Indonesia Lithium-ion Battery Market Size, Share, Trends and Forecast by Product Type, Power Capacity, Application, and Region, 2025-2033

Indonesia Lithium-ion Battery Market Overview:

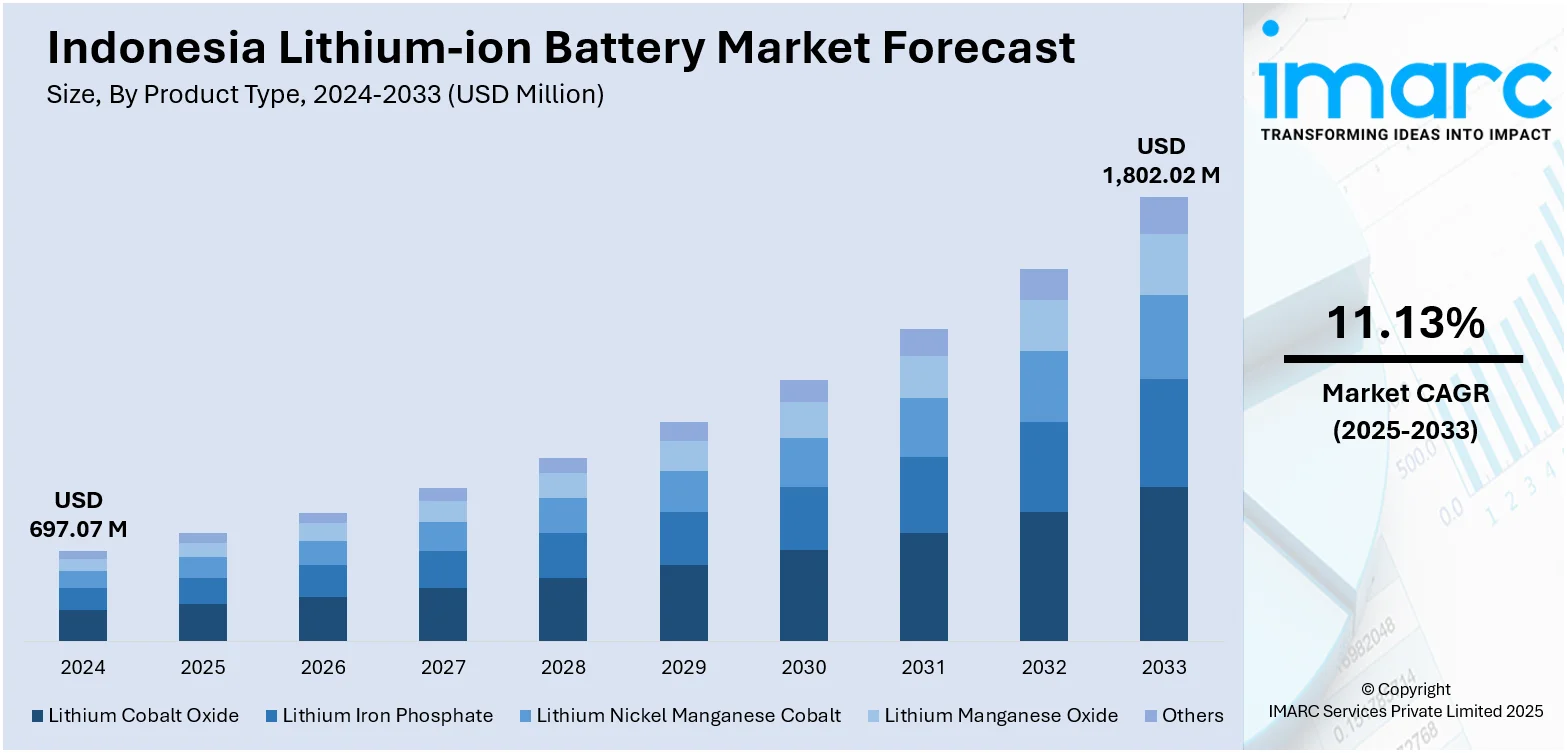

The Indonesia lithium-ion battery market size reached USD 697.07 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,802.02 Million by 2033, exhibiting a growth rate (CAGR) of 11.13% during 2025-2033. Growing electric vehicle adoption, government support for downstream nickel processing, abundant raw materials like nickel and cobalt, rising energy storage needs, foreign investment, and local manufacturing expansion are some of the factors contributing to the Indonesia lithium-ion battery market share. Environmental policies and technological advancements also contribute to increased demand and production.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 697.07 Million |

| Market Forecast in 2033 | USD 1,802.02 Million |

| Market Growth Rate 2025-2033 | 11.13% |

Indonesia Lithium-ion Battery Market Trends:

Shift toward Localized Battery Production

Indonesia is moving toward establishing a stronger base in lithium-ion battery manufacturing. A new facility is being developed through international collaboration, with plans to supply both domestic and export markets. The project is part of a broader effort that also includes upstream activities like raw material extraction and downstream processes such as recycling. The goal is to build a more complete battery supply chain within the country, reducing reliance on imports and increasing value-added production. This signals a longer-term strategy to support electric vehicle growth and take advantage of local mineral resources, particularly in positioning the country as a key player in the regional energy storage and mobility sectors. These factors are intensifying the Indonesia lithium-ion battery market growth. For example, in June 2025, a lithium-ion battery plant co-developed by an Indonesian firm and China’s CATL is set to start operations by late 2026 with a 6.9 GWh capacity. The facility aims to scale up to 15 GWh for domestic and export markets. It forms part of a USD 6 Billion project signed in 2022, covering nickel mining, battery production, and recycling.

To get more information on this market, Request Sample

Growing Emphasis on Integrated Battery Manufacturing

Indonesia is attracting growing interest in large-scale lithium-ion battery production with new projects focused on local manufacturing, research, and sales. A recently announced facility will serve as a hub for producing core battery components, supported by international investment partnerships. This development builds on earlier commitments to renewable energy integration and battery storage, reflecting increased alignment between battery manufacturing and utility-scale energy projects. The focus isn’t only on capacity but also on establishing technical capabilities within the country to support long-term market growth. With more firms investing in local infrastructure, Indonesia is reinforcing its role in the regional battery value chain, linking raw material availability with broader ambitions in energy storage and electrification. For instance, in January 2025, Rept Battero announced plans to build an 8GWh lithium-ion battery gigafactory in Indonesia through its subsidiary PT Rept Battero Indonesia. Backed by USD 139.5 Million in joint investment, including USD 83.7 Million from Infinitude International Investment, the facility will focus on R&D, manufacturing, and sales of battery components. This follows Rept Battero’s 2023 agreement for a 2GW solar-plus-storage project with 8GWh BESS potential.

Indonesia Lithium-ion Battery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, power capacity, and application.

Product Type Insights:

- Lithium Cobalt Oxide

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Lithium Manganese Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lithium cobalt oxide, lithium iron phosphate, lithium nickel manganese cobalt, lithium manganese oxide, and others.

Power Capacity Insights:

- 0 to 3000mAh

- 3000mAh to 10000mAh

- 10000mAh to 60000mAh

- More than 60000mAh

The report has provided a detailed breakup and analysis of the market based on the power capacity. This includes 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, and more than 60000mAh.

