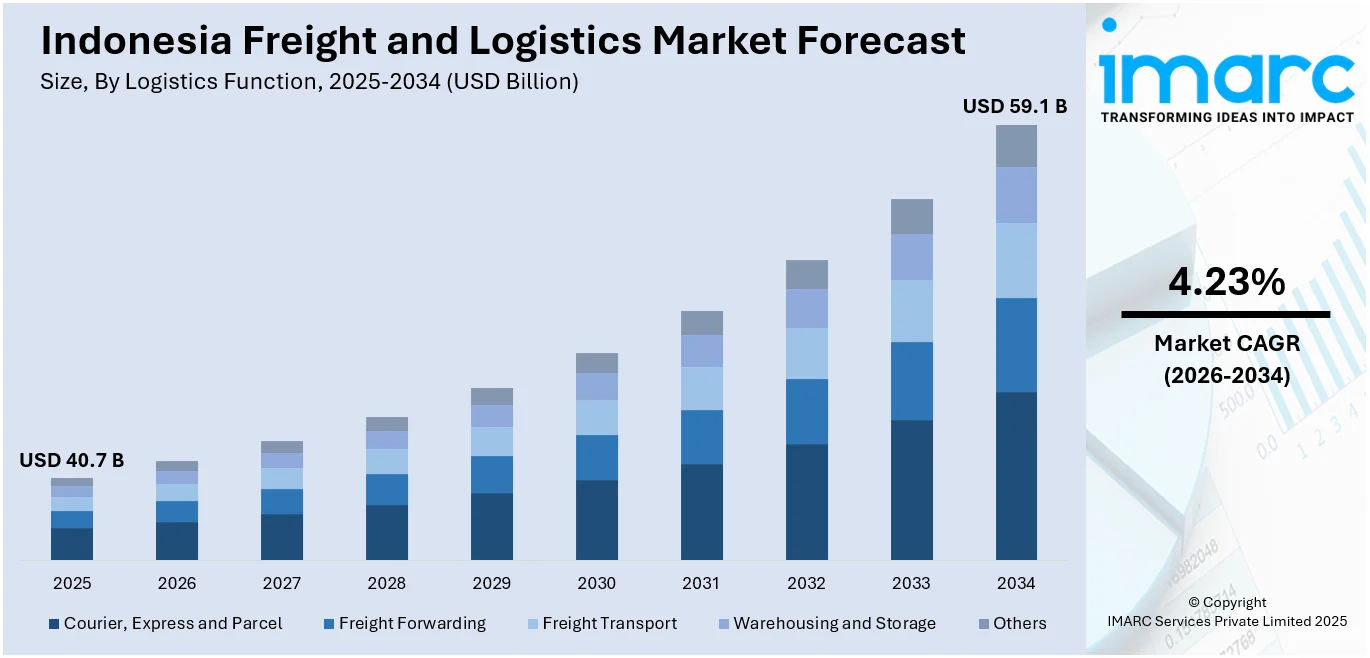

The Indonesia freight and logistics market size reached USD 40.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 59.1 Billion by 2034, exhibiting a growth rate (CAGR) of 4.23% during 2026-2034. The burgeoning e-commerce industry in the country, the implementation of economic development policies, sudden shift towards sustainability, growing adoption of sophisticated tracking and inventory management systems, and the increasing urbanization and rising middle class represent some of the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 40.7 Billion |

| Market Forecast in 2034 | USD 59.1 Billion |

| Market Growth Rate 2026-2034 | 4.23% |

Indonesia Freight and Logistics Market Analysis:

- Major Market Drivers: The burgeoning e-commerce industry in Indonesia is primarily augmenting the demand for efficient and fast delivery services, which is positively impacting the market growth.

- Key Market Trends: The sudden shift toward sustainability, prompting the need for eco-friendly transportation solutions like electric trucks and ships, is one of the significant key trends bolstering the growth of the market.

- Challenges and Opportunities: Challenges in the Indonesia freight and logistics market include infrastructural limitations, bureaucratic hurdles, and regional disparities hindering seamless transportation. However, some of the recent opportunities in Indonesia freight and logistics market arise from the country's strategic location, growing e-commerce sector, and governmental initiatives to improve logistics infrastructure, fostering potential for market expansion and efficiency enhancements.

To get more information on this market Request Sample

Indonesia Freight and Logistics Market Trends:

Expanding E-commerce Sector

The rising expansion of the e-commerce sector, leading to a surge in demand for more diverse and faster shipping options, is providing a thrust to the Indonesia freight and logistics market. In line with this, the sudden shift towards online commerce is compelling the key players to enhance their distribution networks and integrate advanced technologies for real-time tracking and efficient handling of goods. For instance, according to a 2022 report by Wunderman Thompson Commerce, Indonesia's online spending accounted for a significant 64% of the country's total consumer spending. Moreover, the gross merchandise value (GMV) of the e-commerce market in Indonesia is anticipated to reach approximately US$ 160 Billion by 2030, indicating the strength of the market. Furthermore, the escalating number of new startups in the e-commerce industry is also augmenting the need for efficient freight and logistics services across the country. For instance, the number of e-commerce users in Indonesia is expected to reach approximately 131 million by 2028. Additionally, the increasing working women population in the country, along with the inflating spending capacities, is anticipated to propel Indonesia's freight and logistics market revenue in the coming years.

