Indonesia Logistics Market Size, Share, Trends and Forecast by Model Type, Transportation Mode, End Use, and Region, 2026-2034

Indonesia Logistics Market Size:

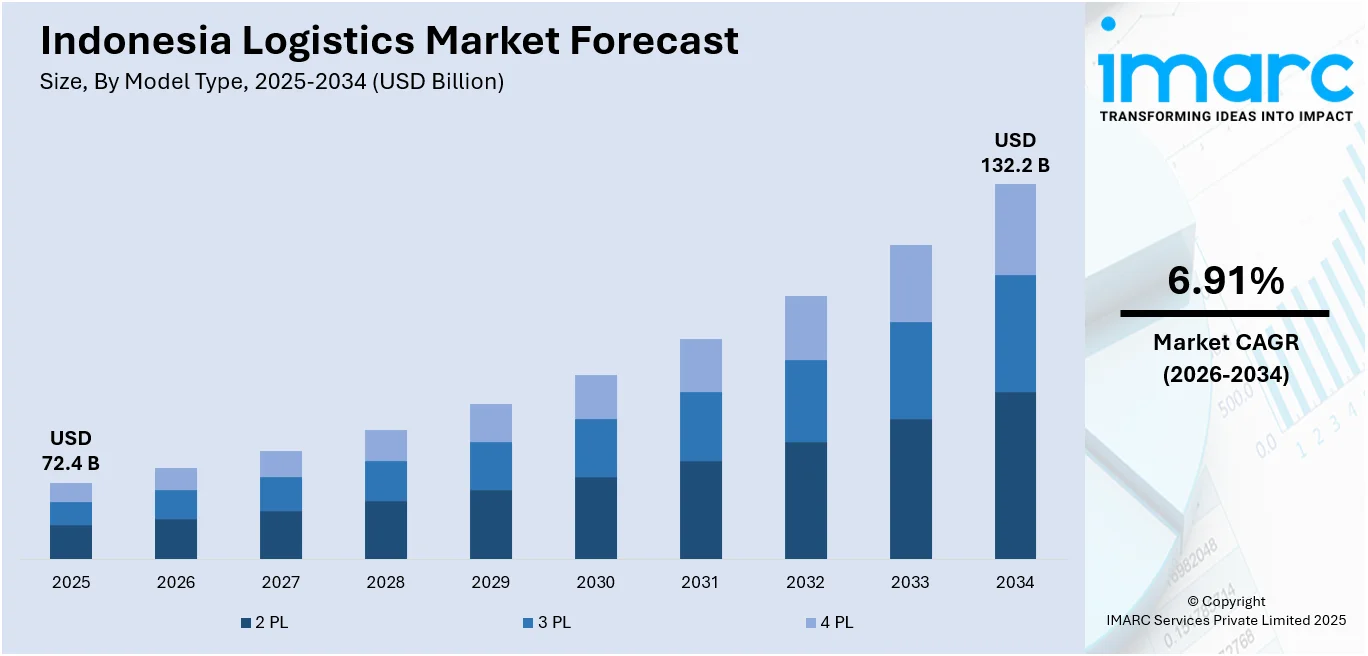

The Indonesia logistics market size reached USD 72.4 Billion in 2025. The market is expected to reach USD 132.2 Billion by 2034, exhibiting a growth rate (CAGR) of 6.91% during 2026-2034. The market growth is attributed to a rapid rise in e-commerce activities, substantial infrastructure investments, regional trade liberalization, adoption of advanced technologies, and supportive government policies.

Market Insights:

- Based on region, the market is divided into Java, Sumatra, Kalimantan, Sulawesi, and others.

- On the basis of model type, the market is segmented into 2 PL, 3 PL, and 4 PL.

- Based on the transportation mode, the market is categorized as roadways, seaways, railways, and airways.

