Indonesia Furniture Market Size, Share, Trends and Forecast by Material, Application, Distribution Channel, and Region, 2026-2034

Market Overview:

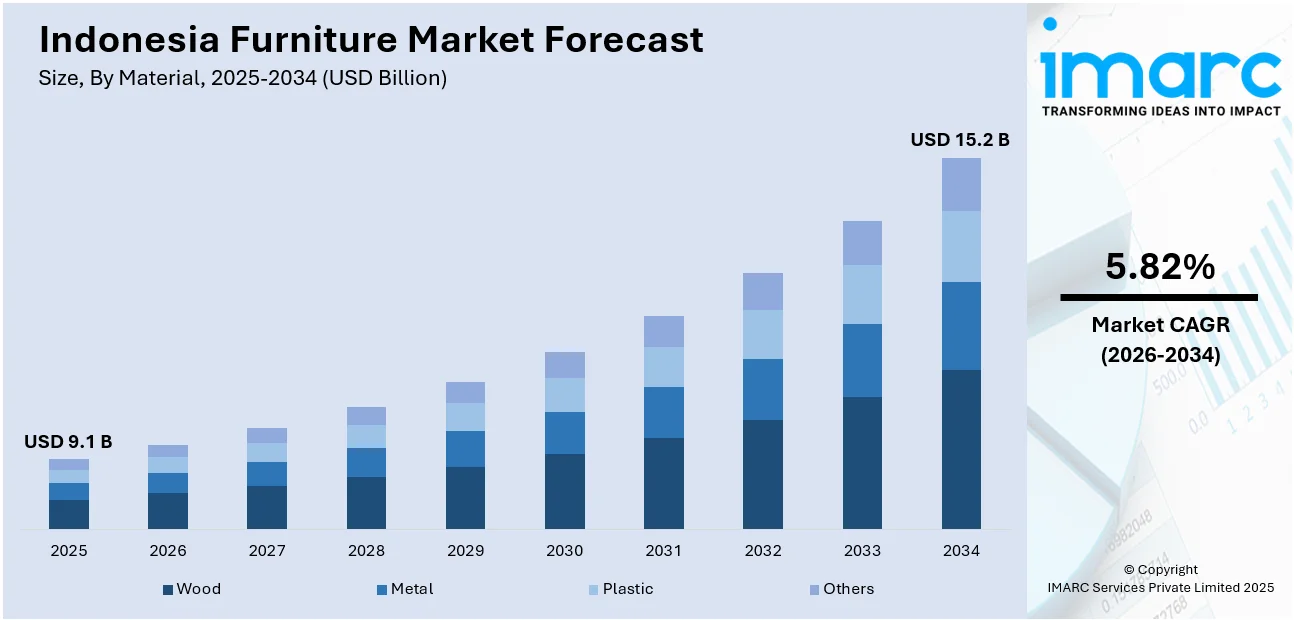

The Indonesia furniture market size reached USD 9.1 Billion in 2025. The market is projected to reach USD 15.2 Billion by 2034, exhibiting a growth rate (CAGR) of 5.82% during 2026-2034. The market growth is attributed to the abundant availability of quality raw materials like teak and rattan, rising disposable incomes, increasing housing development, supportive government policies, and the expansion of e-commerce channels.

Market Insights:

- Based on material, the market is segmented into wood, metal, plastic, and others.