Improving Logistic Infrastructures

The improving road, railway, and airport infrastructures across the country are positively impacting the Indonesia freight and logistics market demand. For instance, as of 2023, Indonesia had 251 existing airports. From 2020 to 2024, four new airports were completed and are now operational, supporting the growth of the air freight transport market. Furthermore, the government authorities of Indonesia are increasingly investing in completing infrastructure development projects at a rapid pace. For instance, by Q1 2023, several infrastructure projects reached completion and commenced operations. The government is targeting to complete 36 ferry ports by the end of 2024 and has already built 11. Moreover, the government's sights are also set on enhancing air transportation infrastructure. In line with this, the "Indonesia Emas" (Golden Indonesia) 2045 vision aspires to fortify the domestic shipping industry, aligning its capacity with optimal export-import dynamics. Such initiatives are projected to propel the Indonesia freight and logistics market share in the coming years.

Technological Advancements

The ongoing technological advancements, such as the integration of the Internet of Things (IoT) to enhance supply chain visibility and control, are one of the prominent logistics industry trends. Moreover, the growing utilization of sensors and radio frequency identification (RFID) tags to facilitate real-time data on the location and condition of goods, allowing more effective tracking and inventory management, is creating a positive influence for the Indonesia freight and logistics market outlook. For instance, in May 2024, a leading telecommunications provider Telkomsel and a global ICT solutions provider Huawei, inaugurated Indonesia's first 5G Smart Warehouse and 5G Innovation Center in Bekasi Regency, West Java. This landmark facility showcases the potential of 5G technology to transform warehouse management, boosting operational efficiency and creating new opportunities for the logistics industry to support the digital economy leapfrog towards the Golden Indonesia Vision 2045. Similarly, in November 2023, the Singapore and Indonesia-based startup Fr8Labs raised US$ 1.5 Million in seed funding from East Ventures, FEBE Ventures, Kaya Founders, Mulia Sky Capital, Seedstars, Venturra, and angel investors. The funding is being utilized to digitize Asia's logistics industry with its SaaS operating system. All these above-mentioned factors further contribute to the Indonesia freight and logistics recent developments.

Indonesia Freight and Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on logistics function and end use industry.

Breakup by Logistics Function:

- Courier, Express and Parcel

- Domestic

- International

- Freight Forwarding

- Air

- Sea and Inland Waterways

- Others

- Freight Transport

- Air

- Pipelines

- Rail

- Road

- Sea and Inland Waterways

- Warehousing and Storage

- Non-Temperature Controlled

- Temperature Controlled

- Others

The report has provided a detailed breakup and analysis of the market based on the logistics function. This includes courier, express and parcel (domestic and international), freight forwarding (air, sea and inland waterways, and others), freight transport (air, pipelines, rail, road, and sea and inland waterways), warehousing and storage (non-temperature controlled and temperature controlled), and others.

According to Indonesia freight and logistics market statistics by IMARC, the preference for road and sea freight transport is growing due to the rising investments and initiatives in Indonesia. Furthermore, the country is adopting port digitalization under the National Logistics Ecosystem (NLE) program to enhance port efficiency. In line with this, the government authorities are also focusing on enhancing air transportation infrastructure. It aims to construct ten new airports, catering to 43 air routes, by the close of 2024. Indonesia freight and logistics market forecast by IMARC indicates that the increasing investments in improving the logistics and freight infrastructure are anticipated to propel the growth of the market in the coming years.