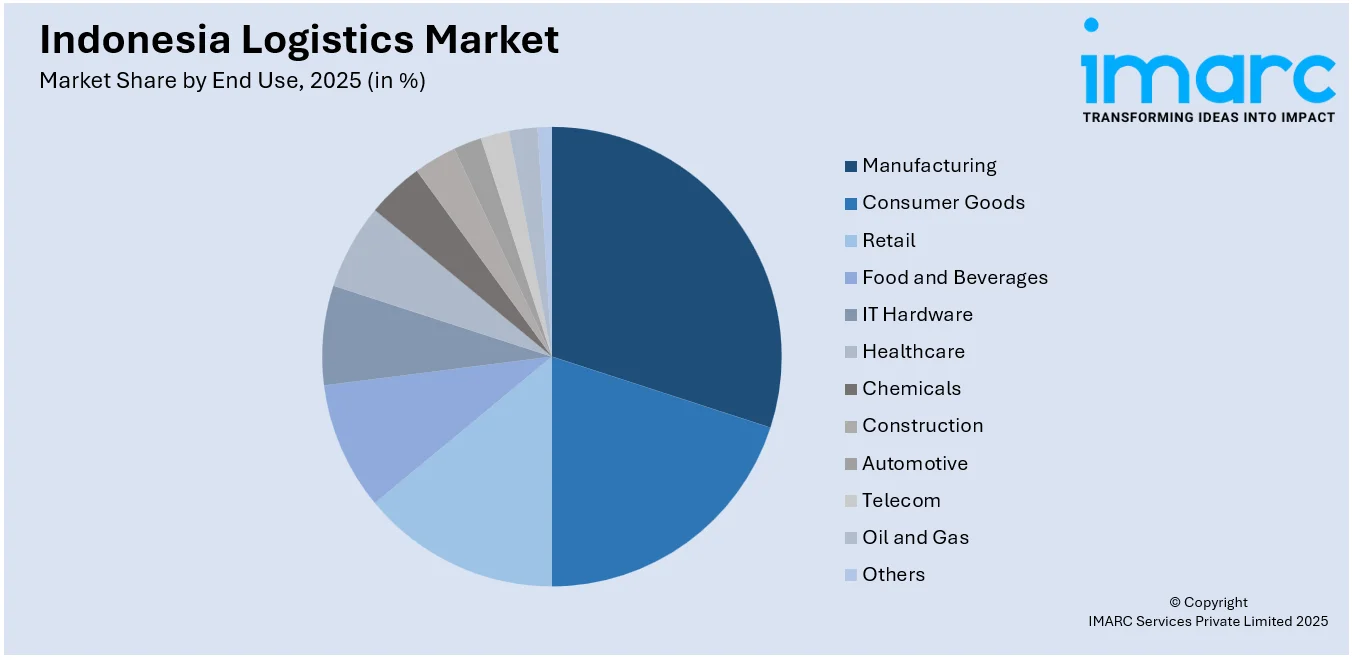

- On the basis of end use, the market is segmented into manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Market Size and Forecast:

- 2025 Market Size: USD 72.4 Billion

- 2034 Projected Market Size: USD 132.2 Billion

- CAGR (2026-2034): 6.91%

Indonesia Logistics Market Analysis:

- Major Market Drivers: The major drivers of the Indonesia logistics market include the expanding e-commerce sector, extensive infrastructure development, trade liberalization, technological advancements, and supportive government initiatives, all contributing to enhanced market growth and increased efficiency.

- Key Market Trends: Key trends in the market involve the adoption of advanced technologies including IoT, blockchain, and AI, increasing investments in green logistics practices, and the formation of strategic partnerships and collaborations to strengthen supply chain networks and expand service offerings.

- Competitive Landscape: Some of the major market players in the Indonesia logistics industry include JNE, Pos Indonesia, Tiki, DHL, J&T Express, and SiCepat, among many others, actively enhancing operations, investing in technology, and expanding their regional and international presence.

- Challenges and Opportunities: Some of the market challenges include infrastructure gaps and regulatory complexities, while opportunities arise from the growing demand for efficient logistics solutions driven by e-commerce, regional trade agreements, and government policies promoting sector growth and sustainability practices.

To get more information on this market Request Sample

Indonesia Logistics Market Trends:

E-commerce expansion

The rapid growth of e-commerce channels is influencing the Indonesia logistics market growth. The developments of the internet and the present-day facilities of smart phones have led to the increased use of online shopping thus calling for appropriate solutions of logistics to deal with the increased volume of parcel deliveries. Major companies are looking for efficient attainments such as warehouses, future distribution centers, and last-mile networks that fit the requirements. The incorporation of automation upon transportation, as well as tracking in real-time, is likewise helping increase the quality and usefulness of such services, which, in turn, is appealing to consumers and businesspersons alike. With e-commerce retailing on the rise, there is likelihood that the logistics market will equally grow in the future thus creating the chances of growth and development in Indonesia. According to a report, the COVID-19 pandemic has led to a rise in local e-commerce with reports suggesting that the internet economy is likely to account for as much as 50% of all commercial transactions by 2025.