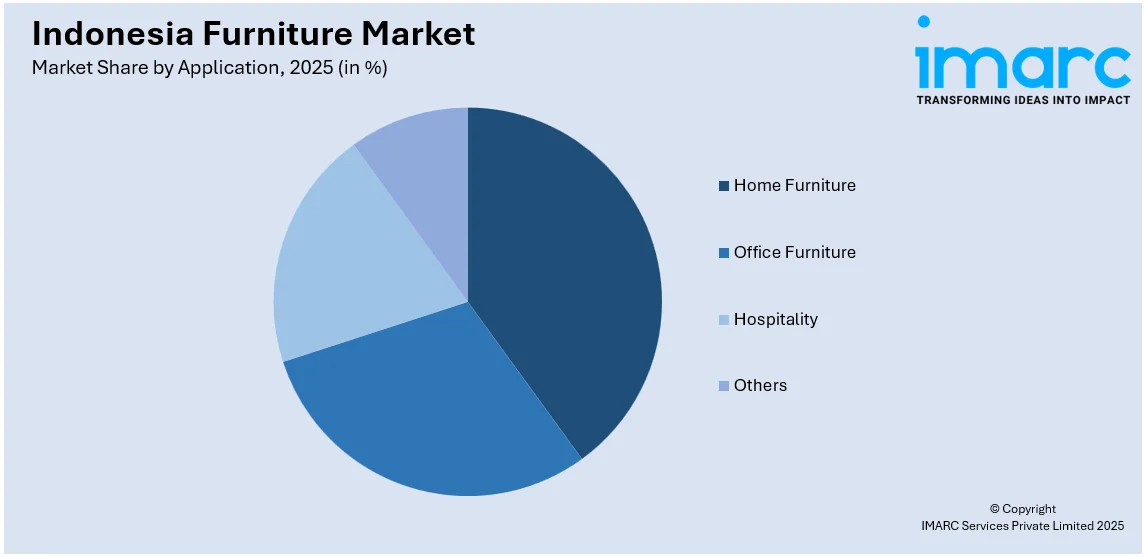

- Based on application, the market is segmented into home furniture, office furniture, hospitality, and others.

- Based on distribution channel, the market is segmented into supermarkets, specialty stores, online, and others.

- Based on region, the market is segmented into Java, Sumatra, Kalimantan, Sulawesi, and others.

Market Size and Forecast:

- 2025 Market Size: USD 9.1 Billion

- 2034 Projected Market Size: USD 15.2 Billion

- CAGR (2026-2034): 5.82%

Furniture refers to movable objects designed to support various human activities such as sitting, lying down, and storing items. The primary materials used in furniture making are wood, metal, plastics, and textiles, each offering unique characteristics like durability, aesthetics, and comfort. Furniture serves both functional and aesthetic purposes, complementing the architectural elements within a living or working space. Modern furniture design incorporates sustainability by utilizing eco-friendly materials and manufacturing processes. Moreover, the trend toward smart furniture is gaining momentum, with integrated technologies such as wireless charging, Bluetooth speakers, and automated adjustability offering enhanced user experience. Consequently, furniture represents an evolving aspect of human life that reflects cultural, technological, and social changes.

To get more information on this market Request Sample

The Indonesia furniture market is experiencing robust growth, driven by several key factors that are shaping its landscape. One of the most prominent drivers is the abundant availability of raw materials, particularly teak and rattan, which are native to Indonesia's forests. This natural resource advantage gives the country a competitive edge in producing high-quality furniture. Additionally, the growing middle class in Indonesia is contributing to a higher demand for furniture. As disposable incomes grow, more consumers are spending on home improvement and interior decoration, fueling the market growth. Besides this, the emergence of various housing projects and the development of residential areas have augmented the demand for furniture items, both for indoor and outdoor use. Moreover, the Indonesian government is actively supporting the furniture industry through various incentives and policies. Export-oriented policies, coupled with reduced bureaucracy and streamlined logistics, are making it easier for local manufacturers to reach global markets. The country is also striving to become a global furniture hub, targeting export markets such as the United States, Europe, and other Asian countries, which is fostering market growth.

Furthermore, technological advancements in manufacturing processes represent another major growth-inducing factor. Modern machinery and design software are optimizing production, reducing costs, and improving efficiency. This technological innovation is enabling Indonesian furniture companies to compete on a global scale in terms of quality and innovation, thereby propelling market growth. Along with this, the rapid proliferation of e-commerce across the country is further supporting market growth. Online platforms are eliminating geographical barriers and making it easier for consumers to access a wide range of products. The younger generation, who are digitally savvy, are increasingly adopting online shopping for furniture, which is accelerating product sales through digital channels. Besides this, the cultural richness of Indonesia, with its diverse art and crafts traditions, is becoming an integral part of furniture designs, attracting both domestic and international consumers looking for unique, artisanal pieces, thus catalyzing market growth.

