Indonesia Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2025-2033

Indonesia Pallet Market Overview:

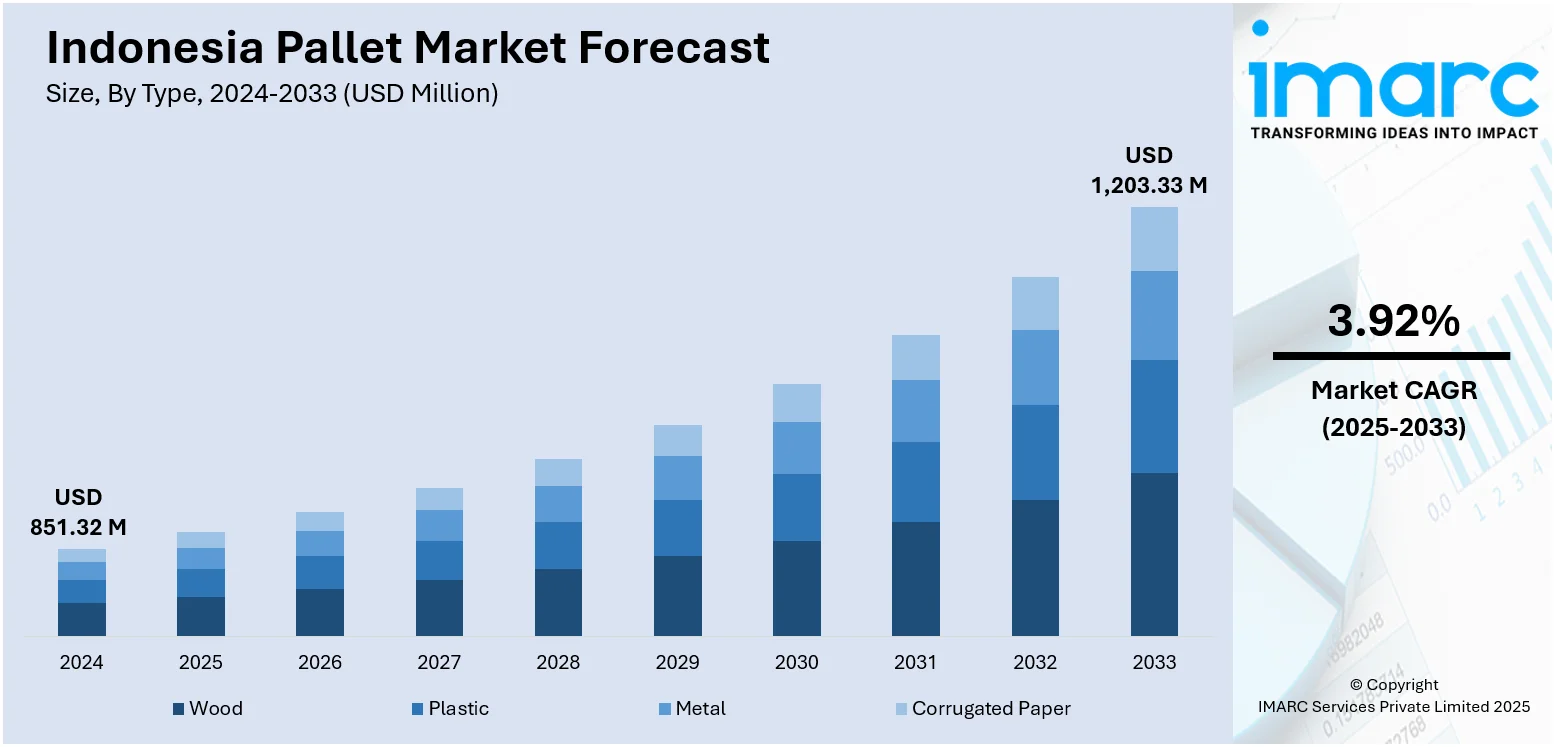

The Indonesia pallet market size reached USD 851.32 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,203.33 Million by 2033, exhibiting a growth rate (CAGR) of 3.92% during 2025-2033. The market is driven by significant infrastructure investments in ports, toll roads, and logistics hubs, exposing supply chain inefficiencies and compelling manufacturers, exporters, and logistics providers to demand higher-quality, standardized pallets for improved resilience. Furthermore, intensifying sustainability pressures from regulations, ESG commitments, and consumer awareness are accelerating the adoption of durable plastic pallet pools and circular wooden pallet models, further augmenting the Indonesia pallet market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 851.32 Million |

| Market Forecast in 2033 | USD 1,203.33 Million |

| Market Growth Rate 2025-2033 | 3.92% |

Indonesia Pallet Market Trends:

Infrastructure Expansion Driving Pallet Standardization and Quality Demand

Indonesia's significant infrastructure investments in ports, such as Patimban, toll roads, and logistics hubs are fundamentally reshaping pallet demand. This expansion facilitates faster movement of goods but exposes inefficiencies in fragmented pallet supply chains, particularly concerning damaged, non-standard, or low-quality wooden pallets, causing delays and product damage. Indonesia's transport industry, crucial to its 17,000-island archipelago of Sumatra, Java, and Papua, has experienced unprecedented growth, its freight and logistics market size reaching USD122.2 Billion by 2024, according to various analysts, set to grow at a 6.5% CAGR to 2030. The government's National Port Master Plan (NPMP) outlines a USD 47 Billion investment in the country's port infrastructure, including upgrades to Sumatra, Java, and Papua ports as required, with the aim of improving container handling and logistics efficiency. Notably, DP World is expanding the capacity of Belawan Port to 1.4 Million TEUs and constructing a new international container terminal in Gresik, further making Indonesian ports ready for greater pallet and cargo handling. Consequently, manufacturers, exporters (especially in CPO, rubber, wood products), and large logistics providers are increasingly demanding higher quality, more durable, and standardized pallets. While full ISO adoption is gradual, there's a strong push towards consistent pallet dimensions, such as the common 1100mm x 1100mm and specifications within industries and supply chains. This trend benefits suppliers offering robust wooden pallets compliant with international phytosanitary standards (ISPM 15) and drives interest in durable plastic pallets for closed-loop systems, improving handling speed, reducing waste, and enhancing overall supply chain resilience as national connectivity improves.

To get more information on this market, Request Sample

Intensifying Sustainability Pressures Accelerating Pallet Innovation and Circular Models

Growing environmental regulations, corporate sustainability commitments (ESG), and consumer awareness are exerting strong pressure on Indonesian businesses to adopt greener logistics practices, directly impacting the pallet market. The traditional linear model of single-use or poorly managed wooden pallets faces scrutiny due to deforestation concerns and waste generation. This drives significant demand for sustainable alternatives and circular economy models. Plastic pallet pools, offering long lifespans, recyclability, and efficient tracking, are experiencing accelerated growth, particularly among multinationals and large FMCG/e-commerce players seeking to reduce their carbon footprint and waste. During the third quarter of 2024, Indonesian consumers spent IDR 256 Trillion on Consumer Technology and Fast-Moving Consumer Goods (FMCG) products, a 1.7% year-on-year increase. From this amount, FMCG accounted for IDR 208 Trillion or 81% of total spending. As investments in infrastructure, especially in ports and logistics, is going on, such as ports development in Gresik and Belawan, the growth in consumer spending will be enhancing the need for pallet-based solutions in logistics, especially for fast-moving goods. In addition, the growth in the FMCG business, particularly in Beverages and Ambient Food, and by 4.3% in Consumer Technology, reflects the persistence of the country's economic growth, which continues to provide opportunities in Indonesia's transportation and supply chain sectors. Simultaneously, the wooden pallet industry is responding with improved sourcing (certified timber), repair and refurbishment services, and formalized pallet rental/pooling schemes to extend pallet life. Companies are increasingly auditing their pallet usage, seeking suppliers with robust sustainability credentials and closed-loop solutions, making environmental impact a core purchasing factor alongside cost.