Ongoing infrastructure development

The infrastructure factor is another critical element that has propelled the development of the Indonesia logistics market share significantly. Indonesia has been focusing heavily on connectivity to the various islands in the country mainly through the development of roads, seaports and airports. These adjustments promote efficient and effective movement of goods, that in turn cuts the transit time as well as costs. The improvement has not only benefited the local logistics demand to develop smoothly, but also greatly propelled Indonesia’s logistics export market. They have enhanced the flow of synchronization, which is useful for the growth of business and increasing market access and helping the logistics sector turn more competitive.

Government initiatives and policies

Indonesia logistics market outlook is highly dependent on positive governmental actions and politics. Indonesian government has been putting in various initiatives with the aim of developing the logistics industry. Solutions being implemented in this regard include the national logistics system which seeks to integrate a good and efficient logistics structure across the nation. They are also undertaking an expenditure on special economic zones (SEZs) and logistic parks for the improvement in the performance of logistics. Also, the implementation of policies to remove constraints such as excessive red tape to ease the business environment are leading to increased domestic and foreign investments in the logistics industry. Such governmental supports persist in encouraging the congenial climate of logistics firms and, therefore, improving Indonesia’s logistics market.

Digitalization, Transparency, and Sustainable Innovations

Digitalization is transforming the sector, led by the necessity for increased transparency, efficiency, and eco-friendliness. Logistics companies are increasingly using IoT sensors, cloud platforms, and analytics to achieve real-time visibility of supply chains. This is enhancing asset tracking, predictive maintenance, and process optimization. These technologies are complemented by automation of warehouses, algorithm-based inventory management, and digital freight matching platforms that increase operational dexterity. Sustainability factors are also becoming more prominent within the country's logistics sector. Carriers are implementing electric or hybrid delivery trucks, energy-conserving warehousing structures, and well-packaged orders designed to lower carbon footprints. According to the Indonesia logistics market forecast, the integration of sustainability and technology is driving the development of new service models, including traceable, low-impact delivery solutions, which are increasingly attractive to both environmentally conscious clients and partners. Indonesia's logistics industry is therefore increasingly adopting digital and green innovations to facilitate adaptability, competitiveness, and long-term sustainability.

Growth Drivers of the Indonesia Logistics Market:

The market is benefiting from several structural and economic drivers, including the rising middle class and increasing consumption in the country, which are driving demand for effective transportation and distribution services. Moreover, the e-commerce growth, driven by higher internet penetration and mobile usage, has increased the demand for sophisticated warehousing, fulfillment, and last-mile delivery capabilities. Also, government investment in ports, roads, and airport facilities is increasing connectivity throughout the archipelago, lowering delivery times and supply chain reliability. Apart from that, the strategic position of Indonesia along major trade routes adds to its status as a regional trade hub, and investment in logistics activity is coming from both domestic and foreign interests. Technology integration, including automation, real-time monitoring, and data analysis, is enhancing operational efficiency and transparency. Besides this, the growth of cold chain logistics is increasing opportunities for perishable products transportation, especially in the food and pharma industries, further stimulating development in the logistics sector of the country.

Opportunities in the Indonesia Logistics Market:

The logistics market in Indonesia presents good opportunities in various segments. Urbanization and expansion of tier-2 and tier-3 cities are generating high demand for distribution networks at the regional level as well as for local delivery. Development of e-commerce opens up opportunities for logistics companies to invest in specialized fulfillment centers, automated sorting facilities, and express delivery. Increasing exports of perishable farm products, seafood, and processed goods offer opportunities for value-added logistics, such as temperature-controlled transport and international freight forwarding. The geographical location of the country in Southeast Asia presents opportunities to create transshipment hubs, which would increase trade flows between Asia, the Middle East, and Europe. Greater focus on sustainability and green supply chains creates opportunities for businesses providing electric vehicle fleets, environmental-friendly packaging, and carbon-effective operations. Additionally, expansion of integrated logistics solutions, such as third-party and fourth-party logistics services, enables providers to provide value-added services like inventory management, supply chain consulting, and end-to-end digital visibility.

Challenges in the Indonesia Logistics Market:

Despite its growth potential, according to the Indonesia logistics market research report, the market faces several challenges that affect efficiency and cost competitiveness. The country’s archipelagic geography creates complexities in transportation, as inter-island connectivity often depends on limited maritime and air freight capacity. In addition to this, infrastructure disparities between major cities and remote regions contribute to uneven service quality and longer delivery times. High logistics costs, driven by fuel prices, inefficiencies, and fragmented supply chains, reduce competitiveness for both domestic and export markets. Besides, regulatory complexities and inconsistent enforcement can slow customs clearance, leading to delays in cross-border shipments. Labor shortages in skilled logistics management and technological operations further constrain industry modernization. Climate-related risks, such as flooding and extreme weather, can disrupt transportation routes and damage goods in transit. In addition, rising cybersecurity threats in digital logistics systems pose risks to data integrity and operational continuity, requiring continuous investment in protective measures and contingency planning.

