Indonesia LED Market Size, Share, Trends and Forecast by Product Type, Application, Installation Type, and Region, 2025-2033

Market Overview:

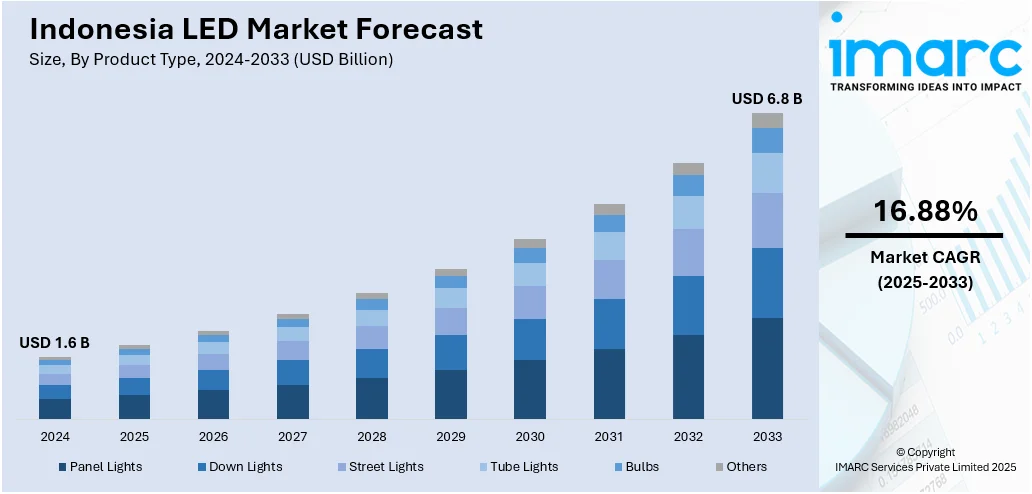

The Indonesia LED market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.8 Billion by 2033, exhibiting a growth rate (CAGR) of 16.88% during 2025-2033.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 1.6 Billion |

|

Market Forecast in 2033

|

USD 6.8 Billion |

| Market Growth Rate 2025-2033 | 16.88% |

The market is currently being catalyzed by the strong support from the Indonesian government, declining prices of LED products, infrastructure growth and rising consumer awareness, etc. Energy deficiency represents a huge problem in Indonesia. The country currently has an electricity penetration rate of around 60-65%, resulting in a significant population living in darkness. Blackouts and power rationing takes place even in the country’s main capital Jakarta. Indonesia plans to increase the penetration rate of its electricity power and the Indonesian government has acknowledged LED technology as a key driver in meeting its energy saving targets. Apart from promoting the usage of LED lights in public construction projects, they are also being applied in various commercial and transportation lighting applications. The transportation lighting market in particular represents a huge opportunity area in Indonesia. The Market for LED lights in Indonesia is currently dominated by imports. The Indonesian government's policy of welcoming in overseas LED industry players has resulted in a flood of foreign products, with the cheapest products being brought in by Chinese manufacturers. This has resulted in other importers looking to compete on non-price grounds.

To get more information on this market, Request Sample

This report provides a deep insight into the Indonesia LED market covering all its essential aspects. This ranges from macro overview of the market to micro details of the industry performance, recent trends, key market drivers and challenges, SWOT analysis, Porter’s five forces analysis, value chain analysis, etc. This report is a must-read for LED manufacturers, investors, researchers, consultants, business strategists, and all those who have any kind of stake or are planning to foray into the Indonesia LED market in any manner.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each sub-segment of the Indonesia LED market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type, application and installation type.

Breakup by Product Type:

- Panel Lights

- Down Lights

- Street Lights

- Tube Lights

- Bulbs

- Others

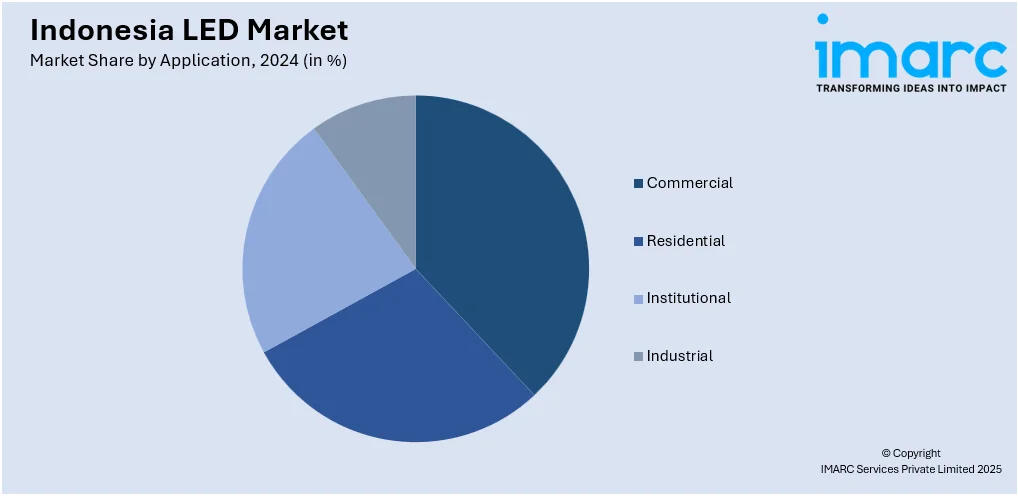

Breakup by Application:

- Commercial

- Residential

- Institutional

- Industrial

Breakup by Installation Type:

- New Installation

- Retrofit Installation

Breakup by Region:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

Value Chain Analysis

Key Drivers and Challenges

Porters Five Forces Analysis

PESTEL Analysis

Government Regulations

Competitive Landscape

- Competitive Structure

- Key Player Profiles

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Segment Coverage | Product Type, Application, Installation Type, Region |

| Region Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Indonesia LED market was valued at USD 1.6 Billion in 2024.

We expect the Indonesia LED market to exhibit a CAGR of 16.88% during 2025-2033.

The rising demand for LEDs as they offer several advantages, including longer shelf life, higher efficiency, enhanced durability, better service life with no flickering, optimal design flexibility, etc., than conventional lighting products, is primarily driving the Indonesia LED market.

The sudden outbreak of the COVID-19 pandemic had led to the implementation of stringent lockdown regulations across the nation, resulting in the temporary closure of various manufacturing units for LEDs.

Based on the product type, the Indonesia LED market can be categorized into panel lights, down lights, street lights, tube lights, bulbs, and others. Currently, panel lights account for the majority of the total market share.

Based on the application, the Indonesia LED market has been segregated into commercial, residential, institutional, and industrial. Among these, residential currently exhibits a clear dominance in the market.

Based on the installation type, the Indonesia LED market can be bifurcated into new installation and retrofit installation. Currently, retrofit installation holds the largest market share.

On a regional level, the market has been classified into Java, Sumatra, Kalimantan, Sulawesi, and others, where Java currently dominates the Indonesia LED market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)