Indonesia Insurtech Market Size, Share, Trends and Forecast by Type, Service, Technology, and Region, 2025-2033

Indonesia Insurtech Market Overview:

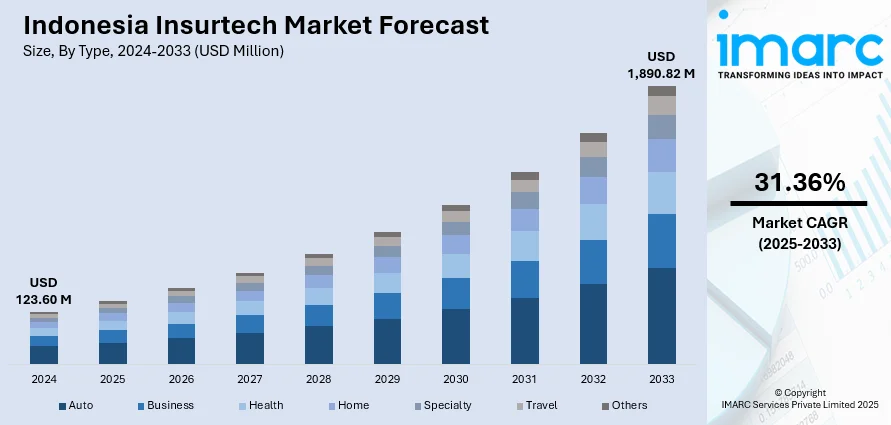

The Indonesia Insurtech market size reached USD 123.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,890.82 Million by 2033, exhibiting a growth rate (CAGR) of 31.36% during 2025-2033. The integration of artificial intelligence (AI) and machine learning (ML) in Insurtech enhances underwriting, claims management, and client support, driving the market growth with customized, data-driven products. Furthermore, the rise of e-commerce in the country is driving the demand for digital insurance solutions that seamlessly integrate into online shopping platforms, further contributing to the expansion of the Indonesia Insurtech market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 123.60 Million |

| Market Forecast in 2033 | USD 1,890.82 Million |

| Market Growth Rate 2025-2033 | 31.36% |

Indonesia Insurtech Market Trends:

Integration of AI and ML

The application of AI and ML is transforming the Insurtech industry in Indonesia by optimizing underwriting procedures, enhancing claims administration, and elevating client support. AI-driven tools allow insurers to evaluate large volumes of data to effectively determine risk profiles, forecast user behavior, and provide more customized insurance products. Algorithms in ML enhance claims management, enabling quicker and more efficient resolutions of claims while minimizing human mistakes. This shift towards automation aids Insurtech firms in reducing operational expenses, thereby making insurance products more accessible and affordable. This transformation is further exemplified by the launch of an AI-driven insurance risk assessment platform in Indonesia. For example, in 2025, FingerMotion announced a partnership with PT Mach Wireless Teknologi to deploy its AI-powered insurance risk rating platform in Indonesia. The platform, designed to support motor, health, and life insurance underwriting, aims to create a seamless telco-insurance ecosystem. Such partnership seeks to leverage AI technology to provide enhanced risk evaluations and enhance the overall client journey through tailored, data-informed insurance solutions. As individuals become more accustomed to the convenience and accuracy of AI-powered solutions, the demand for Insurtech services is growing, reshaping the insurance industry in Indonesia and making insurance more relevant and responsive to individual needs.