Indonesia Furniture Market Trends:

Sustainable Production and Eco-Friendly Materials

One of the major trends in the furniture market in Indonesia is the rise of sustainable production practices. Local manufacturers are increasingly shifting to environmentally responsible sourcing and production, recognizing the global and domestic demand for eco-friendly products. Certified wood from sustainably managed forests, low-VOC finishes, and recyclable materials are becoming more common. This shift isn’t just for exports, Indonesian consumers, especially younger ones, are also becoming more environmentally conscious. Social media has amplified awareness, and brands promoting sustainability are gaining traction. Certification schemes like SVLK (Indonesia’s Timber Legality Assurance System) are helping producers meet international standards, giving them access to lucrative overseas markets. This move toward greener practices is reshaping how companies operate and is influencing product design, branding, and consumer expectations.

Increased Demand for Multifunctional and Space-Saving Furniture

Another trend shaping the furniture industry outlook in the country is the growing interest in multifunctional and space-saving furniture, particularly in urban centers like Jakarta, Bandung, and Surabaya. As apartment living becomes more common due to rapid urbanization and shrinking living spaces, consumers are prioritizing furniture that offers flexibility. Products like foldable beds, modular sofas, and storage-integrated tables are seeing strong demand. This is pushing local manufacturers to innovate beyond traditional craftsmanship and embrace more compact, adaptable designs suited for modern interiors. It’s also giving rise to collaborative efforts between furniture makers and interior designers to cater to customized needs. Urban dwellers are valuing practicality without sacrificing style, driving a noticeable shift toward compact, dual-purpose pieces tailored for tighter floor plans.

Indonesia Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on material, application, and distribution channel.

Material Insights:

- Wood

- Metal

- Plastic

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes wood, metal, plastic, and others.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Home Furniture

- Office Furniture

- Hospitality

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes home furniture, office furniture, hospitality, and others.

Distribution Channel Insights:

- Supermarkets

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets, specialty stores, online, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and Others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In June 2025, Indonesia’s Ministry of Trade signed an MoU with IKEA Indonesia to expand the market reach of micro, small, and medium enterprises (MSMEs) by integrating their flagship products into IKEA’s local and global supply chains. Between January and May 2025, the ministry facilitated 296 business matching events, 197 pitching sessions, and 99 meetings, generating total transactions worth USD 68.65 Million for MSMEs. Indonesian furniture products have already entered IKEA’s global stores, signaling greater international exposure and commercial opportunities for the local industry.

- In May 2025, VIFA ASEAN 2025 was announced as a key trade platform to link Southeast Asia’s furniture industry with global buyers, scheduled for August 26–29 in Ho Chi Minh City. The fair will feature over 1,000 booths and 350 companies, including major players from Indonesia, offering residential and commercial furniture, décor, and manufacturing solutions. With IFFINA Indonesia set to follow on September 17–20, this exhibition circuit is expected to drive new export opportunities for the Indonesian market.

- In March 2025, the Indonesia International Furniture Expo (IFEX) attracted 14,507 visitors and facilitated on-site transactions worth USD 350 Million, highlighting growing global interest in Indonesian furniture. Indonesia’s furniture exports reached USD 2.37 Billion in 2024, underscoring the sector’s rising contribution to the national economy and the role of IFEX in connecting local producers with international buyers.

- In March 2025, SGS opened a dedicated furniture and transit packaging testing laboratory in Semarang, Central Java, strategically located near Indonesia’s key furniture manufacturing hubs. The facility offers localized testing and certification for residential and office furniture, upholstery, fabrics, and packaging materials, ensuring compliance with European, US, and ISTA standards.

Indonesia Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Wood, Metal, Plastic, Others |

| Applications Covered | Home Furniture, Office Furniture, Hospitality, Others |

| Distribution Channels Covered | Supermarkets, Specialty Stores, Online, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia furniture market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The furniture market in Indonesia was valued at USD 9.1 Billion in 2025.

The Indonesia furniture market is projected to exhibit a CAGR of 5.82% during 2026-2034, reaching a value of USD 15.2 Billion by 2034.

Key factors driving the Indonesia furniture market include rising urban development, increased expenses on furniture, evolving preferences for stylish and functional furniture, growth in the real estate sector, and a shift toward online shopping. Additionally, the rise in demand for sustainable and customizable furniture options is further fueling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)