Indonesia Mushroom Market Size, Share, Trends and Forecast by Mushroom Type, Form, Distribution Channel, End Use, and Region, 2025-2033

Indonesia Mushroom Market Overview:

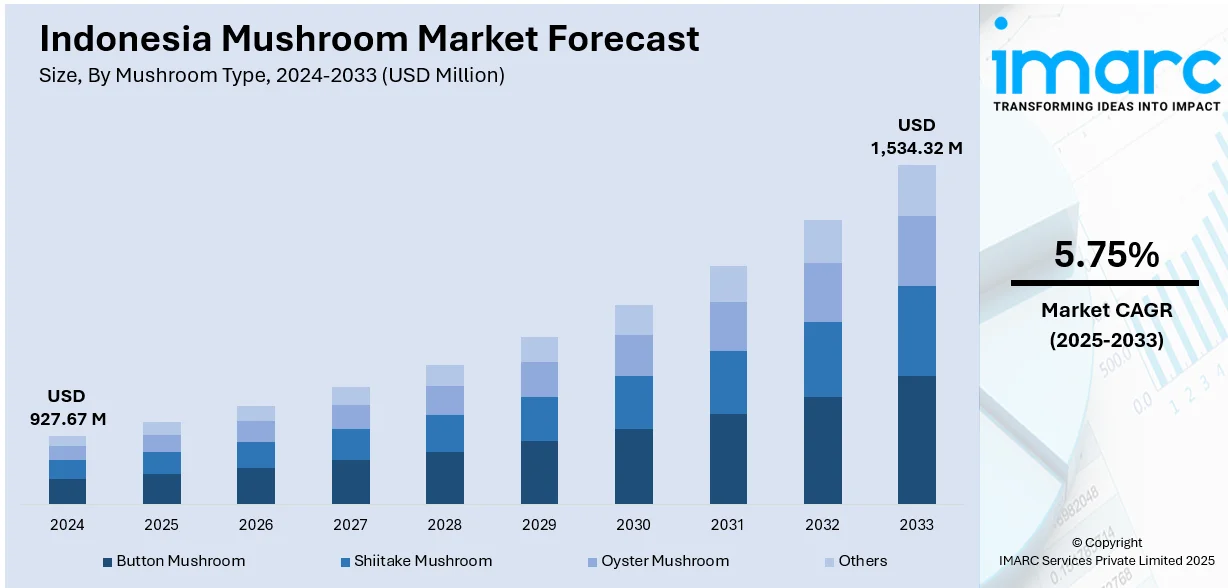

The Indonesia mushroom market size reached USD 927.67 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,534.32 Million by 2033, exhibiting a growth rate (CAGR) of 5.75% during 2025-2033. The mushroom market in Indonesia is expanding owing to digital integration in marketing and distribution, enhancing consumer access and supply efficiency. Additionally, the growing demand from the foodservice and hospitality sectors, driven by health-conscious dining trends, is increasing the Indonesia mushroom market share as a key culinary and commercial ingredient.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 927.67 Million |

| Market Forecast in 2033 | USD 1,534.32 Million |

| Market Growth Rate 2025-2033 | 5.75% |

Indonesia Mushroom Market Trends:

Technological Integration in Marketing and Distribution Channels

Online shopping sites, digital advertising, and mobile apps are facilitating consumer access to fresh mushrooms, allowing for easy purchases from various locations, encompassing both rural and urban settings. E-commerce platforms not only increase accessibility but also enable direct engagement between manufacturers and consumers, improving market responsiveness and fostering better customer relationships. Technological progress in logistics and inventory management enhances the supply chain, reducing waste and guaranteeing prompt, effective delivery of perishable items, such as mushrooms. Moreover, digital marketing initiatives promote awareness about the health advantages, culinary flexibility, and sustainable qualities of mushrooms, thus encouraging increased consumer interest. Significantly, the robust e-commerce industry in Indonesia highlights this pattern. The International Trade Administration (ITA) estimates that Indonesia's e-commerce market will increase from USD 52.93 billion in 2023 to USD 86.81 billion by 2028, reflecting a compound annual growth rate (CAGR) of 10.4%. This swift expansion highlights the growing dependence on digital platforms for routine purchases, including fresh produce. The use of these digital tools allows even modest mushroom growers to connect with broader audiences and compete more efficiently, leading to a more inclusive and robust supply chain. As a result, the integration of technology is bolstering the Indonesia mushroom market growth by improving efficiency, visibility, and consumer interaction throughout the value chain.

To get more information on this market, Request Sample

Increasing Demand from Foodservice and Hospitality Sector

With the robust tourism sector in the country, restaurants, hotels, and catering services are increasingly focusing on obtaining high-quality, fresh, and locally sourced ingredients to satisfy various culinary tastes. Mushrooms, appreciated for their deep flavor, distinct texture, and health advantages, are emerging as a key component in upscale dining, prominently included in gourmet recipes, buffet offerings, and health-focused menus. The movement towards providing sustainable and healthy food choices fits perfectly with the inherent qualities of mushrooms, boosting their attractiveness in the industry. Additionally, the rapid rise of quick-service restaurants (QSRs) and contemporary dining establishments in urban centers is contributing to the increase in institutional mushroom consumption. This shift reflects broader changes in consumer preferences, particularly among younger demographics seeking variety and wellness-oriented dining. Moreover, the growth of the sector is highlighted by data provided by the IMARC Group, which indicated that Indonesia’s foodservice market size attained USD 45.0 Billion in 2024. This substantial market size demonstrates the extent of opportunity for mushroom producers and suppliers serving commercial food sectors. The ongoing transformation of Indonesia’s hospitality and foodservice sectors guarantees a rising need for mushrooms, establishing them as a crucial and dependable component in the country's professional kitchens and culinary advancements.