Indonesia Logistics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on model type, transportation mode, and end use.

Breakup by Model Type:

- 2 PL

- 3 PL

- 4 PL

The report has provided a detailed breakup and analysis of the market based on the model type. This includes 2 PL, 3 PL, and 4 PL.

Breakup by Transportation Mode:

- Roadways

- Seaways

- Railways

- Airways

A detailed breakup and analysis of the market based on the transportation mode have also been provided in the report. This includes roadways, seaways, railways, and airways.

Breakup by End Use:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Consumer Goods

- Retail

- Food and Beverages

- IT Hardware

- Healthcare

- Chemicals

- Construction

- Automotive

- Telecom

- Oil and Gas

- Others

The report has provided a detailed breakup and analysis of the market based on the end use. This includes manufacturing, consumer goods, retail, food and beverages, IT hardware, healthcare, chemicals, construction, automotive, telecom, oil and gas, and others.

Breakup by Region:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major markets in the country, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Businesses are integrating sophisticated technology in their supply chain, including automated warehousing systems, real-time tracking, and powerful data analysis. It signifies that new strategic alliances and collaborative are emerging to enhance supply chain relations as well as service portfolios. Further, these players are concentrating on implementing new storage facilities, distribution channels, and optimizing last-mile logistics due to the escalating online selling platforms. Companies that are seeking to grow their regional and international markets to build the sales front. They are enabling the key players to sustain competitive edge and indeed fuelling the general Indonesia logistics market.

Latest News and Developments:

- July 2025: OIA Global officially launched comprehensive freight forwarding services at its Jakarta office, extending beyond its previous focus on packaging and raw material management to now include integrated logistics capabilities. This strategic expansion enhances customer agility by offering more responsive and streamlined supply chain solutions, leveraging Jakarta’s critical position within Asia-Pacific’s increasingly interconnected trade network.

- April 2025: Synnex Metrodata Indonesia (SMI) officially opened Phase II of its Jakarta Logistics Center, part of an over USD 17 Million investment. The center is significantly expanding its total facility to 40,000 sqm, marking an 82 percent increase in storage capacity. This strategic expansion is intended to enhance SMI’s product distribution, broaden its channel coverage, and drive reductions in operational costs, reinforcing its dominance in Indonesia’s ICT distribution market.

- March 2025: OCS Indonesia and LEX Indonesia jointly launched the VOCIFY Green Apprenticeship Programme, an industry-first initiative held at the LEX Indonesia warehouse in Cimanggis, West Java. The programme is designed to equip frontline logistics professionals with practical green skills, combining sustainable operations training, leadership, and technical development, and credentials certified by renowned British institutions such as ABE and CILT, thereby enhancing productivity, employability, and career mobility.

- March 2025: APL Logistics inaugurated the LEED Silver–certified Marunda Flow Center in the KBN Marunda Industrial Zone, North Jakarta, to bolster sustainable industrial growth and support Indonesia’s expanding role in global trade. Spanning 32,000 sqm, the facility features gantry-mounted scanning systems, automated purchase order sorting, 6,800 racking positions, and over 100 truck parking bays. Built with locally sourced materials, it integrates sustainability measures such as solar panels supplying around 10% of energy needs, a roof design maximizing natural light, and efficient HVAC systems.

Indonesia Logistics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Model Types Covered | 2 PL, 3 PL, 4 PL |

| Transportation Modes Covered | Roadways, Seaways, Railways, Airways |

| End Uses Covered | Manufacturing, Consumer Goods, Retail, Food and Beverages, IT Hardware, Healthcare, Chemicals, Construction, Automotive, Telecom, Oil and Gas, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia logistics market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia logistics market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia logistics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The logistics market in Indonesia was valued at USD 72.4 Billion in 2025.

The logistics market in Indonesia is projected to reach USD 132.2 Billion by 2034, exhibiting a CAGR of 6.91% during 2026-2034.

The Indonesia logistics market is driven by the rapid growth of e-commerce, ongoing infrastructure development, and favorable government initiatives aimed at improving supply chain efficiency. The adoption of digital technologies like real-time tracking, automation, and AI has enhanced logistics operations. Trade liberalization and regional agreements are opening up cross-border logistics opportunities. Companies are investing in last-mile delivery, logistics parks, and warehousing solutions to serve rising consumer demand and business-to-business movement of goods across the archipelago.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)