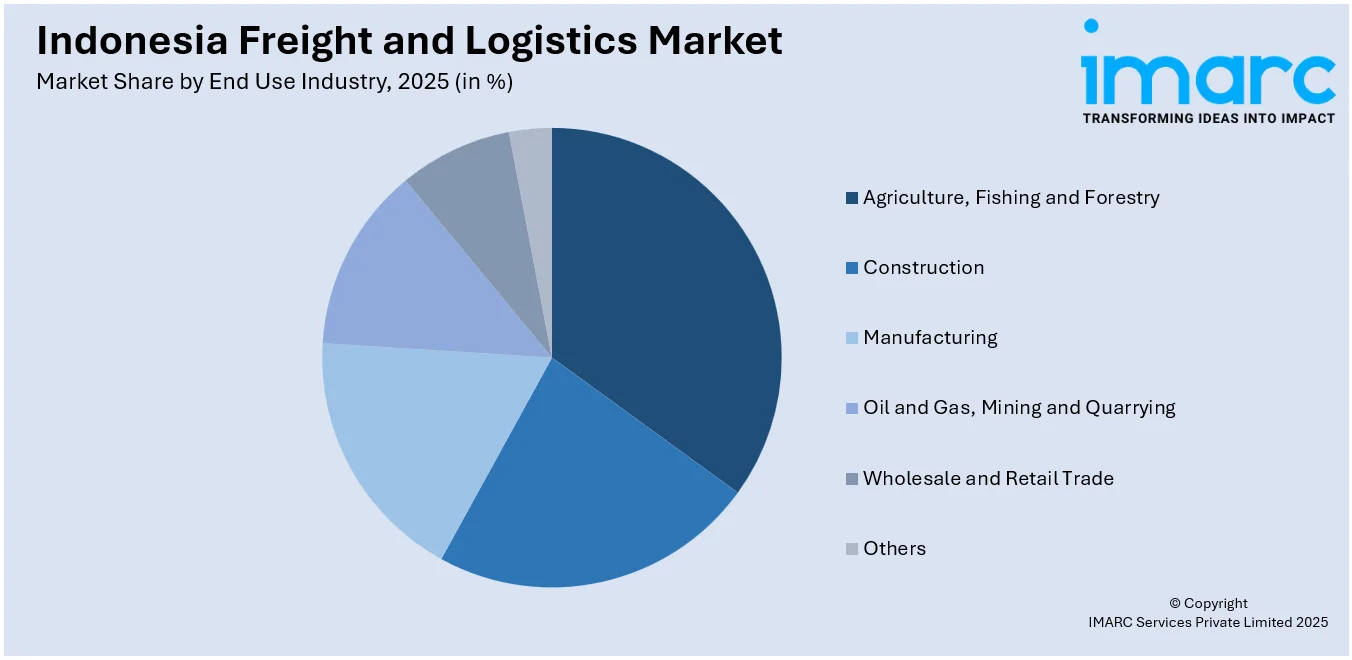

Breakup by End Use Industry:

Access the comprehensive market breakdown Request Sample

- Agriculture, Fishing and Forestry

- Construction

- Manufacturing

- Oil and Gas, Mining and Quarrying

- Wholesale and Retail Trade

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes agriculture, fishing and forestry, construction, manufacturing, oil and gas, mining and quarrying, wholesale and retail trade, and others.

Indonesia aims to become one of the leading global economies under Vision 2045, driven by growth in the manufacturing sector. Furthermore, the Government of Indonesia has invested around US$ 400 Billion in infrastructure development to enhance global connectivity and economic growth. This indicates that the country is anticipated to witness impressive growth in its freight and logistics industry since the overall exports of Indonesia grew by 26% YoY in 2022, with China and the US as major export partners. Moreover, investment in the oil and gas industry in Indonesia reached US$ 13.7 Billion in 2023, a 13% YoY increase. Expansion in various sectors is projected to propel Indonesia's freight and logistics market's recent price in the coming years.

Breakup by Region:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The Indonesia freight and logistics market report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Infrastructure development has gained global traction in recent years. In line with this, the Indonesian government, under Presidential Instruction No. 5/2020, has devised a comprehensive plan to enhance the nation's logistics ecosystem. Moreover, the Indonesia freight and logistics market overview indicates that both private players and government authorities are increasingly investing in the expansion of domestic and international trade activities, which is expected to provide a positive outlook to the overall market.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major Indonesia's freight and logistics market companies have been provided.

Indonesia Freight and Logistics Market Latest News:

- May 2024: Leading telecommunications provider Telkomsel and global ICT solutions provider Huawei inaugurated Indonesia's first 5G Smart Warehouse and 5G Innovation Center in Bekasi Regency, West Java.

- February 2024: A mega India – Indonesia Business Forum 2024 was organized in New Delhi, marking the beginning of 75 years of the creation of diplomatic ties. The forum aimed to enhance economic relations, foster growth, and spotlight promising sectors like pharma, consumer goods, transportation infrastructure, tourism, e-mobility, and FinTech for potential collaborations.

- November 2023: The Singapore and Indonesia-based startup Fr8Labs raised US$ 1.5 Million in seed funding from East Ventures, FEBE Ventures, Kaya Founders, Mulia Sky Capital, Seedstars, Venturra, and angel investors. The funding is being utilized to digitize Asia's logistics industry with its SaaS operating system.

Indonesia Freight and Logistics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Logistics Functions Covered |

|

| End Use Industries Covered | Agriculture, Fishing and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia freight and logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia freight and logistics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia freight and logistics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The freight and logistics market in Indonesia was valued at USD 40.7 Billion in 2025.

The Indonesia freight and logistics market is projected to exhibit a CAGR of 4.23% during 2026-2034, reaching a value of USD 59.1 Billion by 2034.

Rapid expansion in industrial and manufacturing activity, booming e-commerce growth, and increasing infrastructure investment such as ports, highways, and logistical hubs are key drivers. Rising foreign trade volumes and the need for efficient domestic distribution networks further amplify demand across all freight segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)