Indonesia Mushroom Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on mushroom type, form, distribution channel, and end use.

Mushroom Type Insights:

- Button Mushroom

- Shiitake Mushroom

- Oyster Mushroom

- Others

The report has provided a detailed breakup and analysis of the market based on the mushroom type. This includes button mushroom, shiitake mushroom, oyster mushroom, and others.

Form Insights:

- Fresh Mushroom

- Canned Mushroom

- Dried Mushroom

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh mushroom, canned mushroom, dried mushroom, and others.

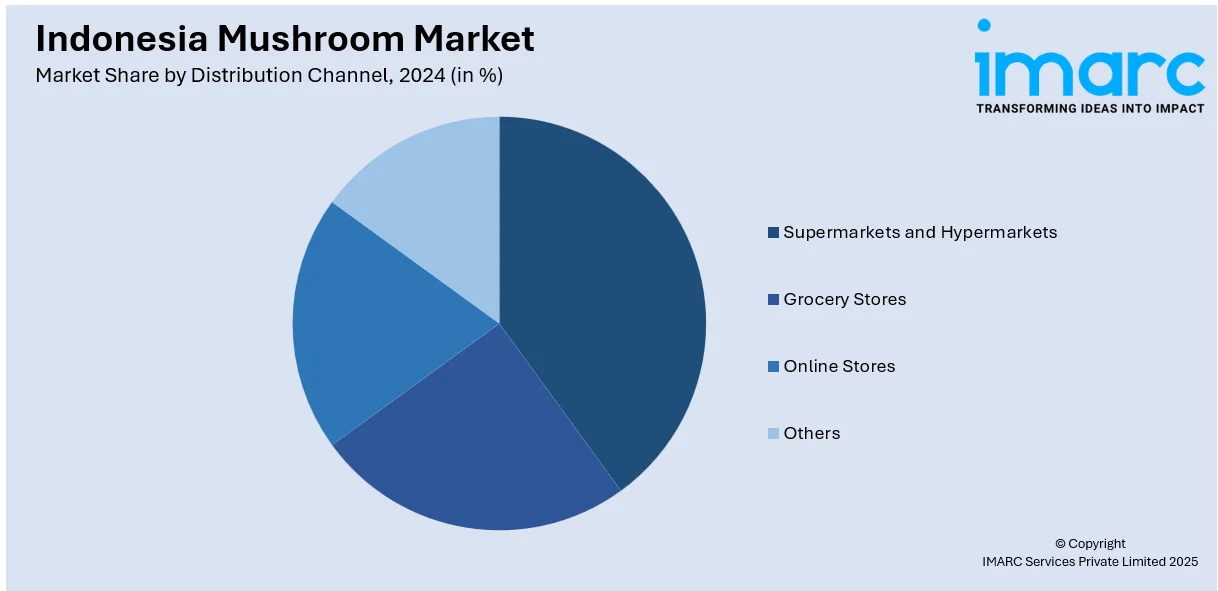

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Grocery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, grocery stores, online stores, and others.

End Use Insights:

- Food Processing Industry

- Food Service Sector

- Direct Consumption

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes food processing industry, food service sector, direct consumption, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Mushroom Market News:

- In May 2024, PT Ajinomoto Indonesia launched Masako® Mushroom Broth, a seasoning made from champignon, shiitake, and oyster mushrooms to support healthy and practical cooking. The product aligned with Ajinomoto’s goal to promote nutritious, balanced meals. It is now available in sachets across markets and online platforms.

- In January 2024, Indonesia-based biotech firm MYCL launched the Shrüm Stool, a modular, eco-friendly seat made from biodegradable mushroom mycelium composite, in collaboration with ōd architecture studio. Weighing just 3 kg and supporting up to 870 kg, the stool was carbon negative and symbolized sustainable design innovation.

Indonesia Mushroom Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Mushroom Types Covered | Button Mushroom, Shiitake Mushroom, Oyster Mushroom, Others |

| Forms Covered | Fresh Mushroom, Canned Mushroom, Dried Mushroom, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Grocery Stores, Online Stores, Others |

| End Uses Covered | Food Processing Industry, Food Service Sector, Direct Consumption, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia mushroom market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia mushroom market on the basis of mushroom type?

- What is the breakup of the Indonesia mushroom market on the basis of form?

- What is the breakup of the Indonesia mushroom market on the basis of distribution channel?

- What is the breakup of the Indonesia mushroom market on the basis of end use?

- What is the breakup of the Indonesia mushroom market on the basis of region?

- What are the various stages in the value chain of the Indonesia mushroom market?

- What are the key driving factors and challenges in the Indonesia mushroom market?

- What is the structure of the Indonesia mushroom market and who are the key players?

- What is the degree of competition in the Indonesia mushroom market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia mushroom market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia mushroom market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia mushroom industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)