Indonesia Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

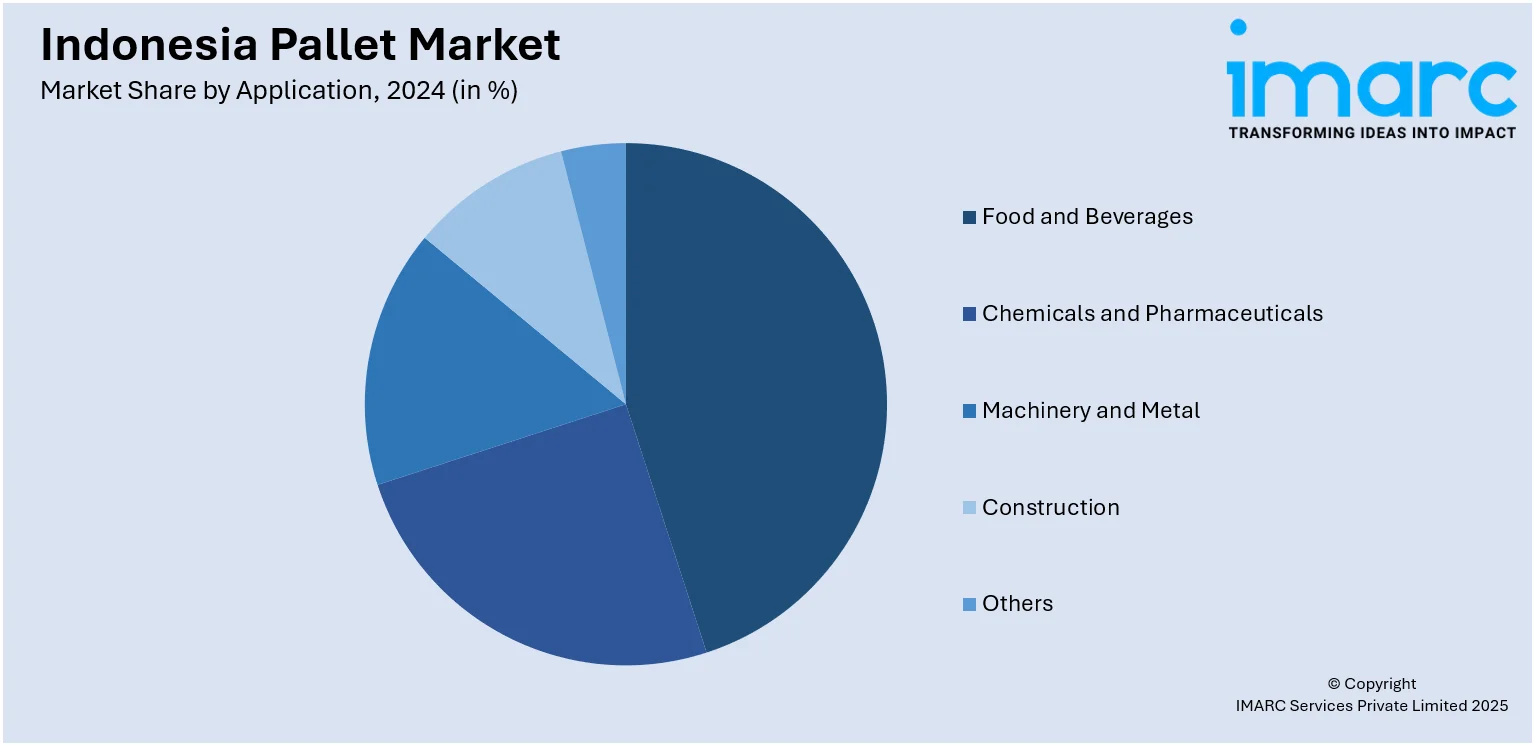

Application Insights:

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application has also been provided in the report. This includes food and beverages, chemicals and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include Java, Sumatra, Kalimantan, Sulawesi, and others.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Indonesia Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Java, Sumatra, Kalimantan, Sulawesi, Others |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Indonesia pallet market performed so far and how will it perform in the coming years?

- What is the breakup of the Indonesia pallet market on the basis of type?

- What is the breakup of the Indonesia pallet market on the basis of application?

- What is the breakup of the Indonesia pallet market on the basis of structural design?

- What is the breakup of the Indonesia pallet market on the basis of region?

- What are the various stages in the value chain of the Indonesia pallet market?

- What are the key driving factors and challenges in the Indonesia pallet market?

- What is the structure of the Indonesia pallet market and who are the key players?

- What is the degree of competition in the Indonesia pallet market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Indonesia pallet market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Indonesia pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Indonesia pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)