To get more information on this market, Request Sample

Rise of E-commerce and Online Platforms

With a growing number of shoppers purchasing online, there is a rise in the need for insurance products that can be smoothly incorporated into e-commerce platforms. Insurtech firms have leveraged this by providing digital insurance options designed for the e-commerce experience, including shipping, delivery, or product-specific coverage. This integration enables clients to effortlessly acquire coverage while shopping online, offering a simple and convenient method to protect their purchases. Furthermore, the comfort that individuals possess with online transactions makes them more receptive to embracing digital insurance options, as they are already used to handling purchases via digital platforms. E-commerce platforms serve as important avenues for insurers to provide tailored products according to user behavior, enhancing the personalized client experience. IMARC Group reports that the Indonesian e-commerce market is projected to hit USD 760.8 Billion by 2033, highlighting the increasing significance of this industry. The increasing integration of e-commerce platforms with digital insurance solutions not only enhances user experience but also plays a pivotal role in bolstering the Indonesia Insurtech market growth, as more people embrace online shopping and demand seamless, personalized insurance products tailored to their purchasing behavior.

Indonesia Insurtech Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, service, and technology.

Type Insights:

- Auto

- Business

- Health

- Home

- Specialty

- Travel

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes auto, business, health, home, specialty, travel, and others.

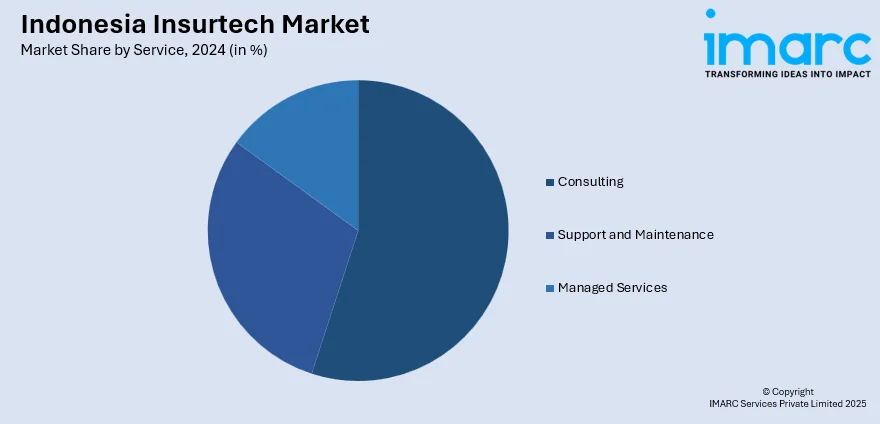

Service Insights:

- Consulting

- Support and Maintenance

- Managed Services

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes consulting, support and maintenance, and managed services.

Technology Insights:

- Block Chain

- Cloud Computing

- IoT

- Machine Learning

- Robo Advisory

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes block chain, cloud computing, IoT, machine learning, robo advisory, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Insurtech Market News:

- In October 2024, Insurtech firm Igloo launched its direct-to-consumer (DTC) platform, igloo.co.id, in Indonesia. The platform offered a range of affordable microinsurance products like motorcycle, car, pet, and travel insurance. Igloo aimed to increase insurance accessibility and transparency for Indonesia’s growing digital user base.

- In March 2024, Insurtech Carrot General Insurance partnered with Lippo General Insurance (LGI) in Indonesia to develop a Behaviour Based Insurance (BBI) solution. The collaboration used Carrot's data expertise to create a real-time mobility analytics platform for accurate risk assessment. This move was aimed at tapping into Indonesia's auto insurance market.

Indonesia Insurtech Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Auto, Business, Health, Home, Specialty, Travel, Others |

| Services Covered | Consulting, Support and Maintenance, Managed Services |

| Technologies Covered | Block Chain, Cloud Computing, IoT, Machine Learning, Robo Advisory, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia Insurtech market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia Insurtech market on the basis of type?

- What is the breakup of the Indonesia Insurtech market on the basis of service?

- What is the breakup of the Indonesia Insurtech market on the basis of technology?

- What is the breakup of the Indonesia Insurtech market on the basis of region?

- What are the various stages in the value chain of the Indonesia Insurtech market?

- What are the key driving factors and challenges in the Indonesia Insurtech market?

- What is the structure of the Indonesia Insurtech market and who are the key players?

- What is the degree of competition in the Indonesia Insurtech market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia Insurtech market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia Insurtech market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia Insurtech industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)