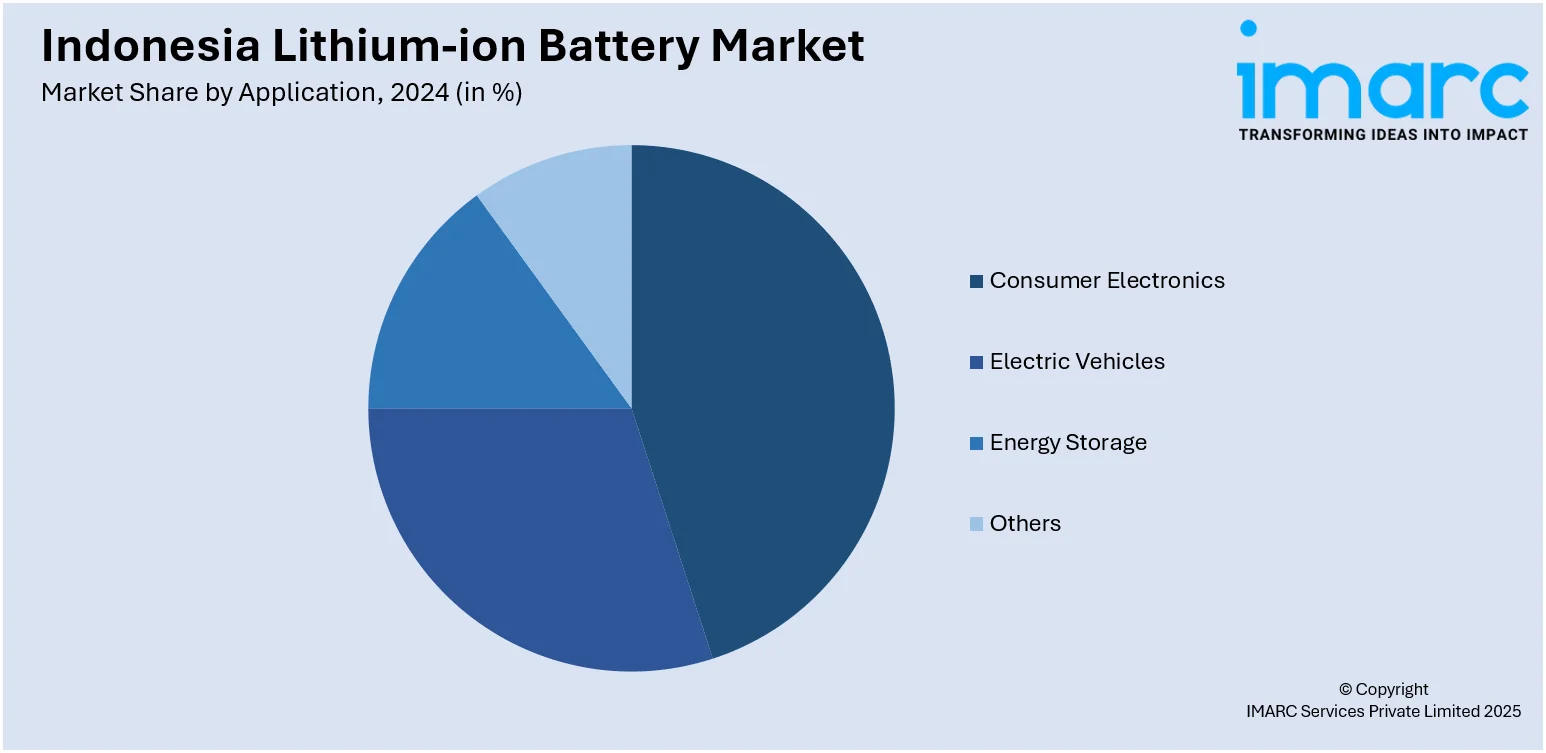

Application Insights:

- Consumer Electronics

- Electric Vehicles

- Energy Storage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes consumer electronics, electric vehicles, energy storage, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Lithium-ion Battery Market News:

- In July 2025, Indonesia increased lithium imports from Australia to support its electric vehicle battery production, aiming to cut shipping costs compared to previous African sources. A 2024 agreement backs the exploration of Australian reserves by a state-owned mining firm. The country is focused on nickel-manganese-cobalt battery development using its domestic nickel, while also exploring lithium-iron-phosphate options to strengthen its EV manufacturing ambitions.

Indonesia Lithium-ion Battery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lithium Cobalt Oxide, Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt, Lithium Manganese Oxide, Others |

| Power Capacities Covered | 0 to 3000mAh, 3000mAh to 10000mAh, 10000mAh to 60000mAh, More than 60000mAh |

| Applications Covered | Consumer Electronics, Electric Vehicles, Energy Storage, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia lithium-ion battery market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia lithium-ion battery market on the basis of product type?

- What is the breakup of the Indonesia lithium-ion battery market on the basis of power capacity?

- What is the breakup of the Indonesia lithium-ion battery market on the basis of application?

- What is the breakup of the Indonesia lithium-ion battery market on the basis of region?

- What are the various stages in the value chain of the Indonesia lithium-ion battery market?

- What are the key driving factors and challenges in the Indonesia lithium-ion battery market?

- What is the structure of the Indonesia lithium-ion battery market and who are the key players?

- What is the degree of competition in the Indonesia lithium-ion battery market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia lithium-ion battery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia lithium-ion battery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia lithium-ion battery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)